🤝💳Axis Bank & Flipkart have launched a new co-branded debit card for Advantage Savings Account holders.

🛍️ The Axis Bank Flipkart Debit Card

💡Here’s a clear breakdown of its features, benefits, fees, and who should consider it

Read the thread below 🧵👇

🛍️ The Axis Bank Flipkart Debit Card

💡Here’s a clear breakdown of its features, benefits, fees, and who should consider it

Read the thread below 🧵👇

The Flipkart Axis Bank Debit Card is available only with the Axis Bank Advantage Savings Account.

✅ Only for new & existing customers of the Axis Bank Advantage Savings Account.

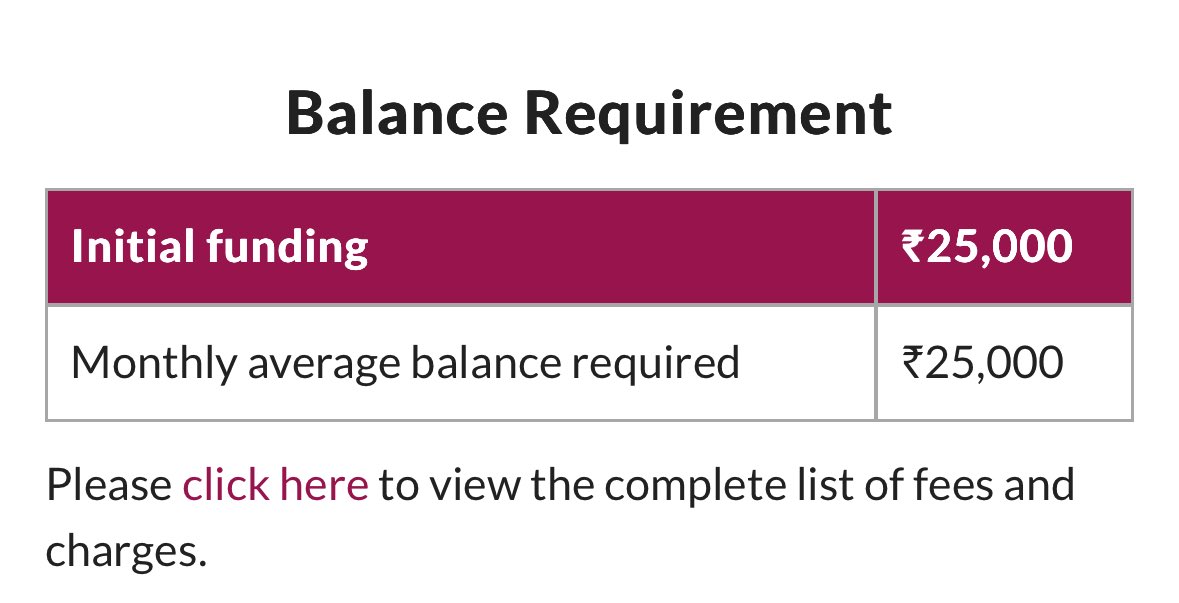

💰 You must maintain a ₹25,000 Monthly Average Balance (MAB) in this account to keep it active.

✅ Only for new & existing customers of the Axis Bank Advantage Savings Account.

💰 You must maintain a ₹25,000 Monthly Average Balance (MAB) in this account to keep it active.

1️⃣Cashback Benefits:

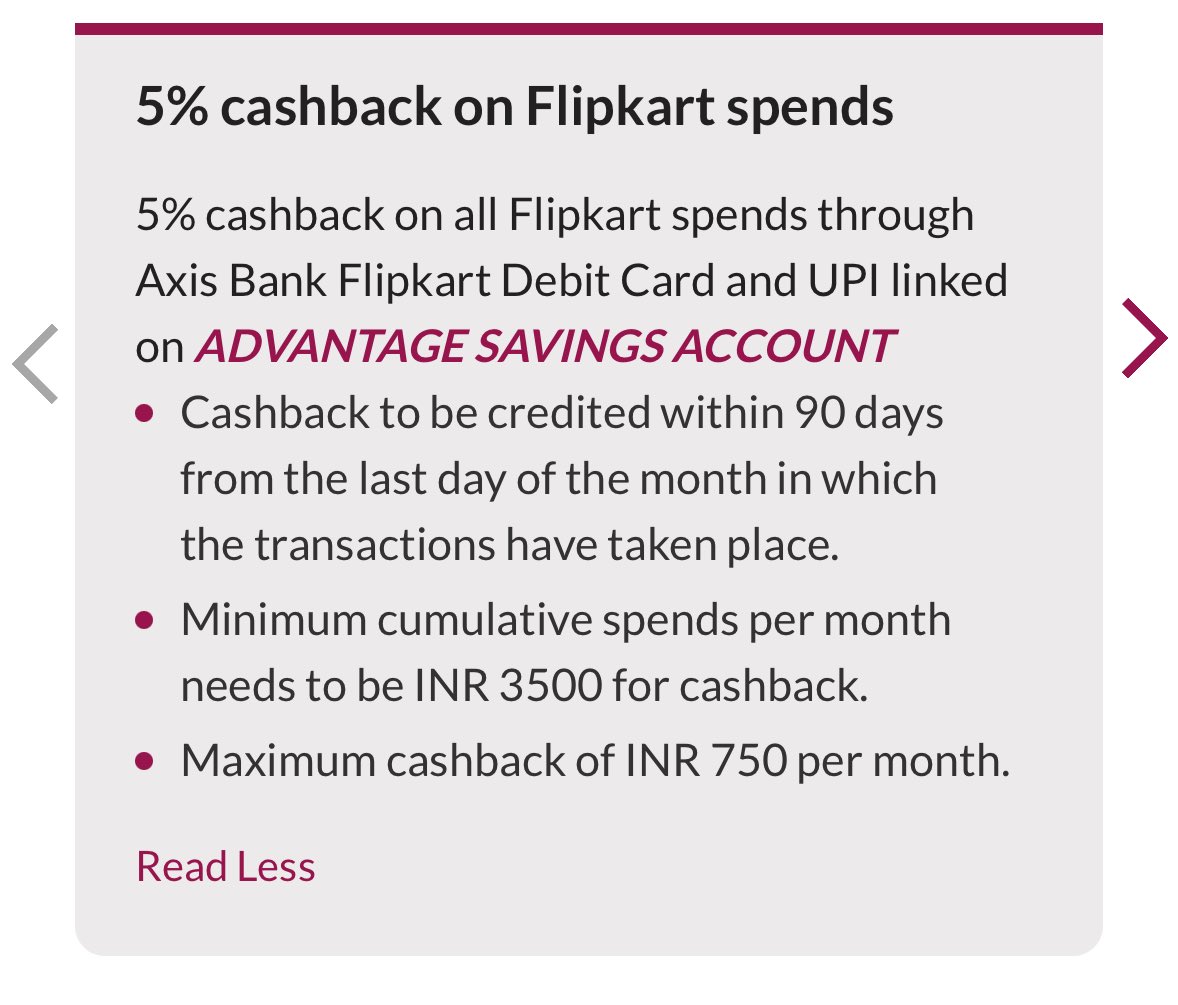

💳 5% cashback on Flipkart spends (including UPI linked to the Advantage Savings Account).

📅 Minimum spend of ₹3,500/month to qualify.

💰 Max cashback: ₹750/month.

⏳ Credited within 90 days from month-end.

🏦The cashback will be credited to the customer's linked Savings Account.

💳 5% cashback on Flipkart spends (including UPI linked to the Advantage Savings Account).

📅 Minimum spend of ₹3,500/month to qualify.

💰 Max cashback: ₹750/month.

⏳ Credited within 90 days from month-end.

🏦The cashback will be credited to the customer's linked Savings Account.

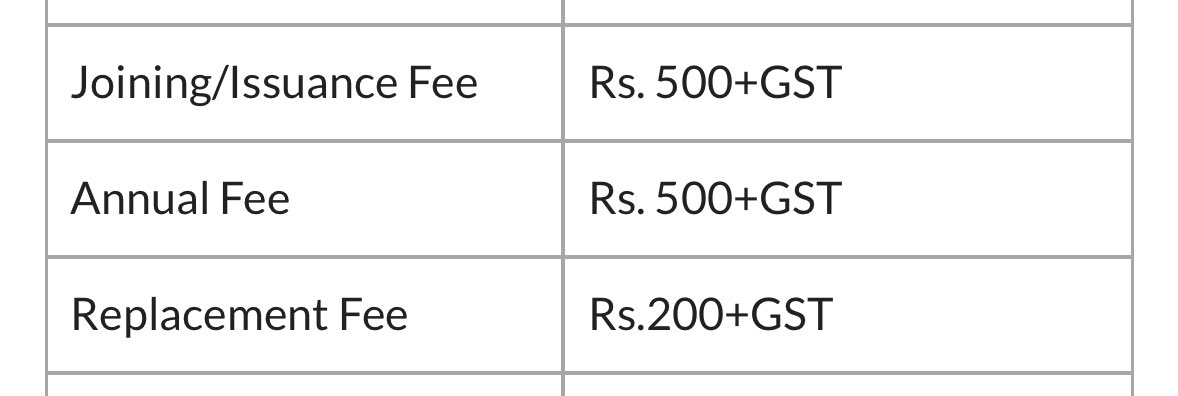

2️⃣Cashback Exclusions

❌No cashback on:

•Utilities, fuel, jewellery

•Insurance, charities, rent payments

•Wallet loads, education fees

•Govt. services, transport, cash withdrawals

❌No cashback on:

•Utilities, fuel, jewellery

•Insurance, charities, rent payments

•Wallet loads, education fees

•Govt. services, transport, cash withdrawals

3️⃣Other Perks

🍽 15% off on EazyDiner’s 10,000+ partner restaurants (up to ₹500/month).

🛡 Insurance cover:

•₹5L Personal Accident

•₹1Cr Air Accident

•₹50K Purchase Protection

🍽 15% off on EazyDiner’s 10,000+ partner restaurants (up to ₹500/month).

🛡 Insurance cover:

•₹5L Personal Accident

•₹1Cr Air Accident

•₹50K Purchase Protection

4️⃣Other Limits:

💵 Daily cash withdrawal limit: ₹50,000

🛒 Daily purchase limit: ₹5,00,000

💵 Daily cash withdrawal limit: ₹50,000

🛒 Daily purchase limit: ₹5,00,000

🔟The Trade-off:

This card works well if you already shop often on Flipkart and maintain ₹25K MAB.

If not, the savings account requirement + spend condition may not justify the benefits.

✅Go for the axis Flipkart credit card which is being issued FYF: bitlii.cc/en/1pFIdx

This card works well if you already shop often on Flipkart and maintain ₹25K MAB.

If not, the savings account requirement + spend condition may not justify the benefits.

✅Go for the axis Flipkart credit card which is being issued FYF: bitlii.cc/en/1pFIdx

🙌🏼If you found this thread useful,

❤️ Like

🔁 Repost

💬 Comment

👤 Follow @AmazingCreditC for more credit & debit card tips, tricks, and reviews!

✅Join our WhatsApp channel for more updates: whatsapp.com/channel/0029Va… x.com/amazingcreditc…

❤️ Like

🔁 Repost

💬 Comment

👤 Follow @AmazingCreditC for more credit & debit card tips, tricks, and reviews!

✅Join our WhatsApp channel for more updates: whatsapp.com/channel/0029Va… x.com/amazingcreditc…

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh