Core inflation was above expectations and had its highest print since January.

But I don't think that really conveys how much more elevated it is in 2025, as shelter disinflation continues to cover up higher services and goods.

This is worrying. Let's dig in: /1

But I don't think that really conveys how much more elevated it is in 2025, as shelter disinflation continues to cover up higher services and goods.

This is worrying. Let's dig in: /1

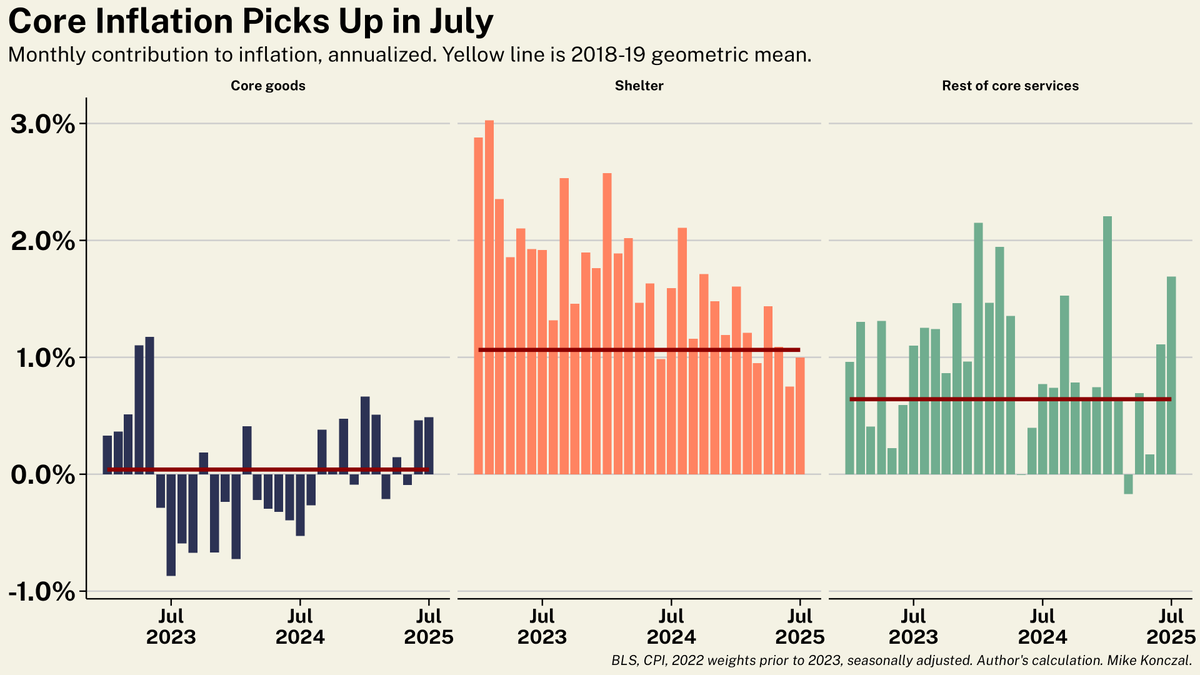

Here's core broken down by goods, shelter, and services. Goods prices are increasing from a negative trend, as expected from tariffs.

But non-housing services have picked up too, masked by the expected measured housing disinflation. /2

But non-housing services have picked up too, masked by the expected measured housing disinflation. /2

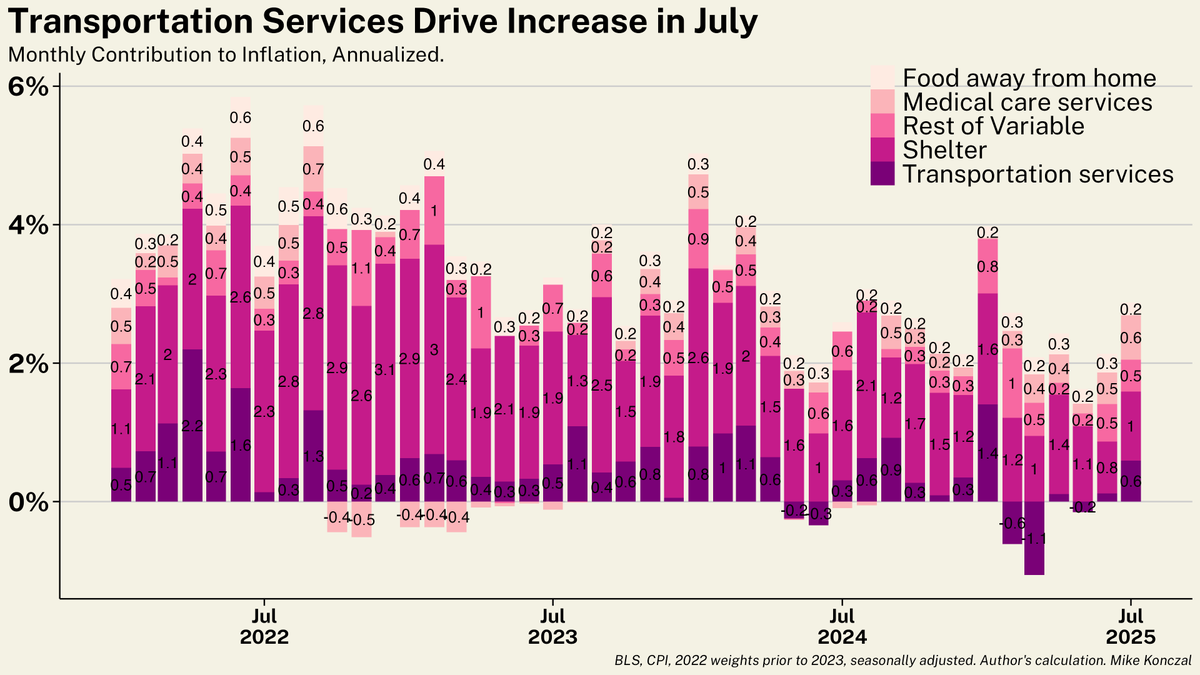

If we dig into non-housing services, 'transportation services' is a driver. Much of that is airline prices rebounding after price drops earlier this year.

But some is from 'motor vehicle maintenance and repair', showing the line between tariffs and services is complicated. /3

But some is from 'motor vehicle maintenance and repair', showing the line between tariffs and services is complicated. /3

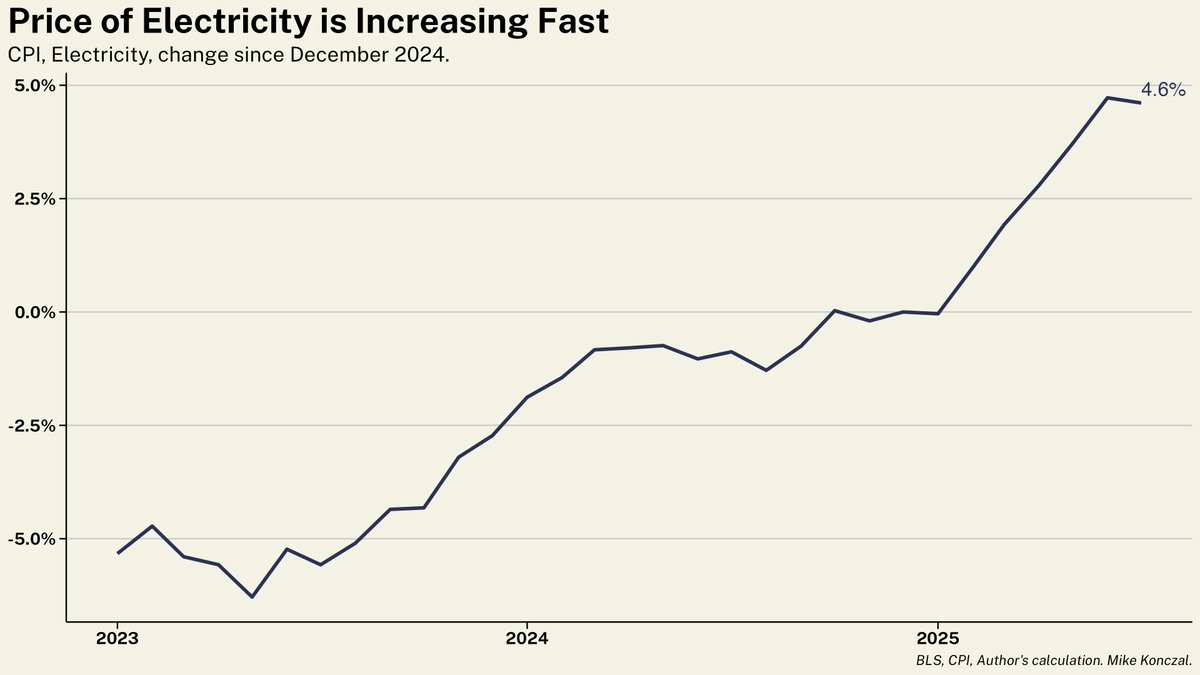

Energy slowed in July, bringing down headline vs core, but it's been increasing fast in 2025. Here's the price index for electricity. It took two years, 2023-2024, for it to increase 5%. It's increased ~5% so far this year.

Bad time to take a lot of green energy offline imho. /4

Bad time to take a lot of green energy offline imho. /4

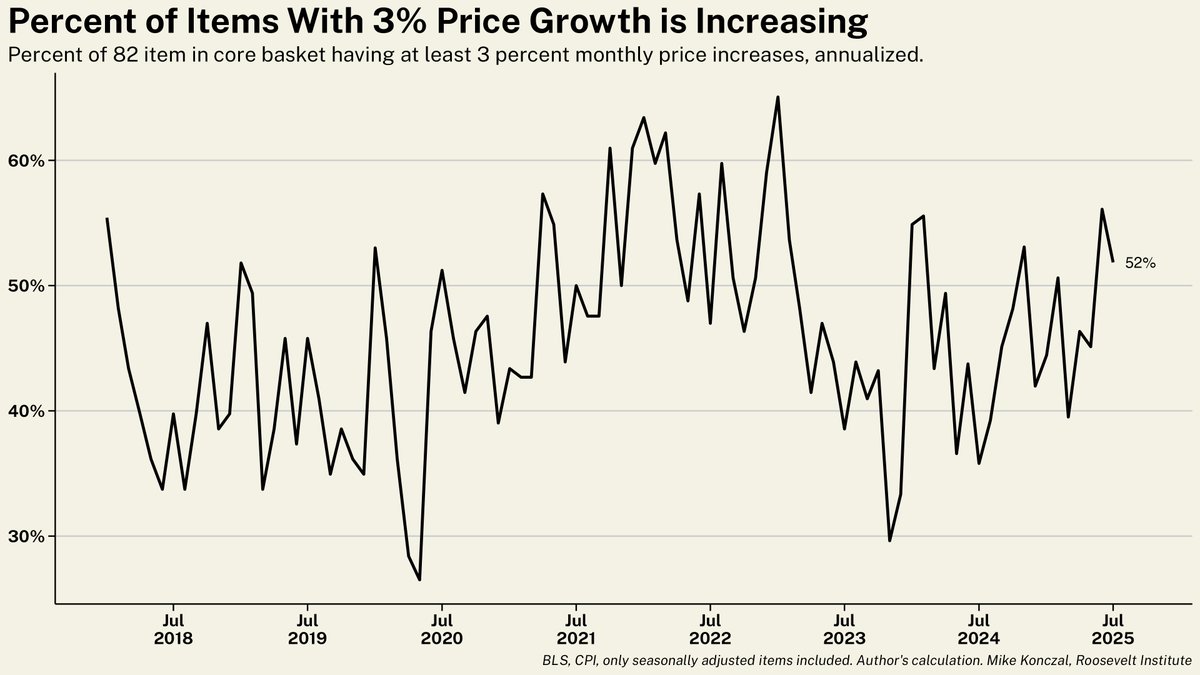

But inflation is broadening. Here's a graphic I had honestly retired but am bringing back into circulation, the percentage of 82 CPI items having at least 3% price growth (annualized) in a month. The evolution of this was a big deal in 2023.

It's back to over 50% recently. /5

It's back to over 50% recently. /5

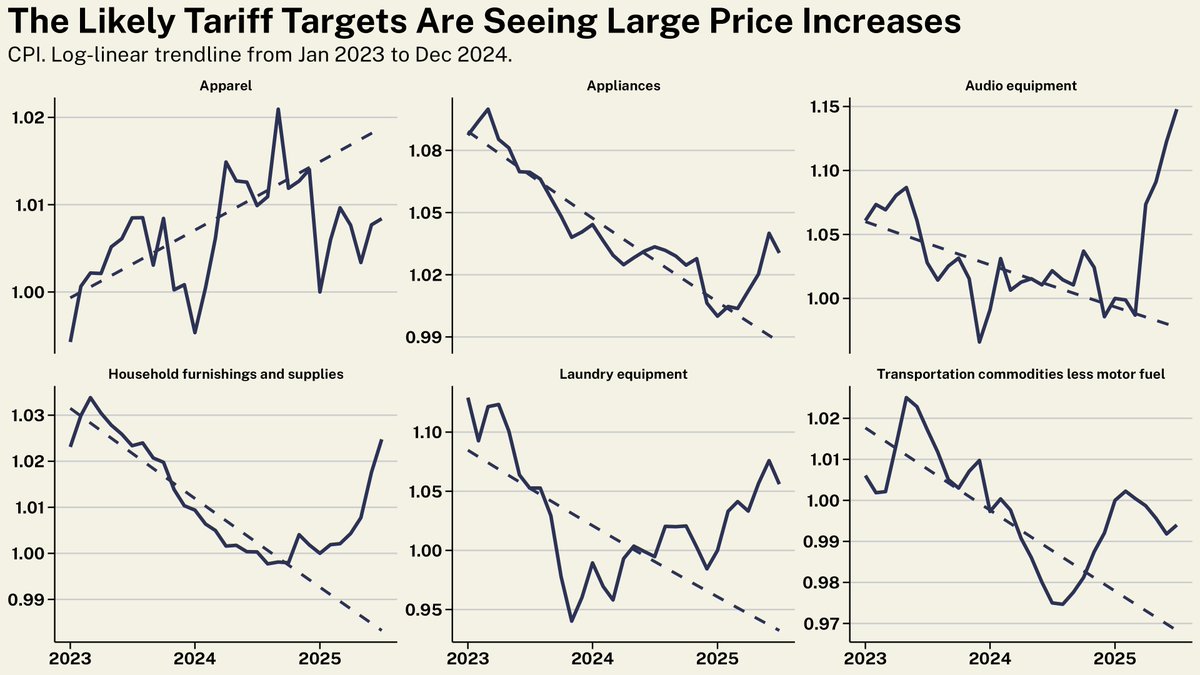

Meanwhile, tariffs are doing tariff things, with preregistered categories seeing prices increase, especially from trend. (Apparel is a notable exception.)

We do have to balance these price increase against the <checks notes> 37,000 jobs lost in manufacturing since April. /6

We do have to balance these price increase against the <checks notes> 37,000 jobs lost in manufacturing since April. /6

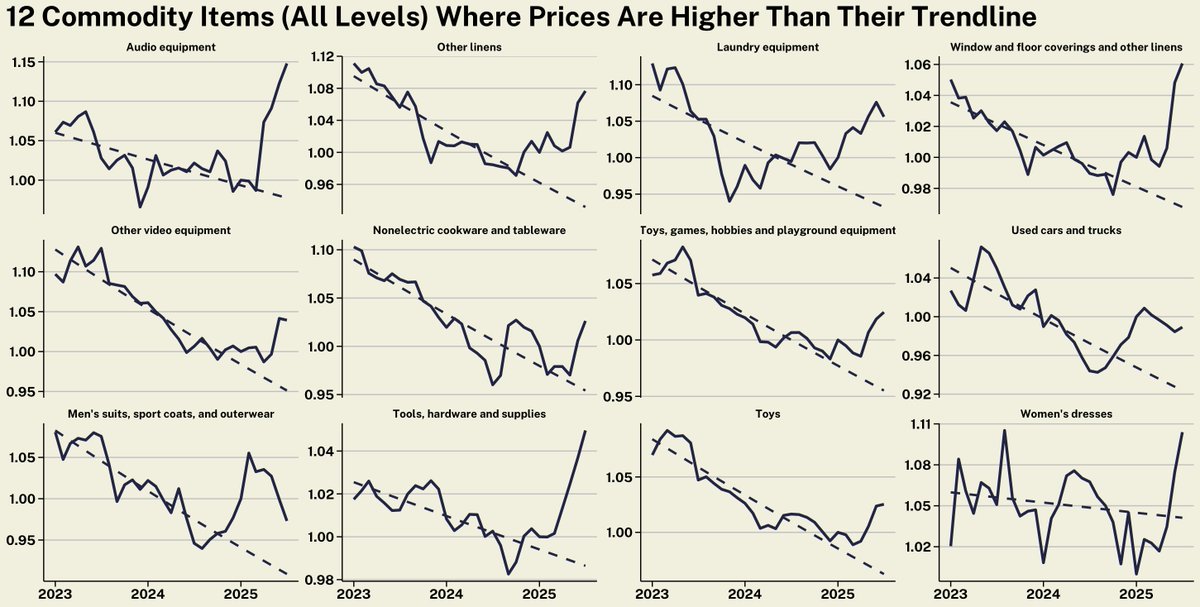

Now I preregistered those categories above, but here are the 12 highest price increases for goods against trendlines.

I assume working families being hit with higher prices alongside more insecure health care from Medicaid and ACA cuts aren't going to sweat some data-mining. /7

I assume working families being hit with higher prices alongside more insecure health care from Medicaid and ACA cuts aren't going to sweat some data-mining. /7

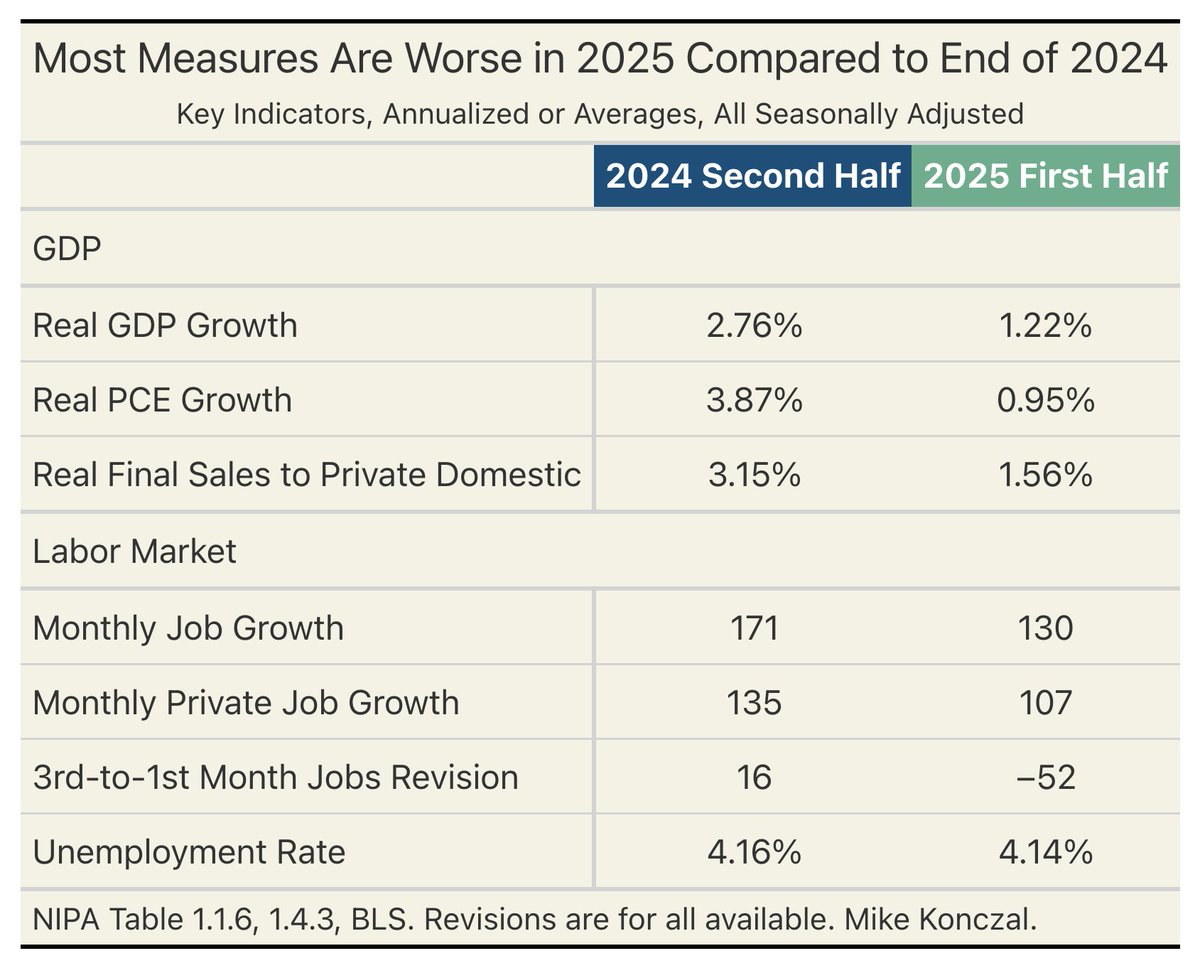

Overall worse than I expected, with the background of government disinvestment and deportations weakening potential growth.

Trump was handed a stable economy. I expected them to screw up either the labor market, prices, or growth. I didn't expect them to fumble all three. 8/8

Trump was handed a stable economy. I expected them to screw up either the labor market, prices, or growth. I didn't expect them to fumble all three. 8/8

• • •

Missing some Tweet in this thread? You can try to

force a refresh