The price action in stocks continues to confirm the macro regime I've laid out

1)The Credit Cycle is in full swing, causing melt-up mode

2)Inflation risk is greater than recession risk

All of this is coming to the macro end game moment where volatility shocks everyone 🧵👇

1)The Credit Cycle is in full swing, causing melt-up mode

2)Inflation risk is greater than recession risk

All of this is coming to the macro end game moment where volatility shocks everyone 🧵👇

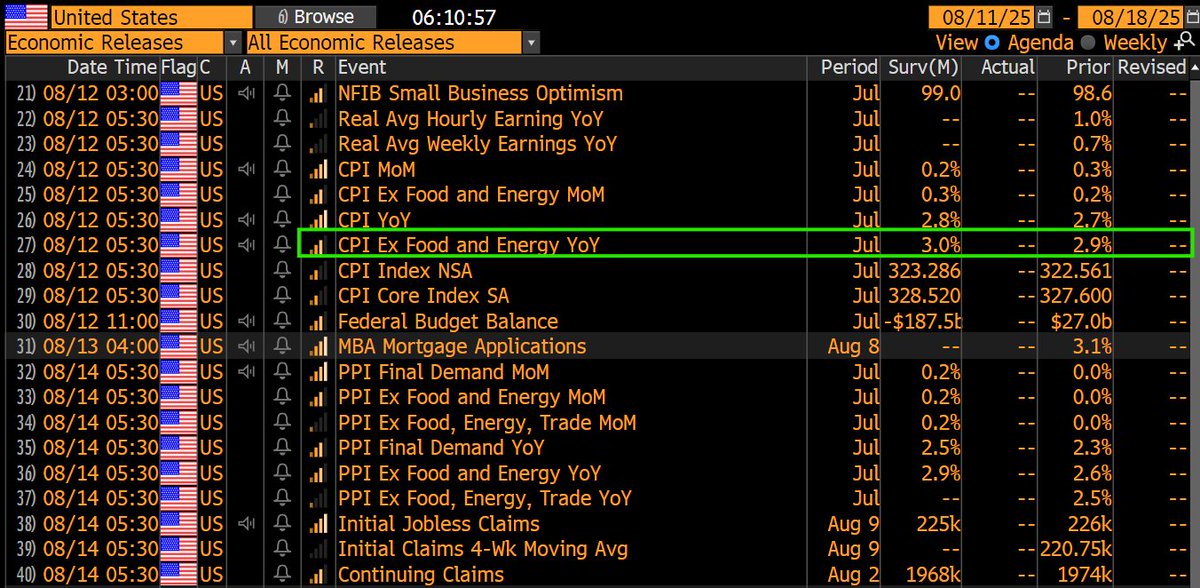

On the CPI print today, we are seeing stocks UP and bonds DOWN. Why? because we need to unwind all the bears who thought a single NFP print meant a recession.

As I laid out earlier this week, the play continues to be stocks bidding and bonds at risk of selling off

As I laid out earlier this week, the play continues to be stocks bidding and bonds at risk of selling off

https://x.com/Globalflows/status/1954673126471836025

When stocks are bidding and bonds are selling, it is an indication that INFLATION RISK IS GREATER THAN RECESSION RISK. Everything for this idea was laid out in the interest rate report:

https://x.com/Globalflows/status/1954751662662590820

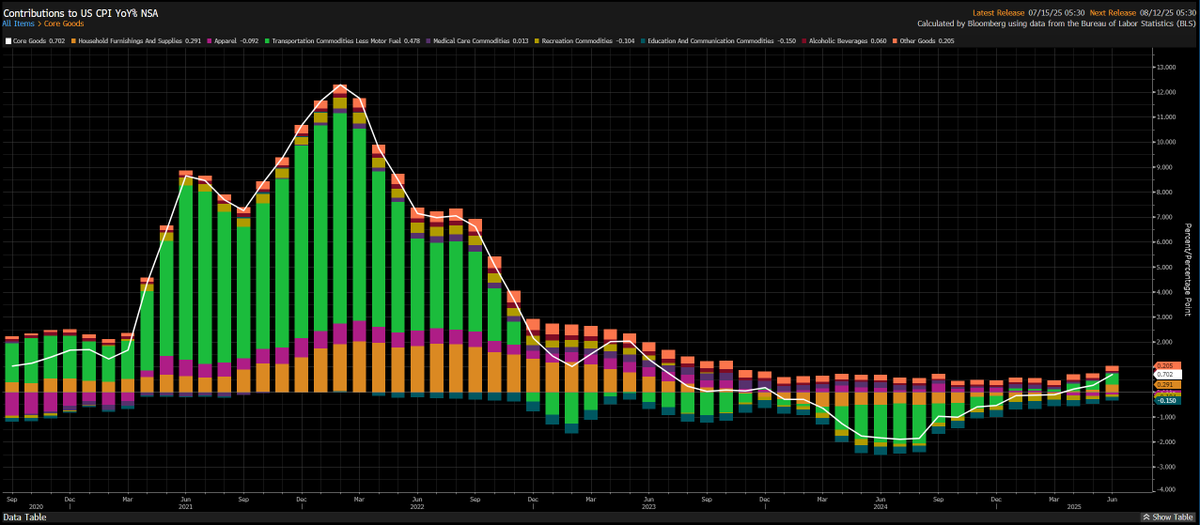

But why is there inflation? It's not because of tariffs. Tariffs are maybe 10-15% of the picture that is causing misdirection. The Fed and every other central banker are saying that they are "looking through" inflation data cause its from tariffs.

This is gross incompetence

This is gross incompetence

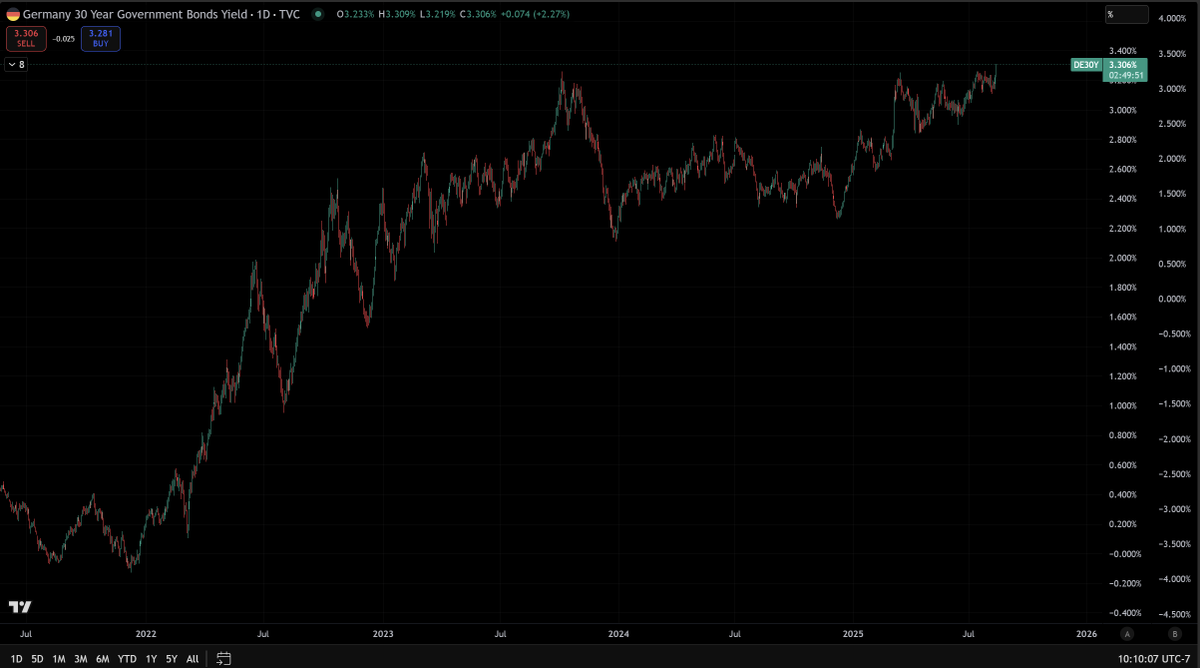

This isn't just in the US. Germany pushed through a massive spending bill, the UK has inflation ticking up, and yields in Japan are blowing through the roof.

Everything is pointing to long end yields moving higher and no one wants to acknowledge it cause their so afraid of a recession.

Everything is pointing to long end yields moving higher and no one wants to acknowledge it cause their so afraid of a recession.

German yields just made a new cycle high. you think there is a recession when german yields are making highs? Cmon anon

The inflation and rise in long end yields isnt driven by tariffs, this is 100% about the credit cycle.

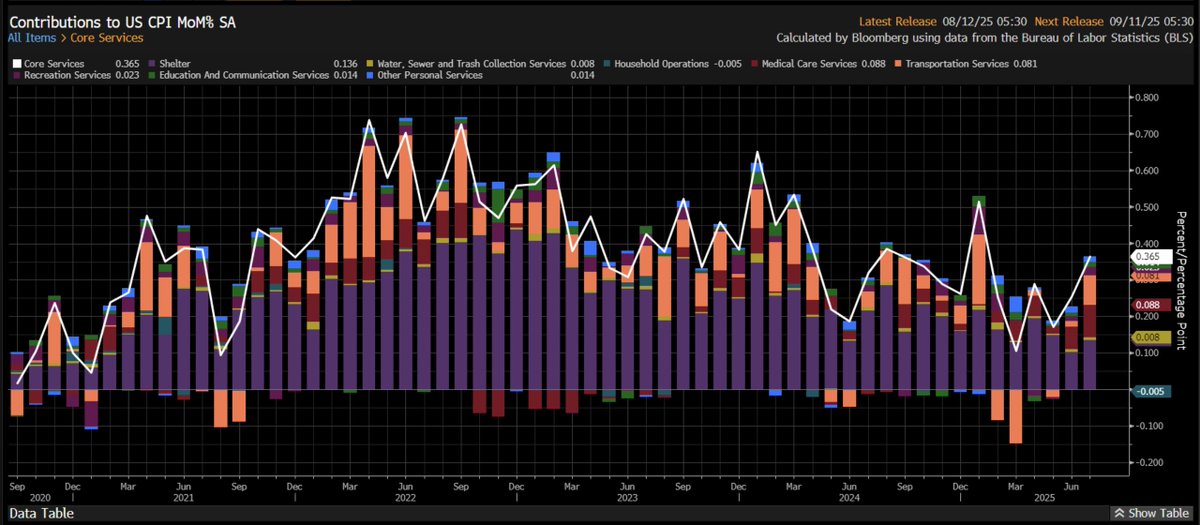

Why else do you think that MoM services inflation just came in above expectations? THis is not tariff driven. It is very simple, this is driven by growth and credit increasing in the system.

Why else do you think that MoM services inflation just came in above expectations? THis is not tariff driven. It is very simple, this is driven by growth and credit increasing in the system.

Inflation swaps have been rising since well BEFORE Trump took office or even floated the idea of tariffs. Why? because this isnt about tariffs. Its about HOW MUCH money is in the system.

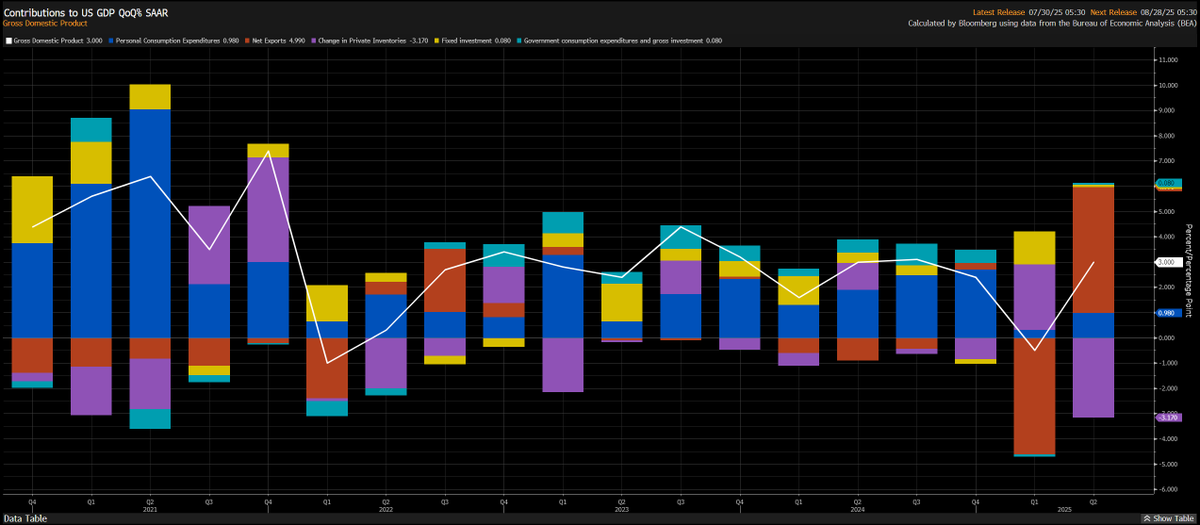

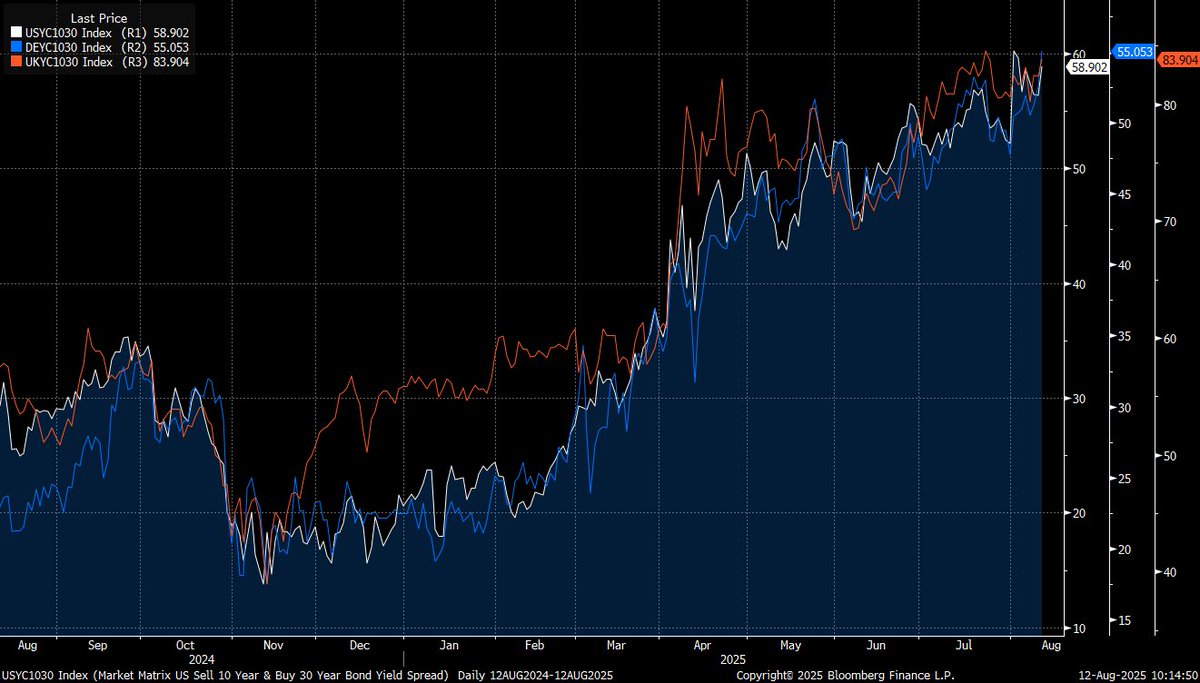

The 10s30s yield curves have been steepening across the US, Germany, and UK, indicating that nominal GDP expectations are RISING. This is the opposite you would see in a recession.

If you are trying to understand the mechanics of these interest rate moves there is an entire free breakdown I recorded here with a connected playbook:

https://x.com/Globalflows/status/1953868562445271240

People think a recession is a higher probability but then the Russell rallies 225bps on the day as 10s30s steepening. This indicates that the companies with the greatest sensitivity to a recession are doing the OPPOSITE of what theyd do in a recession. On top of this 10s30s is showing higher nominal GDP.

Risk assets are going to keep melting up as long the Fed refuses to hike rates in the face of rising inflation data. The money in the financial system is already spilling over into the real economy. When equity valuations are this high (p/s stdv bands below), it shows theres a ton of money in the system that will begin moving into the inflation complex.

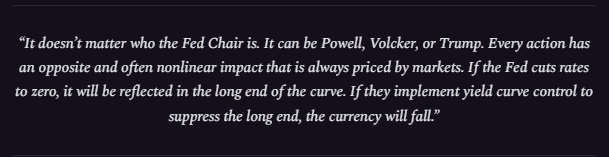

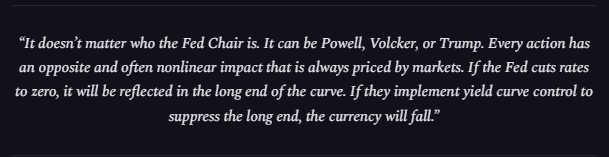

So we remain in melt up mode where stocks are skewed to the upside and bonds are skewed to the downside. And like I already laid out, it doesnt matter who the Fed chair is, if they cut rates into this environment, the long will blow out to push them back into line.

https://x.com/Globalflows/status/1953099622748131819

If they continue to be dovish into this type of regime, it will cause an issue with the currency and ALL assets denominated in that currency. This means people could begin selling USD denominated assets to exit similar to how earlier this year the DXY sold off with equities (Bitcoin sold off too). No one is talking about that cause it goes against their traditional recession cycle narrative.

I have laid out all of the signals in a clear redundancy planning framework here:

https://x.com/Globalflows/status/1954751662662590820

None of this ends well because every credit cycle where the central bank makes a policy error sows the seeds of its own demise. We are in the process of the melt up but there will be a time to exit the train.

https://x.com/Globalflows/status/1955252643368186219

When the regime shifts, I will publish a report on it here: capitalflowsresearch.com

For now, I am HOLDING my long ES trade x.com/Globalflows/st…

For now, I am HOLDING my long ES trade x.com/Globalflows/st…

HOLDING LONG NIKKEI TRADE: (banking sector in japan is going wild rn )

https://x.com/Globalflows/status/1955308234132332918

HOLDING BTC LONG

https://x.com/Globalflows/status/1955248591217496380

We are entering a period of time where thinking clearly pays a premium. The europhia we are and WILL see will test the resolve of even the best. If you can think clearly and execute flawlessly, you will win.

Greatness awaits frens

Greatness awaits frens

• • •

Missing some Tweet in this thread? You can try to

force a refresh