Grok has an unfair advantage for stock research.

It's the only AI trained on X data - where the best investors actually share insights.

I tested this on Wise PLC using 5 specific prompts.

The results changed how I analyze companies:🧵

It's the only AI trained on X data - where the best investors actually share insights.

I tested this on Wise PLC using 5 specific prompts.

The results changed how I analyze companies:🧵

I've been trying to speed up my research process.

Most AI models like ChatGPT or Claude work fine for general analysis.

But Grok is different - it's trained on every tweet from investors who actually move markets.

Most AI models like ChatGPT or Claude work fine for general analysis.

But Grok is different - it's trained on every tweet from investors who actually move markets.

Here's what makes Grok special for investing:

It learned from 200,000 GPUs running in parallel (ChatGPT used 80,000).

More importantly, it absorbed insights from every successful investor on X.

No other AI has access to this data.

It learned from 200,000 GPUs running in parallel (ChatGPT used 80,000).

More importantly, it absorbed insights from every successful investor on X.

No other AI has access to this data.

I decided to test this advantage on Wise PLC - a $8B fintech company.

Instead of spending 6+ hours reading filings and reports, I used 5 specific prompts.

The goal: get 80% of the insights in 10% of the time.

Instead of spending 6+ hours reading filings and reports, I used 5 specific prompts.

The goal: get 80% of the insights in 10% of the time.

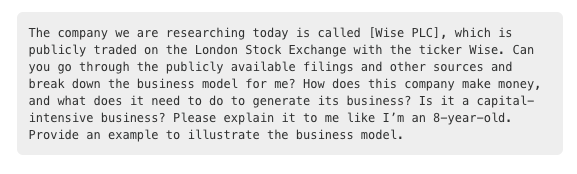

Prompt 1: Business Model Analysis

"Break down the business model for me. How does this company make money? Explain it like I'm 8 years old."

Result: Crystal clear explanation of Wise's money transfer business in seconds.

Much faster than reading through 200-page annual reports.

"Break down the business model for me. How does this company make money? Explain it like I'm 8 years old."

Result: Crystal clear explanation of Wise's money transfer business in seconds.

Much faster than reading through 200-page annual reports.

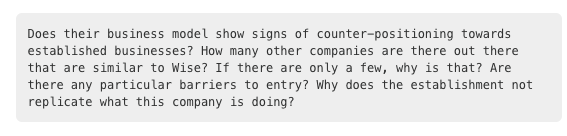

Prompt 2: Competitive Positioning

"Does their business model show counter-positioning against established businesses? How many competitors are similar to Wise?"

This revealed Wise's moat against traditional banks and identified key competitors like Remitly and Revolut.

"Does their business model show counter-positioning against established businesses? How many competitors are similar to Wise?"

This revealed Wise's moat against traditional banks and identified key competitors like Remitly and Revolut.

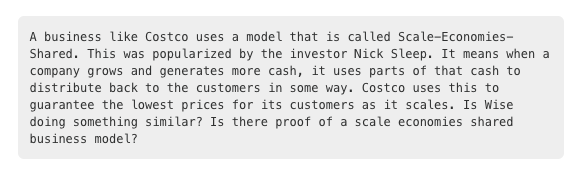

Prompt 3: Scale Economies Shared

"Is Wise doing something similar to Costco's model where they share savings with customers as they grow?"

Grok found evidence that Wise cuts fees as it scales - from 0.67% to 0.52% take rate.

Classic flywheel effect.

"Is Wise doing something similar to Costco's model where they share savings with customers as they grow?"

Grok found evidence that Wise cuts fees as it scales - from 0.67% to 0.52% take rate.

Classic flywheel effect.

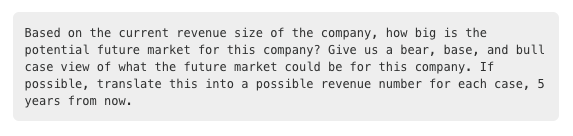

Prompt 4: Market Size Analysis

"How big is the potential market? Give me bear, base, and bull case scenarios for 5 years from now."

This is where AI shows its limits - the projections were inconsistent.

But it laid out clear assumptions I could evaluate.

"How big is the potential market? Give me bear, base, and bull case scenarios for 5 years from now."

This is where AI shows its limits - the projections were inconsistent.

But it laid out clear assumptions I could evaluate.

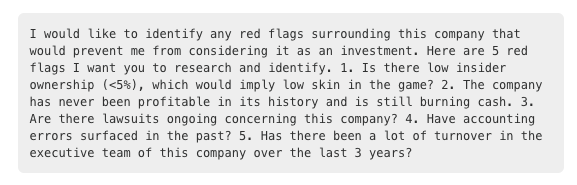

Prompt 5: Red Flag Analysis

"Identify red flags: low insider ownership, never profitable, ongoing lawsuits, accounting errors, executive turnover."

Clean results across the board for Wise.

This prompt alone saves hours of digging through filings.

"Identify red flags: low insider ownership, never profitable, ongoing lawsuits, accounting errors, executive turnover."

Clean results across the board for Wise.

This prompt alone saves hours of digging through filings.

The speed difference was remarkable

I got business model clarity, competitive analysis, and risk assessment faster than ever.

But there's a catch...

I got business model clarity, competitive analysis, and risk assessment faster than ever.

But there's a catch...

AI isn't perfect for everything.

When I fact-checked the results with Claude, it found some number errors.

The key is using AI for rapid screening, then diving deeper on the winners.

Speed for breadth, manual work for depth.

When I fact-checked the results with Claude, it found some number errors.

The key is using AI for rapid screening, then diving deeper on the winners.

Speed for breadth, manual work for depth.

I tested normal mode vs. deep search vs. think mode:

Normal: Fastest, good for business models

Deep search: Better sources, takes 5+ minutes

Think mode: Most concise analysis

For initial screening, normal mode wins.

Normal: Fastest, good for business models

Deep search: Better sources, takes 5+ minutes

Think mode: Most concise analysis

For initial screening, normal mode wins.

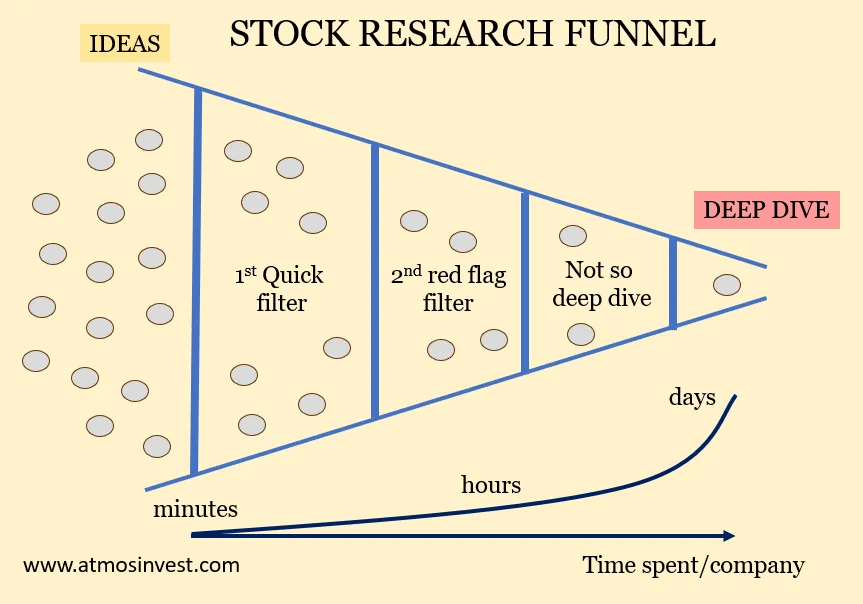

The real advantage isn't replacing analysts.

It's filtering opportunities faster.

I can now screen dozens of companies weekly instead of analyzing 2-3 monthly.

More at-bats = better odds of finding winners.

It's filtering opportunities faster.

I can now screen dozens of companies weekly instead of analyzing 2-3 monthly.

More at-bats = better odds of finding winners.

My new workflow:

Run companies through the 5-prompt system

Reject obvious nos in minutes

Deep dive manually on the survivors

Fact-check AI findings with other sources

This turns stock research from art into process.

Run companies through the 5-prompt system

Reject obvious nos in minutes

Deep dive manually on the survivors

Fact-check AI findings with other sources

This turns stock research from art into process.

After this test, I'm keeping Wise on my watchlist.

Clear business model, competitive moats, scale advantages, clean financials.

But the real win was proving this research system works.

Clear business model, competitive moats, scale advantages, clean financials.

But the real win was proving this research system works.

AI won't replace good analysis.

But it can accelerate your research funnel dramatically.

Grok's X training data gives it a real edge for investing use cases.

Speed matters when hunting for opportunities.

But it can accelerate your research funnel dramatically.

Grok's X training data gives it a real edge for investing use cases.

Speed matters when hunting for opportunities.

Thank you for reading.

If you want to learn more about this and my exact process on using these prompts, read my article on this...

Read it for free here:

100baggerhunting.com/p/better-call-…

If you want to learn more about this and my exact process on using these prompts, read my article on this...

Read it for free here:

100baggerhunting.com/p/better-call-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh