Nvidia CEO Jensen Huang - “In the future, everything - factories, cities, even humans — will have a digital twin.”

Even in India, Digital twin technology presents a multi Billion $ opportunity growing at over 35% CAGR!

An explainer thread and potential winners🧵

1/n

Even in India, Digital twin technology presents a multi Billion $ opportunity growing at over 35% CAGR!

An explainer thread and potential winners🧵

1/n

2/n

What is it?

A digital twin creates digital replica of a physical object, person, system, infrastructure or process as a digital version of its environment.

It is the new frontier of manufacturing that helps simulate and optimise manufacturing processes before deployment.

What is it?

A digital twin creates digital replica of a physical object, person, system, infrastructure or process as a digital version of its environment.

It is the new frontier of manufacturing that helps simulate and optimise manufacturing processes before deployment.

3/n

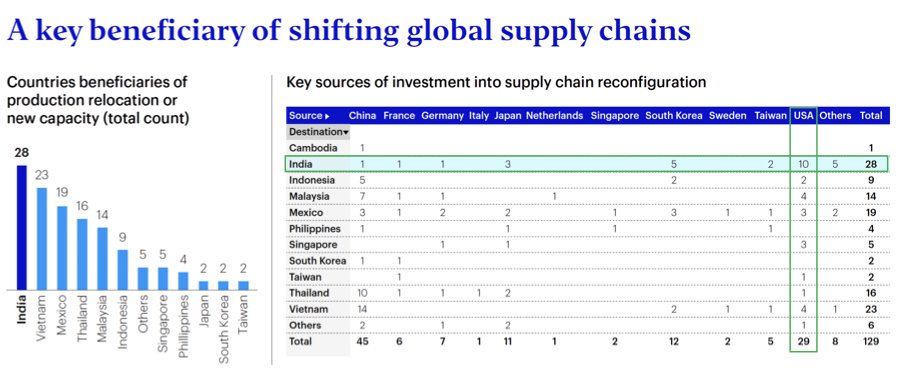

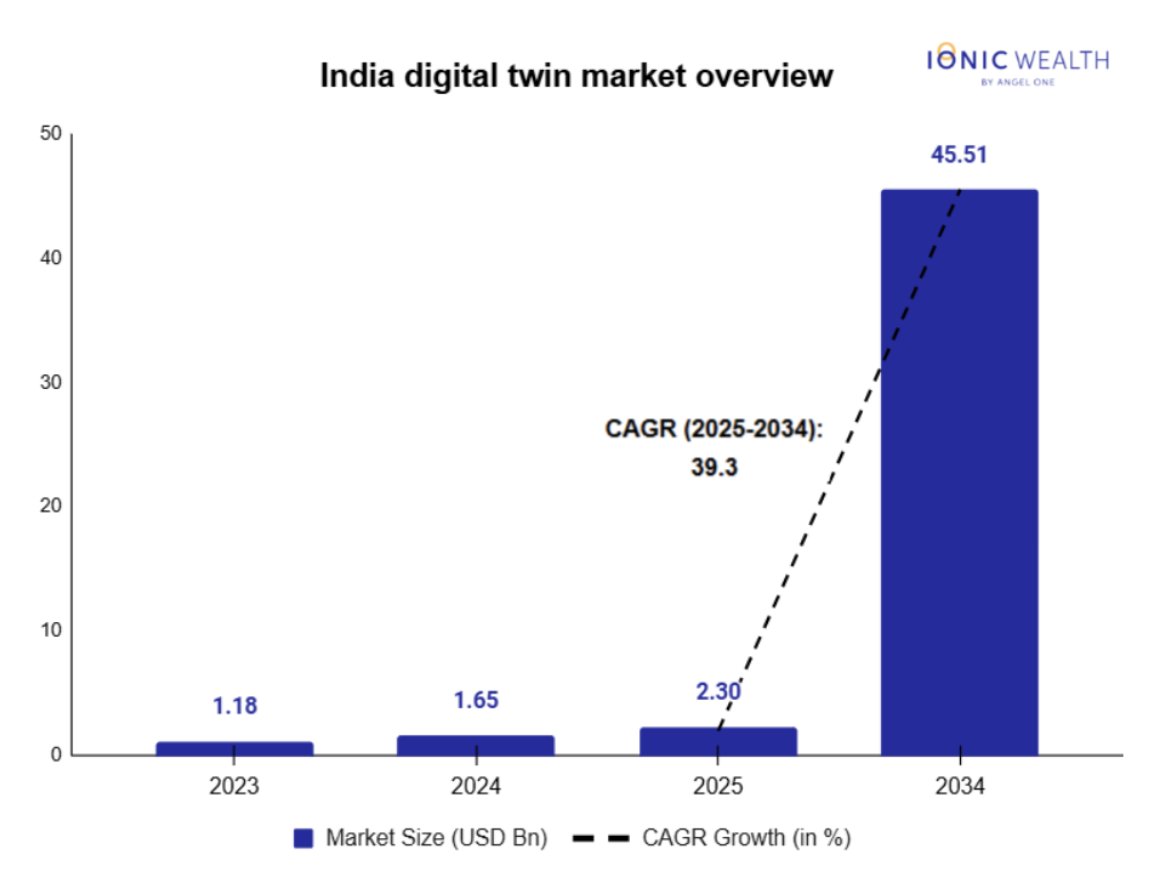

Digital twin models in India are still at a nascent stage of growth with estimates of 35-40% growth for years ahead.

Digital twin models in India are still at a nascent stage of growth with estimates of 35-40% growth for years ahead.

4/n

India is well poised to gain from this fusion of Technology and Manufacturing given:

- World-class, cost-efficient ER&D talent

- PLI manufacturing Capex + Smart-city programs

- 5G rollout & industrial IoT adoption

- Engineering services ecosystem to build & run twins

India is well poised to gain from this fusion of Technology and Manufacturing given:

