How to get URL link on X (Twitter) App

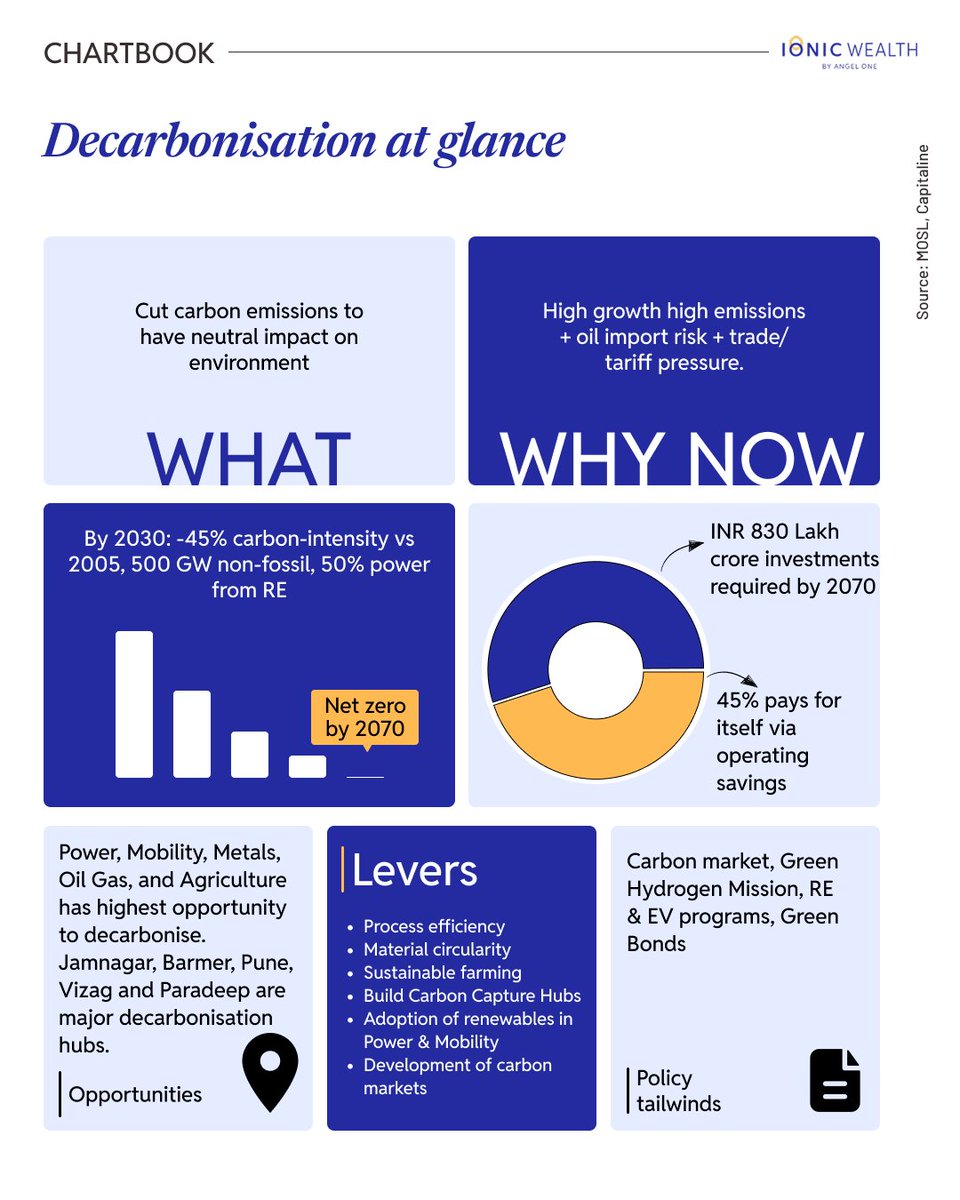

Decarbonisation is about cleaner air, but also about:

Decarbonisation is about cleaner air, but also about:

2/n

2/n

The healthcare sector offers a rare trifecta for investors:

The healthcare sector offers a rare trifecta for investors:

2/ 10 defined focus areas.

2/ 10 defined focus areas.

2/n

2/n

2/n

2/n

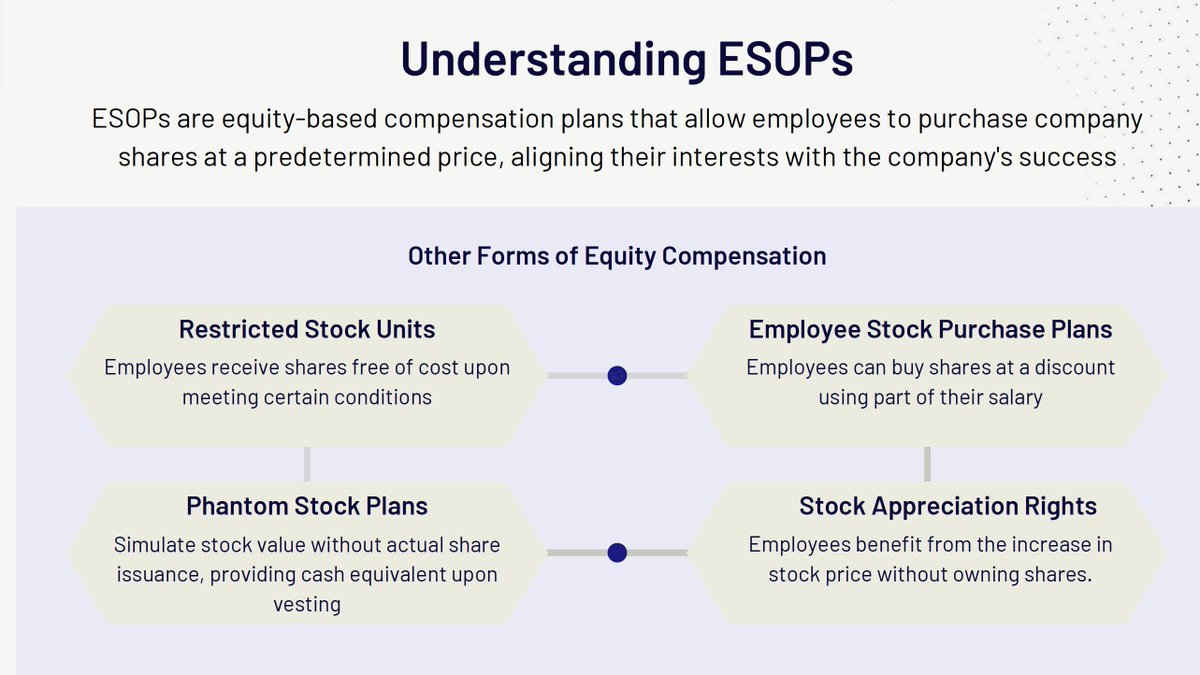

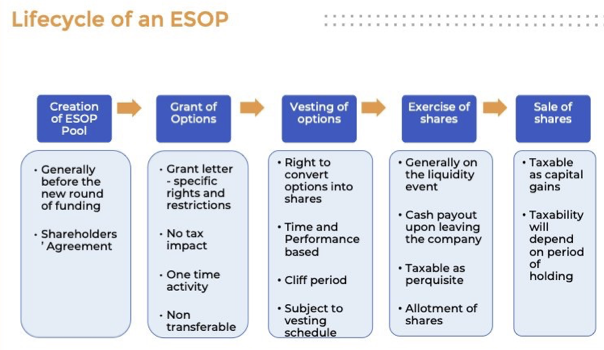

2/ There are 5 stages of in an ESOP:

2/ There are 5 stages of in an ESOP:

2/n

2/n

Mistake 2: Not booking some profits

Mistake 2: Not booking some profits

2/n

2/n