Tracking trading activity across Wall Street and Washington DC. 100% free

How to get URL link on X (Twitter) App

On Wednesday, September 17, the Federal Reserve will announce its rate decision at 2:00 PM ET.

On Wednesday, September 17, the Federal Reserve will announce its rate decision at 2:00 PM ET.

Meet the legend John Meriwether.

Meet the legend John Meriwether.

Jeff Carpoff was a 36-year-old jobless ex-mechanic living in a rundown house.

Jeff Carpoff was a 36-year-old jobless ex-mechanic living in a rundown house.

Steven Cohen started SAC Capital in 1992 with just $25 million.

Steven Cohen started SAC Capital in 1992 with just $25 million.

Just days ago, Burry's Q2 2025 filings were published.

Just days ago, Burry's Q2 2025 filings were published.

Ishan Wahi had the most valuable job in crypto.

Ishan Wahi had the most valuable job in crypto.

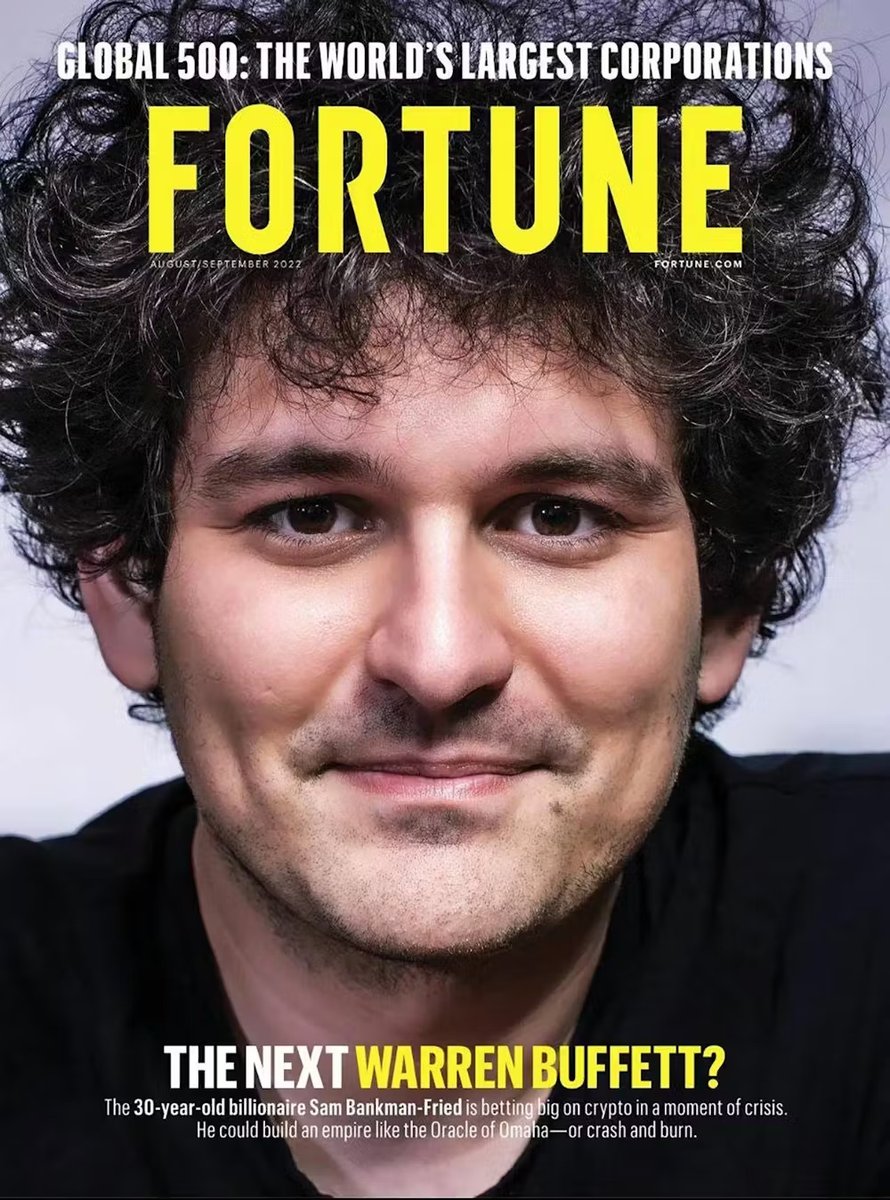

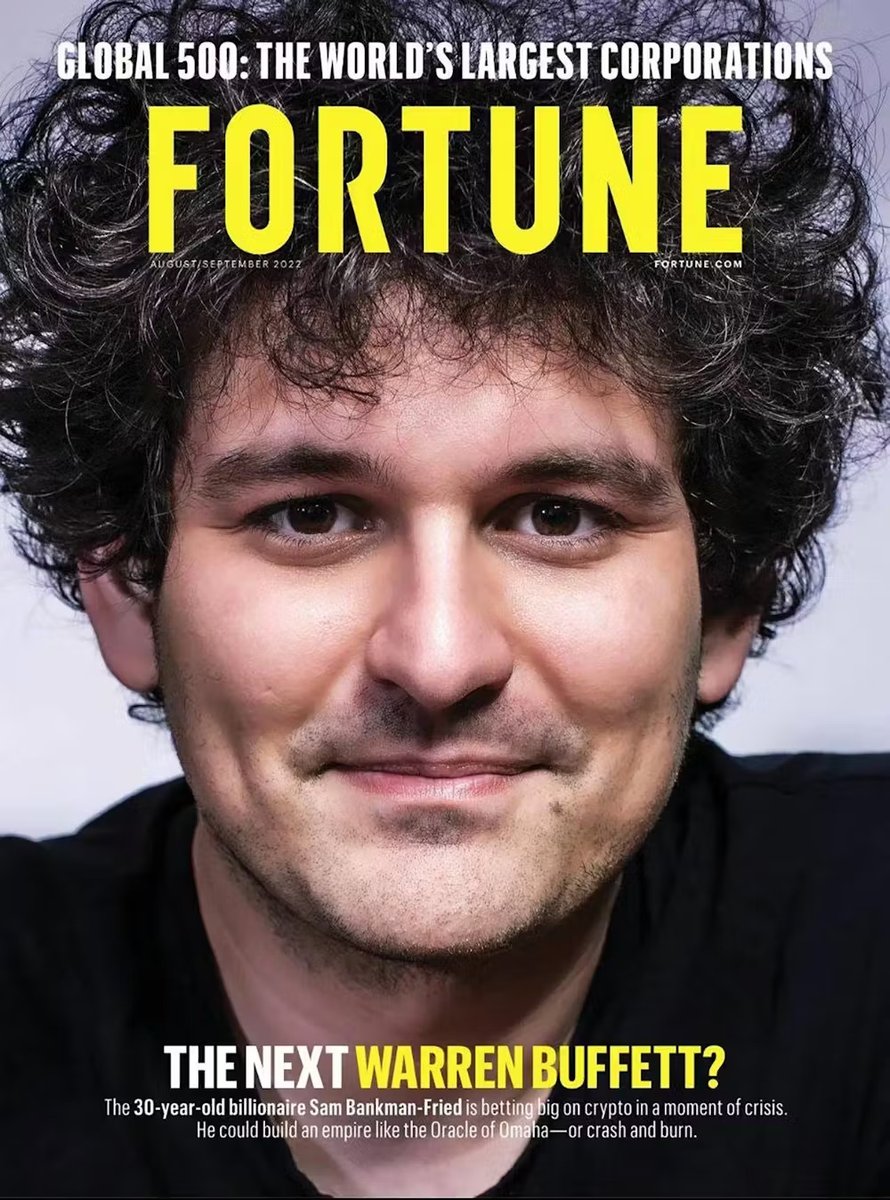

FTX was the crypto world's golden child.

FTX was the crypto world's golden child.

Meet Chris Camillo.

Meet Chris Camillo.

Josh Hawley had a problem with Congress.

Josh Hawley had a problem with Congress.

Max Keiser started his career in the 1980s as a stockbroker on Wall Street.

Max Keiser started his career in the 1980s as a stockbroker on Wall Street.

Trump signed this during the White House July 4th ceremony.

Trump signed this during the White House July 4th ceremony.

America's debt just hit $36.2 trillion.

America's debt just hit $36.2 trillion.

January 24, 2020: Senators received a classified briefing on COVID-19's threat.

January 24, 2020: Senators received a classified briefing on COVID-19's threat.

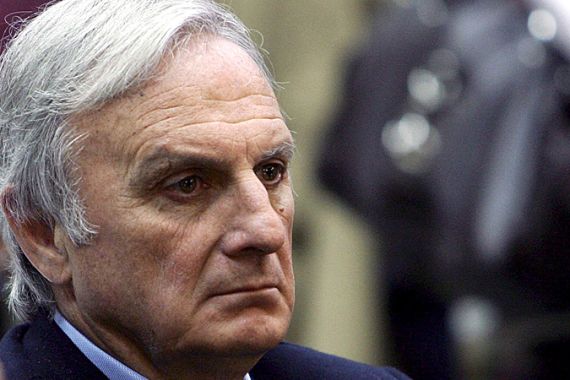

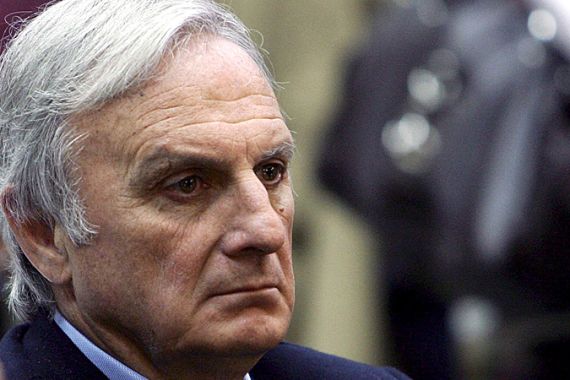

Nelson Bunker Hunt was born into oil money.

Nelson Bunker Hunt was born into oil money.

Raj Rajaratnam was born into financial privilege.

Raj Rajaratnam was born into financial privilege.

Bill Hwang started as a mentee under hedge fund legend Julian Robertson.

Bill Hwang started as a mentee under hedge fund legend Julian Robertson.

It started with Trump putting a 25% tariff on steel and aluminum imported from the UK and EU.

It started with Trump putting a 25% tariff on steel and aluminum imported from the UK and EU.

It all started in 1961 when 22-year-old Calisto Tanzi took over his family’s small dairy business.

It all started in 1961 when 22-year-old Calisto Tanzi took over his family’s small dairy business.

In 2011, Michael Woodford became the first non-Japanese CEO of Olympus.

In 2011, Michael Woodford became the first non-Japanese CEO of Olympus.

The debt industry is massive—worth billions.

The debt industry is massive—worth billions.

Jordan Belfort knew he wanted to be filthy rich since he was a kid.

Jordan Belfort knew he wanted to be filthy rich since he was a kid.