Christian | Global macro research & trading in rates, FX, and equities | Educational primers and dynamic models mapping capital flows(free)⬇️

14 subscribers

How to get URL link on X (Twitter) App

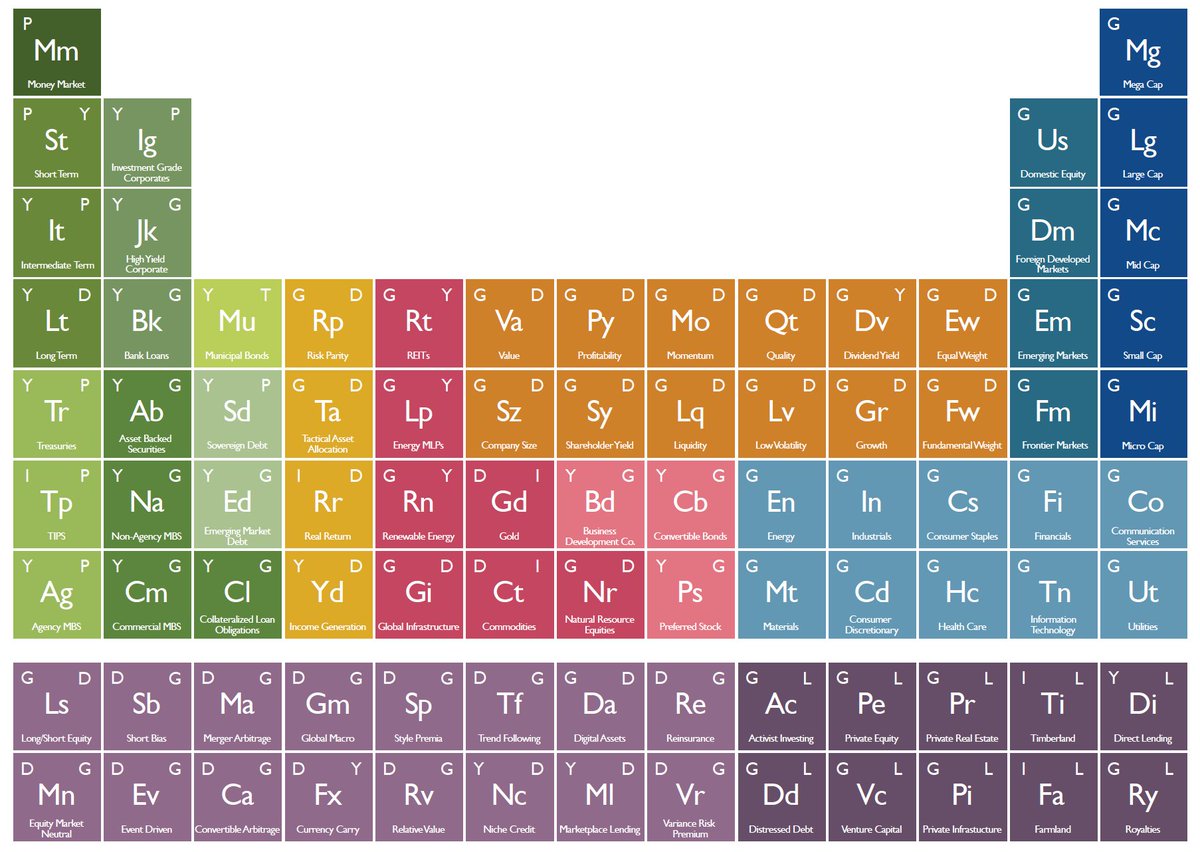

I am going to explain WHERE we are in the credit and liquidity cycle and then break down HOW I am looking at the signals for taking risk. These set the stage for the S&P500, Bitcoin, gold, silver, and every major asset.

I am going to explain WHERE we are in the credit and liquidity cycle and then break down HOW I am looking at the signals for taking risk. These set the stage for the S&P500, Bitcoin, gold, silver, and every major asset.

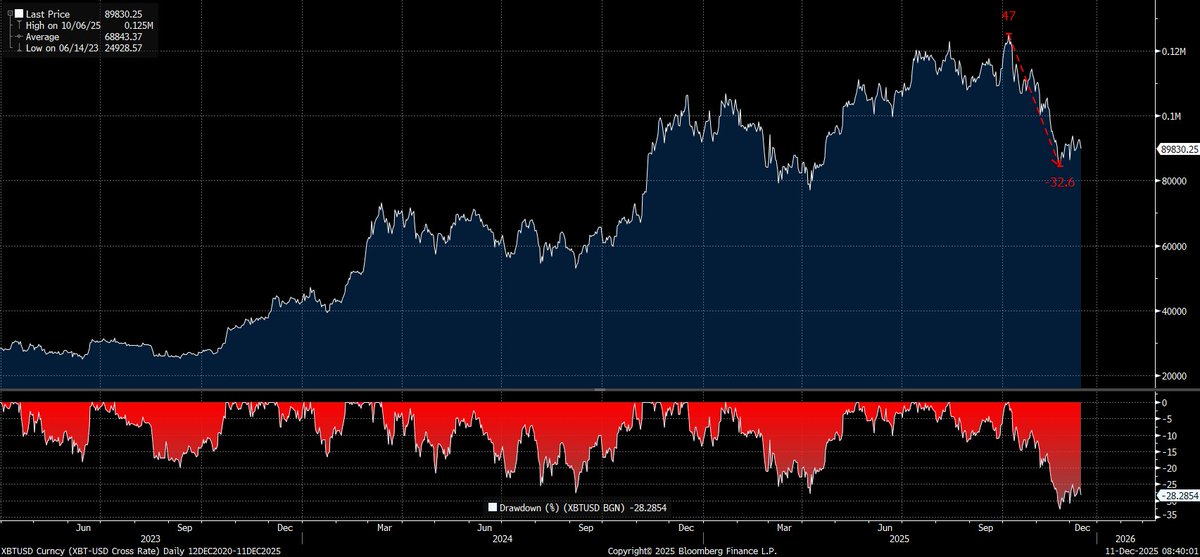

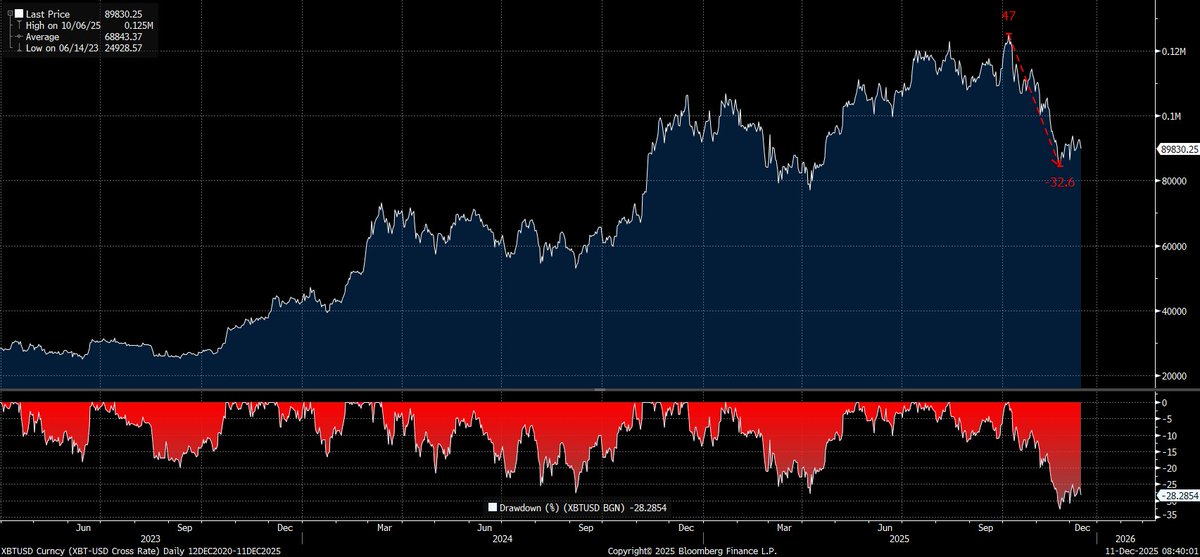

First, Bitcoin functions as a release valve for macro liquidity on the RISK CURVE. This means Bitcoin is telling you that it is a risk asset.

First, Bitcoin functions as a release valve for macro liquidity on the RISK CURVE. This means Bitcoin is telling you that it is a risk asset. https://x.com/Globalflows/status/1953525747349586218?s=20

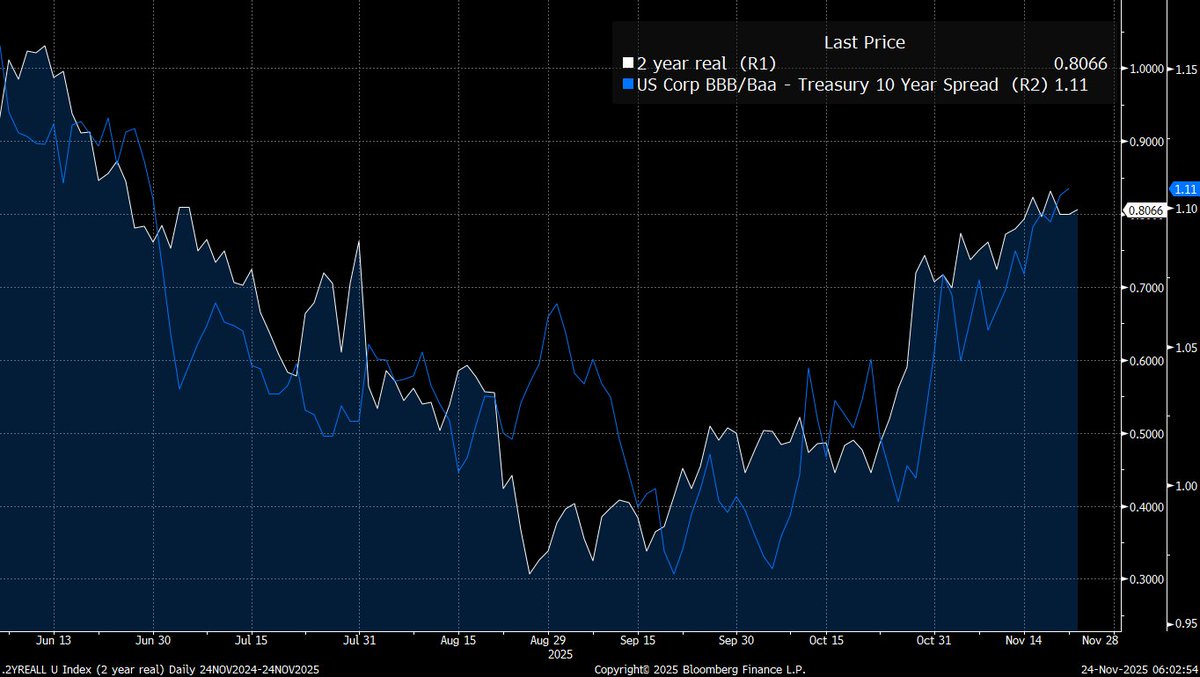

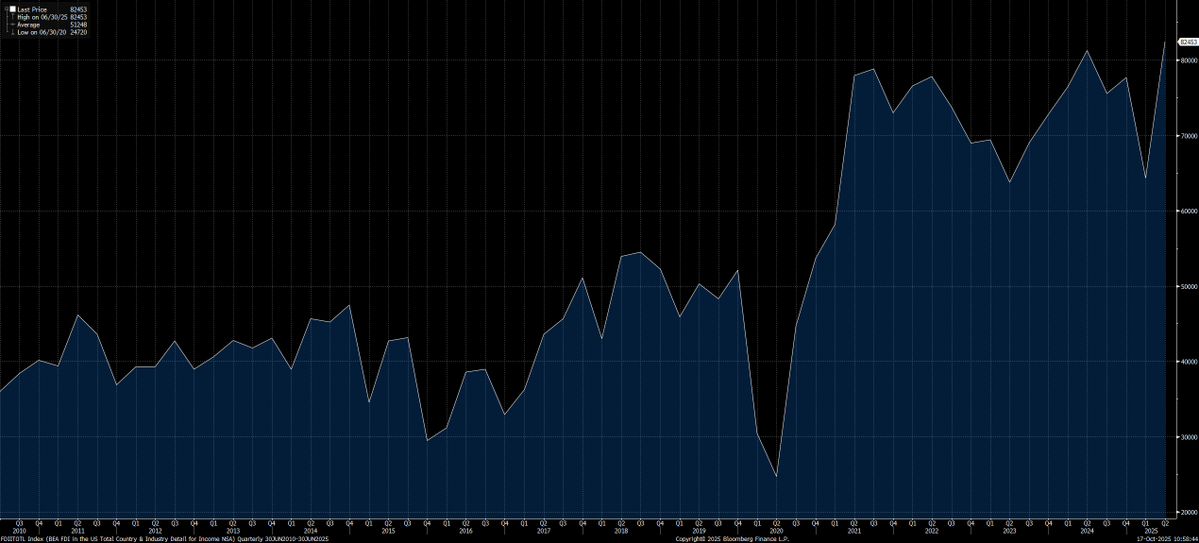

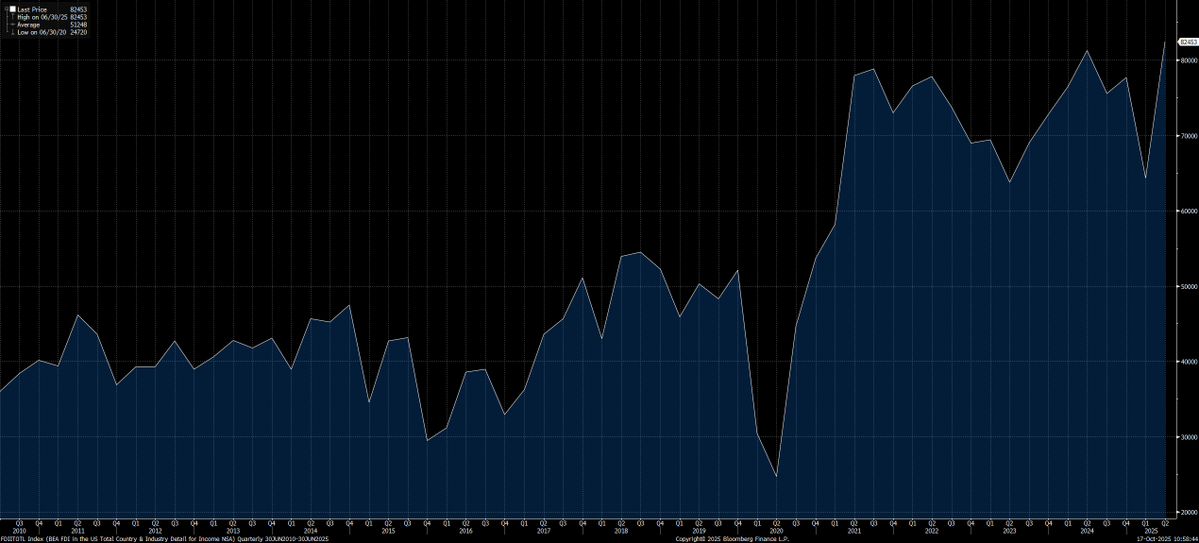

First, my macro thesis is simple: Since April we had a massive injection of credit into the underlying economy and liquidity into financial markets. This created procyclical liquidity where growth and liquidity rose at the same time. This is why asset prices melted up.

First, my macro thesis is simple: Since April we had a massive injection of credit into the underlying economy and liquidity into financial markets. This created procyclical liquidity where growth and liquidity rose at the same time. This is why asset prices melted up.

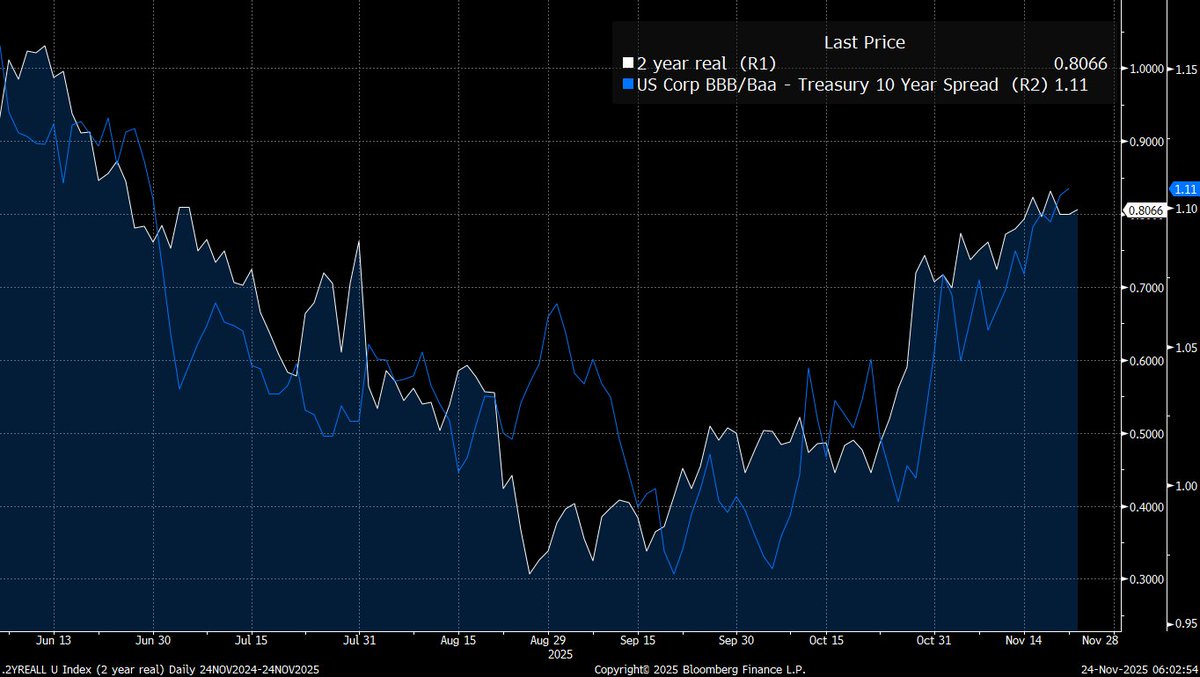

Real rates tell you the true cost of money after adjusting for inflation.

Real rates tell you the true cost of money after adjusting for inflation.

First,

First,

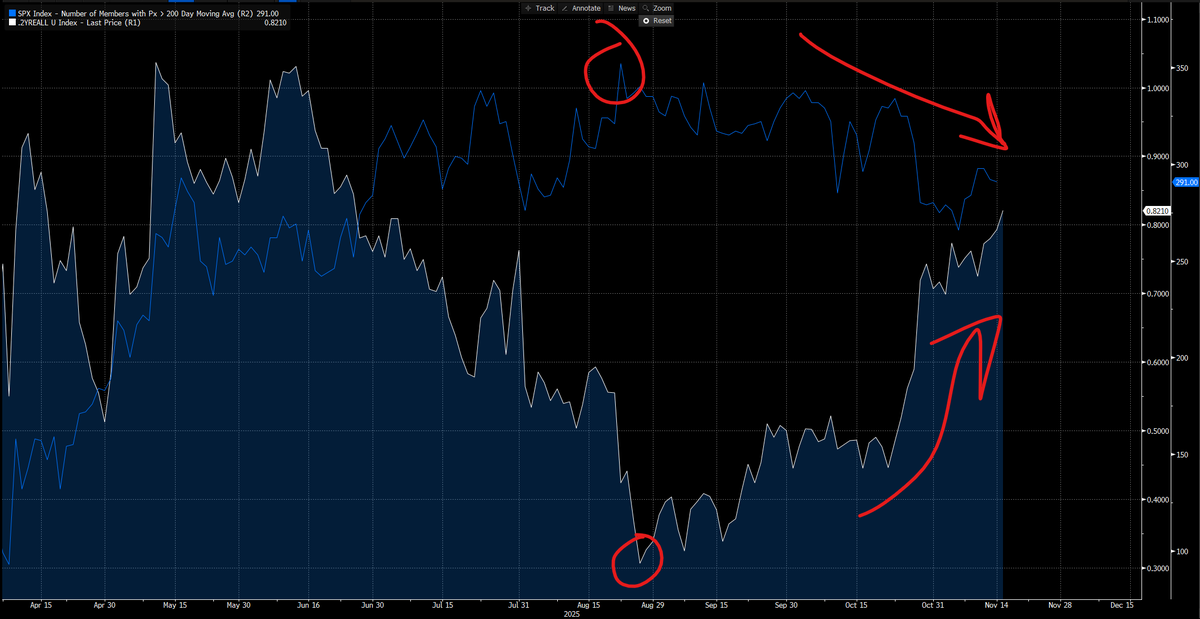

The primary place to start is HOW interest rates are impacting equities

The primary place to start is HOW interest rates are impacting equities

The main divergence we are seeing taking place right now is Mag7 (blue) has been pulling the index HIGHER as the broad market breadth is falling

The main divergence we are seeing taking place right now is Mag7 (blue) has been pulling the index HIGHER as the broad market breadth is falling

The Fed’s transmission mechanism lifts asset prices faster than wages. QE and low rates raise the price of duration assets first. Households with assets gain. Households living on labor incomes lag.

The Fed’s transmission mechanism lifts asset prices faster than wages. QE and low rates raise the price of duration assets first. Households with assets gain. Households living on labor incomes lag.

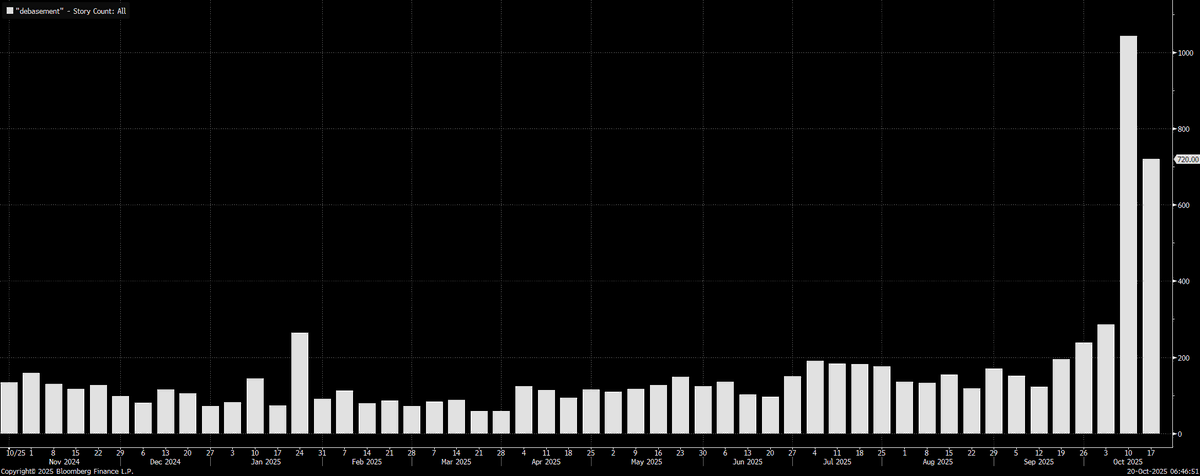

When I analyze the macro flows across every asset, I am always looking for where expectations have a significant divergence from what is likely to take place. The key thing I look for is when expectations are based on an uninformed presupposition.

When I analyze the macro flows across every asset, I am always looking for where expectations have a significant divergence from what is likely to take place. The key thing I look for is when expectations are based on an uninformed presupposition.

If you have been following me for any period of time you know that I have been bullish stocks and neutral bonds on a cyclical basis. This is being driven by the credit cycle, procyclical monetary+fiscal policy, and the entire wall of money from AI.

If you have been following me for any period of time you know that I have been bullish stocks and neutral bonds on a cyclical basis. This is being driven by the credit cycle, procyclical monetary+fiscal policy, and the entire wall of money from AI.

This is the mechanical essence of the “There Is No Alternative” (TINA) effect. When real returns in safe assets are structurally suppressed, capital seeks higher-yielding risk assets by necessity, not preference. The equilibrium becomes self-reinforcing. As equities rally and credit spreads tighten, portfolio managers experience both absolute and relative performance pressure to rotate further into risk. Passive inflows magnify the dynamic as benchmark weights shift toward outperforming sectors.

This is the mechanical essence of the “There Is No Alternative” (TINA) effect. When real returns in safe assets are structurally suppressed, capital seeks higher-yielding risk assets by necessity, not preference. The equilibrium becomes self-reinforcing. As equities rally and credit spreads tighten, portfolio managers experience both absolute and relative performance pressure to rotate further into risk. Passive inflows magnify the dynamic as benchmark weights shift toward outperforming sectors.

papers.ssrn.com/sol3/papers.cf…

papers.ssrn.com/sol3/papers.cf…

The regime is clearly characterized by expanding growth, procyclical monetary policy AND fiscal policy.

The regime is clearly characterized by expanding growth, procyclical monetary policy AND fiscal policy.

Start with the basics:

Start with the basics:

On the upside, competition forces companies to borrow.

On the upside, competition forces companies to borrow.

The existence of crypto sits at the convergence of macro liquidity, technology, and the cultural revolution taking place

The existence of crypto sits at the convergence of macro liquidity, technology, and the cultural revolution taking place

The entire playbook I use to trade the S&P500 is published in the educational primer section of Capital Flows. It is 100% free and breaks down everythinng you need to know capitalflowsresearch.com/p/research-syn…

The entire playbook I use to trade the S&P500 is published in the educational primer section of Capital Flows. It is 100% free and breaks down everythinng you need to know capitalflowsresearch.com/p/research-syn…