Most business leaders think Finance is for CFOs.

That's why they make bad decisions.

Free EBITDA Masterclass on July 11-2025 @ 11 AM EST: https:

Because every business decision is a Finance decision. bit.ly/ebitda-mistakes

That's why they make bad decisions.

Free EBITDA Masterclass on July 11-2025 @ 11 AM EST: https:

Because every business decision is a Finance decision. bit.ly/ebitda-mistakes

Where capital is sourced and deployed.

Where returns are generated and reinvested.

Where cash moves in and out and whether it's managed effectively or wasted.

If you don't understand finance, you're leading blind.

Let's change that.

Where returns are generated and reinvested.

Where cash moves in and out and whether it's managed effectively or wasted.

If you don't understand finance, you're leading blind.

Let's change that.

Here are 10 Critical Finance Topics Every Leader Must Master

Finance Strategies How to source and deploy capital.

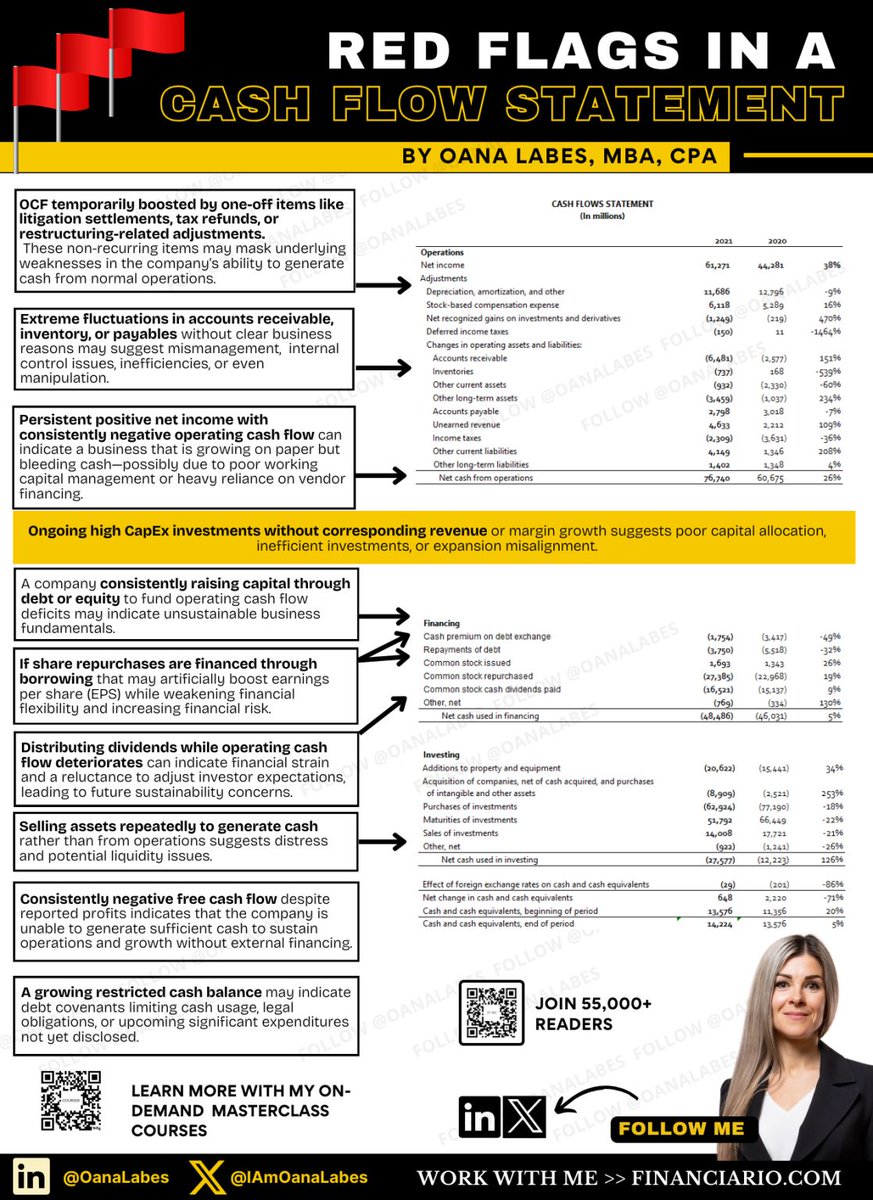

Cash Flow Mastery Understanding critical inflows and outflows.

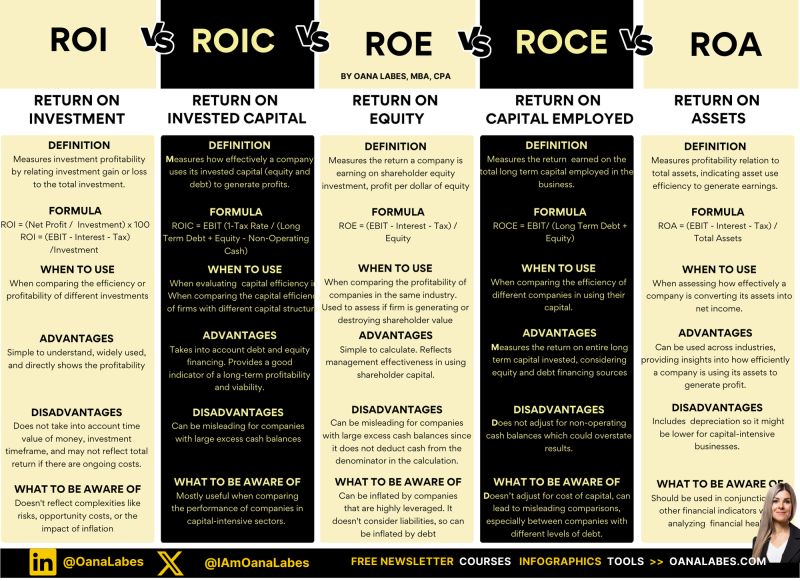

Financial Analysis Ratio analysis, trend analysis, and key insights.

Finance Strategies How to source and deploy capital.

Cash Flow Mastery Understanding critical inflows and outflows.

Financial Analysis Ratio analysis, trend analysis, and key insights.

NPV, IRR, and Payback Making better investment decisions.

The 3 Financial Statements Connecting the P&L, Balance Sheet, and Cash Flow.

Capital Budgeting Evaluating long-term investments.

Profit vs. EBITDA vs. Cash Flow Seeing beyond profitability.

The 3 Financial Statements Connecting the P&L, Balance Sheet, and Cash Flow.

Capital Budgeting Evaluating long-term investments.

Profit vs. EBITDA vs. Cash Flow Seeing beyond profitability.

Cash Flow Drivers Managing operations, investments, and financing.

Key Performance Metrics EBITDA, cash flow, and profit KPIs.

Cash Flow Statement Breakdown Knowing where your cash is really going.

Key Performance Metrics EBITDA, cash flow, and profit KPIs.

Cash Flow Statement Breakdown Knowing where your cash is really going.

Master these, and you won't just run a business you'll scale it intelligently.

If this helped you:

1. Follow @IAmOanaLabes for sharp strategic finance insights

2. Join 55K+ execs reading my free newsletter: https:

3. Repost to share this insightbuff.ly/yPK0EXi

If this helped you:

1. Follow @IAmOanaLabes for sharp strategic finance insights

2. Join 55K+ execs reading my free newsletter: https:

3. Repost to share this insightbuff.ly/yPK0EXi

• • •

Missing some Tweet in this thread? You can try to

force a refresh