Cuts or hikes by the Fed are not inherently bullish or bearish for the credit cycle

It is all about HOW these relate to underlying growth and inflation

If you can understand this relationship+positioning, you can know WHEN to exit the train before the bear market 🧵👇

It is all about HOW these relate to underlying growth and inflation

If you can understand this relationship+positioning, you can know WHEN to exit the train before the bear market 🧵👇

I have been laying out the bullish view for equities for months now and have been running long trades in equities and Bitcoin. You can see the initial views and trades I laid out here:

https://x.com/Globalflows/status/1955320999068700677

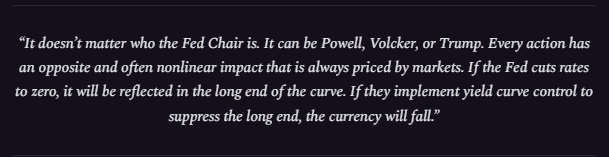

There is this entire narrative that cuts by the Fed is bullish risk assets. This is fundamentally incorrect and not historically accurate. The full video where I explain the scenarios is below but here is the main idea: the Fed can cut or hike interest rates and equities/Bitcoin can rally or sell off depending on the underlying growth regime.

All markets are about supply and demand. When the Fed changes interest rates, this is only one side of the equation. The other side is how much money is in the system via growth and inflation.

x.com/Globalflows/st…

All markets are about supply and demand. When the Fed changes interest rates, this is only one side of the equation. The other side is how much money is in the system via growth and inflation.

x.com/Globalflows/st…

Here is the simple scenario breakdown:

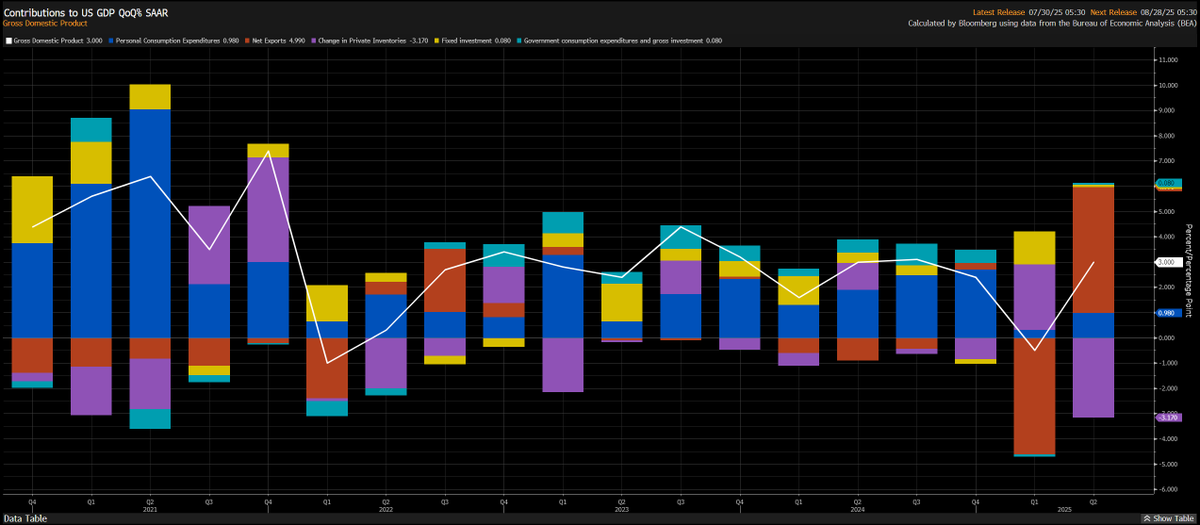

If the Fed is cutting rates into rising growth and inflation, then risk assets like equities or Bitcoin rise to price the increase in money in the financial system as well as the underlying economy.

If the Fed cuts rates into a falling growth and inflation environment, risk assets can be neutral to bearish. It will depend on how aggressively the Fed is cutting relative to how strong the contraction in the economy is. For example, if there is an actual recession that begins to suck money out of financial markets and create deflationary pressures due to a rise in delinquencies, this could be a greater impulse than any cuts by the Fed. The net result would be the Fed cutting rates into a falling economy and bearish market. This is WHY the Fed can cut and equities/Bitcoin can still sell off.

Inversely, if growth is expanding A TON and you have real GDP running above 3% with CPI running above 4%, a single hike by the Fed might not even impact asset markets because its so marginal compared to the strength in the economy. In this scenario, you could have assets rally despite a hike by the Fed.

If the Fed is cutting rates into rising growth and inflation, then risk assets like equities or Bitcoin rise to price the increase in money in the financial system as well as the underlying economy.

If the Fed cuts rates into a falling growth and inflation environment, risk assets can be neutral to bearish. It will depend on how aggressively the Fed is cutting relative to how strong the contraction in the economy is. For example, if there is an actual recession that begins to suck money out of financial markets and create deflationary pressures due to a rise in delinquencies, this could be a greater impulse than any cuts by the Fed. The net result would be the Fed cutting rates into a falling economy and bearish market. This is WHY the Fed can cut and equities/Bitcoin can still sell off.

Inversely, if growth is expanding A TON and you have real GDP running above 3% with CPI running above 4%, a single hike by the Fed might not even impact asset markets because its so marginal compared to the strength in the economy. In this scenario, you could have assets rally despite a hike by the Fed.

All of these changes in interest rates and the underlying economy create a net amount of money that flows across the entire risk curve into credit, equities, crypto, memecoins, and every other type of high-risk deal.

This is WHY understanding both the underlying economy as well as interest rates frames ALL money in the system and thereby all assets denominated in money.

Every good, service and asset is priced in US dollars, which means if you are getting long or short, you're taking a view on BOTH the asset and US dollars.

Every good, service and asset is priced in US dollars, which means if you are getting long or short, you're taking a view on BOTH the asset and US dollars.

So what are we seeing right now?

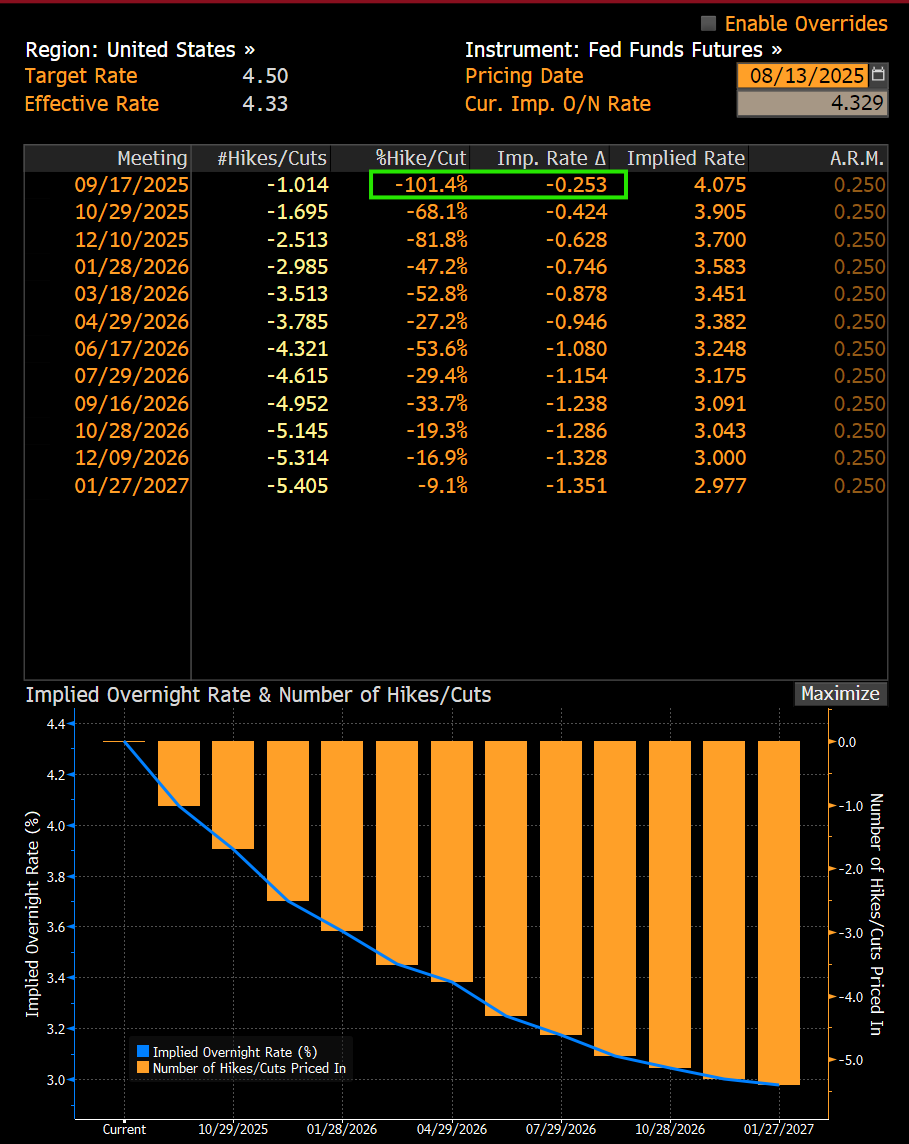

The forward curve is currently pricing a 100% probability of a rate cut in Sept. This isnt sentiment or some narratives. This is actual dollars that are betting on this.

The forward curve is currently pricing a 100% probability of a rate cut in Sept. This isnt sentiment or some narratives. This is actual dollars that are betting on this.

This is taking place as the Z5 contract is pricing a coinflip between a total of 50bps and 70bps this year. In other words, there are 3 meetings for the rest of the year. The market is pricing a 100% probability of a cut in the first one. It is NOT pricing a 100% probability of consecutive cuts in all three meetings but were getting there.

If the Fed cuts in every meeting the rest of this year, this will lower the price of money and thereby increase the supply of money in short end rates.

Now using the logic I laid out above, is this taking place into positive or negative growth/inflation?

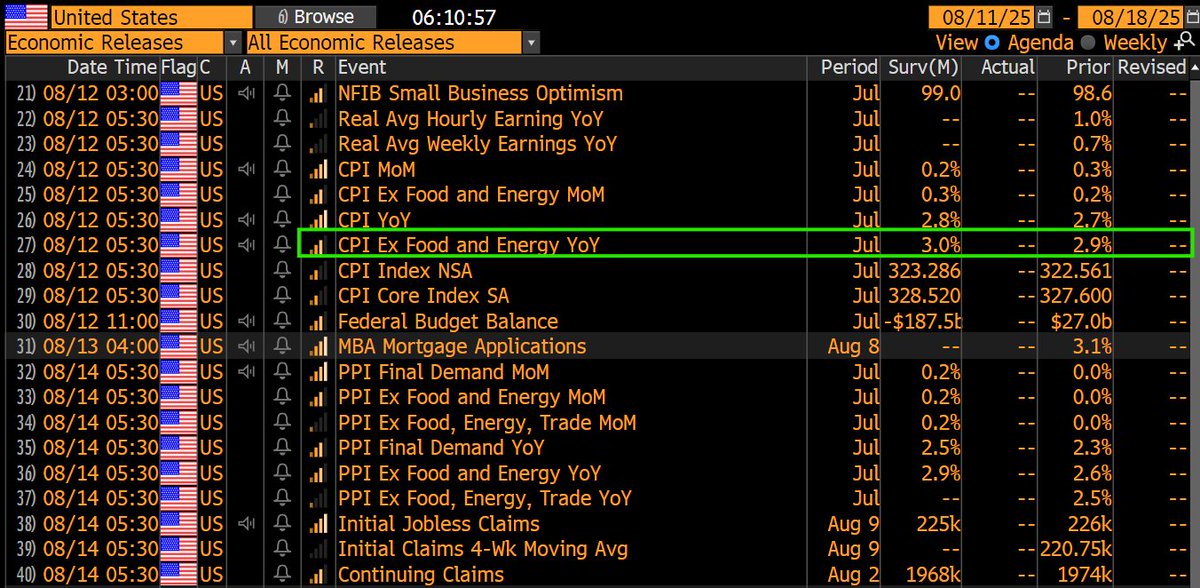

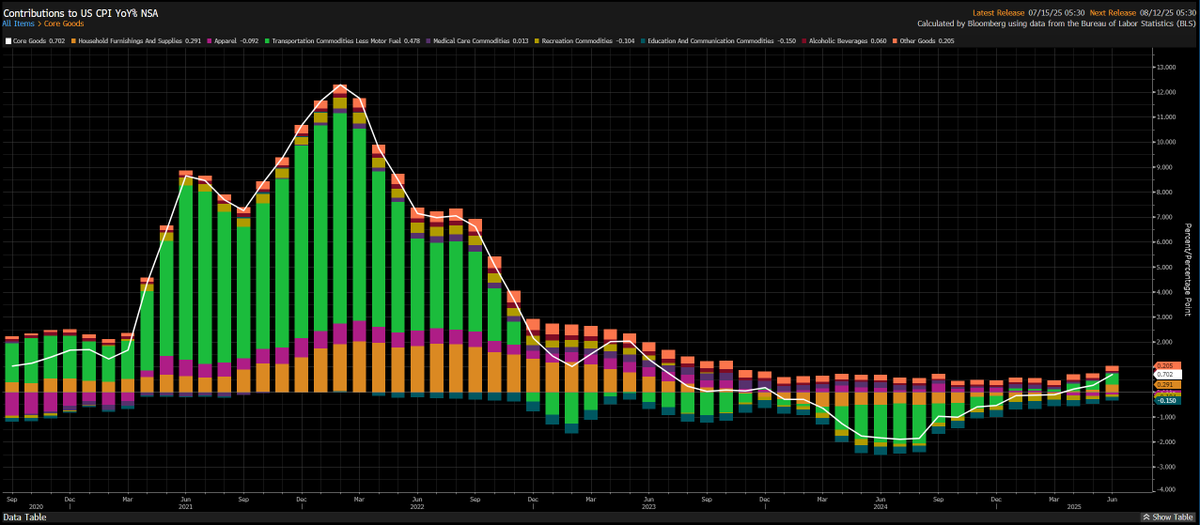

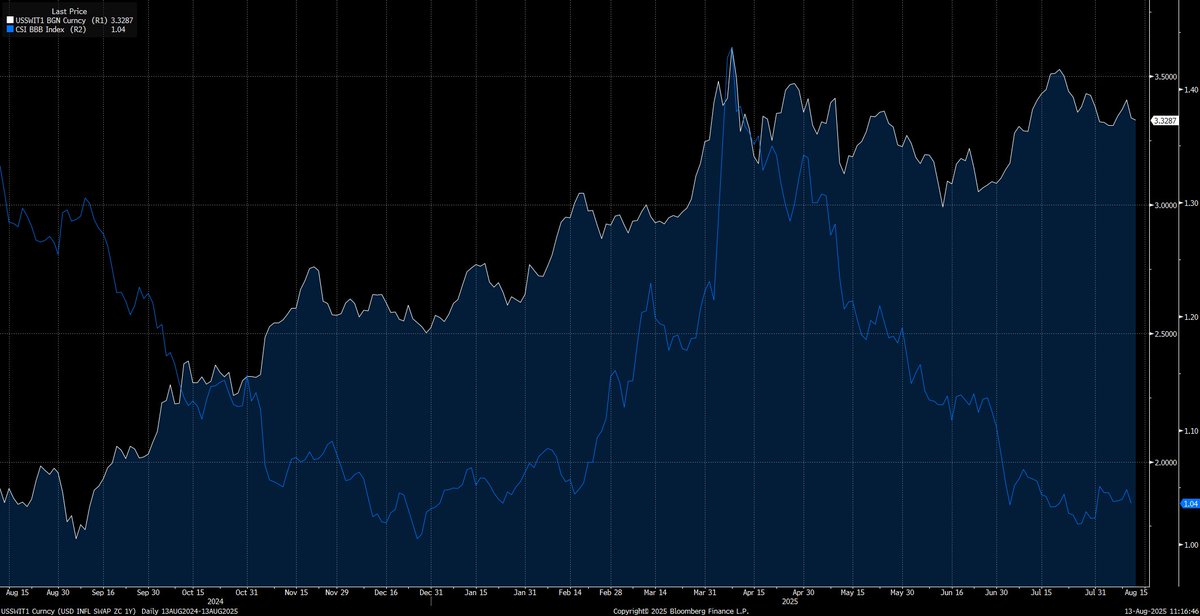

Right now 1 year inflation swaps are ABOVE 3% and credit spreads are at cycle lows which means there is clearly a positive growth/inflation pulse. This is being confirmed in the underlying economic and company data as well.

Now using the logic I laid out above, is this taking place into positive or negative growth/inflation?

Right now 1 year inflation swaps are ABOVE 3% and credit spreads are at cycle lows which means there is clearly a positive growth/inflation pulse. This is being confirmed in the underlying economic and company data as well.

This is WHY I explained that inflation risk is GREATER than recession risk right now. The Fed is cutting into positive growth and inflation and the result is risk assets have been moving higher. This is why I am long BTC, ES and the Nikkei as I laid out in the thread below.

https://x.com/Globalflows/status/1955320999068700677

When the Fed cuts into positive growth and inflation, it pushes capital out the risk curve to buy risky stuff. This is WHY memecoins are rallying in a broadbased way. If it was just about individual culture then you wouldnt see them all rallying at once. When crypto and memes are ALL rallying, its a signal about liquidity in the system. This is what I explained in this video.

x.com/Globalflows/st…

x.com/Globalflows/st…

So how does this all end and what are the signals for a shift into a bear market. Well I laid this out comprehensively in the report below but the main things you want to be watching is for interest rates to begin being restrictive AND underlying growth and inflation beginning to contract. Real bear markets occur when the Fed makes a policy error and are to restrictive relative to financial conditions.

x.com/Globalflows/st…

x.com/Globalflows/st…

If the Fed continues to cut rates into inflation, it is going to put long end rates at risk of blowing out. It is very possible that this happens sometime this year or next year. If that takes place, it could begin to drag on risk assets and potentially put downward pressure on the economy.

THIS IS NOT HAPPENING RIGHT NOW. This is why I am bullish and holding the ES, BTC and Nikkei long I explained here.

https://x.com/Globalflows/status/1955321044002320508

If long end rates begin to rise, a top in equities will be marked by a shift in the yield curve as cross asset spikes and correlations shift.

The entire point of the strategies I run in equities, fixed income and FX is that I am constantly mapping how these changes reverberate across all risk assets (including Bitcoin).

The entire point of the strategies I run in equities, fixed income and FX is that I am constantly mapping how these changes reverberate across all risk assets (including Bitcoin).

If we begin to shift and turn neutral or bearish in risk assets, I will be neutral and likely shorting it if we begin to see persistence in the drivers.

For now, I remain long.

I am going to be publishing a video and a connected report, further breaking everything down and providing a playbook for everyone. If you are a subscriber here, you'll receive the playbook. If my strategy flips, I will publish a report on it: capitalflowsresearch.com

For now, I remain long.

I am going to be publishing a video and a connected report, further breaking everything down and providing a playbook for everyone. If you are a subscriber here, you'll receive the playbook. If my strategy flips, I will publish a report on it: capitalflowsresearch.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh