On a mission to democratize financial knowledge one thread at a time

Quiero democratizar la información financiera para que todos entiendan lo que pocos saben.

4 subscribers

How to get URL link on X (Twitter) App

A stablecoin is a digital asset pegged to a stable currency, often $1.

A stablecoin is a digital asset pegged to a stable currency, often $1.

EAT= Tesoro usa su emisión para afectar la liquidez

EAT= Tesoro usa su emisión para afectar la liquidez

Cuáles BCs compran oro?

Cuáles BCs compran oro?

Inversores foráneos en mercados EEUU tienen 2 riesgos:

Inversores foráneos en mercados EEUU tienen 2 riesgos:

El sistema depende de la constante refinanciación de deuda y la expansión de nuevo crédito para funcionar.

El sistema depende de la constante refinanciación de deuda y la expansión de nuevo crédito para funcionar.

4Fs cambiaron el juego:

4Fs cambiaron el juego:

1. Nominal Thinking = focusing on face-value numbers

1. Nominal Thinking = focusing on face-value numbers

First, let’s define LTV

First, let’s define LTV

Empecemos con el LTV:

Empecemos con el LTV:

Swap spreads should be + because:

Swap spreads should be + because:

Analicemos primero la fórmula:

Analicemos primero la fórmula:

Si alguna vez has sentido que no llegás a ahorrar y que tu salario no llega a fin de mes, es porque el sistema está en tu contra.

Si alguna vez has sentido que no llegás a ahorrar y que tu salario no llega a fin de mes, es porque el sistema está en tu contra.https://x.com/dbaeza13/status/1758497226937029047?s=19

1. Loans:

1. Loans:https://x.com/dbaeza13/status/1800167318313656775

Idea behind passive investing is that it doesn't move the market much, market is more sensible to how active investors are trading. However, passive investing has become so large that it's no longer passive.

Idea behind passive investing is that it doesn't move the market much, market is more sensible to how active investors are trading. However, passive investing has become so large that it's no longer passive.

La productividad y salarios crecían de la mano hasta 1972 donde los salarios se estancan.

La productividad y salarios crecían de la mano hasta 1972 donde los salarios se estancan.

System tries to prevent the power of money creation from being controlled solely by the government.

System tries to prevent the power of money creation from being controlled solely by the government.

Sistema intenta evitar que poder de creación de dinero sea controlado por gobierno.

Sistema intenta evitar que poder de creación de dinero sea controlado por gobierno.

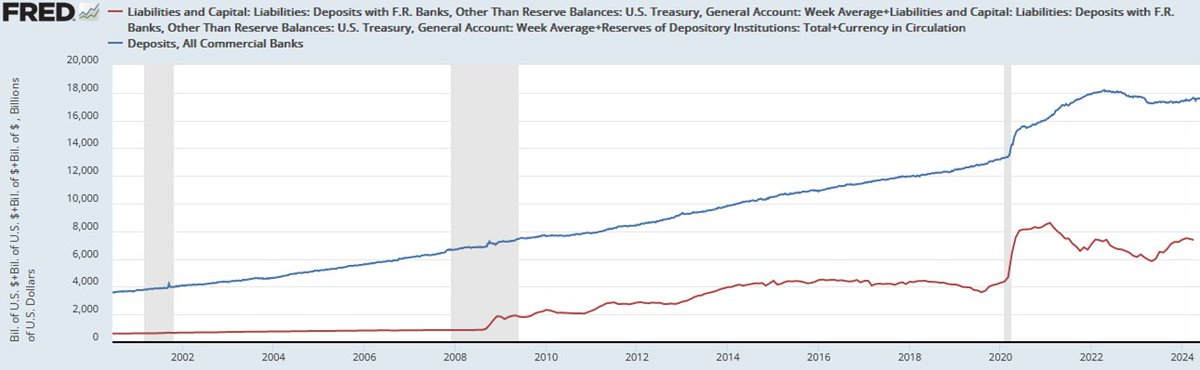

Reservas = depósitos en cuentas de BC. En EEUU las emite FED. Reservas = tokens dentro de sistema de pago para bancos.

Reservas = depósitos en cuentas de BC. En EEUU las emite FED. Reservas = tokens dentro de sistema de pago para bancos.

PS over-indebtedness tends to cause crises. Public debt normally limits the impact of such crises.

PS over-indebtedness tends to cause crises. Public debt normally limits the impact of such crises.

Core of Shadow banking:

Core of Shadow banking: