🚨 Mesh now supports Ripple USD (RLUSD) and pipes it straight into merchant checkout alongside 50+ tokens.

Here’s everything you need to know🧵👇

Here’s everything you need to know🧵👇

2/🧵

What Mesh is (and why it matters):

Mesh is the connective tissue between wallets, exchanges, and merchants — a payments + token checkout layer already plugged into retail flows. When Mesh adds a token, it instantly inherits acceptance across its merchant integrations. RLUSD didn’t start from zero; it started from Mesh’s distribution.

What Mesh is (and why it matters):

Mesh is the connective tissue between wallets, exchanges, and merchants — a payments + token checkout layer already plugged into retail flows. When Mesh adds a token, it instantly inherits acceptance across its merchant integrations. RLUSD didn’t start from zero; it started from Mesh’s distribution.

3/🧵

What RLUSD is (beyond “another stablecoin”):

RLUSD is Ripple’s dollar‑denominated stable instrument, designed for instant settlement on institutional‑grade rails. Think bank‑friendly compliance posture, near‑zero fees, and native alignment with payment standards. It’s not a degen stable; it’s a merchant rail.

What RLUSD is (beyond “another stablecoin”):

RLUSD is Ripple’s dollar‑denominated stable instrument, designed for instant settlement on institutional‑grade rails. Think bank‑friendly compliance posture, near‑zero fees, and native alignment with payment standards. It’s not a degen stable; it’s a merchant rail.

4/🧵

Why merchants care:

Card rails = interchange + chargebacks + T+1–T+3 settlement.

RLUSD via Mesh = low fees, finality in seconds, programmable receipts, and optional auto‑convert to fiat. For high‑margin e‑com and cross‑border sellers, that’s hard to ignore — especially when you can route it through existing Mesh plugins.

Why merchants care:

Card rails = interchange + chargebacks + T+1–T+3 settlement.

RLUSD via Mesh = low fees, finality in seconds, programmable receipts, and optional auto‑convert to fiat. For high‑margin e‑com and cross‑border sellers, that’s hard to ignore — especially when you can route it through existing Mesh plugins.

5/🧵

A U.S.‑issued, U.S.‑aligned dollar instrument settling on U.S.‑friendly infrastructure is monetary soft power. Instead of offshore stables setting the rules, America just placed a compliant digital dollar at the point of sale — quietly. That’s how hegemony is maintained in a multipolar payments world.

A U.S.‑issued, U.S.‑aligned dollar instrument settling on U.S.‑friendly infrastructure is monetary soft power. Instead of offshore stables setting the rules, America just placed a compliant digital dollar at the point of sale — quietly. That’s how hegemony is maintained in a multipolar payments world.

6/🧵

Where XRP fits (don’t blink):

RLUSD is the dollar leg. Real commerce is multi‑asset and cross‑border. XRPL’s pathfinding + native DEX means XRP becomes the neutral bridge when RLUSD needs to hop into non‑USD corridors or settle against other issued currencies. More RLUSD throughput = more XRP path demand.

Where XRP fits (don’t blink):

RLUSD is the dollar leg. Real commerce is multi‑asset and cross‑border. XRPL’s pathfinding + native DEX means XRP becomes the neutral bridge when RLUSD needs to hop into non‑USD corridors or settle against other issued currencies. More RLUSD throughput = more XRP path demand.

7/🧵

This isn’t a pilot — it’s distribution:

•50+ supported tokens already live on Mesh → RLUSD joins the menu

•Merchant checkout SDKs = instant UX for RLUSD tender

•Treasury ops can sweep RLUSD, hedge, or settle invoices same‑day

It’s not the press release that matters; it’s who already integrated the button.

This isn’t a pilot — it’s distribution:

•50+ supported tokens already live on Mesh → RLUSD joins the menu

•Merchant checkout SDKs = instant UX for RLUSD tender

•Treasury ops can sweep RLUSD, hedge, or settle invoices same‑day

It’s not the press release that matters; it’s who already integrated the button.

8/🧵

Compliance & auditability (the part nobody tweets):

RLUSD on modern rails can carry rich metadata (invoice IDs, jurisdiction flags, tax fields), making audits and reconciliations trivial. That’s why enterprise finance teams prefer this over “anonymous” stables. It’s clean, accountable, and CFO‑friendly.

Compliance & auditability (the part nobody tweets):

RLUSD on modern rails can carry rich metadata (invoice IDs, jurisdiction flags, tax fields), making audits and reconciliations trivial. That’s why enterprise finance teams prefer this over “anonymous” stables. It’s clean, accountable, and CFO‑friendly.

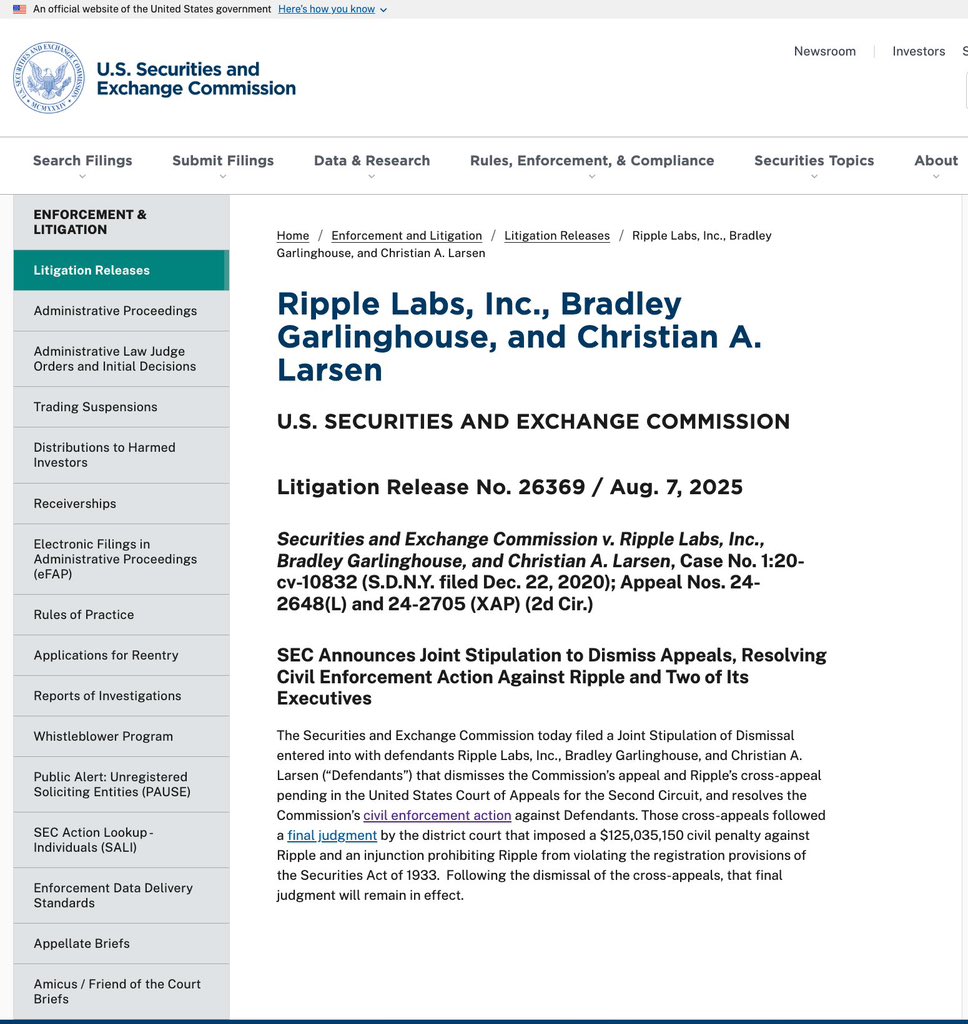

9/🧵

The sequence they won’t spell out:

1.Stabilize Ripple’s legal footing.

2.Roll out a compliant USD rail (RLUSD).

it inside existing merchant pipes (Mesh).

4.Let XRP handle the unseen bridging when commerce crosses borders.

No fanfare. Just corridors quietly turning green.3.Land

The sequence they won’t spell out:

1.Stabilize Ripple’s legal footing.

2.Roll out a compliant USD rail (RLUSD).

it inside existing merchant pipes (Mesh).

4.Let XRP handle the unseen bridging when commerce crosses borders.

No fanfare. Just corridors quietly turning green.3.Land

10/🧵

Next activation points to watch:

•POS providers announcing RLUSD via Mesh plugins

•Subscriptions/recurring billing in RLUSD

•Merchant auto‑FX (RLUSD ↔ local currency) where XRP routes the path

•Treasury dashboards showing RLUSD yield/hedge integrations

Next activation points to watch:

•POS providers announcing RLUSD via Mesh plugins

•Subscriptions/recurring billing in RLUSD

•Merchant auto‑FX (RLUSD ↔ local currency) where XRP routes the path

•Treasury dashboards showing RLUSD yield/hedge integrations

11/🧵

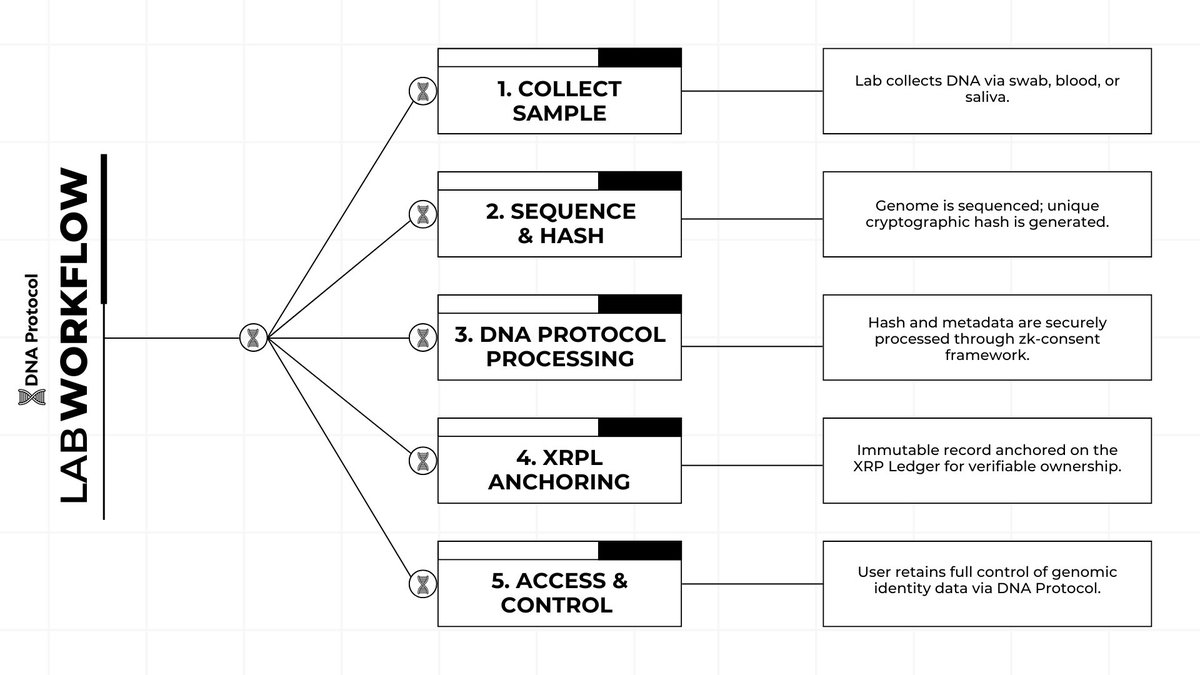

The identity layer (mysterious, but inevitable):

Projects like DNA Protocol are anchoring verifiable identity and genomic data on XRPL. Imagine RLUSD‑gated services that require on‑ledger proofs (consent, KYC, age/region) — payments + identity on one spine. That’s where the rails are headed.

The identity layer (mysterious, but inevitable):

Projects like DNA Protocol are anchoring verifiable identity and genomic data on XRPL. Imagine RLUSD‑gated services that require on‑ledger proofs (consent, KYC, age/region) — payments + identity on one spine. That’s where the rails are headed.

11/🧵

The identity layer (mysterious, but inevitable):

Projects like @DNAOnChain are anchoring verifiable identity and genomic data on XRPL. Imagine RLUSD‑gated services that require on‑ledger proofs (consent, KYC, age/region) payments + identity on one spine. That’s where the rails are headed.

The identity layer (mysterious, but inevitable):

Projects like @DNAOnChain are anchoring verifiable identity and genomic data on XRPL. Imagine RLUSD‑gated services that require on‑ledger proofs (consent, KYC, age/region) payments + identity on one spine. That’s where the rails are headed.

• • •

Missing some Tweet in this thread? You can try to

force a refresh