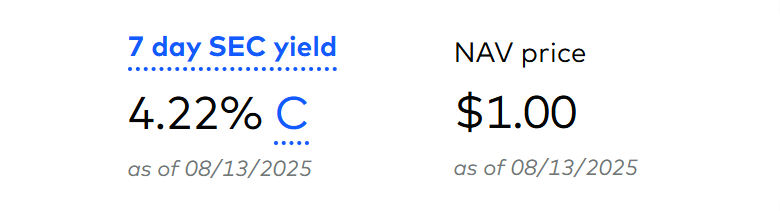

Vanguard Money Market Fund pays 4.22% interest on your cash savings with state tax savings.

But 99% of people don't understand the risk or how they work.

Here's an in depth thread on MMFs:

But 99% of people don't understand the risk or how they work.

Here's an in depth thread on MMFs:

Money Market Funds are mutual funds that try to keep their share price at $1.

The funds investment money in short term, low risk products like treasuries, bonds, and various governement obligations.

The funds investment money in short term, low risk products like treasuries, bonds, and various governement obligations.

For example, Vanguard has a $VMFXX that pays 4.22% annual yield, which is higher than most HYSA (Ally, Capital One, etc)

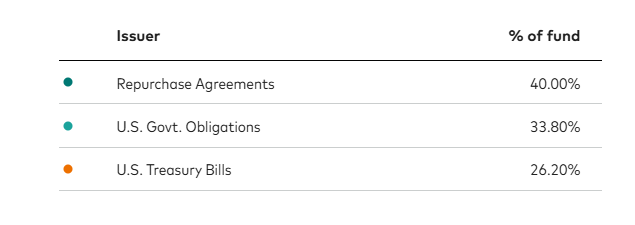

The fund is comprised of:

→ 40% of repurchase agreements

→ 33.8% of U.S. Govt. Obligations

→ 26.20% of U.S. Treasury Bills

The fund is comprised of:

→ 40% of repurchase agreements

→ 33.8% of U.S. Govt. Obligations

→ 26.20% of U.S. Treasury Bills

Different custodians have their own versions of MMFs, and different types of MMF (i.e. Federal, Treasury, Municipal, etc)

For example:

> Vanguard - $VMFXX, $VUSXX

> Fidelity - $FDLXX, $SPAXX

> Schwab - $SNSXX

And you can generally only buy them on their own platforms.

For example:

> Vanguard - $VMFXX, $VUSXX

> Fidelity - $FDLXX, $SPAXX

> Schwab - $SNSXX

And you can generally only buy them on their own platforms.

Another thing is that since the funds hold Treasury bills, a percentage of the interest you receive can be exempt from state taxes.

For example, $VUSXX was 100% exempt from state taxes, which can add a few basis points of after-tax yield.

For example, $VUSXX was 100% exempt from state taxes, which can add a few basis points of after-tax yield.

Say you received $2,000 of interest from $VUSXX.

100% of this interest was not taxed at the state level, but still taxed at the federal level.

vs receiving $2,000 of interest from your HYSA, with 100% of it being taxed at both the state and federal levels.

100% of this interest was not taxed at the state level, but still taxed at the federal level.

vs receiving $2,000 of interest from your HYSA, with 100% of it being taxed at both the state and federal levels.

But MMFs aren't identical to a HYSA. They aren't FDIC insured.

So, it's important to weigh the risks and figure out what YOU are comfortable with.

The biggest risk is if the share price drops below $1. This would obviously never happen with a HYSA.

So, it's important to weigh the risks and figure out what YOU are comfortable with.

The biggest risk is if the share price drops below $1. This would obviously never happen with a HYSA.

For example, during 08-09 there was a MMF called "Reserve Primary Fund"

At its peak it held more than $60 billion in assets, but during the financial crisis, it lost the dollar value and "broke the buck"

The fund dissolved in Dec 2015, having paid investors $0.991 per share.

At its peak it held more than $60 billion in assets, but during the financial crisis, it lost the dollar value and "broke the buck"

The fund dissolved in Dec 2015, having paid investors $0.991 per share.

In 2023, the SEC adopted MMF reform that increased minimum liquidity requirements for MMFs to provide a substantial buffer in the event of redemptions.

MMF shares held at a brokerage are also protected under SIPC, if a brokerage fails.

MMF shares held at a brokerage are also protected under SIPC, if a brokerage fails.

Overall, you have to determine where your comfort level is.

Vanguard's MMF fund ($VMFXX) has $359 billion of net assets or $VUSXX has $95 billion.

I'm personally comfortable with the risk but you have to analyze your own situation.

Vanguard's MMF fund ($VMFXX) has $359 billion of net assets or $VUSXX has $95 billion.

I'm personally comfortable with the risk but you have to analyze your own situation.

If you've found this post insightful, please help spread this message by:

1. reposting the first post

2. sending this post to a friend or family

3. following me @money_cruncher for more personal finance tips

1. reposting the first post

2. sending this post to a friend or family

3. following me @money_cruncher for more personal finance tips

• • •

Missing some Tweet in this thread? You can try to

force a refresh