The "Dead Economy"s ratings just got upgraded by S&P.

50% Tariff to crush India? Come On.

PM Modi’s vision + FM Sitharaman’s execution have built an economy so resilient, even a 50% US tariff would barely scratch it.

Here’s why India is tariff-war-proof — in numbers 👇

50% Tariff to crush India? Come On.

PM Modi’s vision + FM Sitharaman’s execution have built an economy so resilient, even a 50% US tariff would barely scratch it.

Here’s why India is tariff-war-proof — in numbers 👇

1) S&P’s global stamp of confidence

On Aug 14, 2025, S&P Global Ratings upgraded India to ‘BBB’ from ‘BBB-’, outlook Stable. Their reason? “Economic resilience” + “sustained fiscal consolidation” — a rare combo in a slowing world.

And it’s not just the sovereign rating that went up.

S&P also revised India’s Transfer & Convertibility (T&C) assessment — which measures the risk of moving capital in and out of the country — to ‘A-’ from ‘BBB+’.

This signals to global investors that India’s capital account is secure, currency is stable, and the risk of restrictions on cross-border payments is among the lowest for emerging markets.

This upgrade means lower borrowing costs, stronger investor trust, and greater ability to attract capital in turbulent times.

PM Modi’s long-term reform vision and FM Nirmala Sitharaman’s disciplined execution have built an economy that can absorb external shocks, including tariff wars, without losing momentum.

The result: India enters this global trade turbulence from a position of strength, not fear.

On Aug 14, 2025, S&P Global Ratings upgraded India to ‘BBB’ from ‘BBB-’, outlook Stable. Their reason? “Economic resilience” + “sustained fiscal consolidation” — a rare combo in a slowing world.

And it’s not just the sovereign rating that went up.

S&P also revised India’s Transfer & Convertibility (T&C) assessment — which measures the risk of moving capital in and out of the country — to ‘A-’ from ‘BBB+’.

This signals to global investors that India’s capital account is secure, currency is stable, and the risk of restrictions on cross-border payments is among the lowest for emerging markets.

This upgrade means lower borrowing costs, stronger investor trust, and greater ability to attract capital in turbulent times.

PM Modi’s long-term reform vision and FM Nirmala Sitharaman’s disciplined execution have built an economy that can absorb external shocks, including tariff wars, without losing momentum.

The result: India enters this global trade turbulence from a position of strength, not fear.

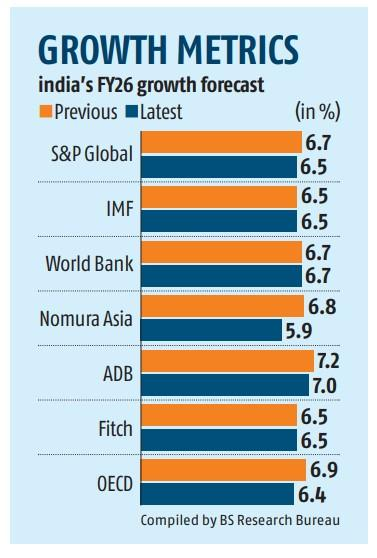

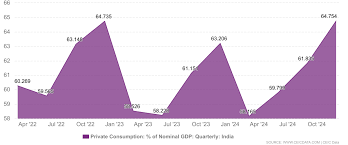

2)Growth engine that resists trade shocks

India’s GDP is projected to grow ~6.8% annually for the next 3 years, far above peers. Since FY22, growth has averaged 8.8%, the highest in Asia-Pacific.

Even if the U.S. imposes 50% tariffs, S&P estimates only 1.2% of GDP in directly affected exports — a marginal impact.

Why? Because India’s growth is powered by domestic consumption, not over-dependence on exports.

With 60% of GDP coming from household spending, even external hits are cushioned.

This structure — intentionally nurtured through Make in India, Atmanirbhar Bharat, and MSME support — makes tariffs a speed bump, not a derailment.

India’s GDP is projected to grow ~6.8% annually for the next 3 years, far above peers. Since FY22, growth has averaged 8.8%, the highest in Asia-Pacific.

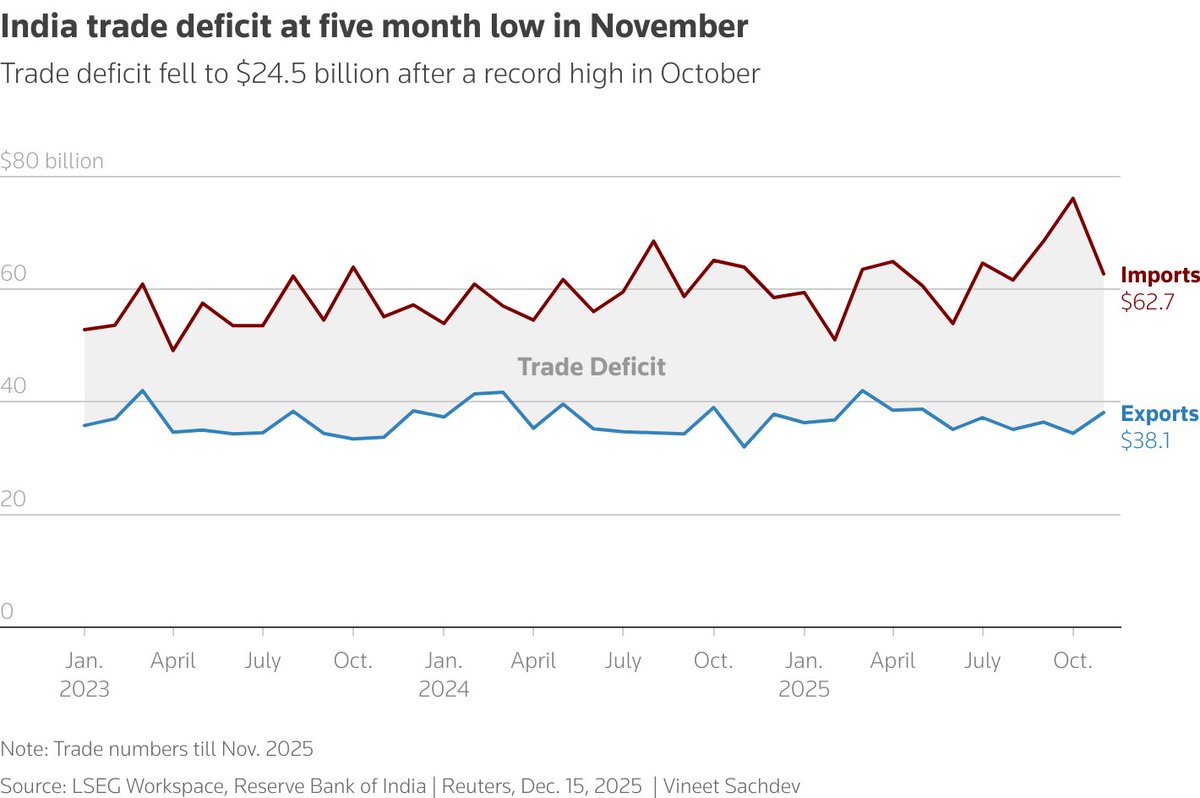

Even if the U.S. imposes 50% tariffs, S&P estimates only 1.2% of GDP in directly affected exports — a marginal impact.

Why? Because India’s growth is powered by domestic consumption, not over-dependence on exports.

With 60% of GDP coming from household spending, even external hits are cushioned.

This structure — intentionally nurtured through Make in India, Atmanirbhar Bharat, and MSME support — makes tariffs a speed bump, not a derailment.

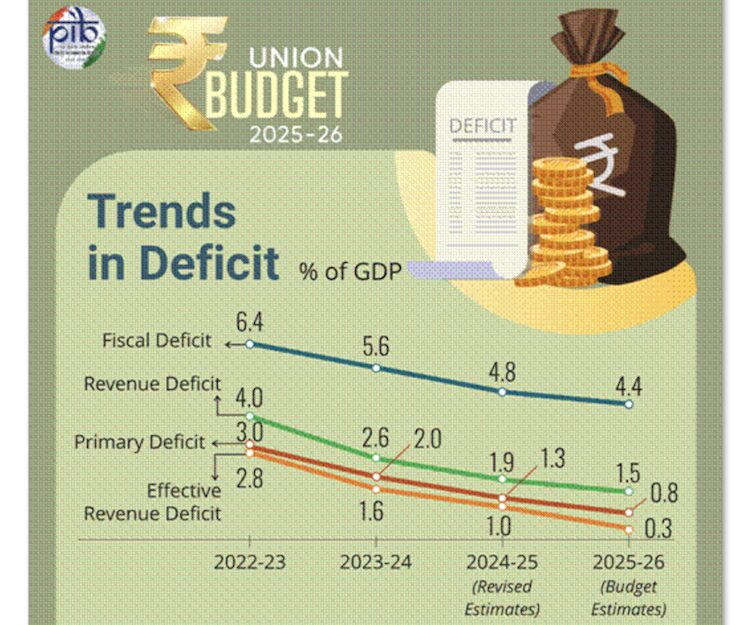

3) Fiscal discipline + income tax relief = balanced growth

FM Sitharaman’s budgets have delivered the rare combo: deficit reduction and higher disposable incomes. The central deficit has fallen from 6.4% (FY23) to 4.4% (FY26 target).

At the same time, raising the minimum taxable income threshold has freed up spending power for millions of households.

S&P notes this will feed directly into domestic consumption growth — India’s strongest economic pillar.

Lower deficits keep debt sustainable, while income tax relief fuels spending in retail, housing, travel, and consumer goods. This is smart fiscal policy that both stabilizes the books and accelerates the economy.

FM Sitharaman’s budgets have delivered the rare combo: deficit reduction and higher disposable incomes. The central deficit has fallen from 6.4% (FY23) to 4.4% (FY26 target).

At the same time, raising the minimum taxable income threshold has freed up spending power for millions of households.

S&P notes this will feed directly into domestic consumption growth — India’s strongest economic pillar.

Lower deficits keep debt sustainable, while income tax relief fuels spending in retail, housing, travel, and consumer goods. This is smart fiscal policy that both stabilizes the books and accelerates the economy.

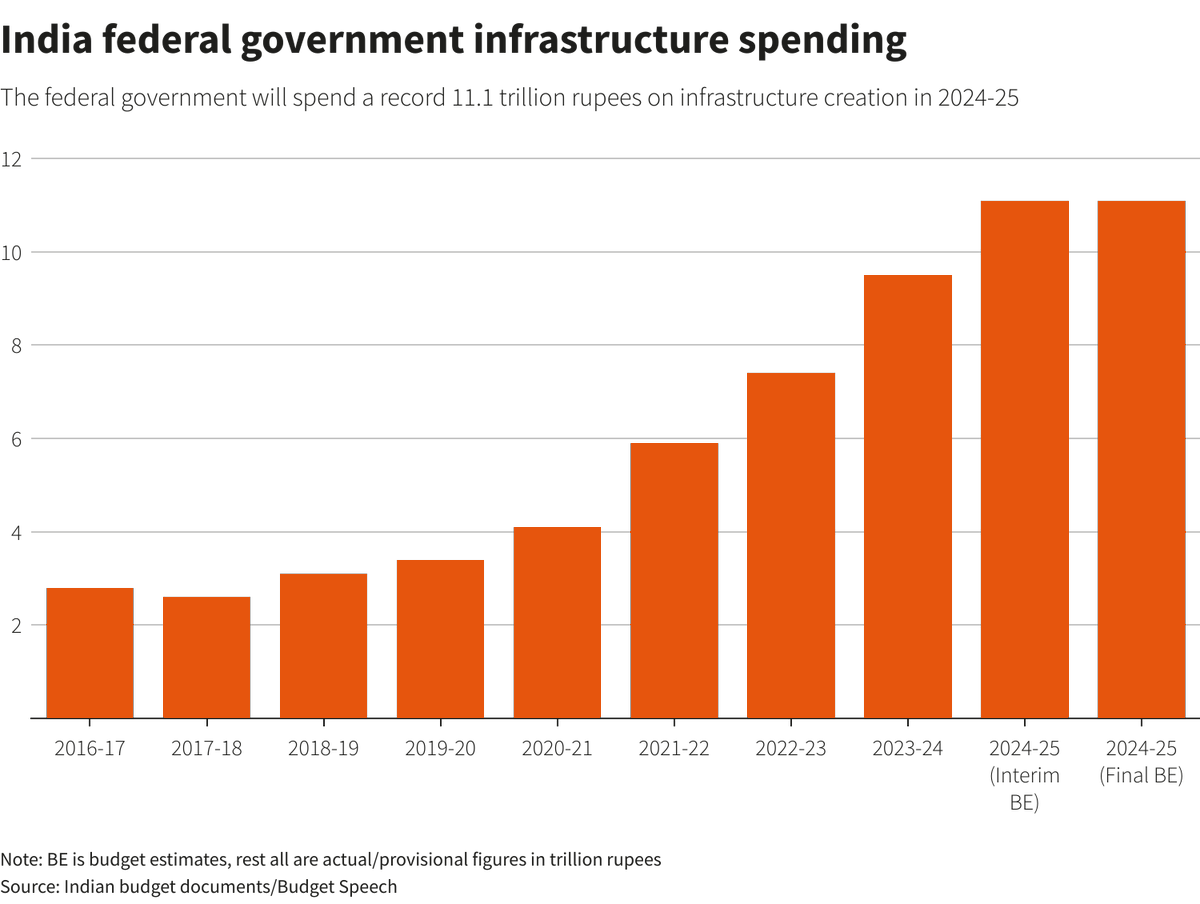

4)Infrastructure push that lifts long-term growth

India’s capex spend is at a record ₹11.2 lakh crore in FY26 (3.1% of GDP) — the highest ever.

Including states, public infra investment is 5.5% of GDP, matching or beating top global peers.

PM Modi’s focus on highways, railways, ports, digital networks, and rural connectivity is removing bottlenecks that historically slowed growth.

S&P sees this as a key reason for India’s stronger rating — because infrastructure not only creates jobs today but also lowers business costs and boosts productivity for decades.

This shift in spending quality, away from subsidies toward assets, is a structural game-changer.

India’s capex spend is at a record ₹11.2 lakh crore in FY26 (3.1% of GDP) — the highest ever.

Including states, public infra investment is 5.5% of GDP, matching or beating top global peers.

PM Modi’s focus on highways, railways, ports, digital networks, and rural connectivity is removing bottlenecks that historically slowed growth.

S&P sees this as a key reason for India’s stronger rating — because infrastructure not only creates jobs today but also lowers business costs and boosts productivity for decades.

This shift in spending quality, away from subsidies toward assets, is a structural game-changer.

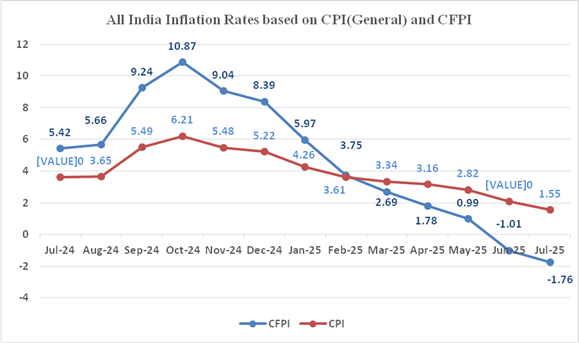

5)Inflation control = policy credibility

RBI’s inflation-targeting regime, backed by government policy discipline, has kept CPI growth at an average 5.5% over the past 3 years, despite oil price shocks and global supply disruptions.

July 2025 CPI is just 1.6%, at the lower end of the RBI’s target band (2%-6%). This allowed the RBI to cut rates by 100 basis points this year, providing room to stimulate if global trade tensions hurt growth.

S&P credits this “enhanced monetary policy environment” as anchoring inflation expectations — a far cry from 2008–2014 when double-digit inflation repeatedly eroded purchasing power. Stability breeds investor confidence.

RBI’s inflation-targeting regime, backed by government policy discipline, has kept CPI growth at an average 5.5% over the past 3 years, despite oil price shocks and global supply disruptions.

July 2025 CPI is just 1.6%, at the lower end of the RBI’s target band (2%-6%). This allowed the RBI to cut rates by 100 basis points this year, providing room to stimulate if global trade tensions hurt growth.

S&P credits this “enhanced monetary policy environment” as anchoring inflation expectations — a far cry from 2008–2014 when double-digit inflation repeatedly eroded purchasing power. Stability breeds investor confidence.

6)Domestic demand as India’s superpower

Around 65% of GDP comes from domestic consumption, making India less vulnerable to export volatility.

This strength is now amplified by income tax relief, digital payment adoption, and growing middle-class aspirations.

UPI alone processed 19.47B transactions worth ₹25.08 lakh crore in July 2025 — ensuring money circulates quickly through the economy.

PM Modi’s policies have systematically built a demand-driven model: better rural incomes, urban job creation, and direct benefit transfers all help sustain consumption.

In a tariff war, countries reliant on exports struggle; India’s home market becomes its shock absorber.

Around 65% of GDP comes from domestic consumption, making India less vulnerable to export volatility.

This strength is now amplified by income tax relief, digital payment adoption, and growing middle-class aspirations.

UPI alone processed 19.47B transactions worth ₹25.08 lakh crore in July 2025 — ensuring money circulates quickly through the economy.

PM Modi’s policies have systematically built a demand-driven model: better rural incomes, urban job creation, and direct benefit transfers all help sustain consumption.

In a tariff war, countries reliant on exports struggle; India’s home market becomes its shock absorber.

7) FX reserves: a $700B trade-war buffer

With $700B in FX reserves, India has one of the largest financial cushions in the world.

FY25 current account deficit was just 0.6% of GDP, with even a quarterly surplus recently — meaning India earns enough in foreign exchange to cover its imports.

S&P calls this “a strong external balance sheet” and a major reason the upgrade happened.

This buffer gives the RBI space to manage the rupee, maintain liquidity, and keep capital flowing even if tariffs shake global markets.

In short, India can fight a currency battle while keeping its growth story intact.

With $700B in FX reserves, India has one of the largest financial cushions in the world.

FY25 current account deficit was just 0.6% of GDP, with even a quarterly surplus recently — meaning India earns enough in foreign exchange to cover its imports.

S&P calls this “a strong external balance sheet” and a major reason the upgrade happened.

This buffer gives the RBI space to manage the rupee, maintain liquidity, and keep capital flowing even if tariffs shake global markets.

In short, India can fight a currency battle while keeping its growth story intact.

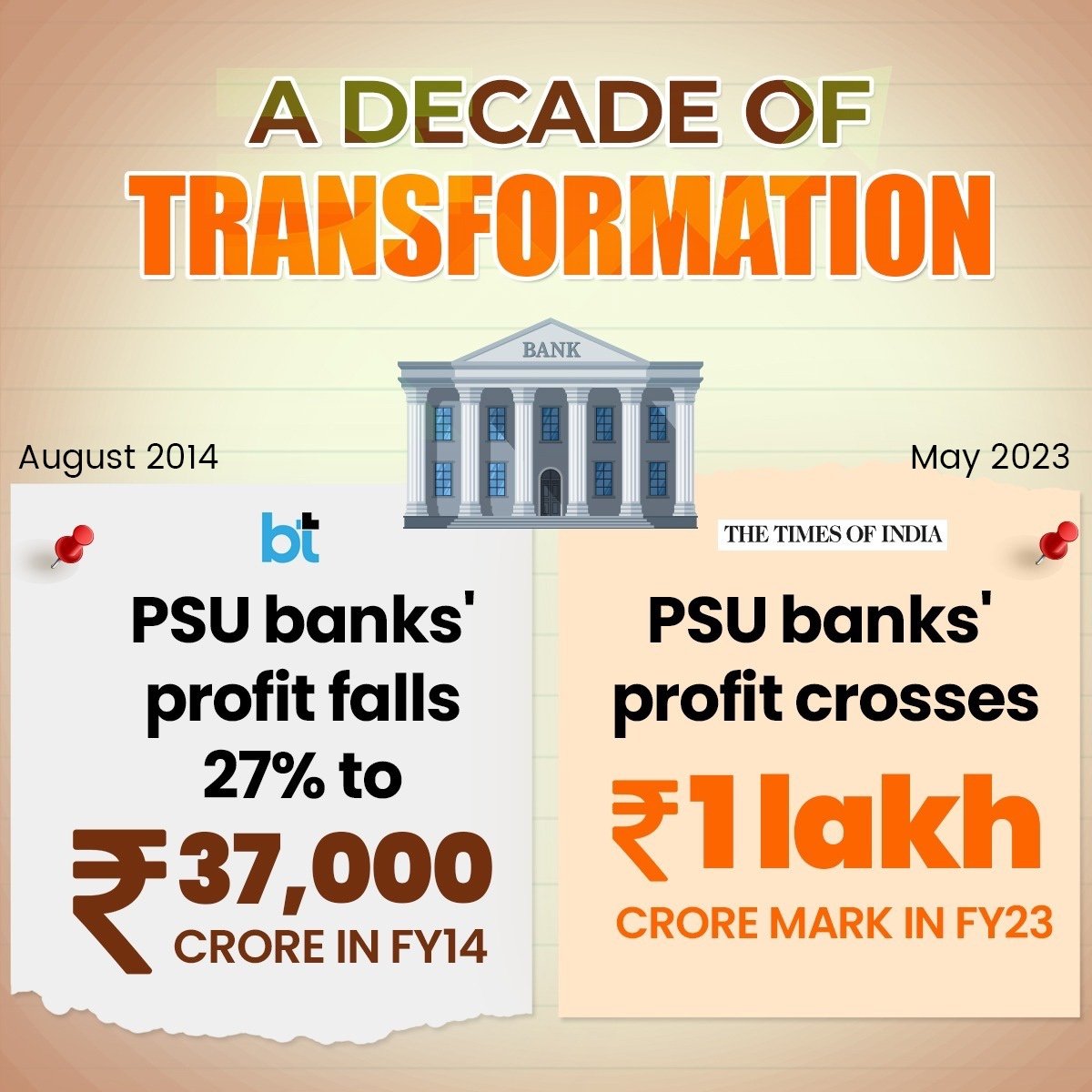

8) Strongest banking sector in decades

Post-2014 banking reforms and bad loan clean-up have delivered results: GNPA ratio is now 2.3% (Mar-25), capital adequacy ~17.3% — both multi-decade highs.

This means banks can lend to businesses and consumers at scale, even if some export sectors slow down due to tariffs.

S&P acknowledges that the corporate and financial sectors have “stronger balance sheets than before the pandemic,” allowing them to finance growth without excessive risk.

This resilience is a product of deliberate reform — Insolvency and Bankruptcy Code, PSU bank recapitalisation, and stricter lending norms — all core to Modi govt policy.

Post-2014 banking reforms and bad loan clean-up have delivered results: GNPA ratio is now 2.3% (Mar-25), capital adequacy ~17.3% — both multi-decade highs.

This means banks can lend to businesses and consumers at scale, even if some export sectors slow down due to tariffs.

S&P acknowledges that the corporate and financial sectors have “stronger balance sheets than before the pandemic,” allowing them to finance growth without excessive risk.

This resilience is a product of deliberate reform — Insolvency and Bankruptcy Code, PSU bank recapitalisation, and stricter lending norms — all core to Modi govt policy.

9) Political stability = investor trust

PM Modi’s third term, even in coalition, ensures policy continuity — crucial for investor confidence.

S&P explicitly cites “continued policy stability” as a driver of its stable outlook.

The government’s track record — GST rollout, inflation targeting, direct tax simplification, and infrastructure build-out — signals to global markets that India will stick to its reform path.

In times of global uncertainty, investors prize predictability. India offers that — and now, with an S&P upgrade, it offers it with a stronger credit profile than ever before.

PM Modi’s third term, even in coalition, ensures policy continuity — crucial for investor confidence.

S&P explicitly cites “continued policy stability” as a driver of its stable outlook.

The government’s track record — GST rollout, inflation targeting, direct tax simplification, and infrastructure build-out — signals to global markets that India will stick to its reform path.

In times of global uncertainty, investors prize predictability. India offers that — and now, with an S&P upgrade, it offers it with a stronger credit profile than ever before.

10)The bottom line:

The S&P upgrade to BBB is not just a ratings move — it’s a validation of a decade-long strategy:

PM Modi’s vision: self-reliance, infra-led growth, and global positioning.

FM Sitharaman’s execution: fiscal discipline, spending quality, and targeted relief to boost demand.

Economic resilience: strong banks, huge reserves, controlled inflation, and consumption-led growth.

Tariff wars will bruise some exporters — but India’s macro story stays intact. This is a nation built not just to survive shocks, but to turn them into opportunities.

The S&P upgrade to BBB is not just a ratings move — it’s a validation of a decade-long strategy:

PM Modi’s vision: self-reliance, infra-led growth, and global positioning.

FM Sitharaman’s execution: fiscal discipline, spending quality, and targeted relief to boost demand.

Economic resilience: strong banks, huge reserves, controlled inflation, and consumption-led growth.

Tariff wars will bruise some exporters — but India’s macro story stays intact. This is a nation built not just to survive shocks, but to turn them into opportunities.

11) And it’s not just the sovereign rating that went up.

S&P also revised India’s Transfer & Convertibility (T&C) assessment — which measures the risk of moving capital in and out of the country — to ‘A-’ from ‘BBB+’.

This signals to global investors that India’s capital account is secure, currency is stable, and the risk of restrictions on cross-border payments is among the lowest for emerging markets.

In simple terms: India is now seen as a safe, reliable place for foreign capital — even in volatile global conditions."

S&P also revised India’s Transfer & Convertibility (T&C) assessment — which measures the risk of moving capital in and out of the country — to ‘A-’ from ‘BBB+’.

This signals to global investors that India’s capital account is secure, currency is stable, and the risk of restrictions on cross-border payments is among the lowest for emerging markets.

In simple terms: India is now seen as a safe, reliable place for foreign capital — even in volatile global conditions."

• • •

Missing some Tweet in this thread? You can try to

force a refresh