1) According to John Burns, from 2022-24, all of the growth in renter households came from immigration.

While only 5% of buyer demand came from immigration.

While only 5% of buyer demand came from immigration.

2) Suggesting there could be some headwinds for the rental market as the precipitous drop-off in immigration filters through to apartment demand.

However, to date in 2025, rental absorption has been strong.

However, to date in 2025, rental absorption has been strong.

3) According to RealPage, there were 227k apartment units absorbed in Q2 2025, which was above last year.

And allowed the trailing 12 absorption figure to hit a record.

Something many apartment landlords are celebrating today.

And allowed the trailing 12 absorption figure to hit a record.

Something many apartment landlords are celebrating today.

4) I'm seeing this on the ground in a market like Nashville.

Many of the communities that were 50-60% occupied last year are now 80-90% occupied.

Especially in Class A Product.

Many of the communities that were 50-60% occupied last year are now 80-90% occupied.

Especially in Class A Product.

5) But I have a sneaking suspicion these demand levels won't last, given the backdrop of collapsing immigration.

We went from having around 200k border crossings per month for 3 years, to less than 10k.

That's a 95% reduction.

We went from having around 200k border crossings per month for 3 years, to less than 10k.

That's a 95% reduction.

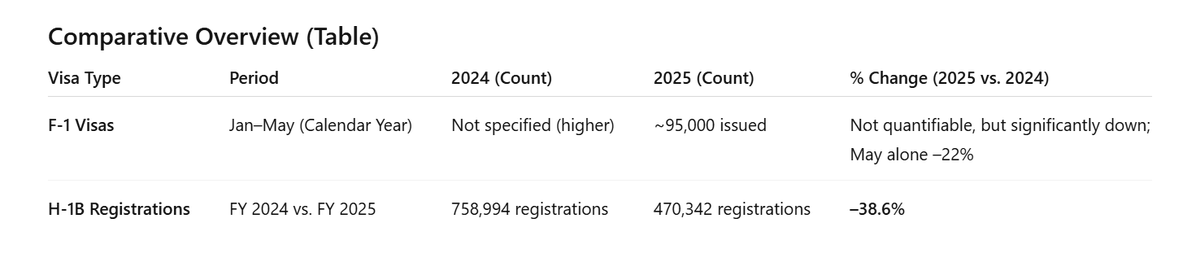

6) There also appear to be declines in the number of student and H1B visas issued so far in 2025 compared to 2024, at least according to ChatGPT.

7) Suggesting that there will be a hit to apartment rental demand at some point in the future.

The question is when. And how big will the negative impact be?

An immigrant's journey into finding an apartment in the U.S. isn't straightforward, and there could be a significant lag between coming into the U.S. and applying for an apartment.

The question is when. And how big will the negative impact be?

An immigrant's journey into finding an apartment in the U.S. isn't straightforward, and there could be a significant lag between coming into the U.S. and applying for an apartment.

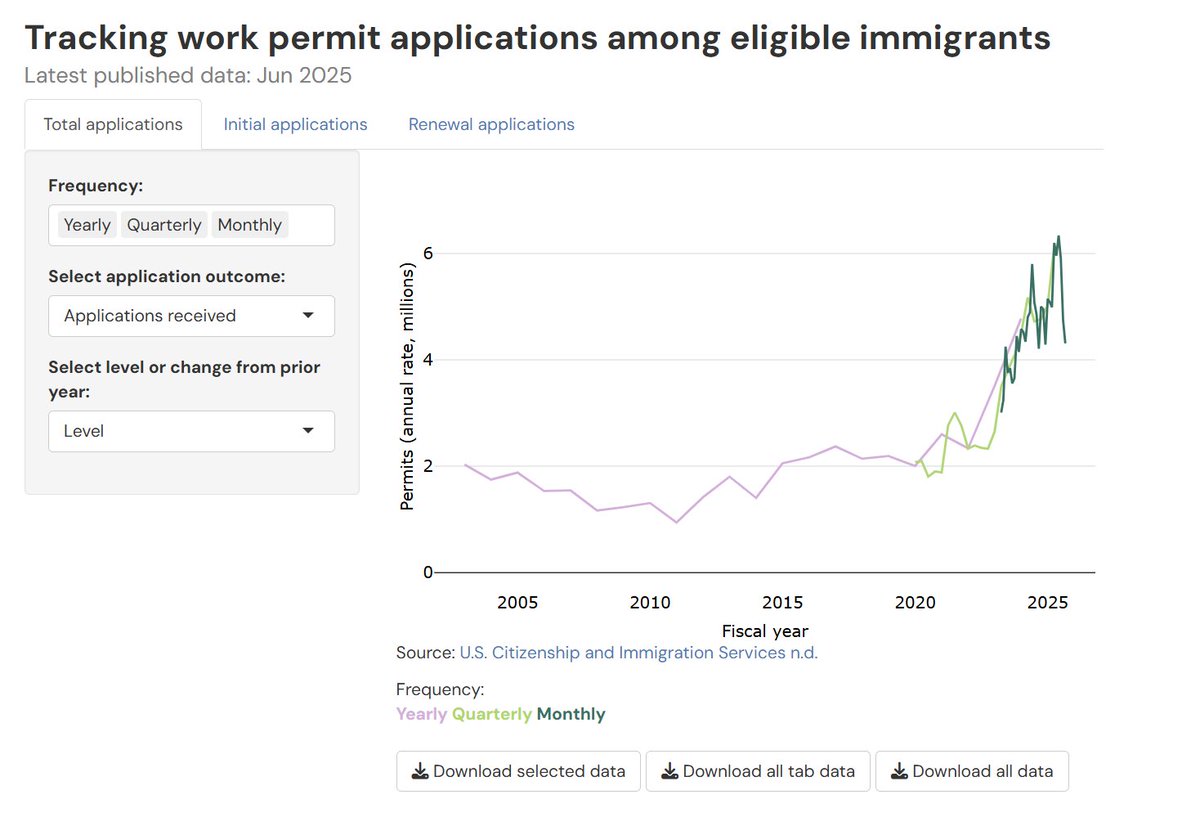

8) We're seeing this lag play out with work permit applications.

As of June 2025, there were over 4 million seasonally adjusted, annualized work permit applications from immigrants.

This is down from the peak January, but still way above the long-term norm of 2 million.

Suggesting that the huge influx of immigration from 2021-2024 is still rippling through the economy in terms of labor supply and apartment demand.

Source: Brookings Institution

As of June 2025, there were over 4 million seasonally adjusted, annualized work permit applications from immigrants.

This is down from the peak January, but still way above the long-term norm of 2 million.

Suggesting that the huge influx of immigration from 2021-2024 is still rippling through the economy in terms of labor supply and apartment demand.

Source: Brookings Institution

9) Based on this, I suspect apartment demand still has another 6 months of resilience from the surge in immigration that occurred in 2021-24.

But once the page turns to 2026, we could start seeing meaningful slowdowns in renter absorption, particularly in markets that are heavily immigrant-dependent.

But once the page turns to 2026, we could start seeing meaningful slowdowns in renter absorption, particularly in markets that are heavily immigrant-dependent.

10) The market for sale isn't really impacted by this.

According to John Burns, 95% of for-sale demand from 2022-24 was native born Americans.

Only 5% was immigrants.

According to John Burns, 95% of for-sale demand from 2022-24 was native born Americans.

Only 5% was immigrants.

11) One thing to note, however, is that starting in May 2025 the Trump administration suspended the ability of non-permanent residents to apply for FHA mortgages.

So there could be a negative demand impact from that decision, as it relates more to the existing immigrant population than new immigrants.

So there could be a negative demand impact from that decision, as it relates more to the existing immigrant population than new immigrants.

• • •

Missing some Tweet in this thread? You can try to

force a refresh