The human struggles to grasp two concepts that are essential for understanding the current financial system:

1. We think in nominal terms (ignoring inflation)

2. We think linearly (ignoring exponential change)

A 🧵on why these 2 mental frameworks matter.

1. We think in nominal terms (ignoring inflation)

2. We think linearly (ignoring exponential change)

A 🧵on why these 2 mental frameworks matter.

1. Nominal Thinking = focusing on face-value numbers

Example:

If GDP goes from $20T to $22T, most people think “growth.”

Even if inflation ate away all that gain.

We like nominal growth — it feels like progress and keeps businesses alive.

Example:

If GDP goes from $20T to $22T, most people think “growth.”

Even if inflation ate away all that gain.

We like nominal growth — it feels like progress and keeps businesses alive.

Why does the human mind like nominal?

Because nominal GDP growth (even if it’s just inflation) means:

a) Businesses have higher sales in dollars

b) Workers get higher wages (on paper)

c) Debt feels easier to repay

It’s an illusion of prosperity and it keeps the system running.

Because nominal GDP growth (even if it’s just inflation) means:

a) Businesses have higher sales in dollars

b) Workers get higher wages (on paper)

c) Debt feels easier to repay

It’s an illusion of prosperity and it keeps the system running.

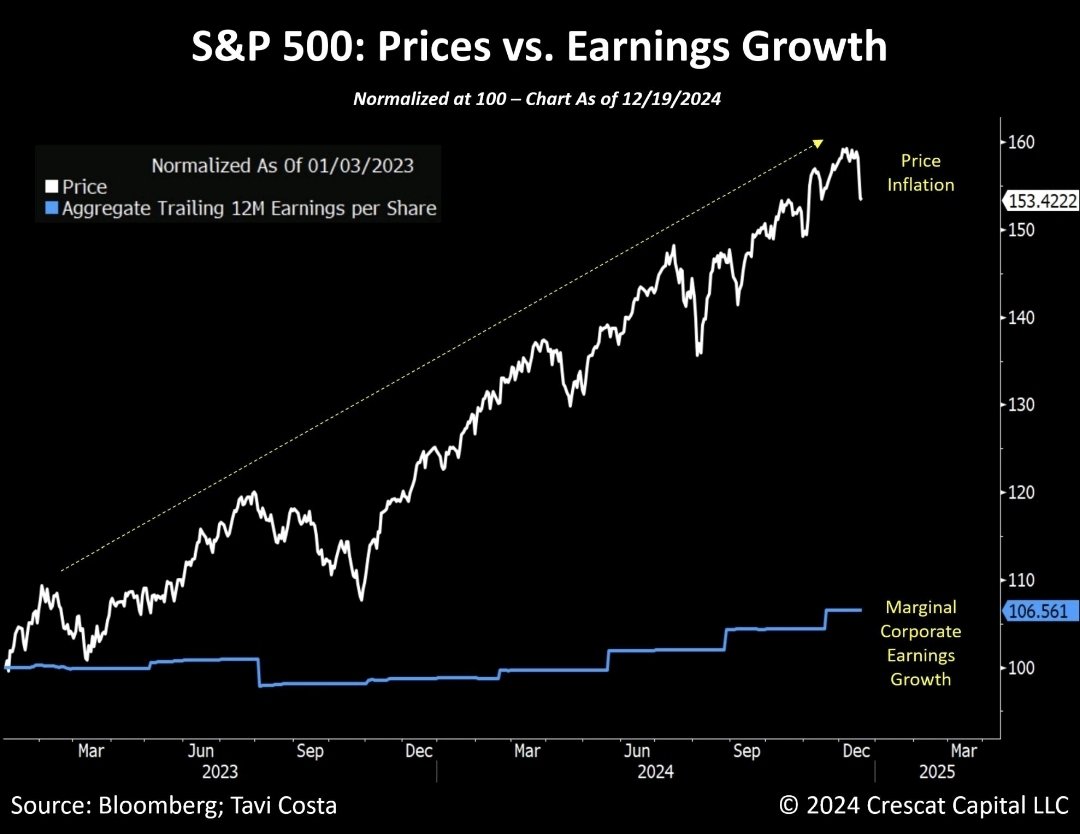

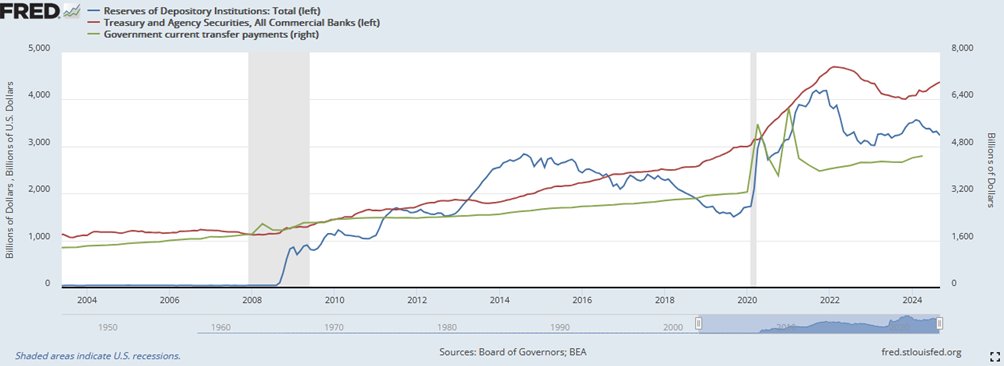

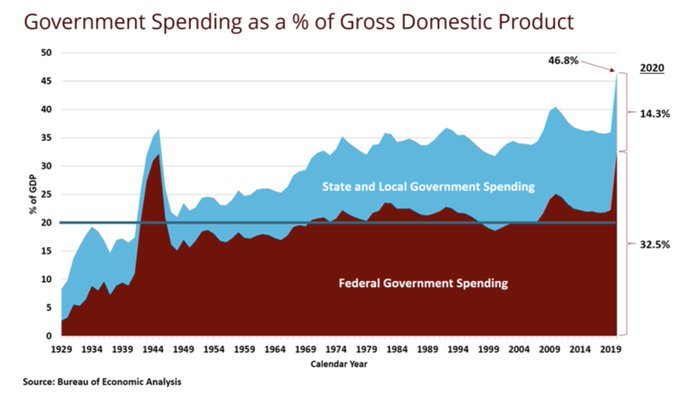

And WHAT is the best catalyst for nominal growth?

Government spending

When government spends money, that spending directly adds to nominal GDP.

When government prints money to fund spending, it injects more currency into the system. Currency debasement pushes up nominal prices.

Government spending

When government spends money, that spending directly adds to nominal GDP.

When government prints money to fund spending, it injects more currency into the system. Currency debasement pushes up nominal prices.

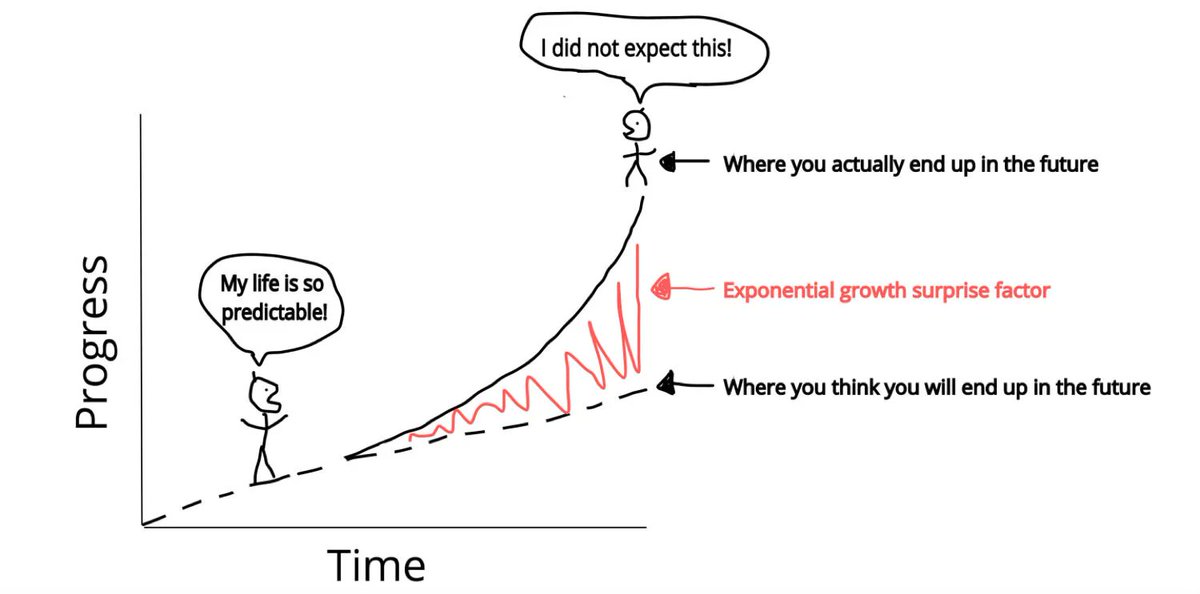

2. Linear Thinking

Assuming tomorrow will be like today, but real world moves exponentially, especially tech

Tech innovation 2x in capability over shorter & shorter cycles. Growth is invisible at first, then suddenly massive

Better tech = ⬇️prices

No bueno for governments/CBs

Assuming tomorrow will be like today, but real world moves exponentially, especially tech

Tech innovation 2x in capability over shorter & shorter cycles. Growth is invisible at first, then suddenly massive

Better tech = ⬇️prices

No bueno for governments/CBs

And here comes the exponential thinking our minds struggle to grasp:

Fold a piece of paper 50 times

How thick will it be?

- Most guess a few centimeters/inches or maybe the height of a building

= In reality, it would reach the Sun (150 million kilometers / 93 million miles)

Fold a piece of paper 50 times

How thick will it be?

- Most guess a few centimeters/inches or maybe the height of a building

= In reality, it would reach the Sun (150 million kilometers / 93 million miles)

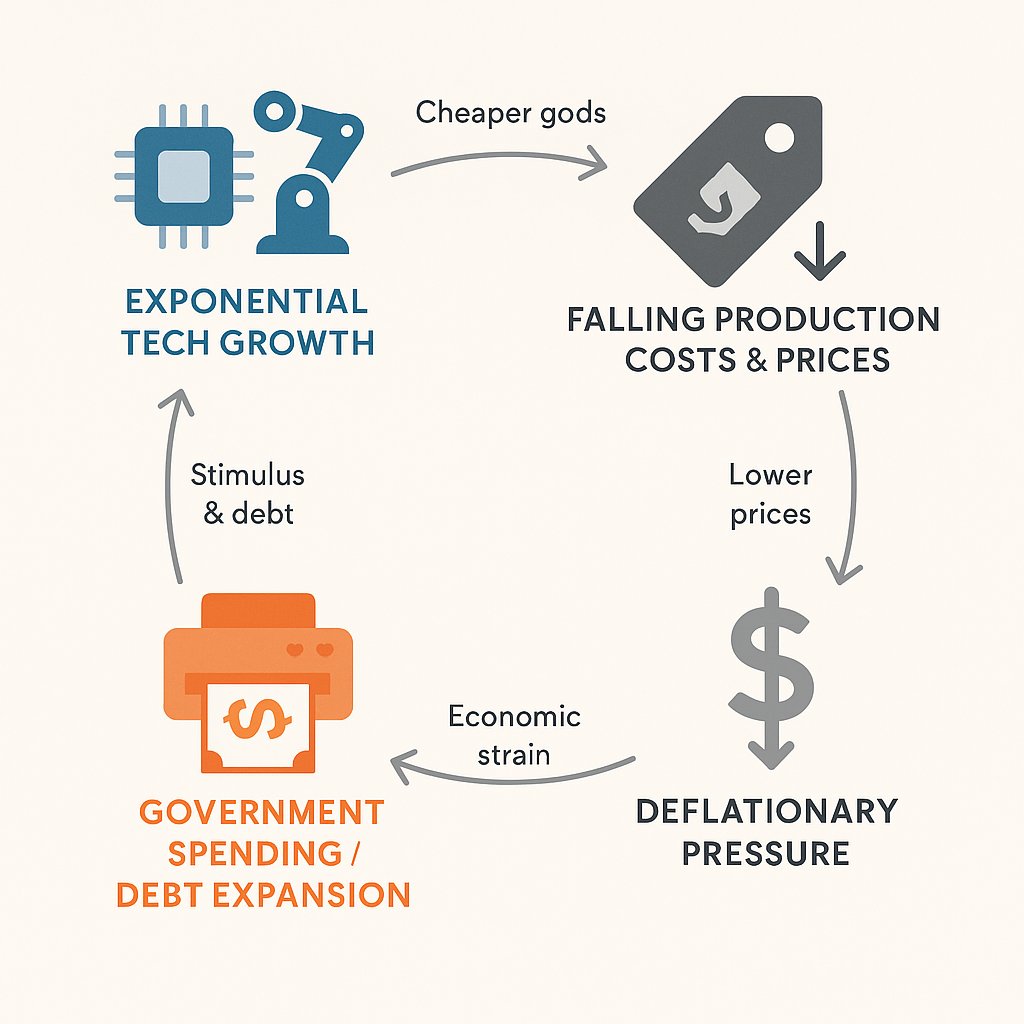

As tech accelerates exponentially, deflationary pressure grows in a system that is built on inflation.

To offset it, governments need bigger spending injections.

This creates a long-term pattern:

Exponential tech growth → stronger deflation → larger deficits → rising debt

To offset it, governments need bigger spending injections.

This creates a long-term pattern:

Exponential tech growth → stronger deflation → larger deficits → rising debt

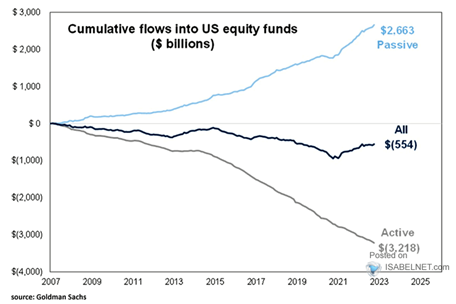

And here is where both mental concepts meet:

Our minds default to NOMINAL thinking, so we cheer bigger numbers.

But EXPONENTIAL tech makes things cheaper, threatening those numbers.

To keep the illusion alive, governments print — turning abundance into inflation.

Our minds default to NOMINAL thinking, so we cheer bigger numbers.

But EXPONENTIAL tech makes things cheaper, threatening those numbers.

To keep the illusion alive, governments print — turning abundance into inflation.

• • •

Missing some Tweet in this thread? You can try to

force a refresh