🚨 The Fed’s “safe cash” parking lot is almost EMPTY.

Reverse Repo usage has plunged to $57.49B, the lowest since 2021.

Here’s why it’s happening and why it matters more than you think.

(a thread)

Reverse Repo usage has plunged to $57.49B, the lowest since 2021.

Here’s why it’s happening and why it matters more than you think.

(a thread)

First, what’s a reverse repo? It’s the Fed telling big financial players:

“Lend us your cash overnight. We’ll give you U.S. Treasuries as collateral, pay you interest, and reverse the deal tomorrow.”

It’s like a risk-free overnight savings account for Wall Street.

“Lend us your cash overnight. We’ll give you U.S. Treasuries as collateral, pay you interest, and reverse the deal tomorrow.”

It’s like a risk-free overnight savings account for Wall Street.

Why does the Fed offer it? To set a floor for short-term interest rates.

If money market funds can earn 4.25% risk-free at the Fed, they won’t lend for less elsewhere.

Think of it as an anchor keeping rates steady in the choppy waters of money markets.

If money market funds can earn 4.25% risk-free at the Fed, they won’t lend for less elsewhere.

Think of it as an anchor keeping rates steady in the choppy waters of money markets.

From 2021–2023, the Fed’s Reverse Repo usage exploded to about $2.5T daily because:

– Pandemic stimulus flooded the system with cash.

– Banks had more deposits than they could handle.

– Money market funds had few safe investments.

The RRP became their favorite parking lot.

– Pandemic stimulus flooded the system with cash.

– Banks had more deposits than they could handle.

– Money market funds had few safe investments.

The RRP became their favorite parking lot.

Now? That parking lot is nearly empty. From $2.5T in 2022 → $57B today.

A 97% drop in just 2 years.

That means trillions in cash have left the Fed and moved somewhere else.

A 97% drop in just 2 years.

That means trillions in cash have left the Fed and moved somewhere else.

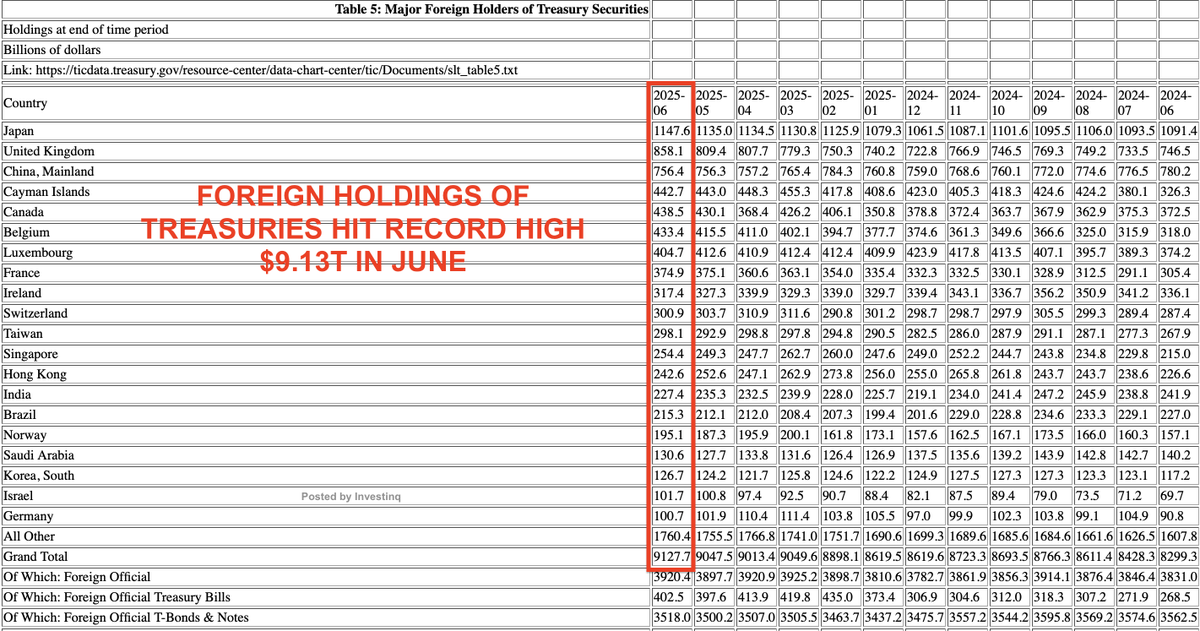

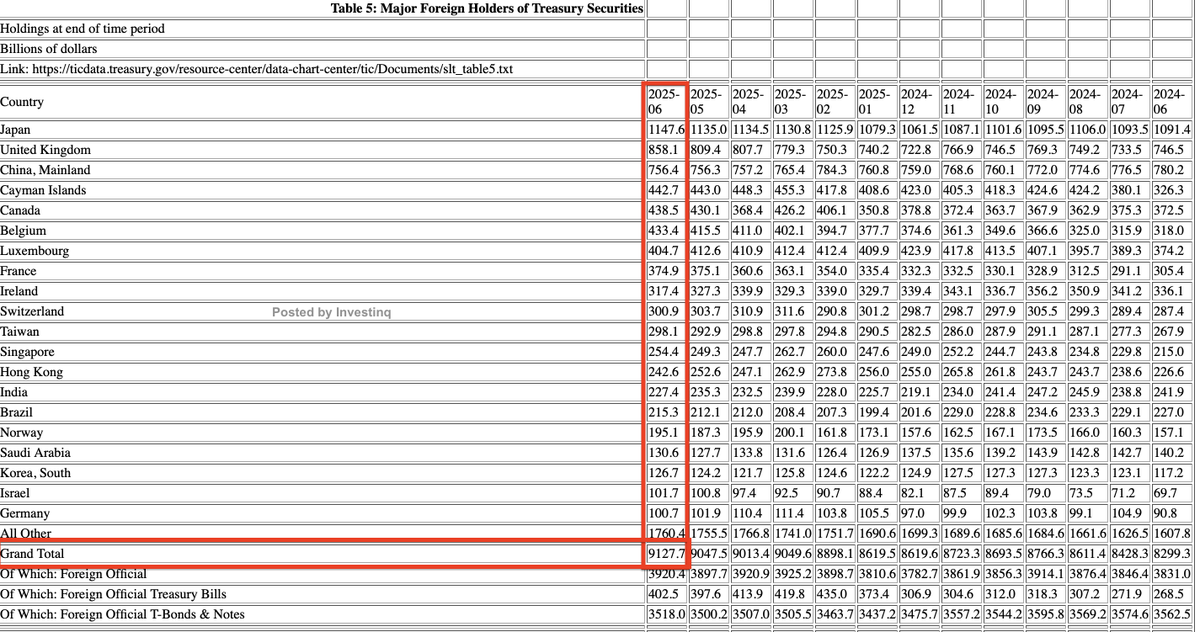

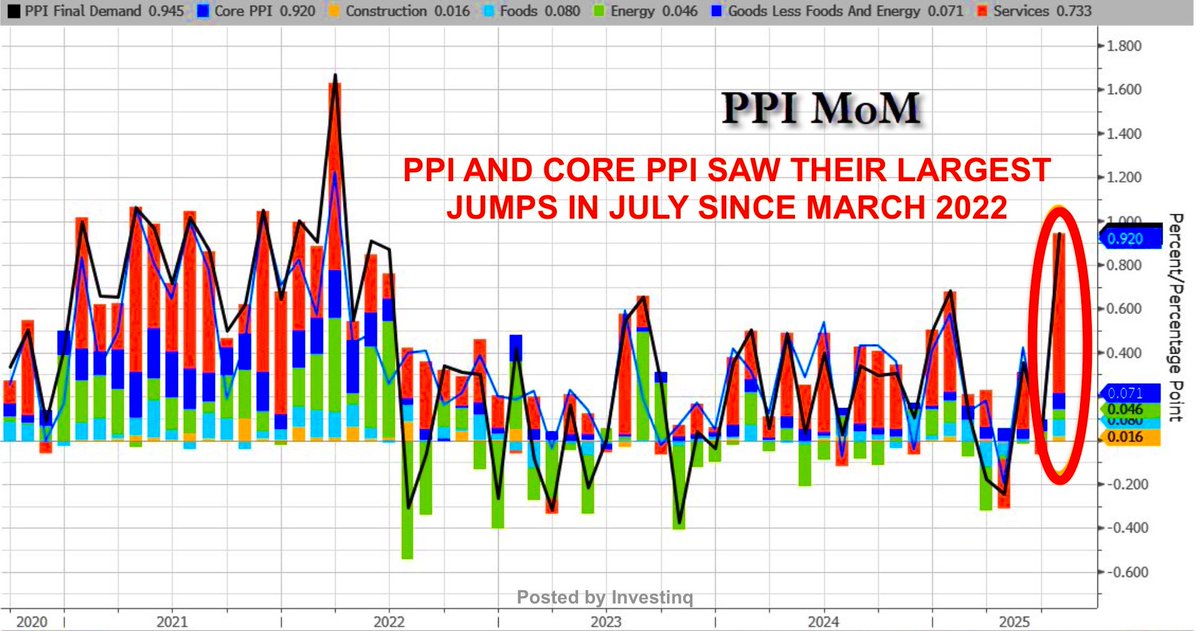

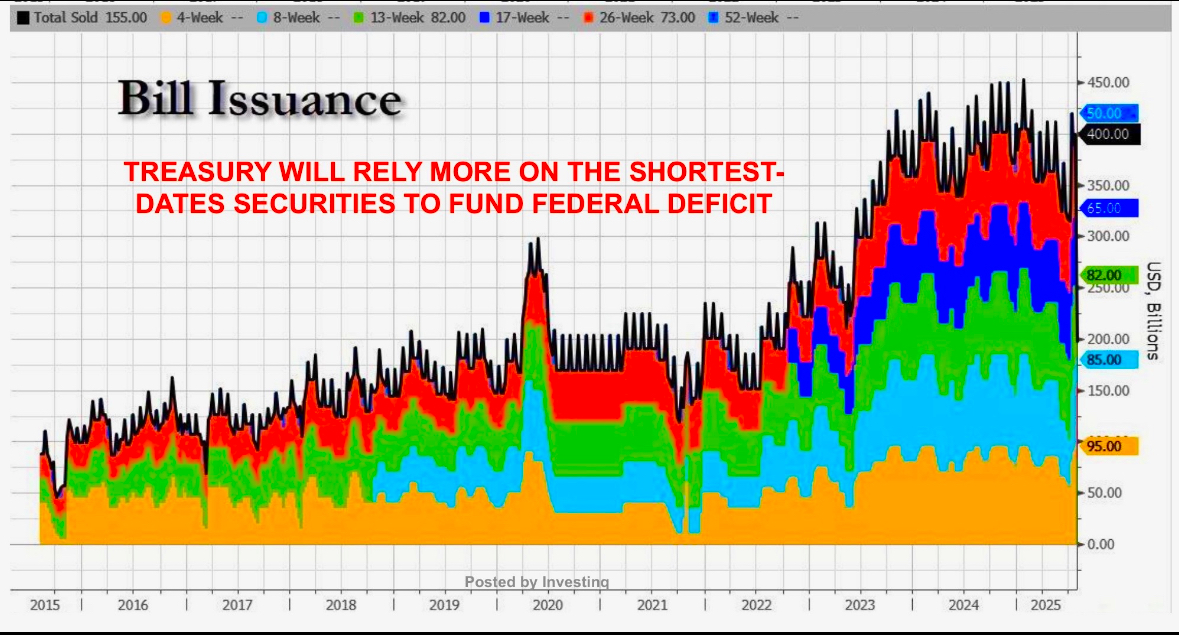

Reason #1: Treasury bills (T-bills)

The U.S. Treasury has been issuing mountains of short-term debt paying more than the Fed’s RRP rate.

If you’re a money market fund, you swap the Fed for T-bills, still safe, but with slightly better yield.

The U.S. Treasury has been issuing mountains of short-term debt paying more than the Fed’s RRP rate.

If you’re a money market fund, you swap the Fed for T-bills, still safe, but with slightly better yield.

Reason #2: Liquidity returning to banks When cash leaves RRP, it often goes into:

– Bank deposits

– Treasury purchases

– Corporate lending markets

That can boost bank reserves, making credit more available but also fuel more risk-taking.

– Bank deposits

– Treasury purchases

– Corporate lending markets

That can boost bank reserves, making credit more available but also fuel more risk-taking.

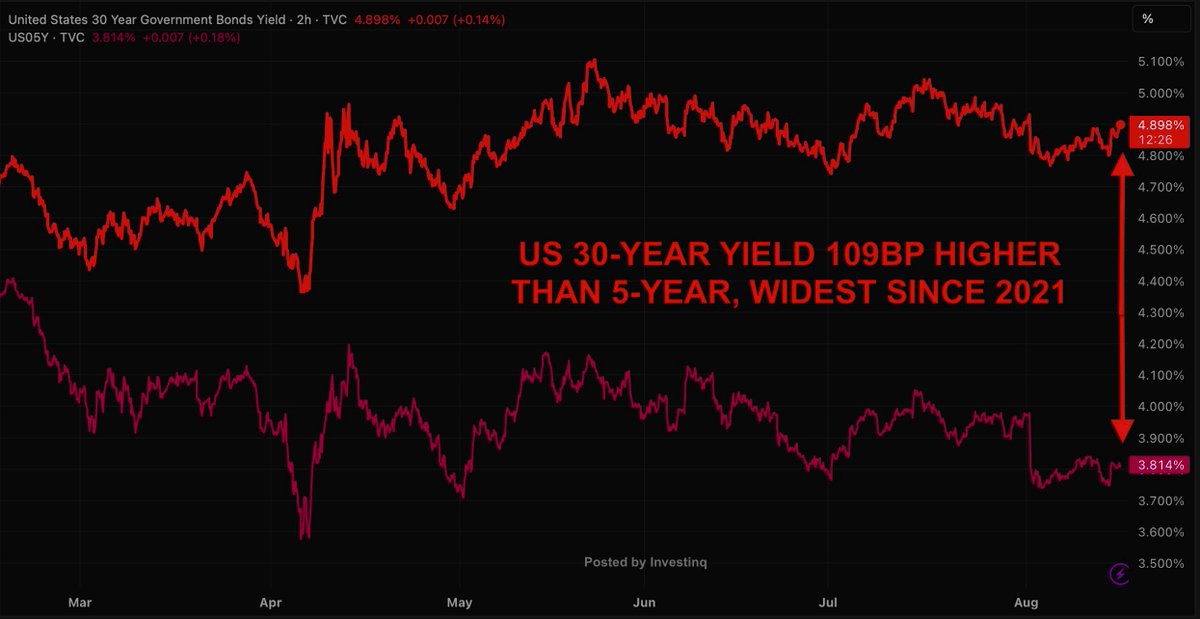

Reason #3: Fed rate settings

The RRP rate is 4.25%, but short-term market yields (like 1-month T-bills) are higher.

If the market beats the Fed’s rate, the RRP becomes irrelevant and that’s exactly what’s happening now.

The RRP rate is 4.25%, but short-term market yields (like 1-month T-bills) are higher.

If the market beats the Fed’s rate, the RRP becomes irrelevant and that’s exactly what’s happening now.

Quick background:

Repo = Fed adds liquidity (lends cash, takes Treasuries).

Reverse repo = Fed removes liquidity (takes cash, gives Treasuries).

Same collateral, opposite direction for the money flow.

Repo = Fed adds liquidity (lends cash, takes Treasuries).

Reverse repo = Fed removes liquidity (takes cash, gives Treasuries).

Same collateral, opposite direction for the money flow.

Why the big drop matters:

The RRP has been a shock absorber during the Fed’s balance sheet shrinkage (QT).

With it almost gone, any further liquidity drain will hit bank reserves directly, the core buffer of the financial system.

The RRP has been a shock absorber during the Fed’s balance sheet shrinkage (QT).

With it almost gone, any further liquidity drain will hit bank reserves directly, the core buffer of the financial system.

Think of it like a bathtub:

– Bank reserves = water in the tub

– Reverse repo = a separate bucket of water on the side

– QT = pulling the plug

Now the bucket is empty so the tub itself starts draining faster.

– Bank reserves = water in the tub

– Reverse repo = a separate bucket of water on the side

– QT = pulling the plug

Now the bucket is empty so the tub itself starts draining faster.

Why you should care: When reserves fall too far:

– Banks tighten lending

– Deposit rates can stall or drop

– Loan and mortgage rates can rise

It’s like removing a shock absorber from your car, bumps hit harder.

– Banks tighten lending

– Deposit rates can stall or drop

– Loan and mortgage rates can rise

It’s like removing a shock absorber from your car, bumps hit harder.

For money market funds, this is also a behavior shift.

In 2022, they parked trillions at the Fed for safety.

Now they’re buying T-bills, lending in repo markets, and even reaching for riskier assets. That loosens financial conditions.

In 2022, they parked trillions at the Fed for safety.

Now they’re buying T-bills, lending in repo markets, and even reaching for riskier assets. That loosens financial conditions.

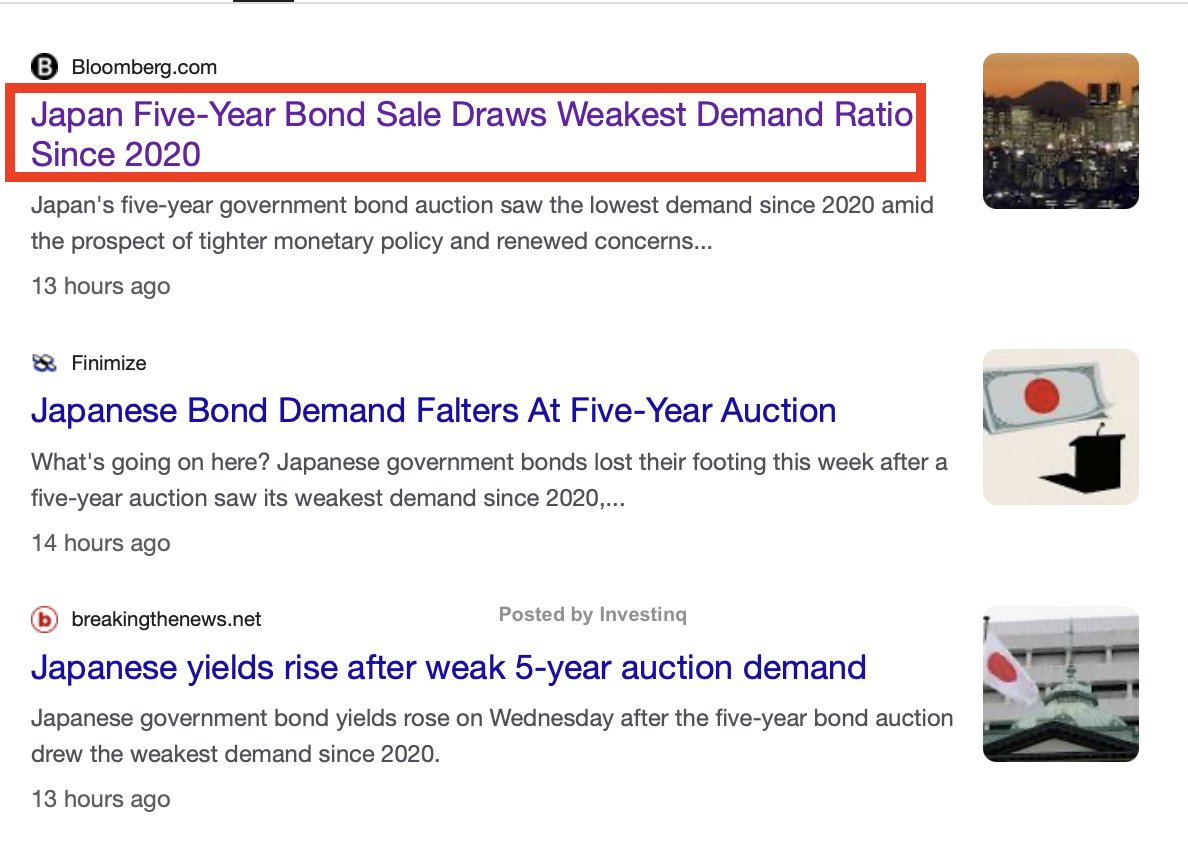

But there’s a flip side, the stress signal.

If market stress hits (credit crunch, debt ceiling drama, bank panic), demand for RRP could surge overnight as everyone runs to safety.

A sudden spike would be a canary in the coal mine.

If market stress hits (credit crunch, debt ceiling drama, bank panic), demand for RRP could surge overnight as everyone runs to safety.

A sudden spike would be a canary in the coal mine.

The big picture: RRP near zero = liquidity buffer gone.

From here, QT bites harder.

The Fed may have to pause its balance sheet shrinkage sooner if reserves drop too much and markets wobble.

From here, QT bites harder.

The Fed may have to pause its balance sheet shrinkage sooner if reserves drop too much and markets wobble.

Right now, markets like it: Cash is flowing into T-bills, stocks, and credit.

But for the Fed, it’s a warning, they’re about to be flying without a safety net for short-term rate control and liquidity management.

But for the Fed, it’s a warning, they’re about to be flying without a safety net for short-term rate control and liquidity management.

In short, the collapse in RRP tells us:

– Cash is moving into markets and banks

– Reserves are rising (for now)

– The Fed’s liquidity buffer is gone

– The system is more exposed to shocks

– Cash is moving into markets and banks

– Reserves are rising (for now)

– The Fed’s liquidity buffer is gone

– The system is more exposed to shocks

This is one of those financial plumbing stories that seems boring… until it isn’t.

If you care about interest rates, lending, and market stability, watch the Reverse Repo.

Because it just sent a major signal and the real test hasn’t started yet.

If you care about interest rates, lending, and market stability, watch the Reverse Repo.

Because it just sent a major signal and the real test hasn’t started yet.

If you found these insights valuable: Sign up for my FREE newsletter! thestockmarket.news

I hope you've found this thread helpful.

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

https://x.com/_investinq/status/1956027249150366148?s=46

Update from today: Fed Reverse Repo usage has plunged to $28.8B, the lowest since 2021.

Down from $57.49B just yesterday.

This is a massive liquidity shift in 24 hours.

Down from $57.49B just yesterday.

This is a massive liquidity shift in 24 hours.

• • •

Missing some Tweet in this thread? You can try to

force a refresh