Adj. Prof. Financial Markets,Credit,Banking @ Unicatt, Milan.

Strategic Advisor.

All things Macro, Bonds.

Energy Specialist with a Softs touch.

Ex Citi, ex UBM.

How to get URL link on X (Twitter) App

https://twitter.com/degiorgiod/status/2015398408220004554

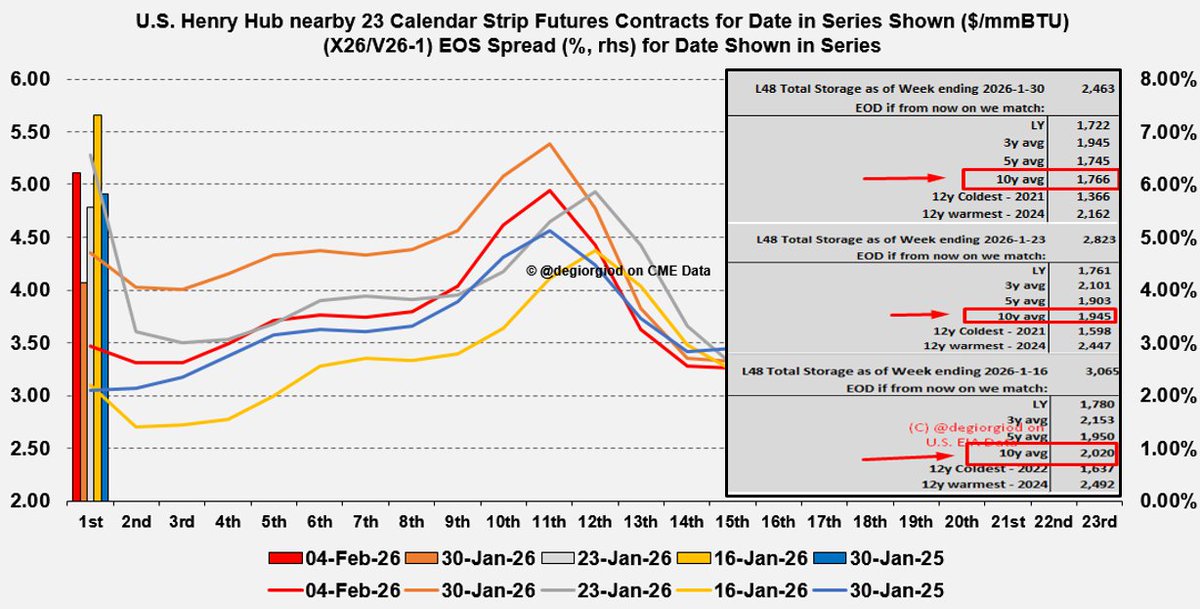

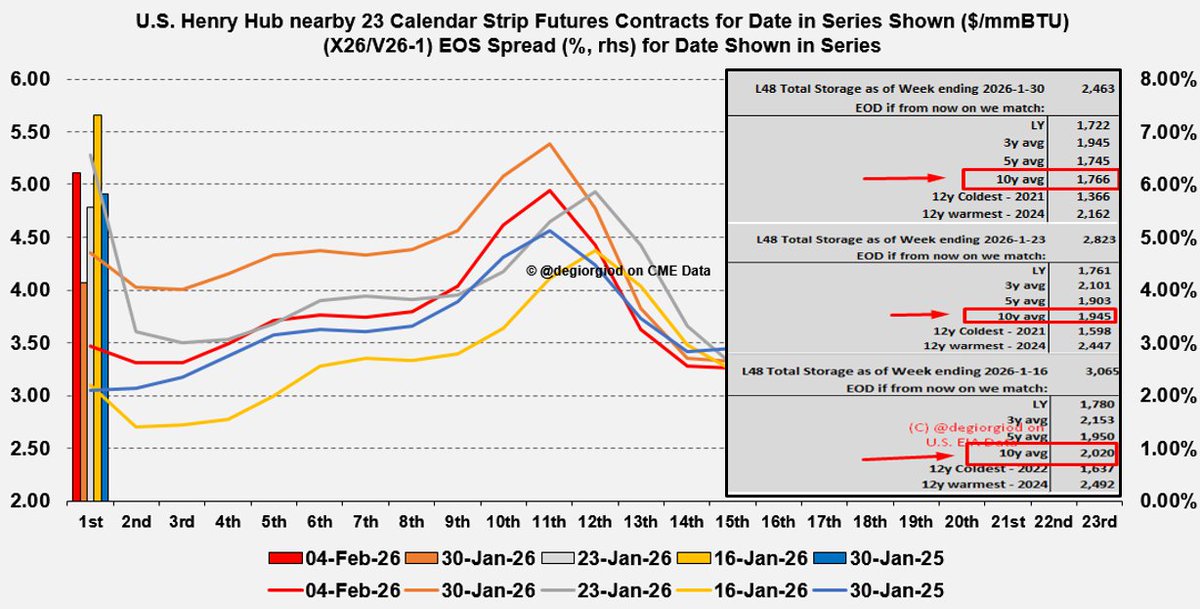

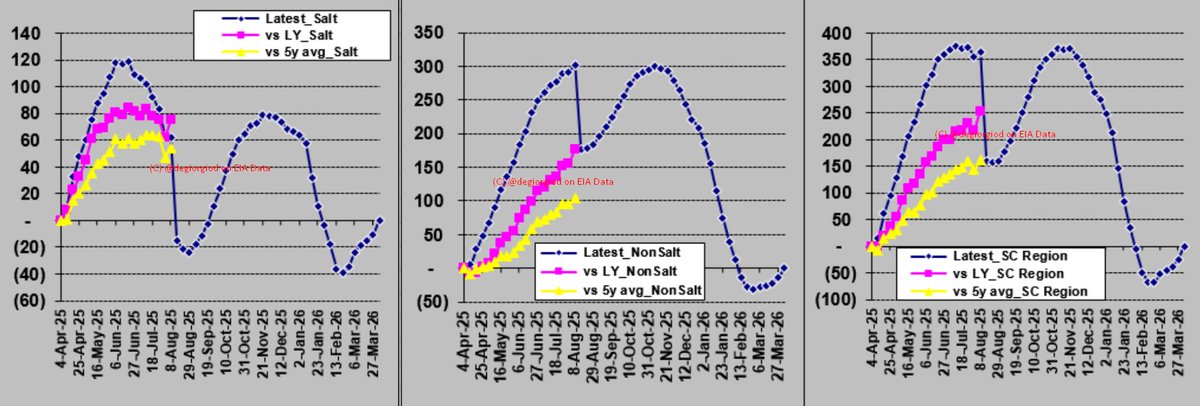

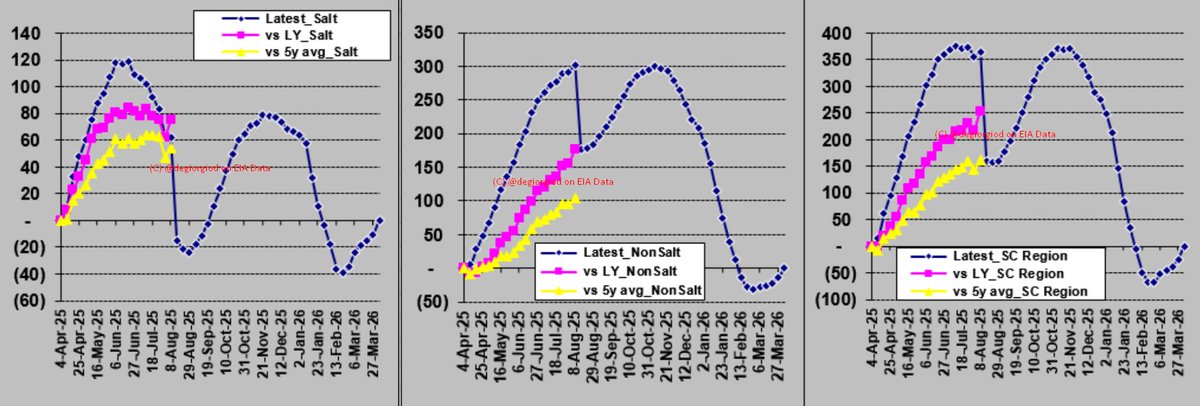

3. a grey box on the RHS of the chart, where I put my Storage model's levels for the last 3 EIA Reporting weeks and its EOD scenarios based on different assumptions of how the rest of the Draw Season may behave

3. a grey box on the RHS of the chart, where I put my Storage model's levels for the last 3 EIA Reporting weeks and its EOD scenarios based on different assumptions of how the rest of the Draw Season may behave

https://twitter.com/degiorgiod/status/2011844667235520573

we actually did.

we actually did.

https://twitter.com/KatieMiller/status/2007486726735044969

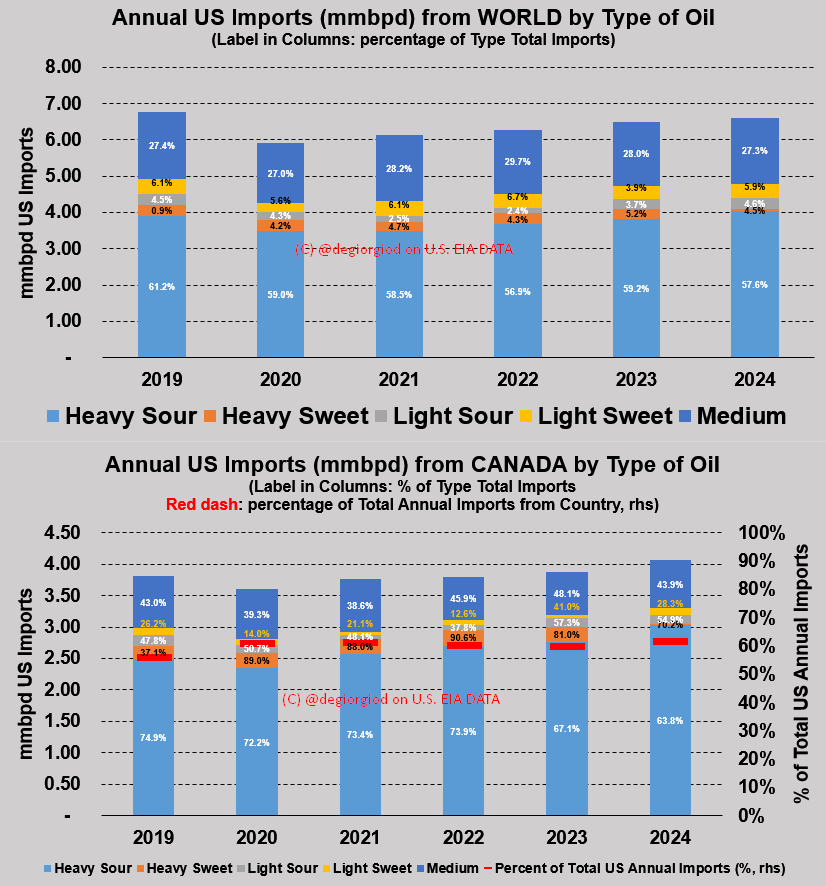

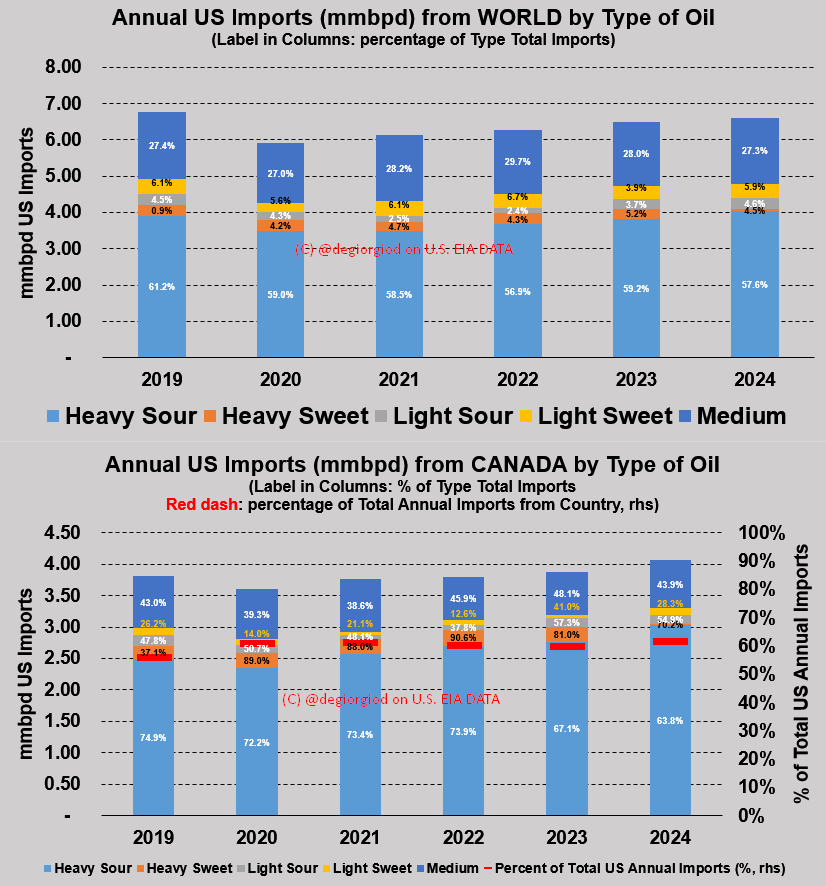

anyone?), 60% of which (~4mmbpd) from Canada.

anyone?), 60% of which (~4mmbpd) from Canada.https://twitter.com/gideonrachman/status/2007395376350015867comparable ethics and rule-following across signatories. They don’t exist. Fundamentalist theocracies don’t play by liberal rules—yet we treat them as if they do.

https://twitter.com/degiorgiod/status/2004856567477522706narrative.

https://twitter.com/degiorgiod/status/2001927293833445822masterpiece of "creative accounting": pillaging frozen Russian assets held by Euroclear to keep Ukraine’s economy (and military) on life support through 2026/27. That plan died on the vine. Instead, as the sun rose on December 19th, we found out the choice had fallen on a 2/

https://twitter.com/emmevilla/status/1996855662039781484

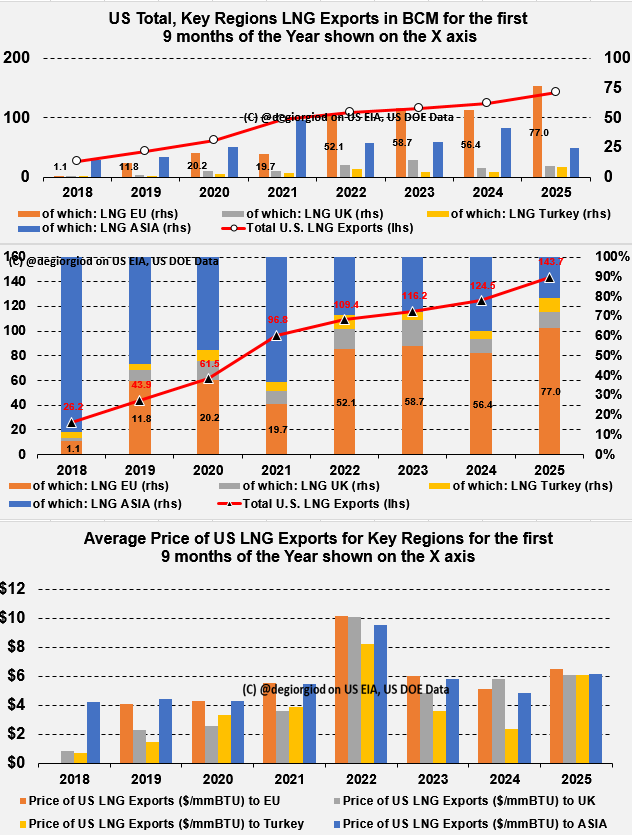

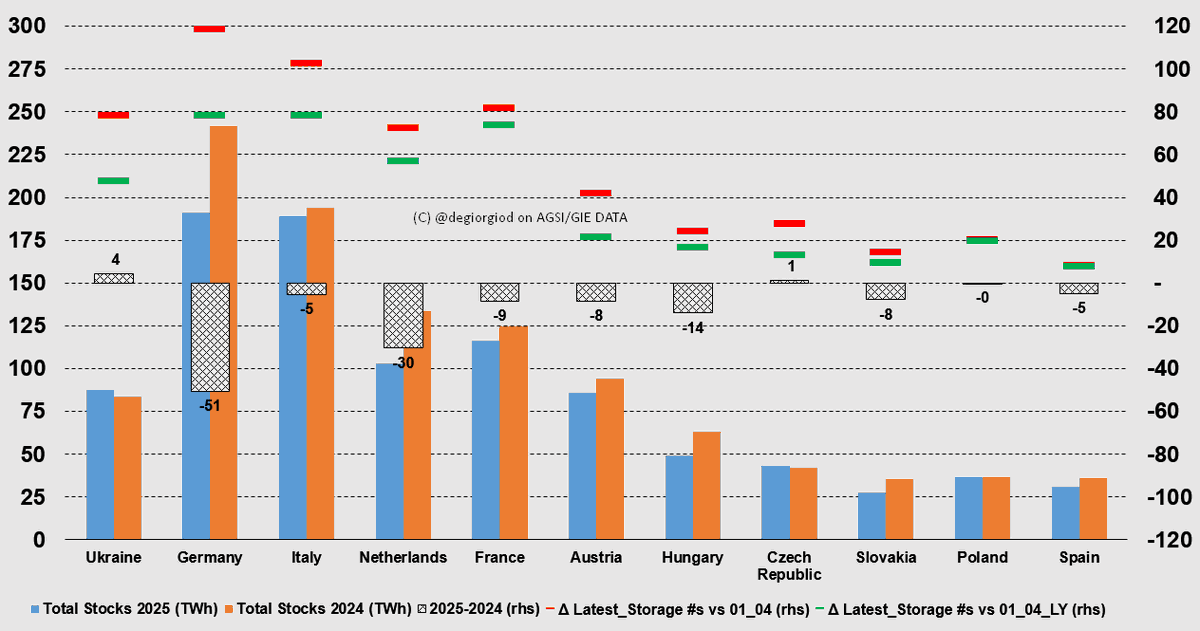

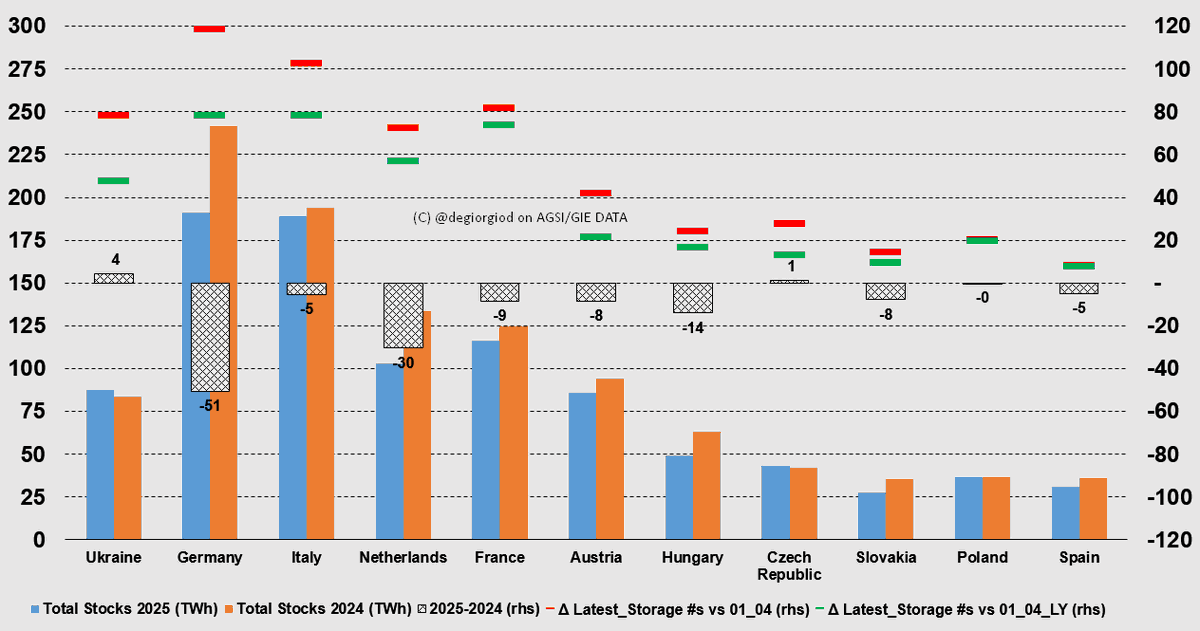

Dagli Stati Uniti (e *non* vuol dire che i venditori siano gli USA, ovviamente) son partiti 77miliardi di metri cubi di LNG per l'Europa, oltre il 60% dell'ammontare record (~144bcm) esportato nei primi 9 mesi del 2025.

Dagli Stati Uniti (e *non* vuol dire che i venditori siano gli USA, ovviamente) son partiti 77miliardi di metri cubi di LNG per l'Europa, oltre il 60% dell'ammontare record (~144bcm) esportato nei primi 9 mesi del 2025.

https://twitter.com/degiorgiod/status/1897199524357267937

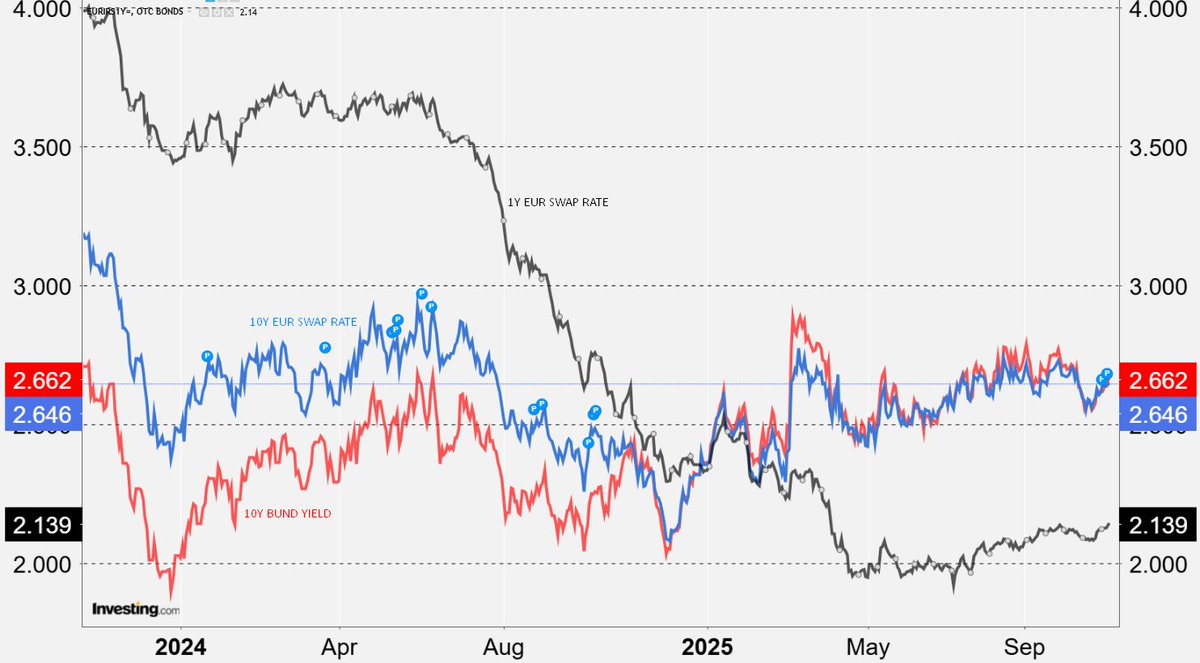

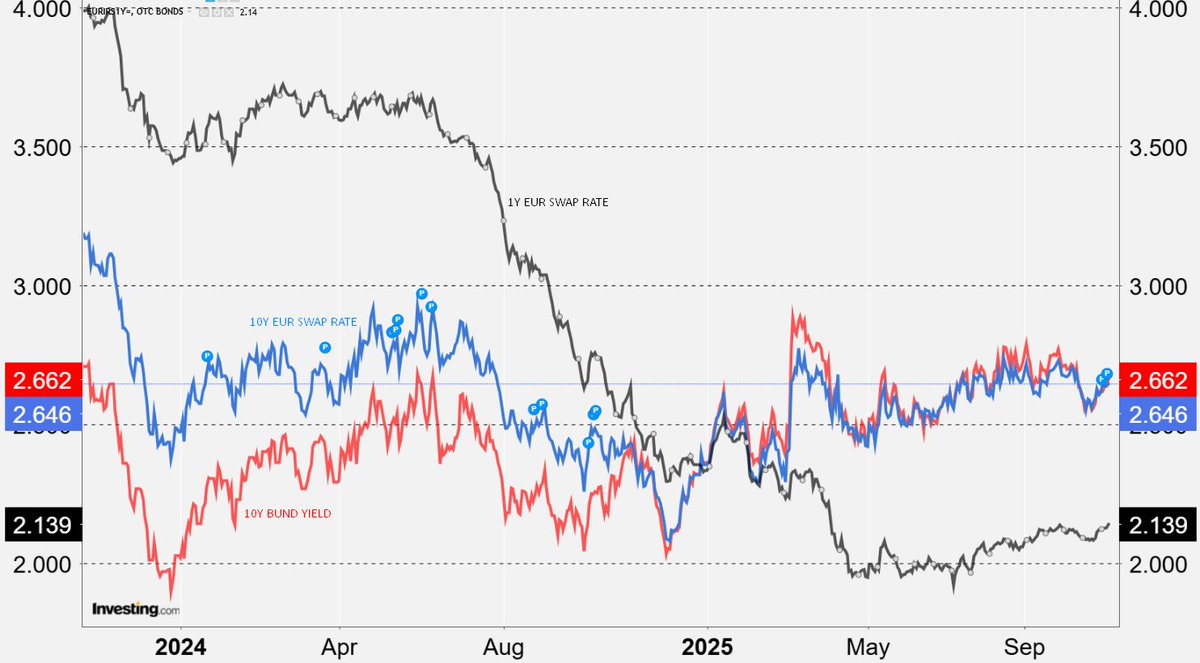

short-term Monetary Policy Action (its proxy here is the 1-year EUR Swap rate, black).

short-term Monetary Policy Action (its proxy here is the 1-year EUR Swap rate, black).https://x.com/degiorgiod/status/1940072716234535139

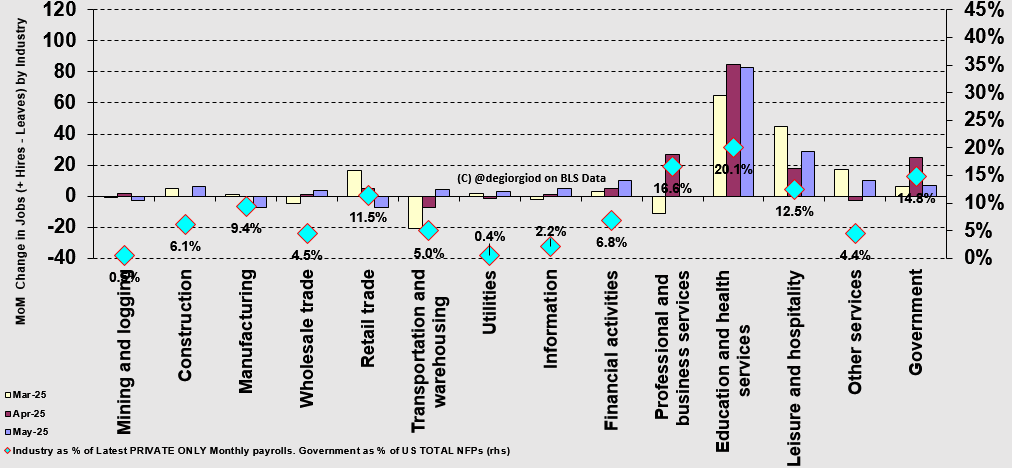

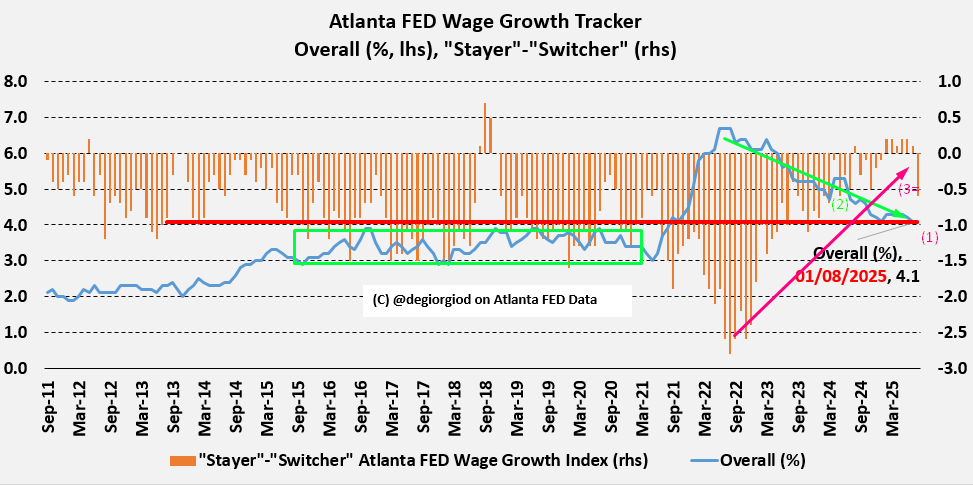

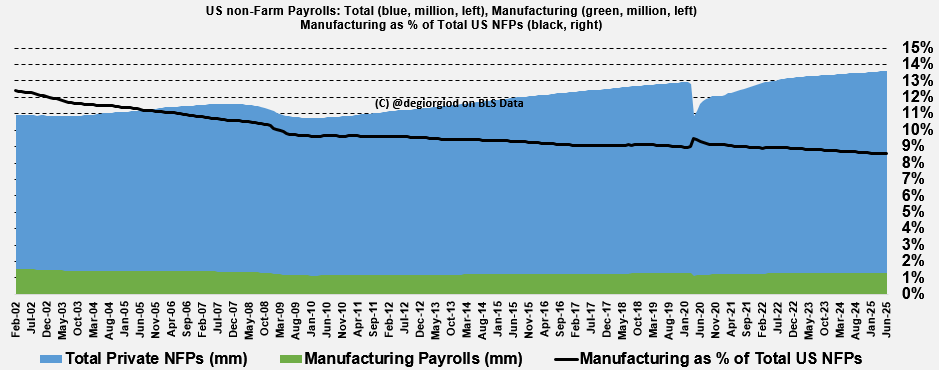

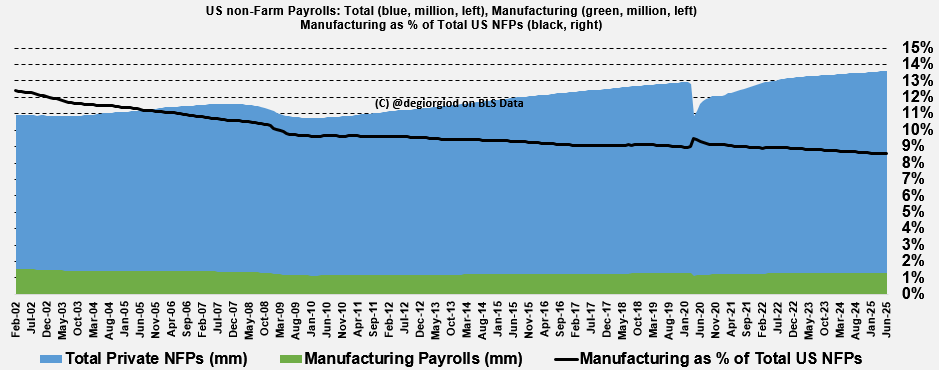

a vibrant, dynamic Job/Salaries ecosystem where spending is solid and consistent with a lively (2) yet less hot wages/jobs set-up where Wages continue to clock @ 4.1% YoY (1), ~+0.5% more than pre-Covid era but with a clearly less tight (3) balance btwn Labour S/D as Stayers' 2/

a vibrant, dynamic Job/Salaries ecosystem where spending is solid and consistent with a lively (2) yet less hot wages/jobs set-up where Wages continue to clock @ 4.1% YoY (1), ~+0.5% more than pre-Covid era but with a clearly less tight (3) balance btwn Labour S/D as Stayers' 2/

Here's why:

Here's why:

https://twitter.com/degiorgiod/status/1975204364873867759

on November 5th, 2023).

on November 5th, 2023).

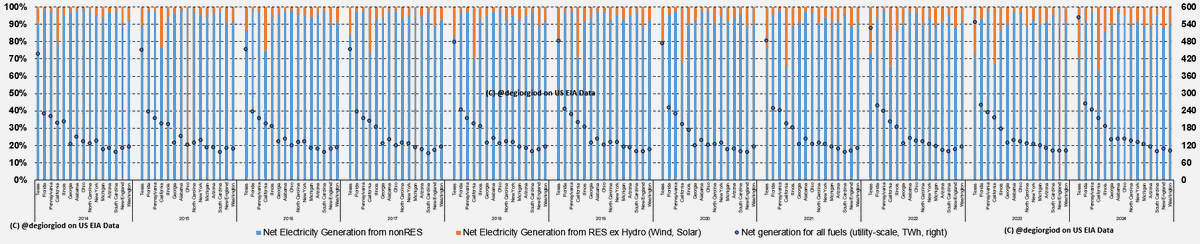

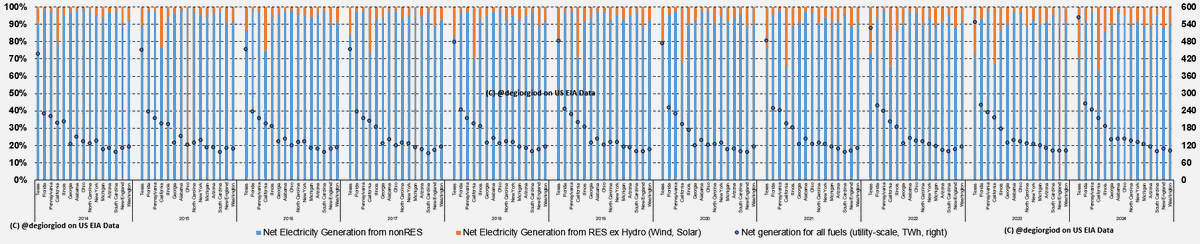

https://twitter.com/degiorgiod/status/1975204349543608580representing 13% of the entire U.S. total (4,305 TWh). Between 2001 and 2024, Texas increased its Net Electricity Generation by 51% (from 373 TWh to 564 TWh), while the entire U.S. increased its generation from 3,737 TWh to 4,305 TWh.

https://twitter.com/degiorgiod/status/1958554232082063392

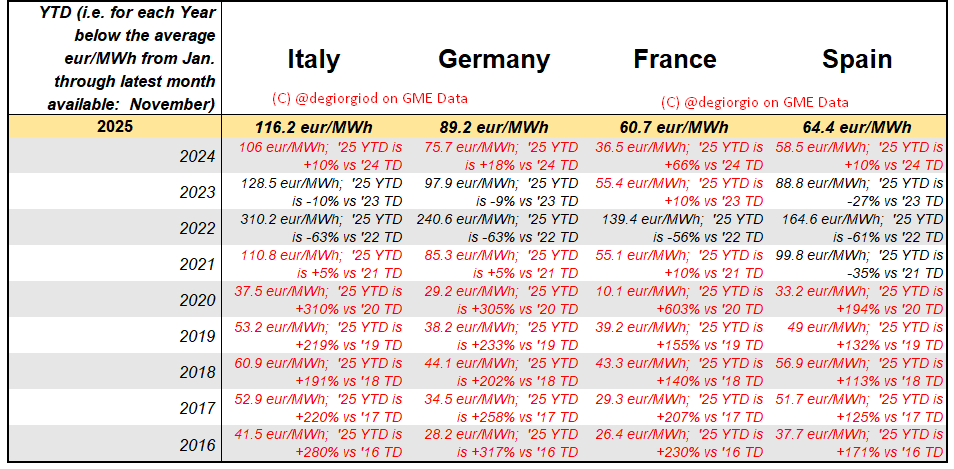

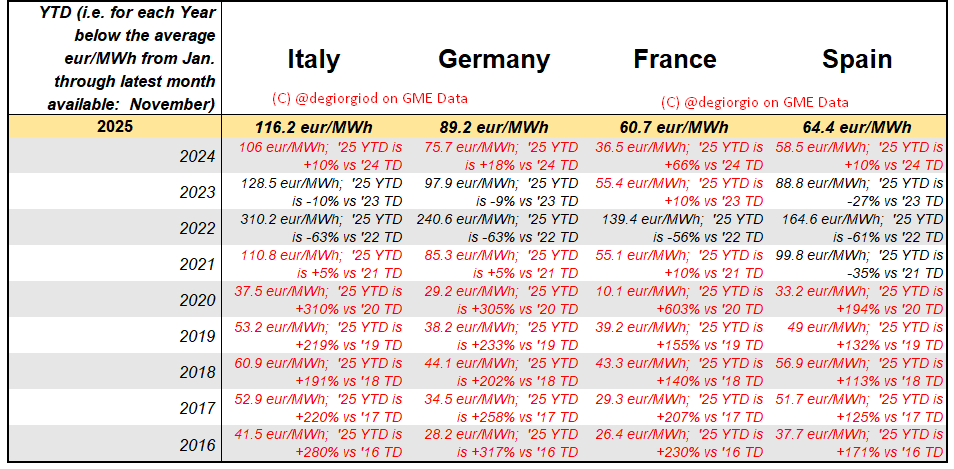

Things are frail already in Power-land...

Things are frail already in Power-land...https://x.com/degiorgiod/status/1975930193773498655

https://x.com/degiorgiod/status/1508813416768675852

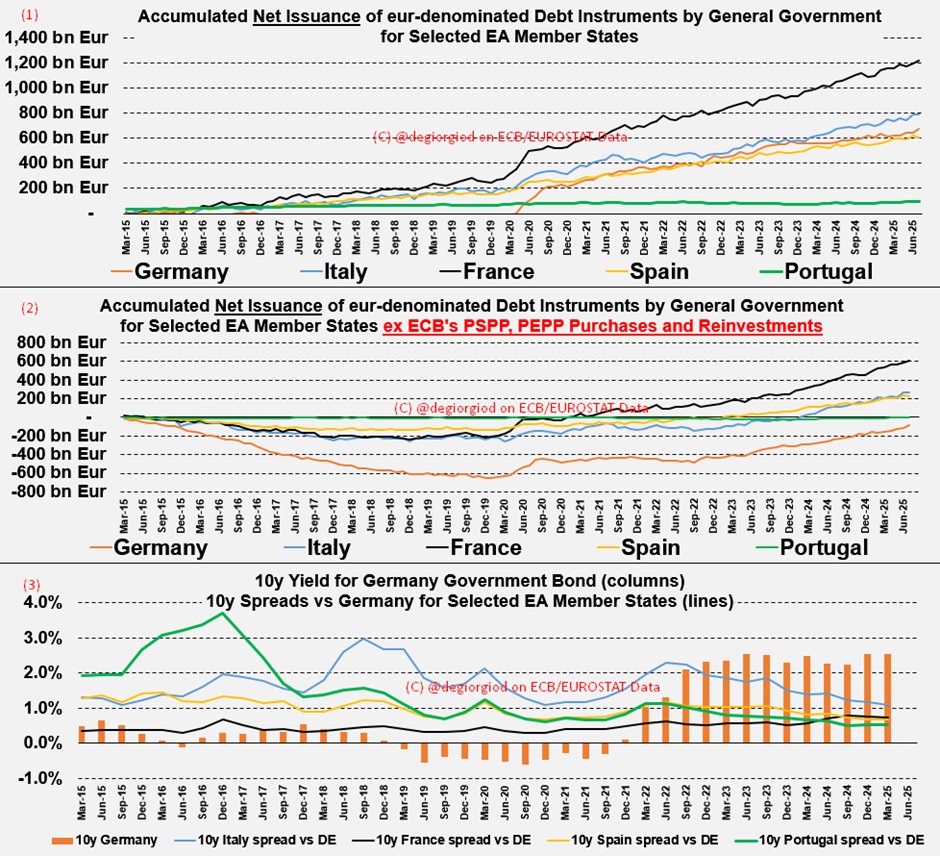

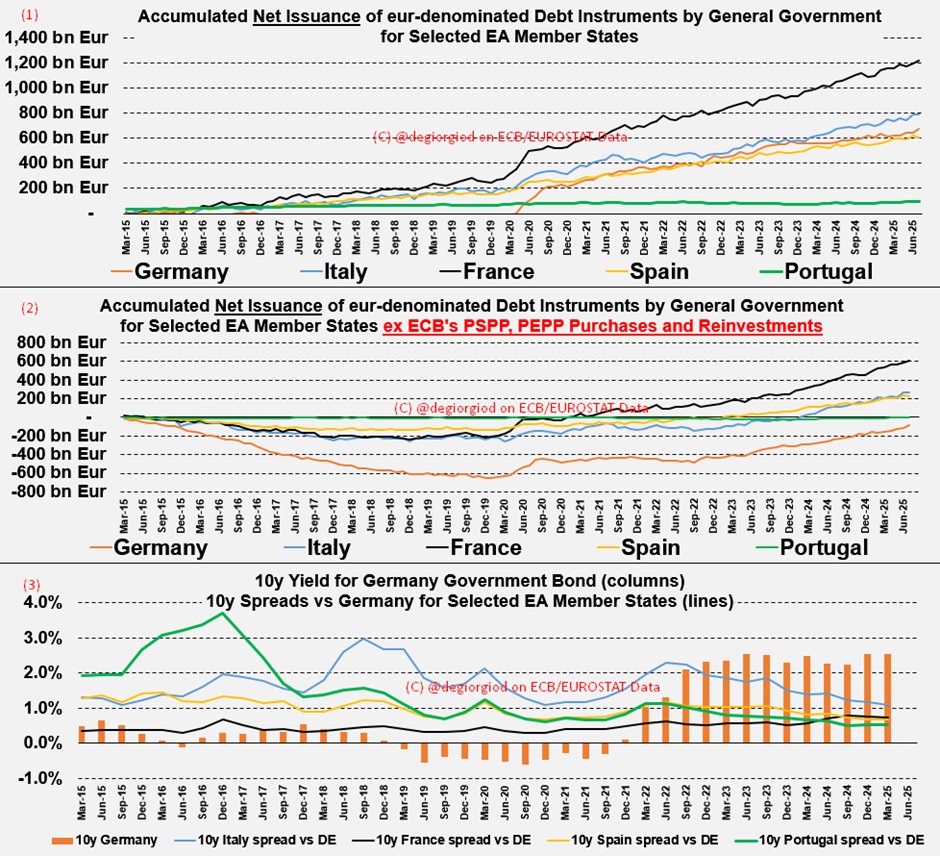

https://twitter.com/degiorgiod/status/1620841903125299201of political irresponsibility and short-term, short-sighted spending profligacy.

https://twitter.com/degiorgiod/status/1708591467889852852

supine posture towards Washington in handling EU foreign affairs (see ↓) had alienated the only credible, usable, viable leverage in the hands of the EU and of its member states: trade, namely energy trade.

supine posture towards Washington in handling EU foreign affairs (see ↓) had alienated the only credible, usable, viable leverage in the hands of the EU and of its member states: trade, namely energy trade.https://x.com/degiorgiod/status/1505857683588534274?t=xxOgJhBvMZThdbmh84obEg&s=19

https://twitter.com/degiorgiod/status/1927070750395032022

non-Salt (center), SC (rhs) through EIA's latest Number (today's). Data past latest number (blue line again) is as of corresponding week from Last Year. Purple and Yellow are accumulated incremental(+),decremental(-) BCF of storage added from Start of Injection Season vs LY, 2/

non-Salt (center), SC (rhs) through EIA's latest Number (today's). Data past latest number (blue line again) is as of corresponding week from Last Year. Purple and Yellow are accumulated incremental(+),decremental(-) BCF of storage added from Start of Injection Season vs LY, 2/

https://twitter.com/degiorgiod/status/1911447033149354461

but on a scale not comparable to what feared.

but on a scale not comparable to what feared.

https://twitter.com/degiorgiod/status/1805159333690331583*Expanding Energy Mix towards Nuclear ...

https://x.com/degiorgiod/status/1640099483458347008?t=Ui5Uzf4xLBYOYV8EQ5_jHA&s=19

https://twitter.com/degiorgiod/status/1932820416315134037

Jobs creation continues to be in L&H, where additions clock north of 80k/month new jobs.

Jobs creation continues to be in L&H, where additions clock north of 80k/month new jobs.