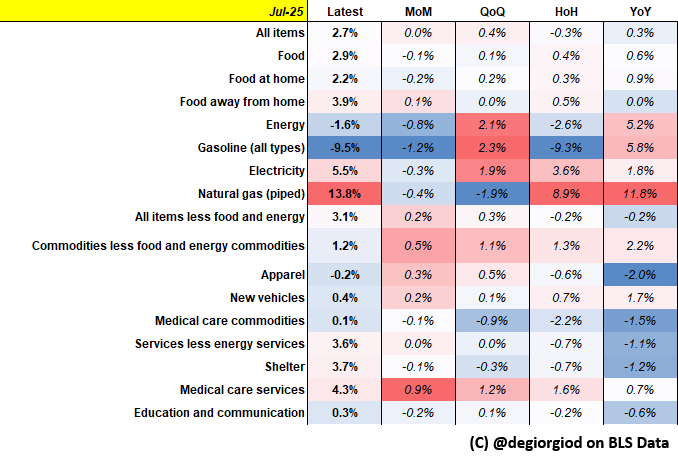

US CPI Thoughts, Jul'25

3 months into the TACO Trade War inflationary pressures into those CPI macro-categories in principle more impacted by tariffs appear limited.

On a YoY, HoH basis Food, Commodities ex Food&Energy and New Vehicles do show reverberations of the trade war 1/

3 months into the TACO Trade War inflationary pressures into those CPI macro-categories in principle more impacted by tariffs appear limited.

On a YoY, HoH basis Food, Commodities ex Food&Energy and New Vehicles do show reverberations of the trade war 1/

https://twitter.com/degiorgiod/status/1911447033149354461

but on a scale not comparable to what feared.

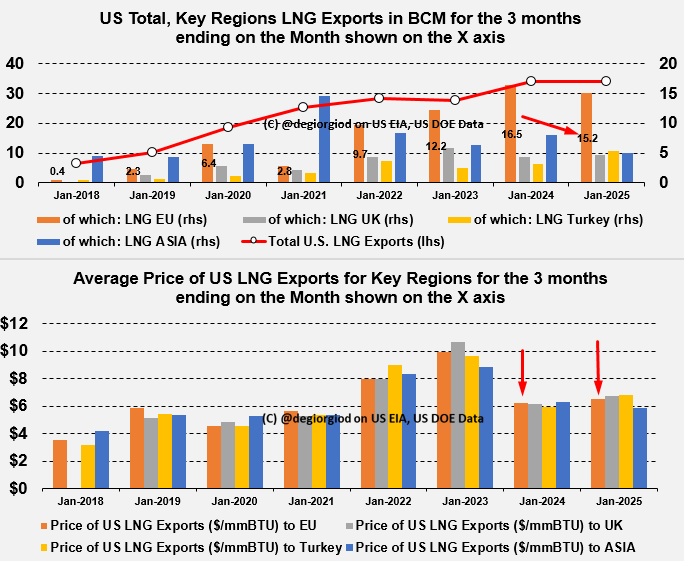

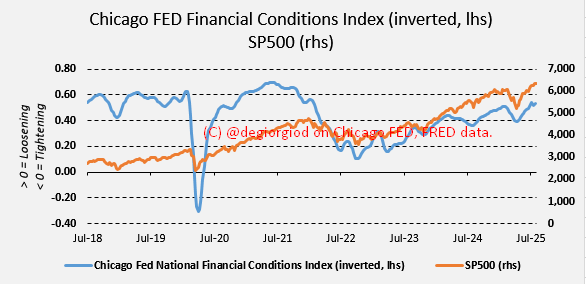

Odds are that courtesy of ever looser Financial Conditions US and massive pre-emptive imports 2/

Odds are that courtesy of ever looser Financial Conditions US and massive pre-emptive imports 2/

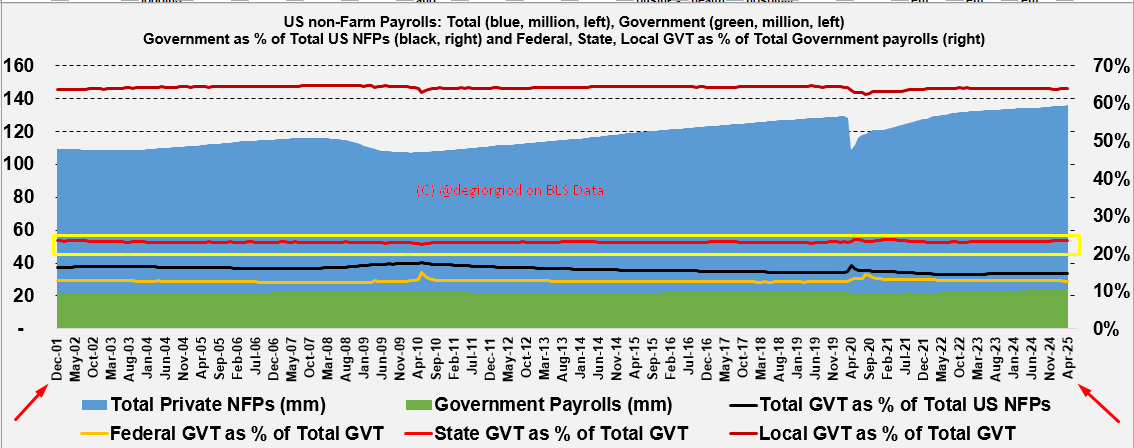

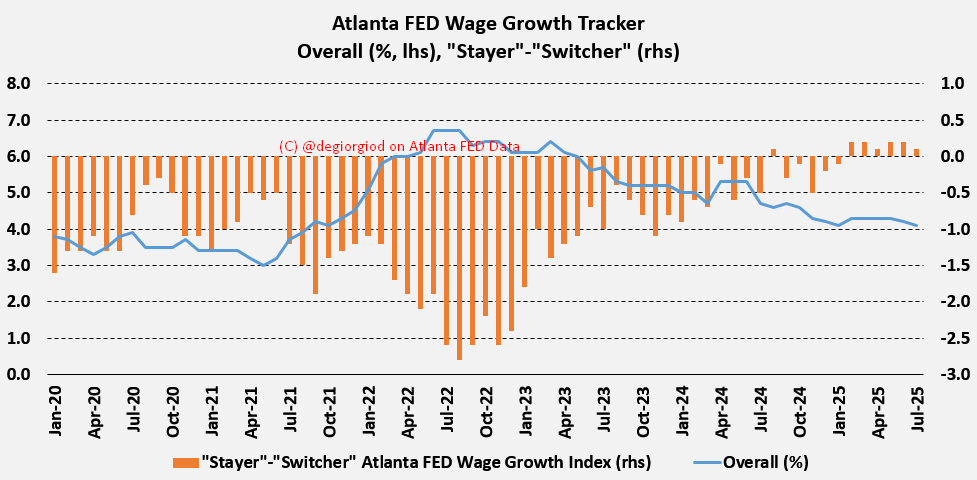

Wages dynamics (blue) continue to remain healthy and stronger by a 2% Margin vs 10y ago in the context of a cooler Job Market (Stayers Wage Growth steadily outpaces Switchers'). These two factors 4/

coupled w/ renewed fears US COs will *not* want to foot in more of the increased Tariffs burden and will pass it onto Consumers are contributing to reignite near-term (5y) increased inflationary expectations (red, LHS), especially vs longer-dated ones (blue, RHS).

@gianlucac1bis

@gianlucac1bis

@gianlucac1bis @threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh