Now: Pre-Seed Investor @DeVC_Global || Prev: Founder @VerakInsurance (acq. by ID) || Views are my own

5 subscribers

How to get URL link on X (Twitter) App

Founder Interviews:

Founder Interviews:

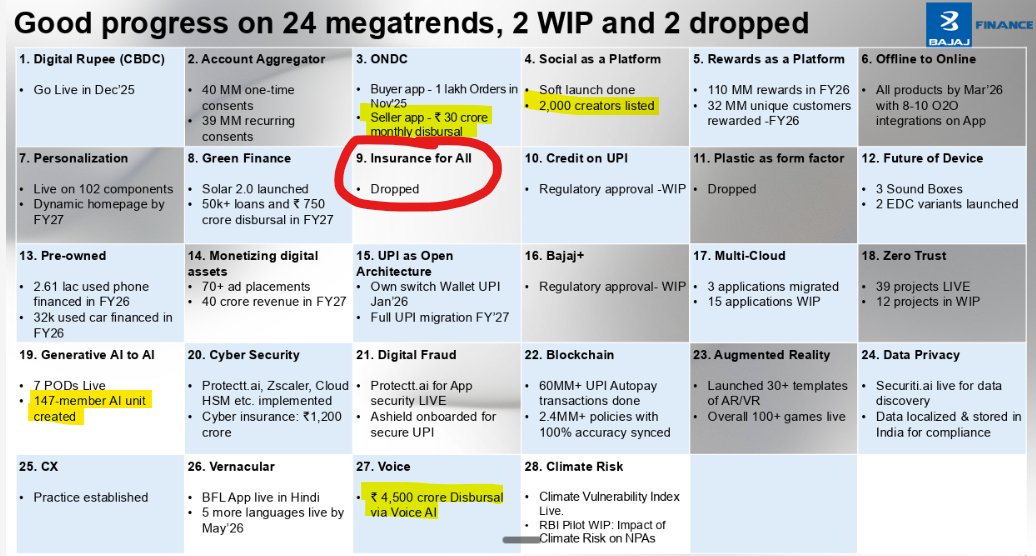

1️⃣Certain updates from BFL regarding megatrends caught my attention:

1️⃣Certain updates from BFL regarding megatrends caught my attention:

(1) AI first collections agencies are emerging 🗣️

(1) AI first collections agencies are emerging 🗣️

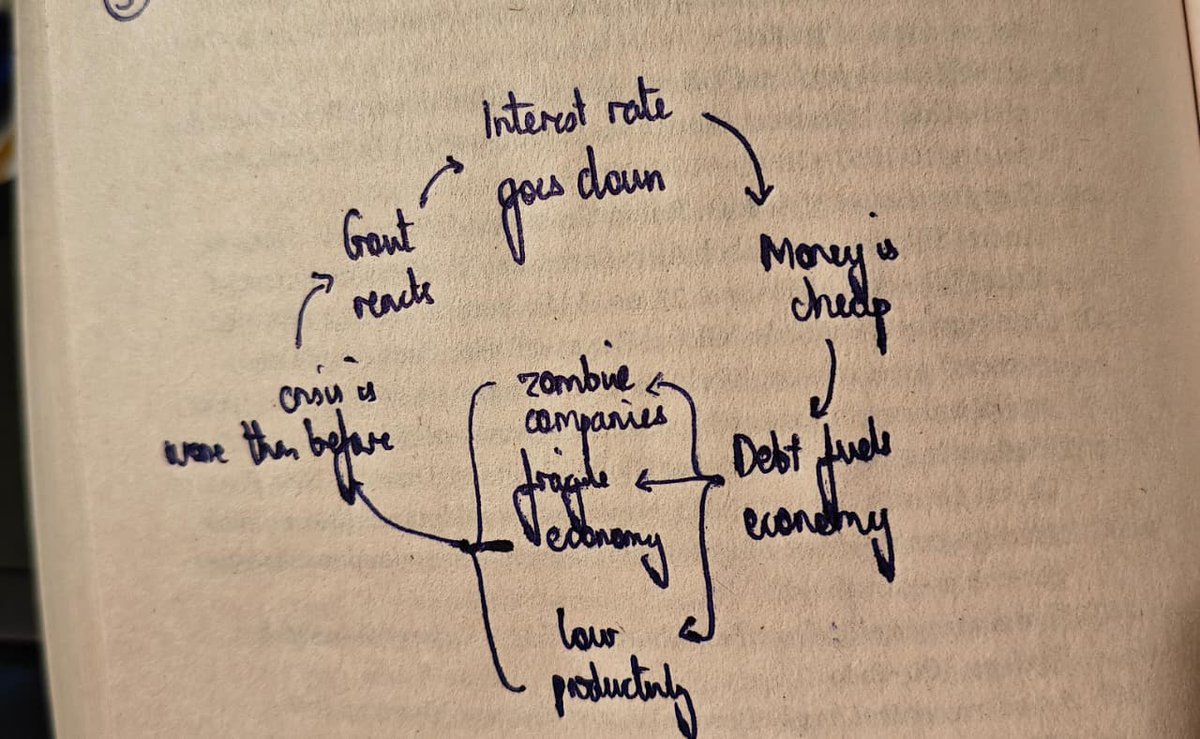

First, I think it is important to set the premise of this book:

First, I think it is important to set the premise of this book: