Every few centuries, the world changes its money.

Those who adapt, prosper.

Those who don’t… get left behind.

We’re living through the next shift right now—and most people won’t see it until it’s over. 🧵👇

Those who adapt, prosper.

Those who don’t… get left behind.

We’re living through the next shift right now—and most people won’t see it until it’s over. 🧵👇

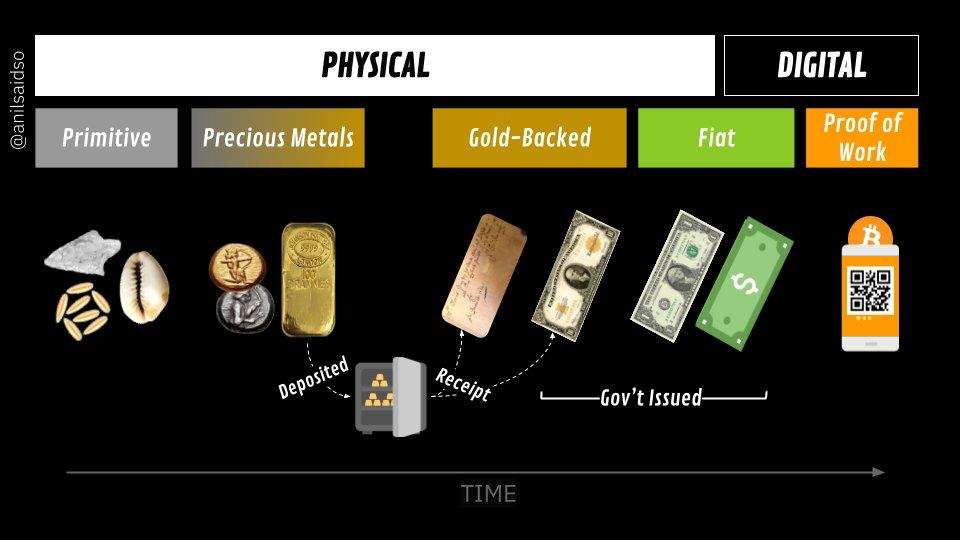

Early money was local.

Cowrie shells in Africa. Wampum beads in North America. Rai stones on Yap Island.

These worked—until trade expanded and weight, transport, and verification became bottlenecks.

Cowrie shells in Africa. Wampum beads in North America. Rai stones on Yap Island.

These worked—until trade expanded and weight, transport, and verification became bottlenecks.

Metals solved those problems.

Gold, silver, and copper were durable, divisible, and universal.

They were money not because rulers declared it, but because the market converged on them.

Gold, silver, and copper were durable, divisible, and universal.

They were money not because rulers declared it, but because the market converged on them.

Then came a twist:

Paper notes redeemable for gold.

Easier to carry. Easier to transfer. But they relied on trust that the gold was still there.

This trust was tested—and eventually broken—over and over.

Paper notes redeemable for gold.

Easier to carry. Easier to transfer. But they relied on trust that the gold was still there.

This trust was tested—and eventually broken—over and over.

By 1971, the gold standard was gone.

Money became purely fiat: backed by nothing but law and confidence.

It could be created in unlimited quantities—and it has been—driving 50 years of relentless asset inflation.

Money became purely fiat: backed by nothing but law and confidence.

It could be created in unlimited quantities—and it has been—driving 50 years of relentless asset inflation.

Today, money is just numbers in databases—moved at the speed of light.

But the base layer is still political. Centralized. Inflatable.

It’s built for the issuer, not the user.

But the base layer is still political. Centralized. Inflatable.

It’s built for the issuer, not the user.

Bitcoin is the first upgrade in 50 years.

It’s global like the internet. Scarce like gold. Verifiable without trust.

No king, bank, or government can change its rules.

It’s global like the internet. Scarce like gold. Verifiable without trust.

No king, bank, or government can change its rules.

We’ve shifted our monetary substrate before.

From beads to gold. Gold to paper. Paper to digital fiat.

The next leap—to Bitcoin—isn’t just likely. It’s already underway.

From beads to gold. Gold to paper. Paper to digital fiat.

The next leap—to Bitcoin—isn’t just likely. It’s already underway.

History shows one truth:

When better money emerges, it wins. Not overnight—but inevitably.

This thread was based on the brilliant book “Broken Money” by Lyn Alden.

When better money emerges, it wins. Not overnight—but inevitably.

This thread was based on the brilliant book “Broken Money” by Lyn Alden.

At Swan Private, we help high-net-worth individuals and businesses make that leap—securely stacking and storing Bitcoin for the long term.

If you’re ready to position yourself for the next era of money, book a call with a member of the team today.

swanbitcoin.com/private?utm_ca…

If you’re ready to position yourself for the next era of money, book a call with a member of the team today.

swanbitcoin.com/private?utm_ca…

• • •

Missing some Tweet in this thread? You can try to

force a refresh