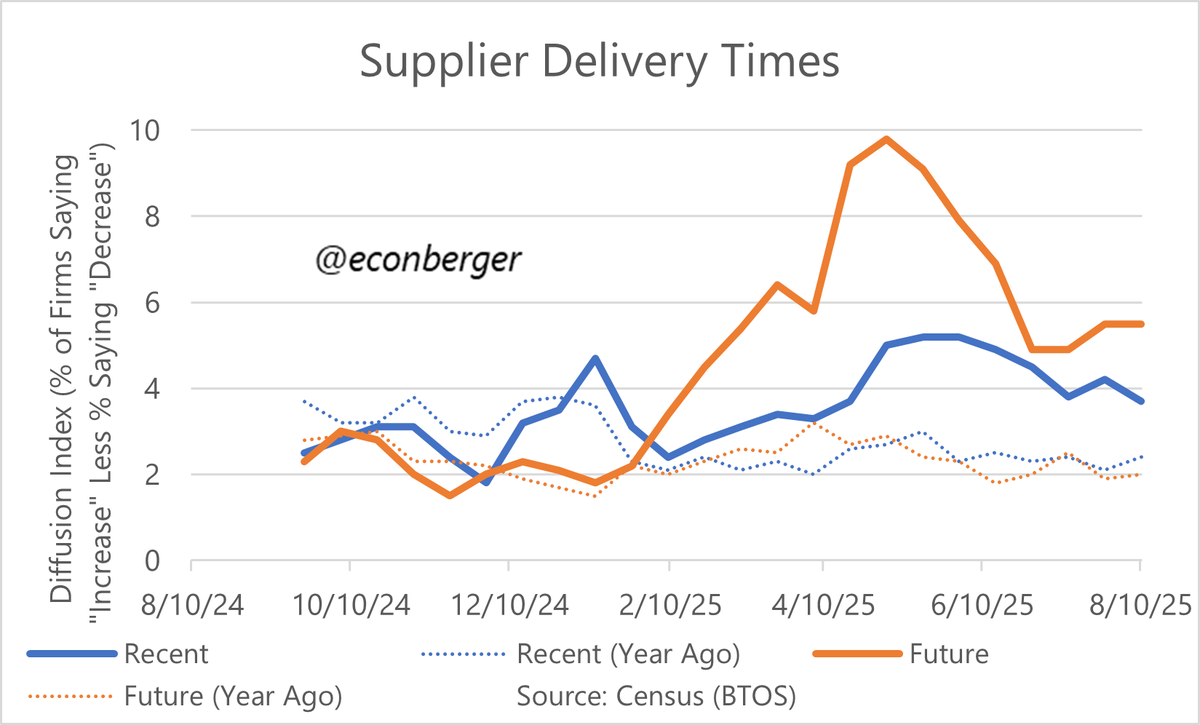

1/ Interesting tidbits on the labor market from @uscensusbureau 's latest Business Trends & Outlook Survey - which indicates the US labor market may be warming up.

Thread...

Thread...

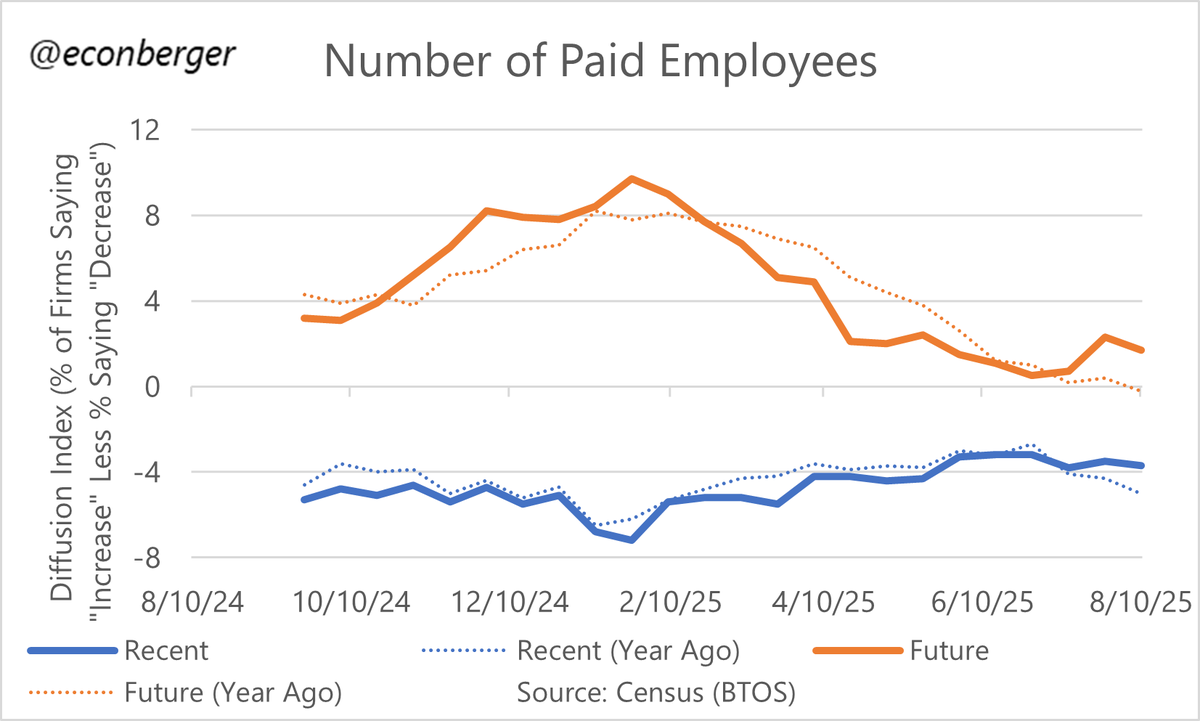

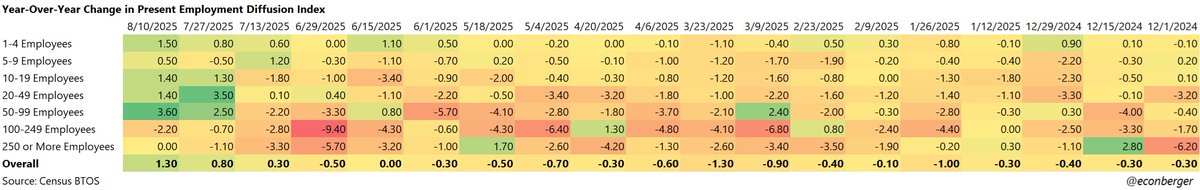

2a/ First off are recent employer actions on headcount.

For the first time in the history of this survey (which is less than 2 years), we've had 4 consecutive weeks where actions have been more expansionary (as measured by a diffusion index) than a year earlier.

For the first time in the history of this survey (which is less than 2 years), we've had 4 consecutive weeks where actions have been more expansionary (as measured by a diffusion index) than a year earlier.

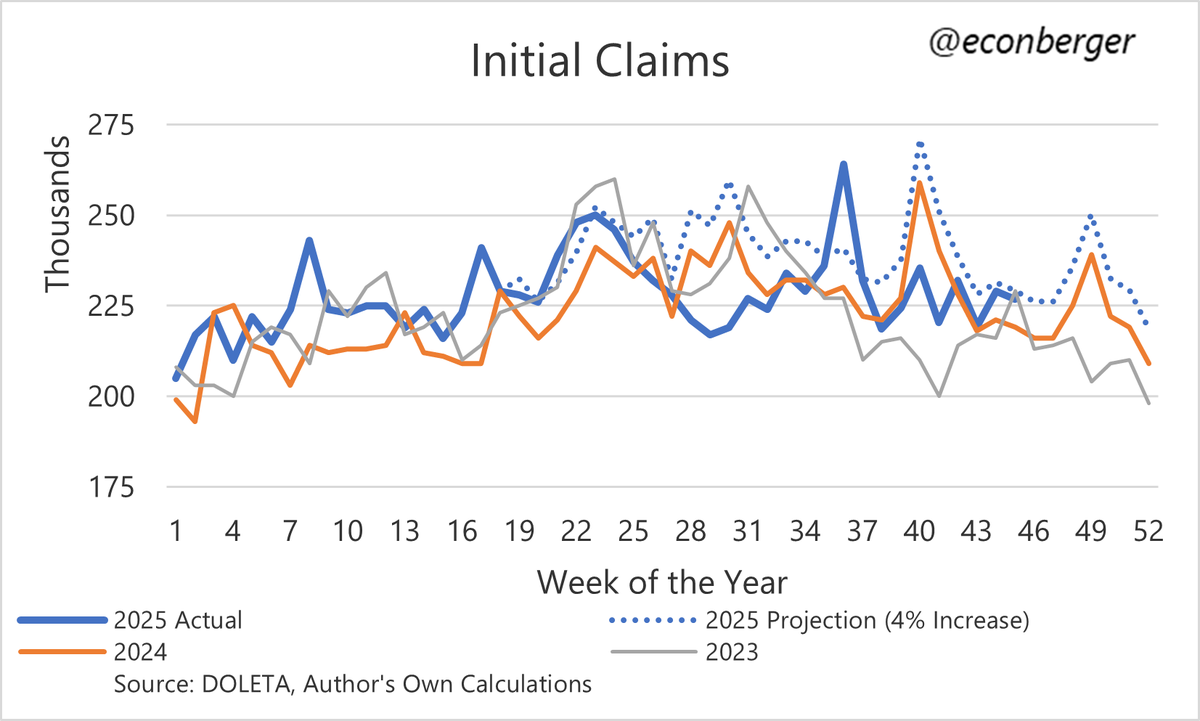

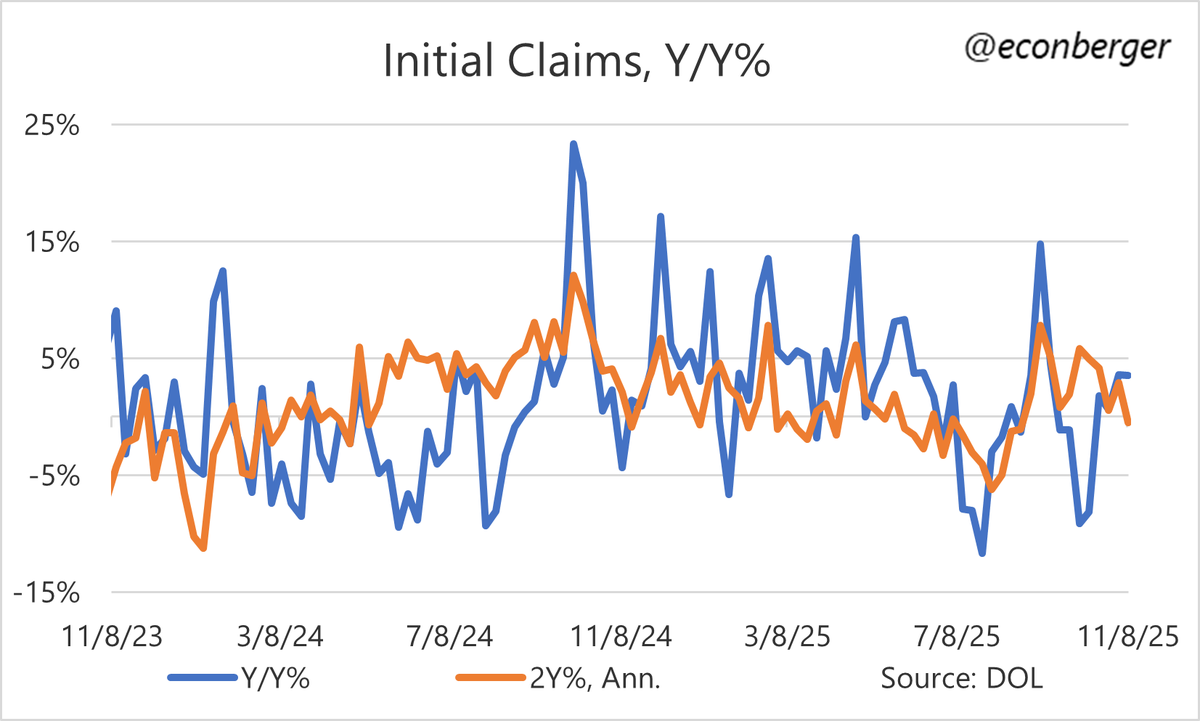

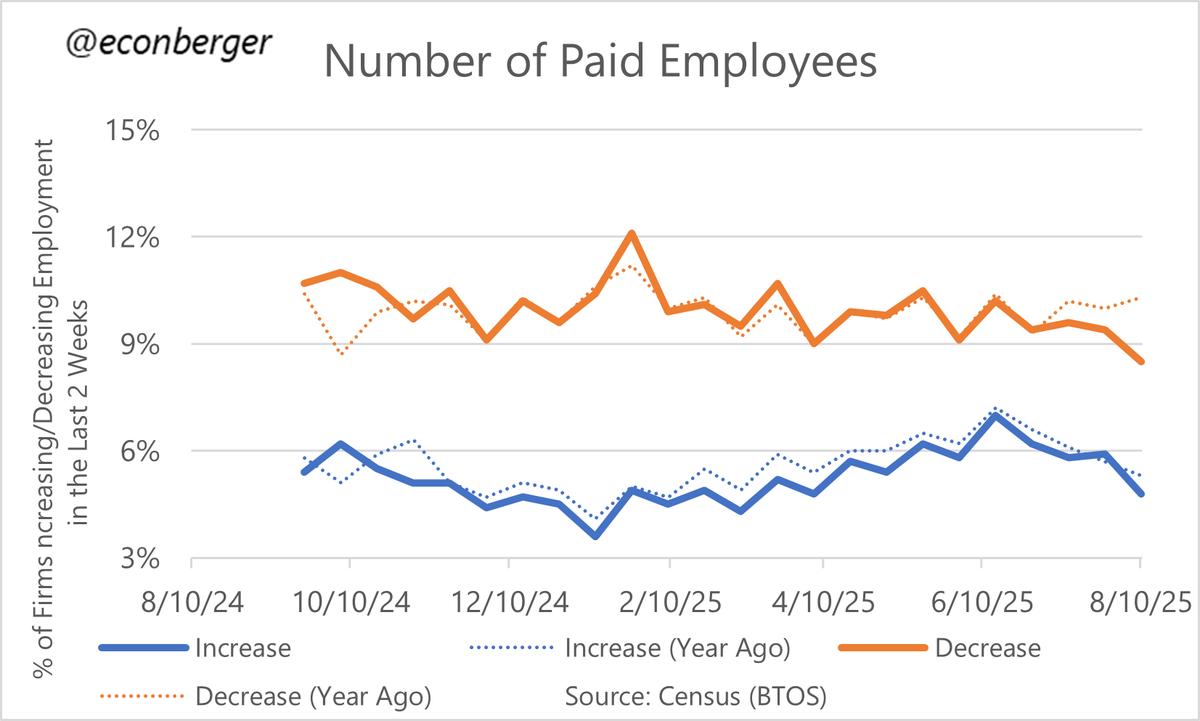

2b/ The improvement has primarily come from a sharp decline (relative to a year ago) in the share of firms cutting headcount.

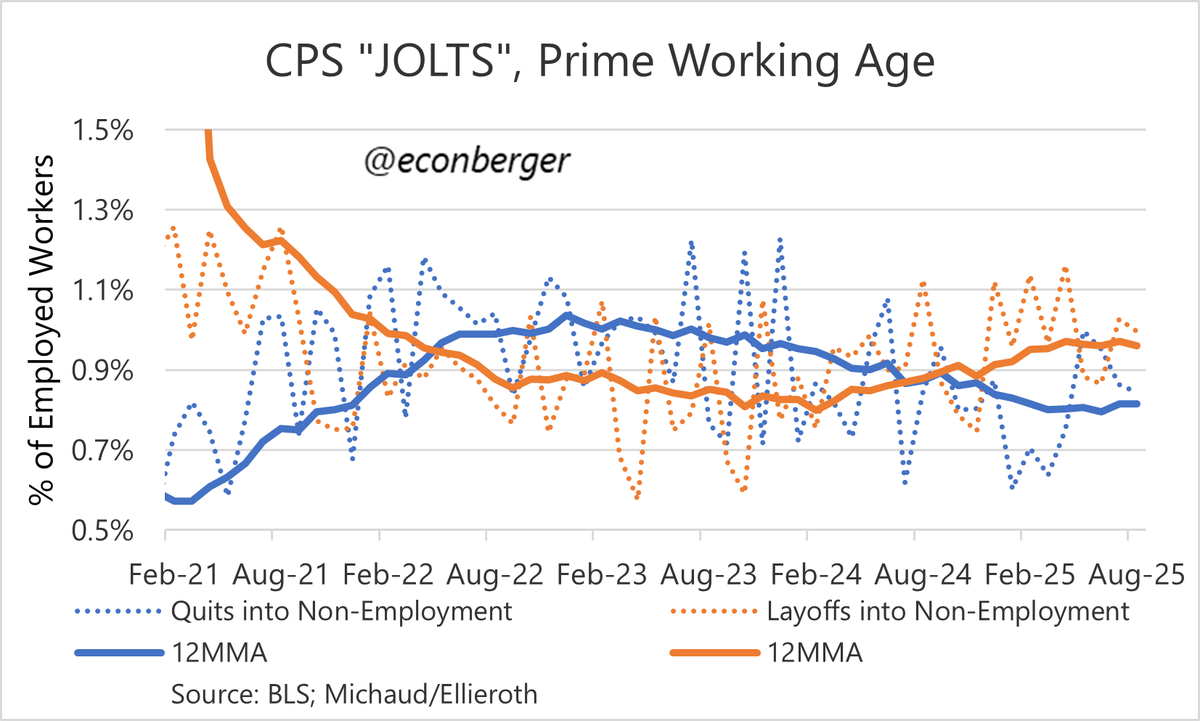

Consistent with the recent decline in layoffs we've seen in the hard data.

There's been no improvement in the share of firms planning to expand.

Consistent with the recent decline in layoffs we've seen in the hard data.

There's been no improvement in the share of firms planning to expand.

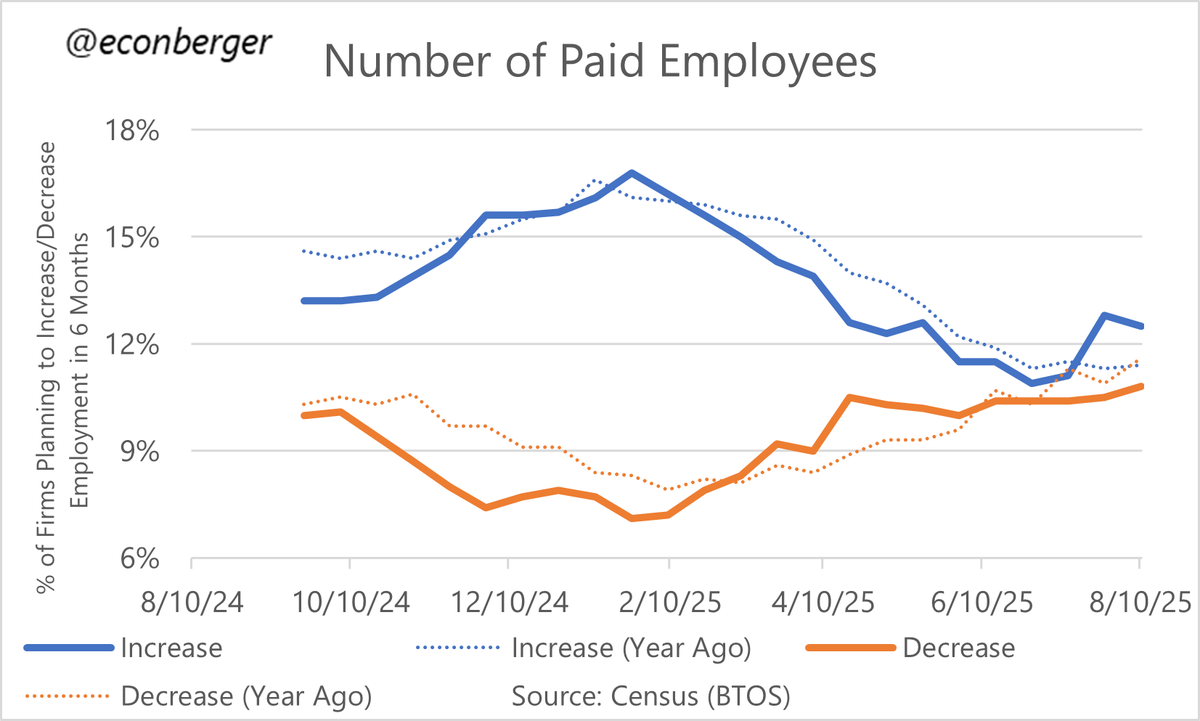

3/ Plans have fluctuated wildly since the fall, ping-ponging between extreme optimism and pessimism.

Currently we're in an optimistic phase. The share of firms planning to expand headcount has increased relative to a year ago.

We'll see what comes of these vibesy plans.

Currently we're in an optimistic phase. The share of firms planning to expand headcount has increased relative to a year ago.

We'll see what comes of these vibesy plans.

4/ One catch about this type of survey is firms are equally weighted!

So even though firms say they are expanding in the diffusion index (relative to a year ago), aggregating it economy-wide it might be negative if the small firms are the expanding ones (as is the case)

So even though firms say they are expanding in the diffusion index (relative to a year ago), aggregating it economy-wide it might be negative if the small firms are the expanding ones (as is the case)

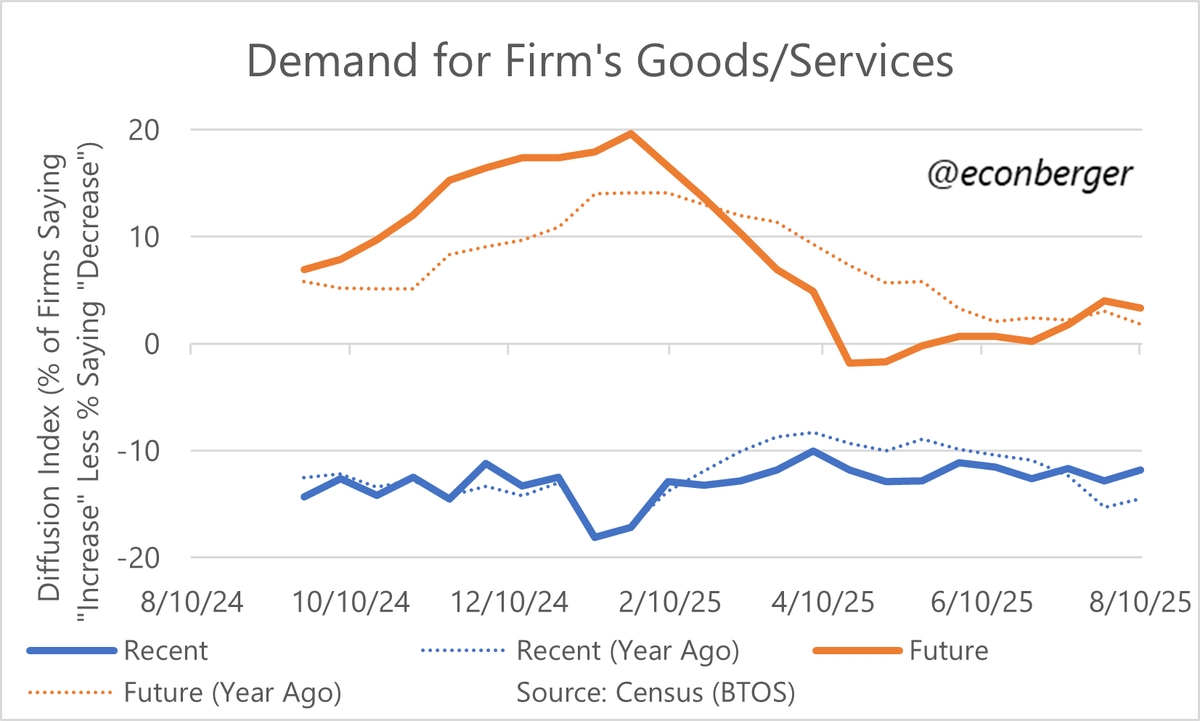

5/ Not my main domain, but US businesses are seeing rising demand for their goods & services (relative to a year ago), and also anticipate a increase in demand in 6 months.

• • •

Missing some Tweet in this thread? You can try to

force a refresh