#Creditcards💳 | Deals🛍️|#ccgeek🏦| Fintech 💸 | Best Credit Cards in India 💳|Disc: https://t.co/5HeEPGIJGf| collab@amazingcreditcards.in🙋🏻♂️By:@sagarbdkr

How to get URL link on X (Twitter) App

💰 Annual Fees & Waivers

💰 Annual Fees & Waivers

✨ The Myth Before Reality

✨ The Myth Before Reality

🏦 What Are Co-Branded Cards?

🏦 What Are Co-Branded Cards?

💰 Annual Fees

💰 Annual Fees

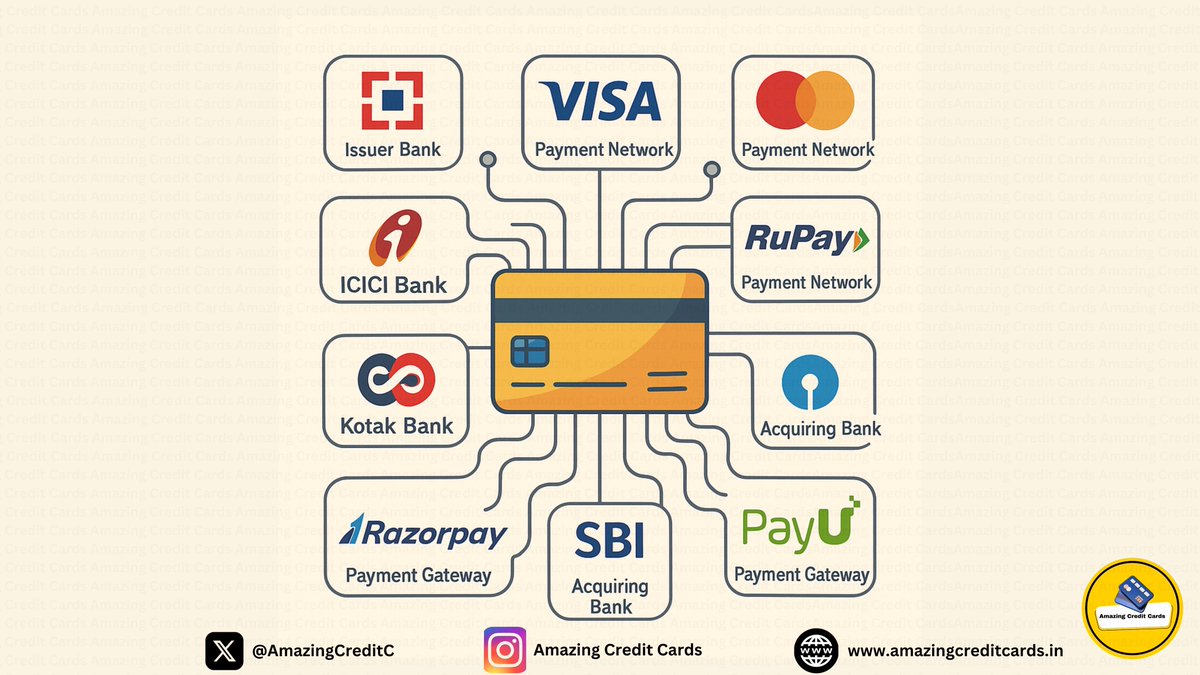

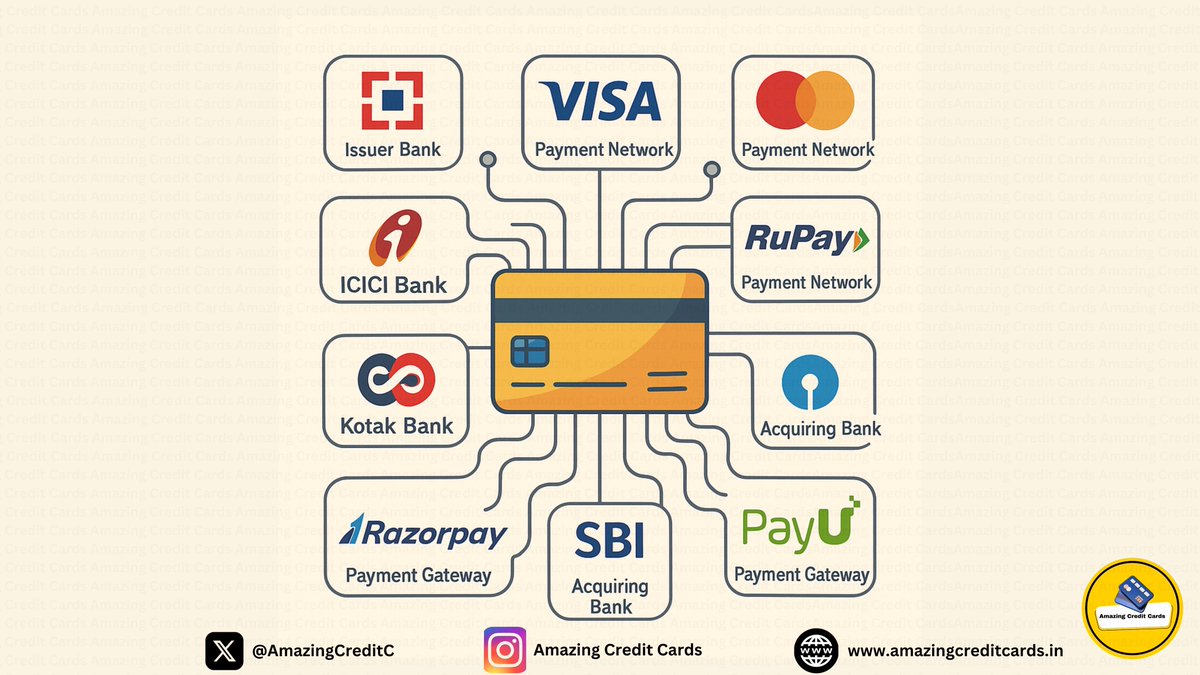

1️⃣ Who Are the Players?

1️⃣ Who Are the Players?

💰 Card Fees:

💰 Card Fees:

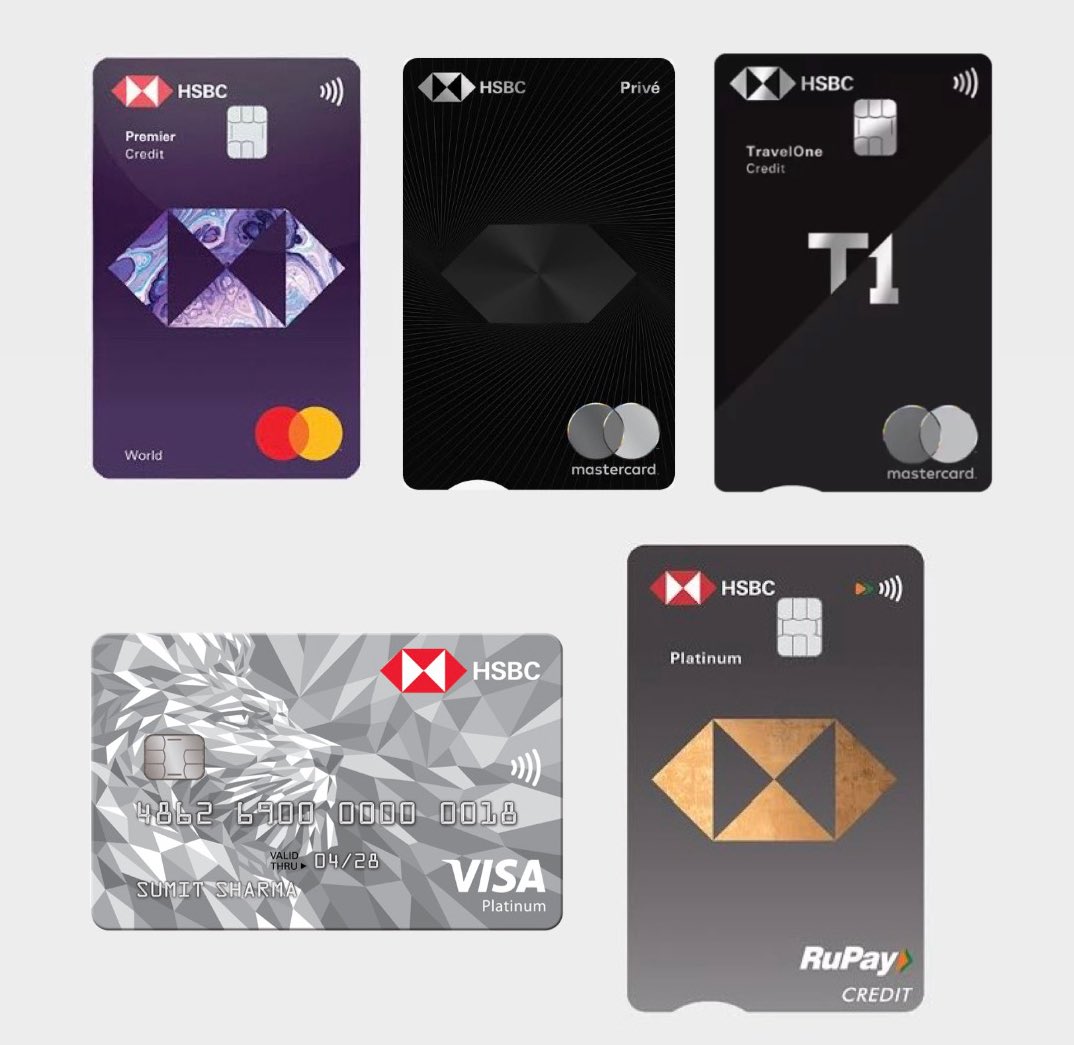

Only 5 HSBC cards participate:

Only 5 HSBC cards participate:

Visa has tied up with the Hudle App a sports booking platform to give new users one complimentary Pickleball or Padel game.

Visa has tied up with the Hudle App a sports booking platform to give new users one complimentary Pickleball or Padel game.

The Flipkart Axis Bank Debit Card is available only with the Axis Bank Advantage Savings Account.

The Flipkart Axis Bank Debit Card is available only with the Axis Bank Advantage Savings Account.

👑Activation Benefits & Rewards

👑Activation Benefits & Rewards

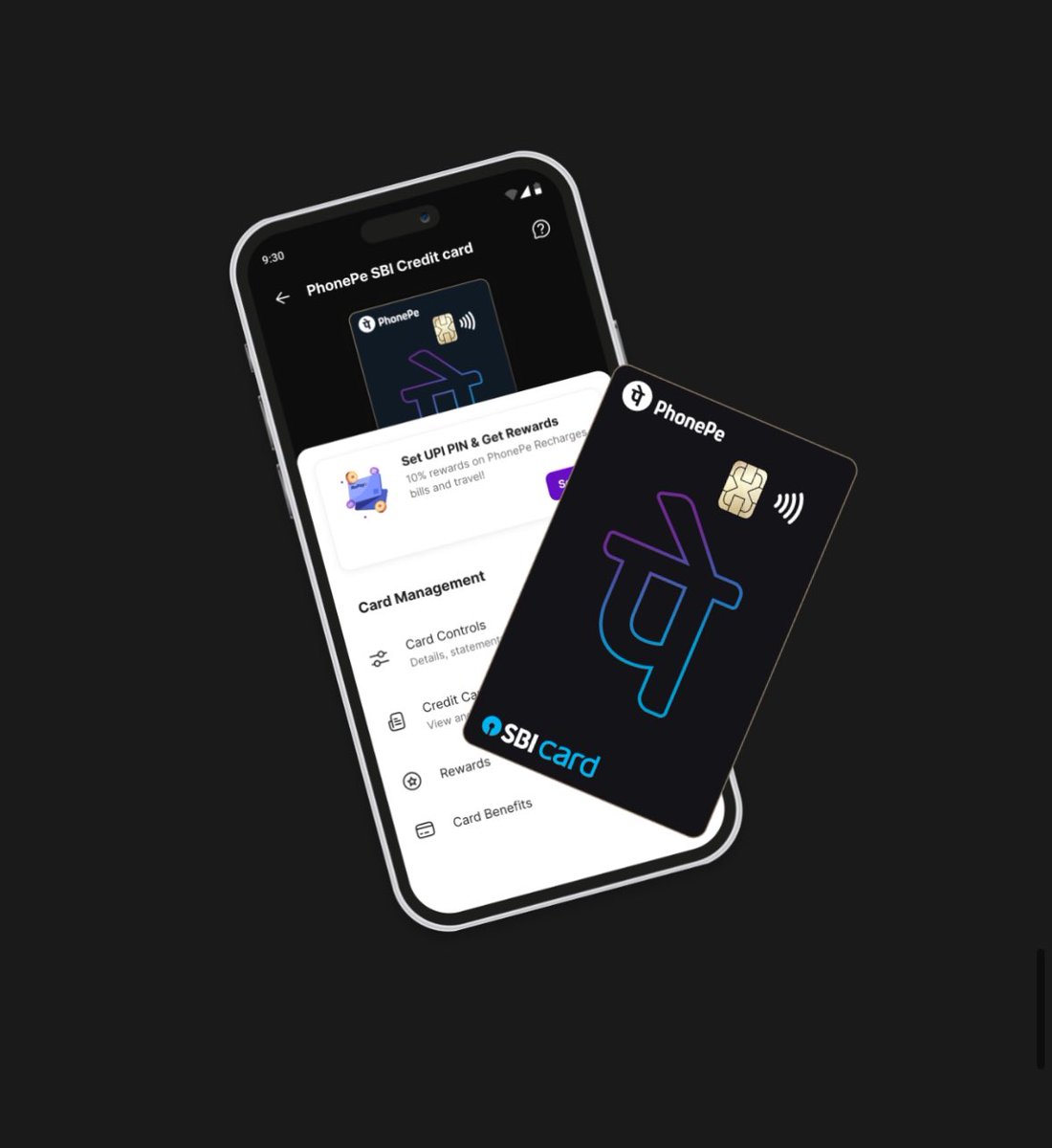

PhonePe SBI Card SELECT BLACK:

PhonePe SBI Card SELECT BLACK:

HSBC RuPay Cashback Credit Card

HSBC RuPay Cashback Credit Card

📲 How to access the BOB Smart Deals portal

📲 How to access the BOB Smart Deals portal

Aadhaar is now central to almost every financial process in India from credit cards to SIM activation to filing your taxes.

Aadhaar is now central to almost every financial process in India from credit cards to SIM activation to filing your taxes.

Let’s talk Myntra first.

Let’s talk Myntra first.

🙋🏻♂️Say hello to the Kredit .Pe Yes Bank Ace Credit Card

🙋🏻♂️Say hello to the Kredit .Pe Yes Bank Ace Credit Card

I’ve been investing in mutual funds through Groww since 2019.

I’ve been investing in mutual funds through Groww since 2019.

🧾 Annual Fees

🧾 Annual Fees

🤑 Credit Card Fees

🤑 Credit Card Fees

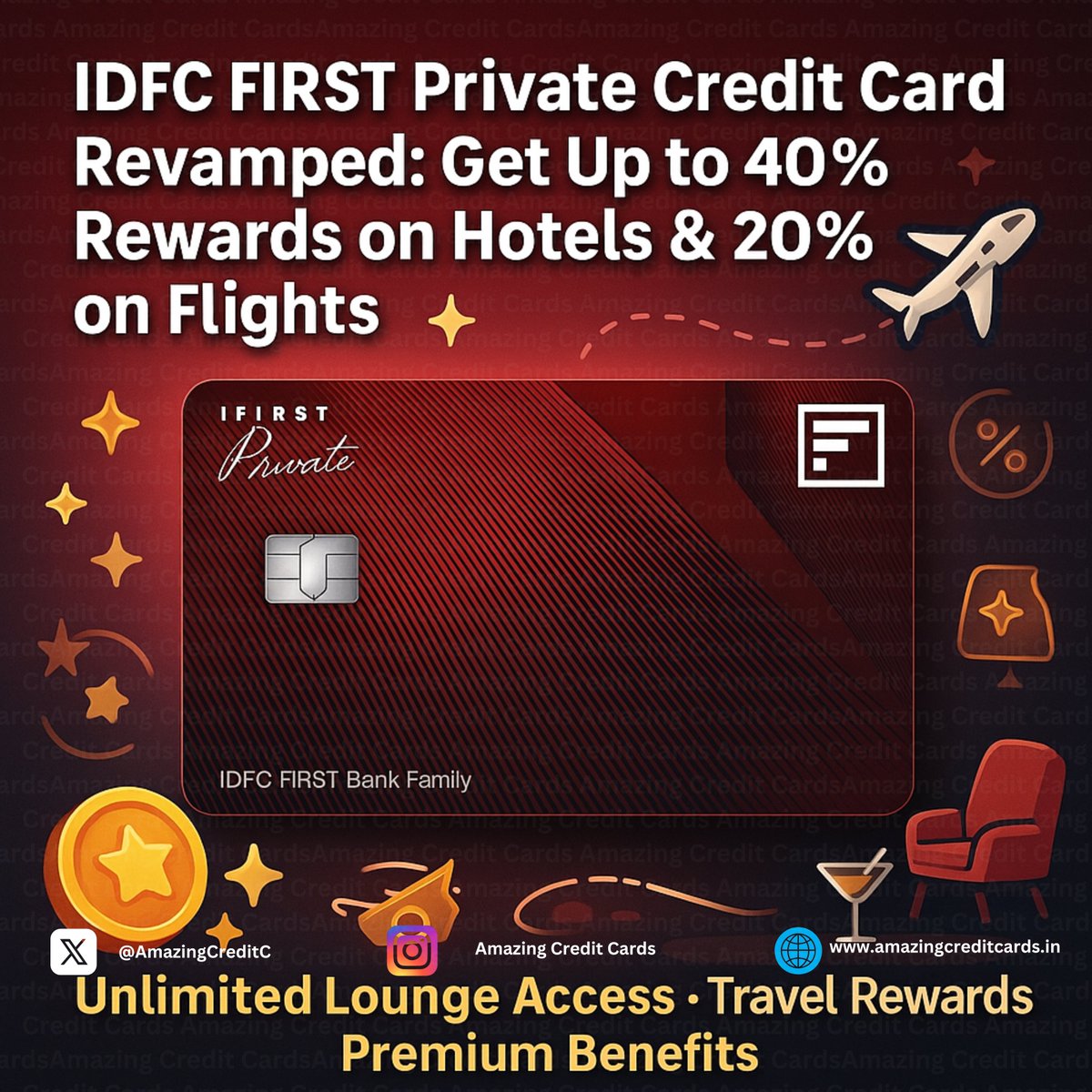

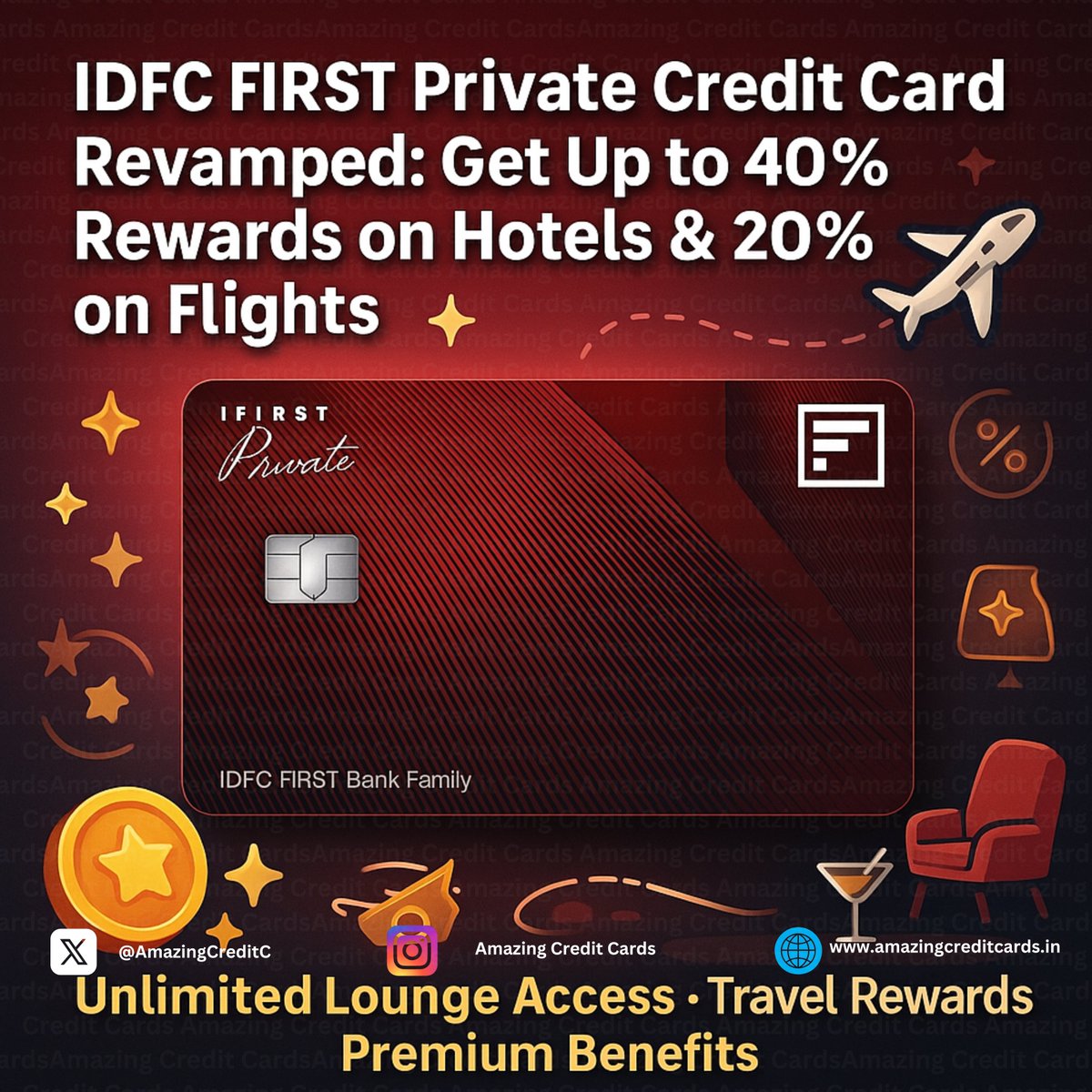

👑 IDFC FIRST Private Credit Card is the most premium offering in the bank’s credit card portfolio.

👑 IDFC FIRST Private Credit Card is the most premium offering in the bank’s credit card portfolio.