This is unprecedented:

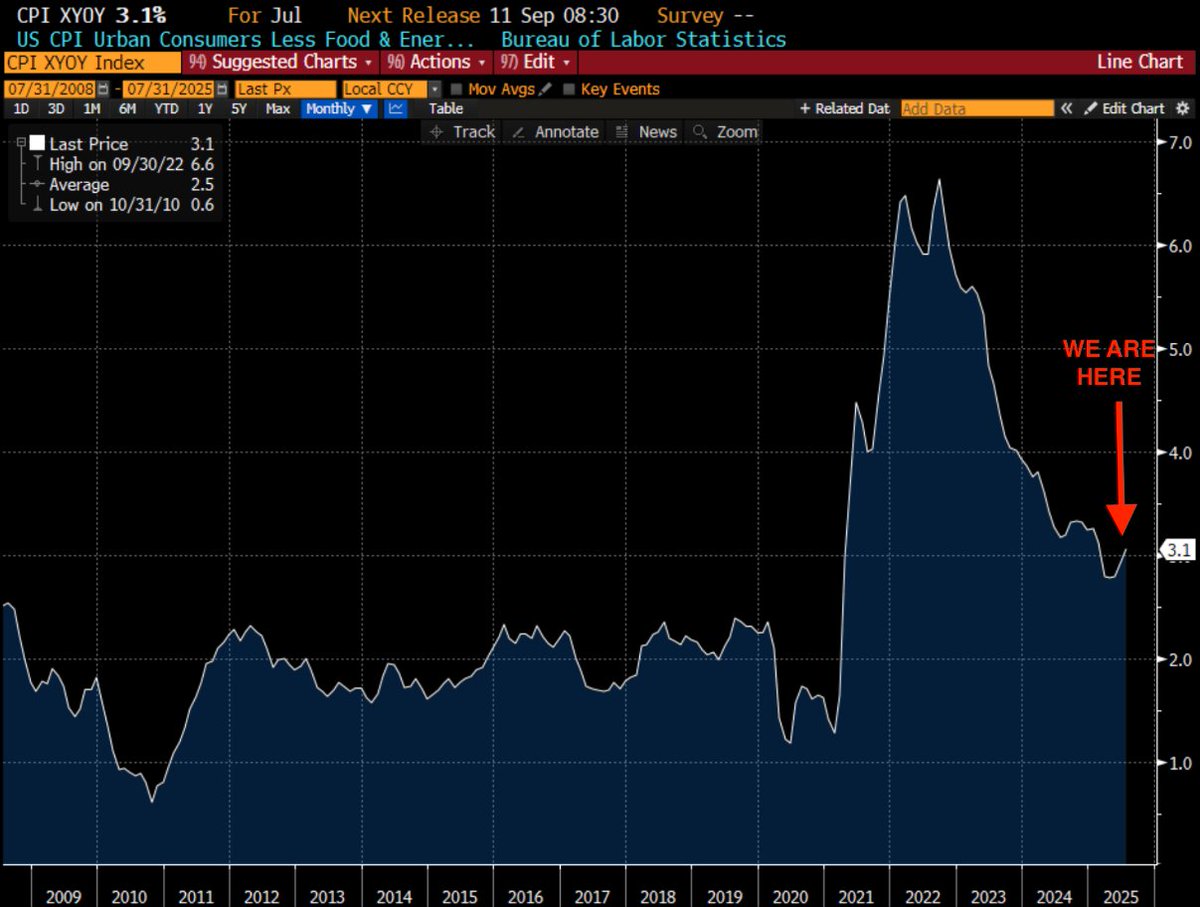

Core CPI inflation is back above +3% and PPI inflation is at its hottest since March 2022.

Meanwhile, President Trump is calling for a 300 BASIS POINT rate cut and is set to replace Fed Chair Powell.

Are you ready for what's next?

(a thread)

Core CPI inflation is back above +3% and PPI inflation is at its hottest since March 2022.

Meanwhile, President Trump is calling for a 300 BASIS POINT rate cut and is set to replace Fed Chair Powell.

Are you ready for what's next?

(a thread)

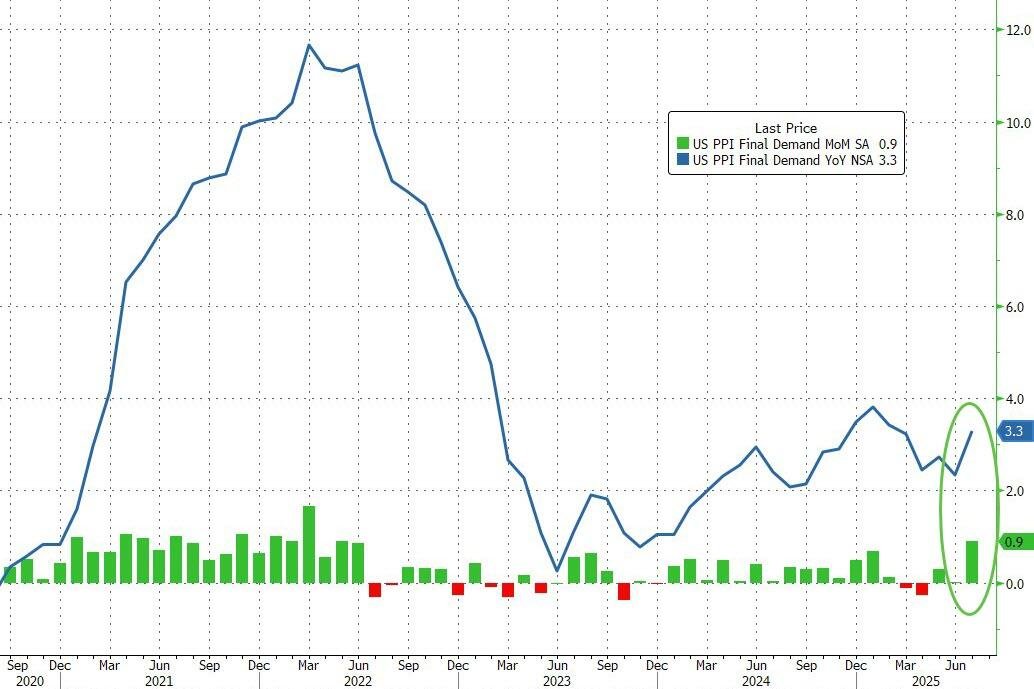

This week's inflation data was not ideal.

Core CPI inflation is now up to 3.1% and both headline and Core PPI inflation are above 3.0%.

As seen in the below chart, per Zerohedge, PPI inflation is clearly re-accelerating.

But, here's where it gets even more interesting.

Core CPI inflation is now up to 3.1% and both headline and Core PPI inflation are above 3.0%.

As seen in the below chart, per Zerohedge, PPI inflation is clearly re-accelerating.

But, here's where it gets even more interesting.

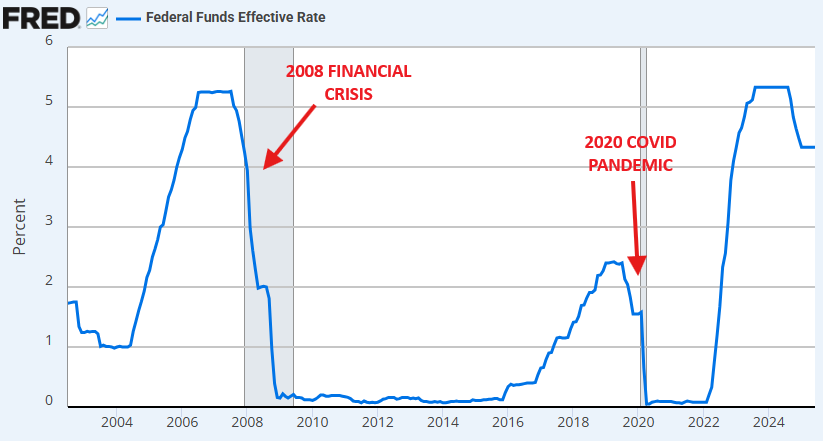

The question has shifted from IF the Fed will cut rates.

It is now, HOW MANY rate cuts will we get?

As shown below, there is now a 94% chance of a rate cut in September 2025 with markets pricing in a BASE CASE of 3 cuts in 2025.

This comes as inflation is rebounding.

It is now, HOW MANY rate cuts will we get?

As shown below, there is now a 94% chance of a rate cut in September 2025 with markets pricing in a BASE CASE of 3 cuts in 2025.

This comes as inflation is rebounding.

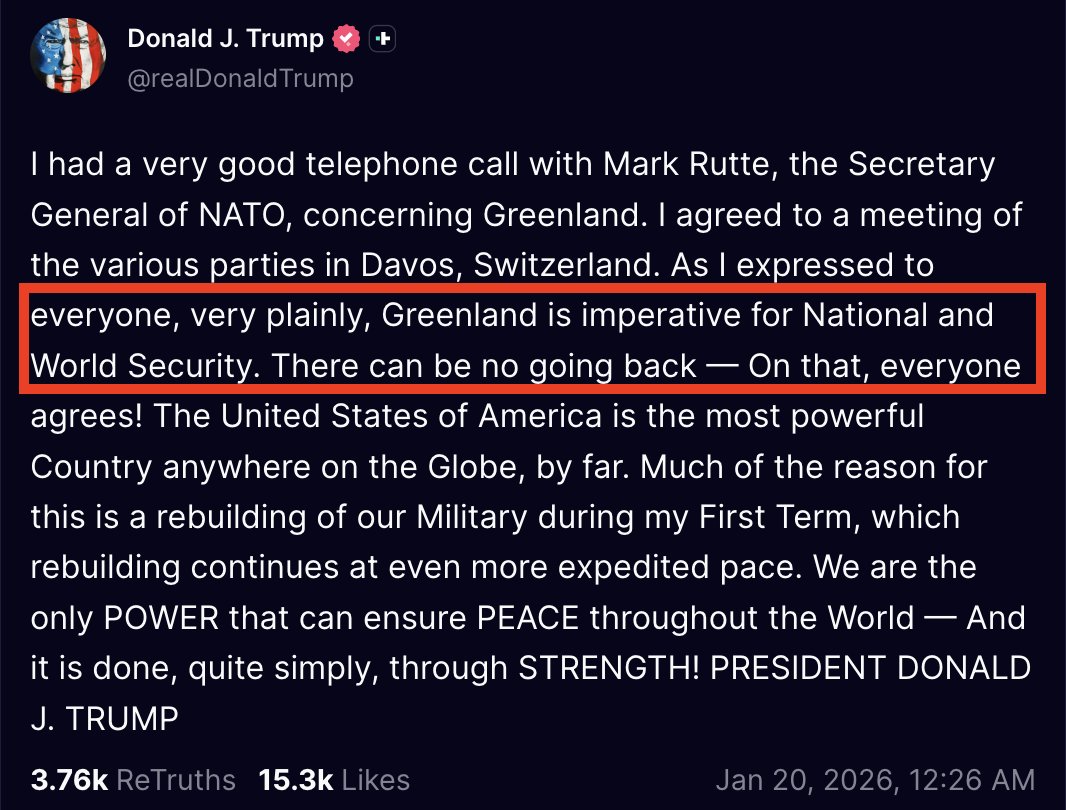

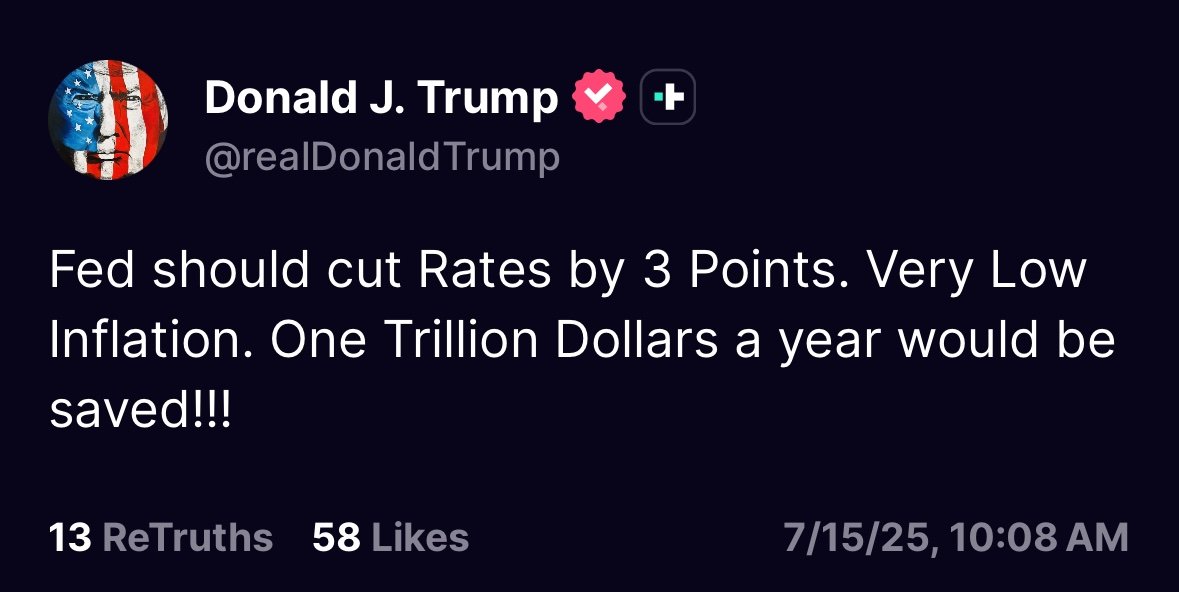

And, Trump says that's nothing.

President Trump is now calling for a 300 basis point interest rate cut, immediately.

This would be 3 TIMES larger than the 100 bps cut on March 15th, 2020, the largest in history.

Fed Chair Powell is refusing to do so, for now.

President Trump is now calling for a 300 basis point interest rate cut, immediately.

This would be 3 TIMES larger than the 100 bps cut on March 15th, 2020, the largest in history.

Fed Chair Powell is refusing to do so, for now.

However, President Trump has said that he is narrowing down his list for the next Fed Chair.

Fed Chair Powell's term will end in May 2026, and the new Fed Chair announcement is coming soon.

Markets will begin trading off what the new Fed Chair guides over Fed Chair Powell.

Fed Chair Powell's term will end in May 2026, and the new Fed Chair announcement is coming soon.

Markets will begin trading off what the new Fed Chair guides over Fed Chair Powell.

This is clearing a path for Trump to get rate cuts, even as inflation re-accelerates.

He wants rates down to 1%.

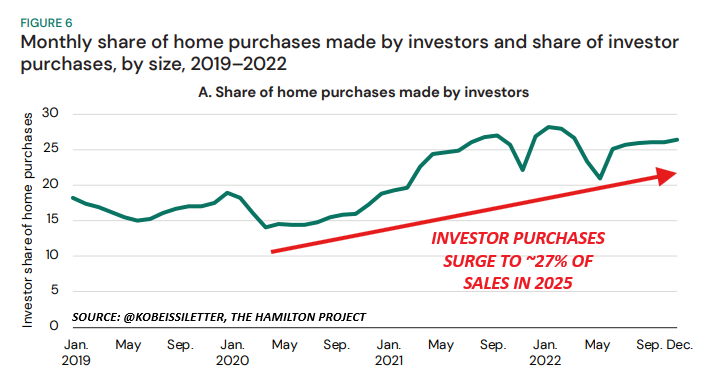

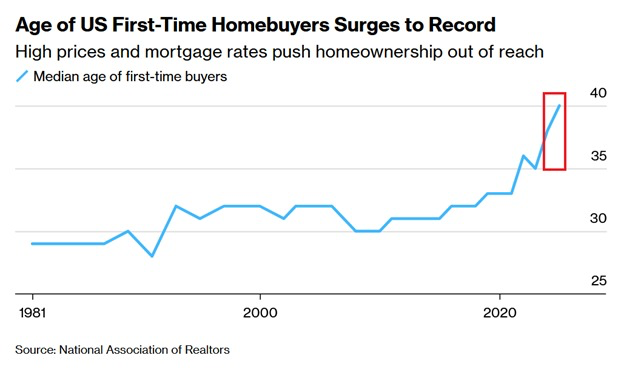

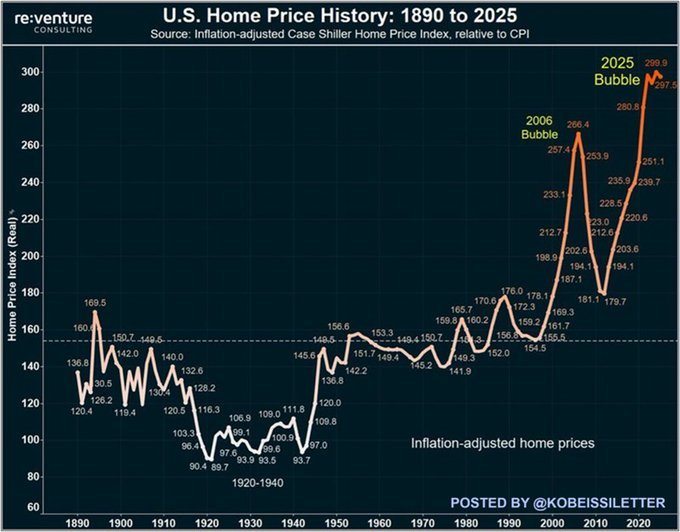

If this happens, mortgage rates will fall toward 3% and already record high housing prices will explode.

In our view, home prices would surge by 10%+ in year 1.

He wants rates down to 1%.

If this happens, mortgage rates will fall toward 3% and already record high housing prices will explode.

In our view, home prices would surge by 10%+ in year 1.

The near-term effects on equities would also be explosive.

300 basis points of rate cuts would send the S&P 500 well above 7,000.

But, it would come at a substantial cost, as we would expect CPI inflation to exceed 5.0% within a year of such drastic rate cuts.

300 basis points of rate cuts would send the S&P 500 well above 7,000.

But, it would come at a substantial cost, as we would expect CPI inflation to exceed 5.0% within a year of such drastic rate cuts.

And, here's the even bigger problem.

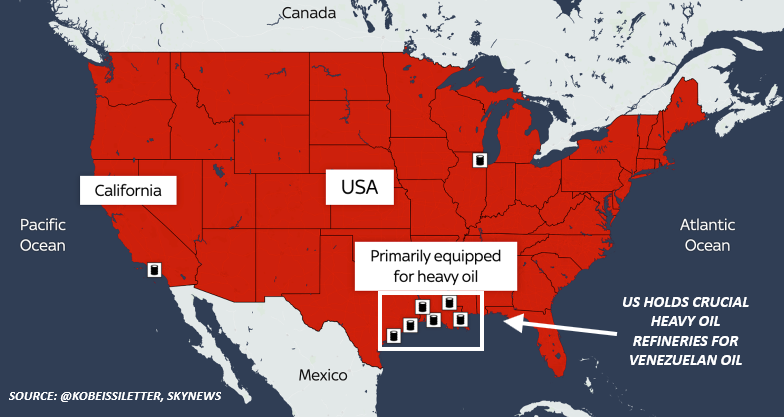

Services inflation surged +1.1%, led by +3.8% in margins for machinery/equipment wholesaling.

Fresh and dry vegetables also surged +38.9%, leading goods inflation.

Why is this so bad? It's the first sign of tariff-induced inflation.

Services inflation surged +1.1%, led by +3.8% in margins for machinery/equipment wholesaling.

Fresh and dry vegetables also surged +38.9%, leading goods inflation.

Why is this so bad? It's the first sign of tariff-induced inflation.

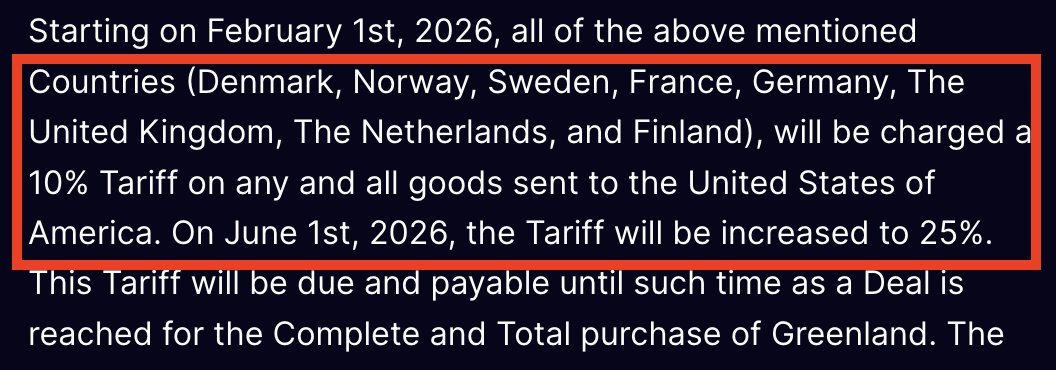

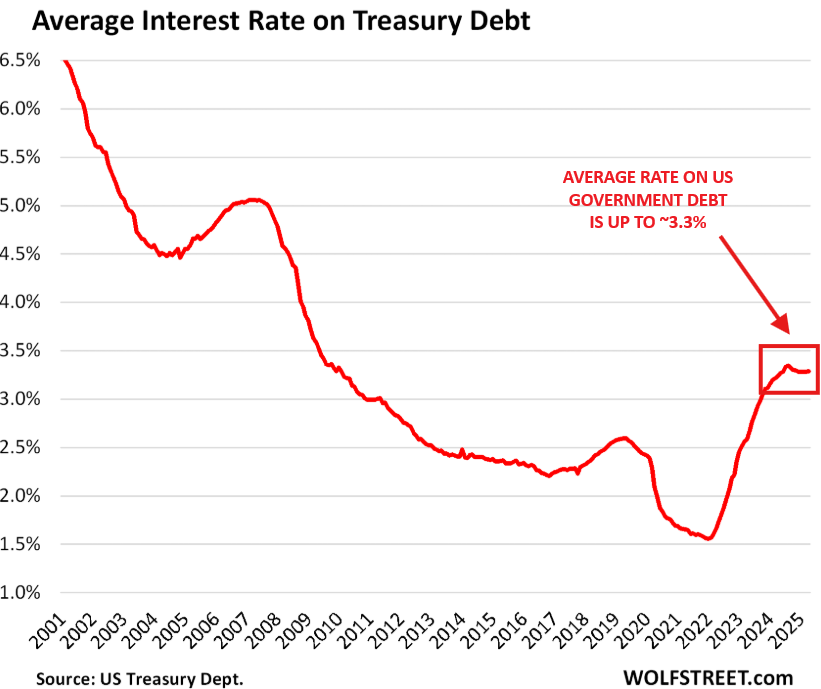

Trump's argument is that cutting rates would reduce US interest.

If the rate on ALL $29T in public debt was cut by 300 bps, the US could save $290B × 3 = $870B/year.

But, refinancing all of this debt ASAP would be impossible.

20% could be refinanced in year 1 to save ~$174B.

If the rate on ALL $29T in public debt was cut by 300 bps, the US could save $290B × 3 = $870B/year.

But, refinancing all of this debt ASAP would be impossible.

20% could be refinanced in year 1 to save ~$174B.

So now, Trump wants immediate rate cuts to lower interest expense on US debt.

But, tariffs are adding to inflation and the Fed would be cutting into hot inflation data.

With the trade war clearly here to stay, 300+ bps of rate cuts would create an unprecedented situation.

But, tariffs are adding to inflation and the Fed would be cutting into hot inflation data.

With the trade war clearly here to stay, 300+ bps of rate cuts would create an unprecedented situation.

Yesterday's news won't make it any easier.

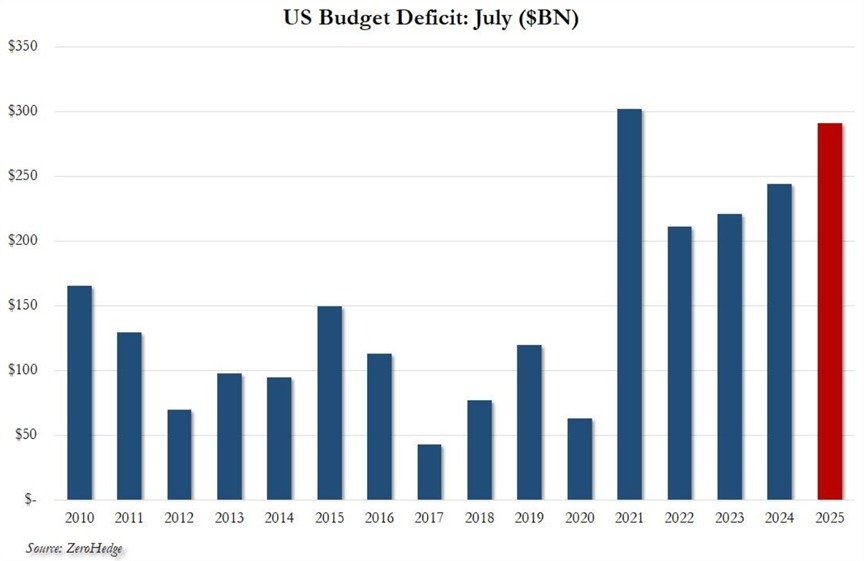

The US Treasury posted a $291 billion budget deficit in July, the 2nd-largest deficit for any July on record.

US interest expense is set to exceed $3 billion PER DAY.

Without rate cuts, interest will skyrocket, adding more pressure.

The US Treasury posted a $291 billion budget deficit in July, the 2nd-largest deficit for any July on record.

US interest expense is set to exceed $3 billion PER DAY.

Without rate cuts, interest will skyrocket, adding more pressure.

As rate cuts near, we expect to see explosive moves across various markets.

This is setting up for a historic 2026 for investors, with even more volatility.

Want to see how we are trading it?

Subscribe below to our premium analysis:

thekobeissiletter.com/subscribe

This is setting up for a historic 2026 for investors, with even more volatility.

Want to see how we are trading it?

Subscribe below to our premium analysis:

thekobeissiletter.com/subscribe

Trump's new Fed Chair will clearly be cutting rates.

However, the question becomes, will this new Fed Chair maintain rate cuts if inflation continues to rise?

If so, we are about to witness history.

Follow us @KobeissiLetter for real time analysis as this develops.

However, the question becomes, will this new Fed Chair maintain rate cuts if inflation continues to rise?

If so, we are about to witness history.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh