YouTube has 49 crore active users in India who consume an average of 29 hours of content per month.

If you’re not watching YouTube - you’re probably scrolling Reels (32 crore Indians are active there) or binge watching Netflix (300 crore hours of Indian content were consumed last year!)

The last time I visited a cinema was ~2.5 years ago; as a child - I would be going twice per week & wait in a long line at the counter to buy a good seat for a Sunday show

Here’s how OTT is silently killing India’s ₹12,000 crore cinema industry ⤵️

If you’re not watching YouTube - you’re probably scrolling Reels (32 crore Indians are active there) or binge watching Netflix (300 crore hours of Indian content were consumed last year!)

The last time I visited a cinema was ~2.5 years ago; as a child - I would be going twice per week & wait in a long line at the counter to buy a good seat for a Sunday show

Here’s how OTT is silently killing India’s ₹12,000 crore cinema industry ⤵️

(1) Start with revenue - Box Office collections are flat

In 10 years, collections have grown at 3.5% CAGR - slower than inflation.

The best data source is the annual Box Office report from Ormax Media

You can see how pre-2018 (i.e. pre OTT going mainstream) - Cinema had a steady growth rate.

Then came the COVID slump

Now, has come the realization: Why go to the cinema when the same movie is coming on OTT in less than 60 days?

In 10 years, collections have grown at 3.5% CAGR - slower than inflation.

The best data source is the annual Box Office report from Ormax Media

You can see how pre-2018 (i.e. pre OTT going mainstream) - Cinema had a steady growth rate.

Then came the COVID slump

Now, has come the realization: Why go to the cinema when the same movie is coming on OTT in less than 60 days?

(2) Next: We should understand where/how Cinema makes revenue (hint: not from movies)

Ajay Bijli, CEO of PVR Inox, said: “I have seen customers come only for food, leave without watching the movie”

Data:

Avg ticket price at PVR = ₹259 (versus ₹180 in 2015)

F&B spend per head at PVR = ₹134 (versus ₹70 in 2015)

But, here’s the kicker - F&B has a 75% gross margin i.e. it is a real money maker

Let us look at PVR’s FY 25 financials:

Total rev from Ops = ₹5780 crore

Ticket sales = ₹3530 crore

F&B sales @ 75% GM = ₹1800 crore

Advertising @ 90% GM = ₹450 crore

F&B + Ads = ₹1750 crore of margin - which is the same as tickets sales @ 50% margin 🤯

Takeaway: On a margin basis - F&B & Ads contributes as much as ticket sales. Hence, the old joke that cinemas are expensive restaurants which play movies and have bad service. 😂

Ajay Bijli, CEO of PVR Inox, said: “I have seen customers come only for food, leave without watching the movie”

Data:

Avg ticket price at PVR = ₹259 (versus ₹180 in 2015)

F&B spend per head at PVR = ₹134 (versus ₹70 in 2015)

But, here’s the kicker - F&B has a 75% gross margin i.e. it is a real money maker

Let us look at PVR’s FY 25 financials:

Total rev from Ops = ₹5780 crore

Ticket sales = ₹3530 crore

F&B sales @ 75% GM = ₹1800 crore

Advertising @ 90% GM = ₹450 crore

F&B + Ads = ₹1750 crore of margin - which is the same as tickets sales @ 50% margin 🤯

Takeaway: On a margin basis - F&B & Ads contributes as much as ticket sales. Hence, the old joke that cinemas are expensive restaurants which play movies and have bad service. 😂

(3) Footfalls have been on a decline for over a decade

Unlike Box Office collections which have grown - footfall has actually declined!

If a cinema (which has high fixed costs) is unable to attract footfall - who is left to sell the F&B to? why would an advertiser pay for the ad slots?

This is why the business model is under attack - without footfalls, like any hospitality business, the economics of a cinema are very poor!

Unlike Box Office collections which have grown - footfall has actually declined!

If a cinema (which has high fixed costs) is unable to attract footfall - who is left to sell the F&B to? why would an advertiser pay for the ad slots?

This is why the business model is under attack - without footfalls, like any hospitality business, the economics of a cinema are very poor!

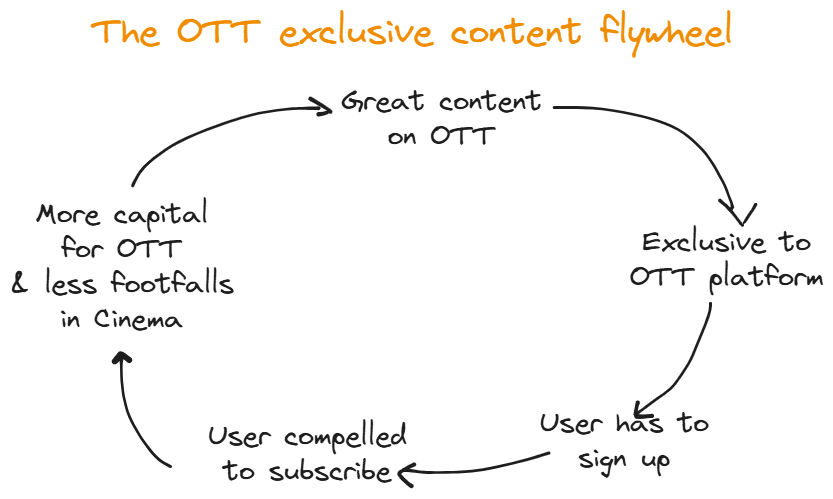

Turning point in Cinema was when OTTs went from content distributors to media studios

Netflix outbid HBO for House of Cards in 2011 - which kicked off a capital war to acquire media IP

Broadly, two models were followed by OTTs:

(a) Acquired model - Amazon Prime Studio India w/ Shersaah in 2021 which it bought from Dharmaa Productions

(b) Commissioned model - Netflix India w/ Betaal via Red Chillies Entertainment

The content flywheel explains why owning exclusive content now ensures you & I don’t step out of the house to watch a movie - because exclusive content is on our phones via OTTs!

Netflix outbid HBO for House of Cards in 2011 - which kicked off a capital war to acquire media IP

Broadly, two models were followed by OTTs:

(a) Acquired model - Amazon Prime Studio India w/ Shersaah in 2021 which it bought from Dharmaa Productions

(b) Commissioned model - Netflix India w/ Betaal via Red Chillies Entertainment

The content flywheel explains why owning exclusive content now ensures you & I don’t step out of the house to watch a movie - because exclusive content is on our phones via OTTs!

All is NOT dead for Cinema - there is a glimmer of hope:

Aamir Khan decided to launch Sitaare Zameen Par in cinemas - collecting ₹90 crore in Week 1 at the Box Office. He even turned down a reported ₹120 crore OTT offer - the movie is now on YouTube Pay Per View at ~₹100!

Ajay Bijli said: “While there is negativity associated with OTTs impact on the multiplex industry… We are focused on experience that cannot be replicated at home, – enjoying food while watching a movie in a cinema is a different experience from sitting on your sofa.”

PVR Inox & its metro city competitors are building premium experiences e.g. INOX Insignia and PVR Director’s Cut - where ticket prices start at ₹1,000. Premiumization is happening everywhere!

Aamir Khan decided to launch Sitaare Zameen Par in cinemas - collecting ₹90 crore in Week 1 at the Box Office. He even turned down a reported ₹120 crore OTT offer - the movie is now on YouTube Pay Per View at ~₹100!

Ajay Bijli said: “While there is negativity associated with OTTs impact on the multiplex industry… We are focused on experience that cannot be replicated at home, – enjoying food while watching a movie in a cinema is a different experience from sitting on your sofa.”

PVR Inox & its metro city competitors are building premium experiences e.g. INOX Insignia and PVR Director’s Cut - where ticket prices start at ₹1,000. Premiumization is happening everywhere!

In small town India, cinemas continue to thrive - Ajay Devgn has made the “entertainer to entrepreneur” career switch:

Ajay Devgn deployed ₹600 crore in his multiplex venture NY Cinemas LLP which has 47 mini-plexes across UP and Assam

Even SRK said: “I still believe that the call of the day is: a lot more theatres, simpler theatres, cheaper theatres, in smaller towns and cities, so that we can showcase Indian films in whichever language to a larger majority of Indians for cheaper rates.”

Ajay was early to this trend (more below)

I’ve recorded a 20 minute Breakdown on the Indian Cinema industry - from the history of Bollywood to how Tollywood was taking over until OTT came to the scene.

➡️ Watch on YouTube: youtu.be/XcJKEilzcFo?si…

Ajay Devgn deployed ₹600 crore in his multiplex venture NY Cinemas LLP which has 47 mini-plexes across UP and Assam

Even SRK said: “I still believe that the call of the day is: a lot more theatres, simpler theatres, cheaper theatres, in smaller towns and cities, so that we can showcase Indian films in whichever language to a larger majority of Indians for cheaper rates.”

Ajay was early to this trend (more below)

I’ve recorded a 20 minute Breakdown on the Indian Cinema industry - from the history of Bollywood to how Tollywood was taking over until OTT came to the scene.

➡️ Watch on YouTube: youtu.be/XcJKEilzcFo?si…

The future of India’s Cinema industry is a Barbell - premium experiences in metro cities (e.g. PVR Insignia) and affordable entertainment in small town India (e.g. Ajay Devgn’s NY Cinemas)

While PVR continues to put up a great fight every quarter - I continue to remain skeptical about this industry. The CR2 Cinema next to my family home in Mumbai used to be a circus on Sundays - this Sunday it was a ghost town.

Deep down many of you may resonate when I say:

Content has moved from Cinema to OTT

Experience has moved from Cinema to Concerts

Therefore, what does Cinema offer today?

Discl: Breakdown YT channel is part of @Zero1byZerodha Network and the YT channel is owned by Aeos Media Labs. Videos are produced by the Aeos team. Shared for informational purposes only; check additional disclaimers in the video. No company mentions are paid sponsorships or endorsements.

While PVR continues to put up a great fight every quarter - I continue to remain skeptical about this industry. The CR2 Cinema next to my family home in Mumbai used to be a circus on Sundays - this Sunday it was a ghost town.

Deep down many of you may resonate when I say:

Content has moved from Cinema to OTT

Experience has moved from Cinema to Concerts

Therefore, what does Cinema offer today?

Discl: Breakdown YT channel is part of @Zero1byZerodha Network and the YT channel is owned by Aeos Media Labs. Videos are produced by the Aeos team. Shared for informational purposes only; check additional disclaimers in the video. No company mentions are paid sponsorships or endorsements.

• • •

Missing some Tweet in this thread? You can try to

force a refresh