- World-class, cost-efficient ER&D talent

- PLI manufacturing Capex + Smart-city programs

- 5G rollout & industrial IoT adoption

- Engineering services ecosystem to build & run twins

5/n

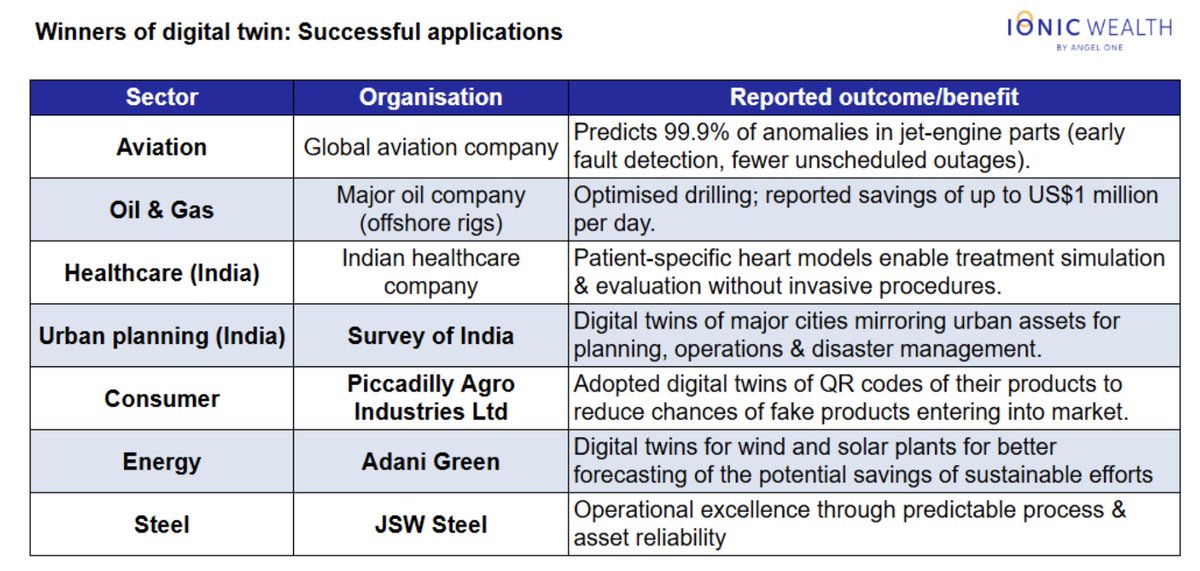

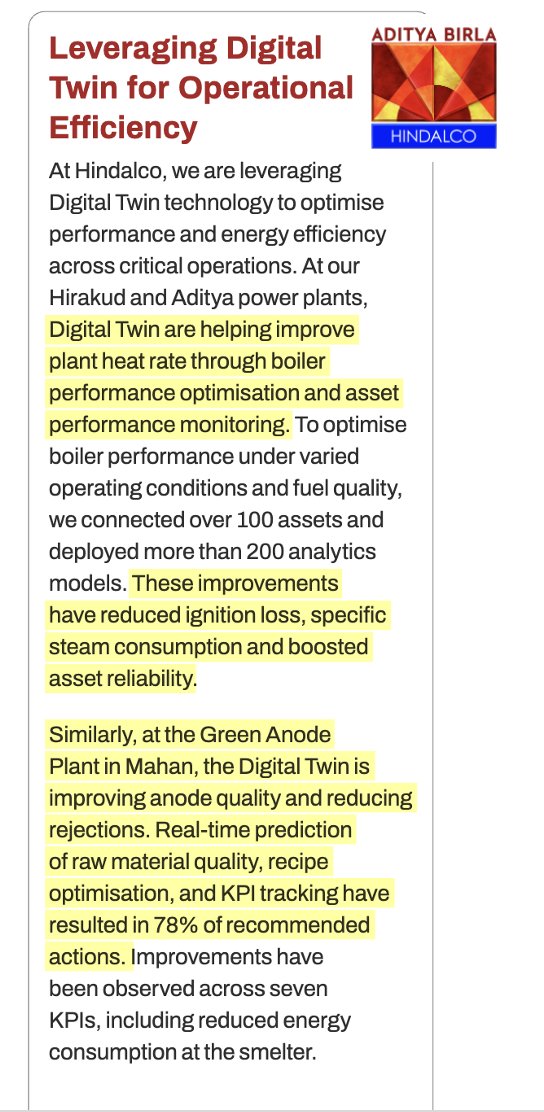

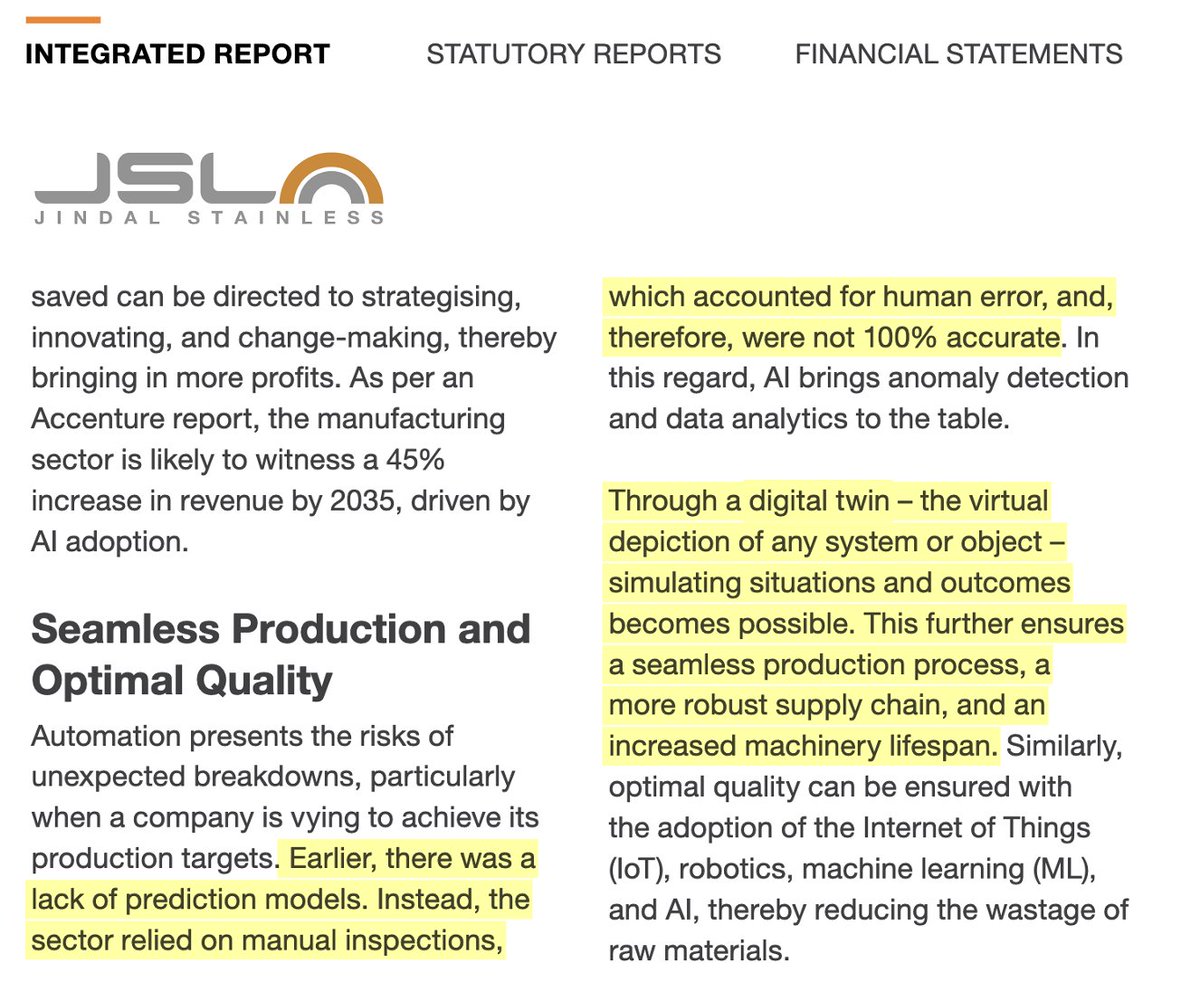

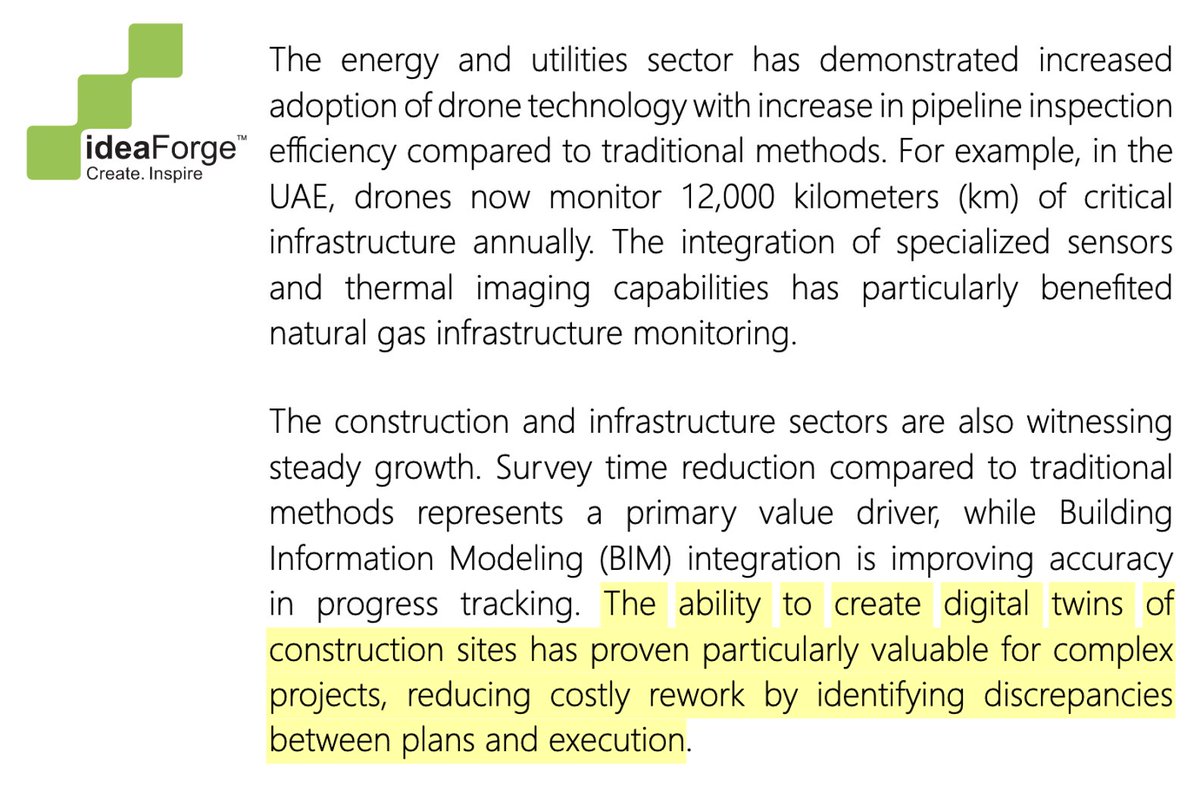

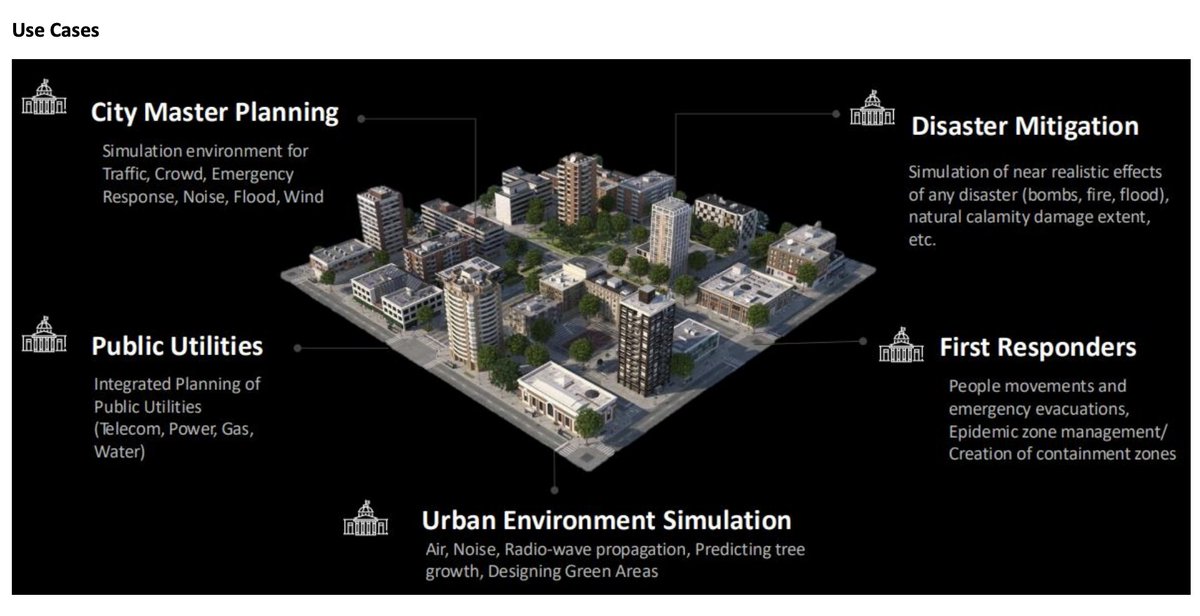

Growing industry use cases.

Extracts from latest Annual Reports of companies show how they are benefitting from Digital Twin technologies:

- Hindalco Industries

- Jindal Stainless

- IdeaForge

- Electronics maker

Growing industry use cases.

Extracts from latest Annual Reports of companies show how they are benefitting from Digital Twin technologies:

- Hindalco Industries

- Jindal Stainless

- IdeaForge

- Electronics maker

6/n

TCS, Reliance, Tech Mahindra and Ola Electric are using digital twin technologies in their various operations to optimise efficiency

TCS, Reliance, Tech Mahindra and Ola Electric are using digital twin technologies in their various operations to optimise efficiency

7/n

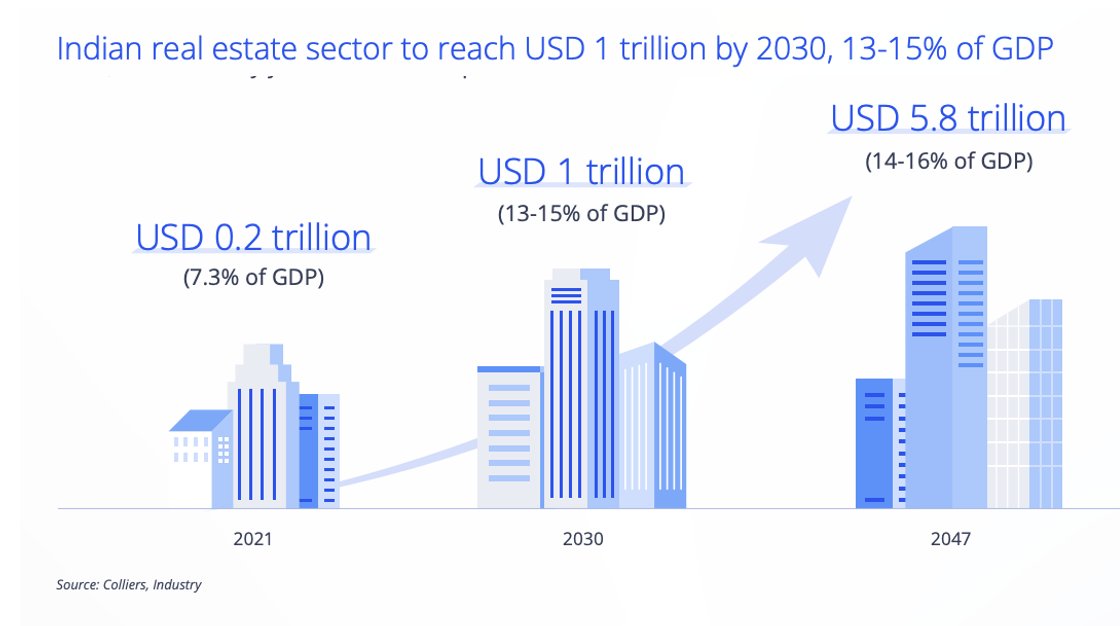

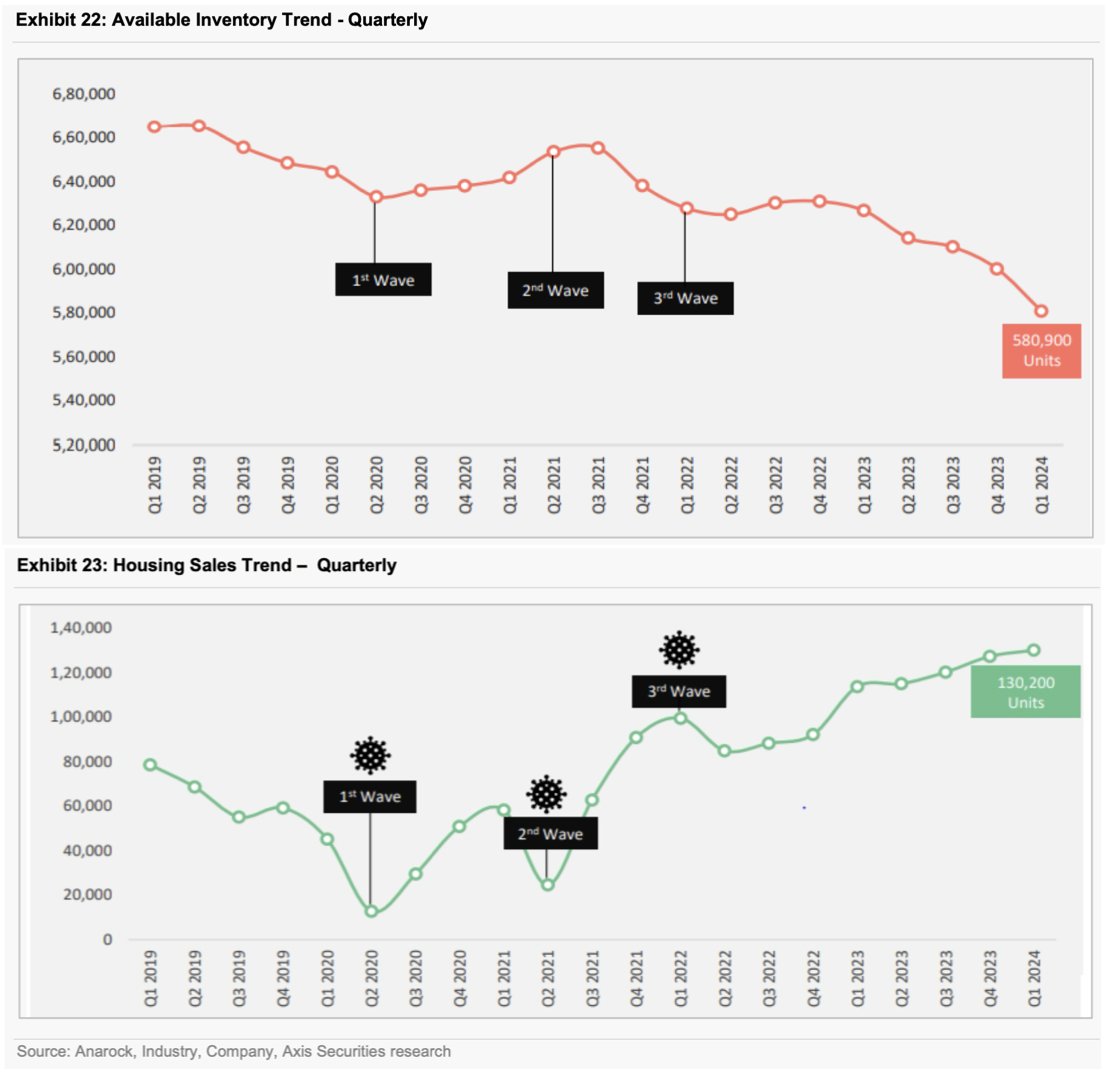

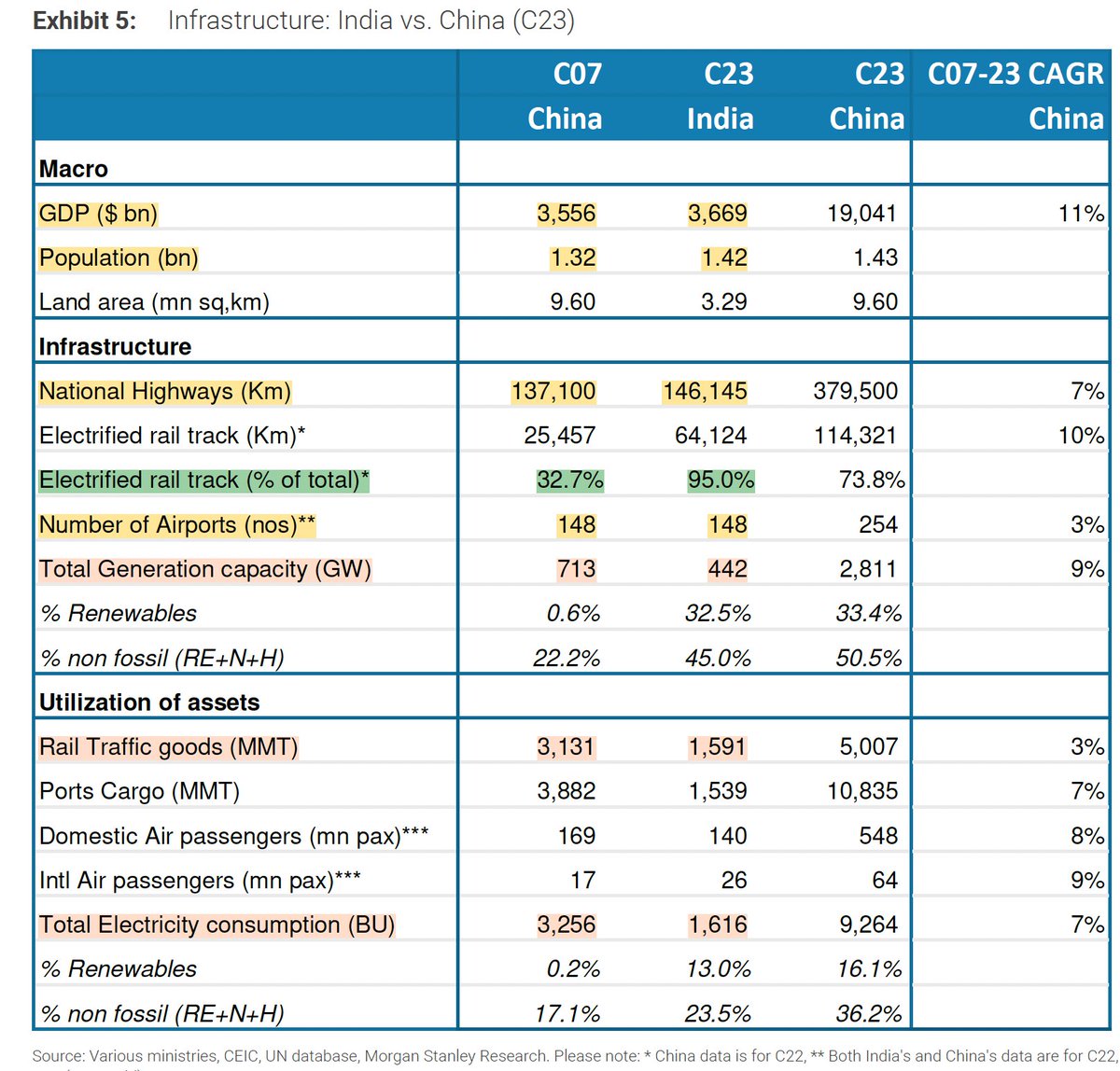

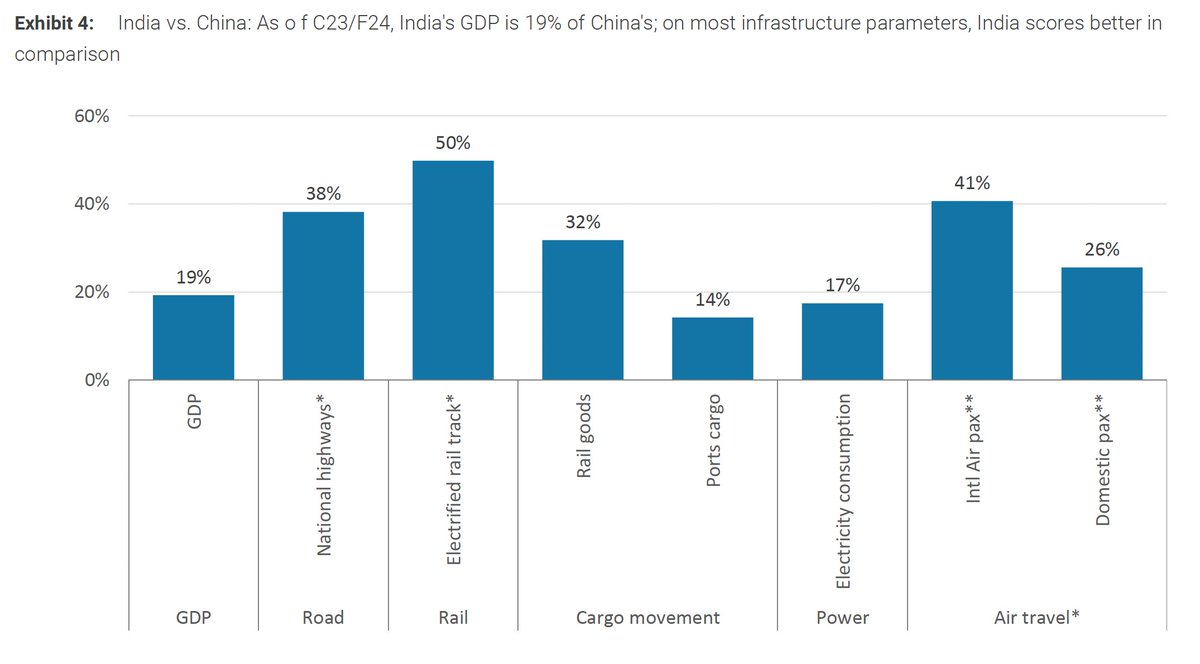

India's Trillion Dollar bet: India has earmarked over $1.4 Trillion for its National Infrastructure Pipeline.

Digital Twin tech is key:

- Enabling virtual design

- Construction sequencing, and

- Lifecycle management

Ensuring projects are delivered on time and on budget.

India's Trillion Dollar bet: India has earmarked over $1.4 Trillion for its National Infrastructure Pipeline.

Digital Twin tech is key:

- Enabling virtual design

- Construction sequencing, and

- Lifecycle management

Ensuring projects are delivered on time and on budget.

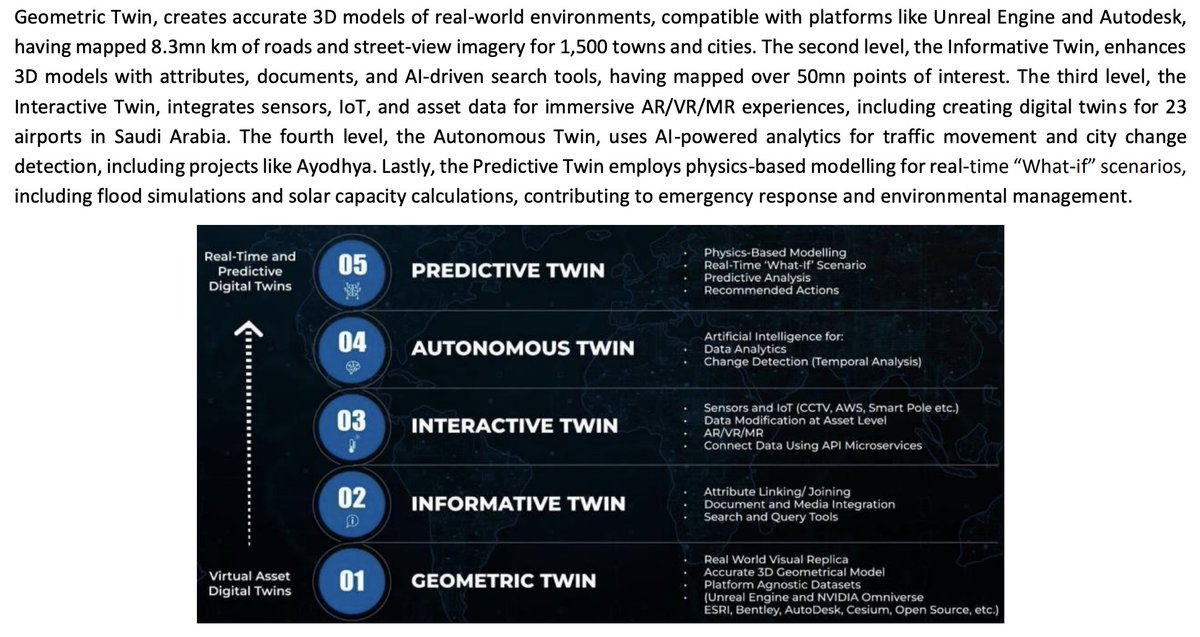

9/n

Digital Twin Maturity Models for Technology providers.

5 stages of Twin Capability:

- Geometric twin

- Informative Twin

- Interactive Twin

- Autonomous Twin

- Predictive Twin

Digital Twin Maturity Models for Technology providers.

5 stages of Twin Capability:

- Geometric twin

- Informative Twin

- Interactive Twin

- Autonomous Twin

- Predictive Twin

10/n

IT and Geospatial companies are key beneficiaries of this shift. Some key players leading in providing digital twin services:

- Genesys International

- CE Info Systems

- L&T Technology Services

- Ceinsys Tech

- Tata Technologies

IT and Geospatial companies are key beneficiaries of this shift. Some key players leading in providing digital twin services:

- Genesys International

- CE Info Systems

- L&T Technology Services

- Ceinsys Tech

- Tata Technologies

• • •

Missing some Tweet in this thread? You can try to

force a refresh