David Tepper has achieved a 28% annual return over the past two decades.

It's one of the best contrarian investors, he was right about Alibaba and now he has a new bet

Let me tell you about it🧵

It's one of the best contrarian investors, he was right about Alibaba and now he has a new bet

Let me tell you about it🧵

Tepper left Goldman Sachs in 1992 and founded Appaloosa Management in 1993 with $57 million in capital

Appaloosa Management is renowned for its strong performance, particularly in distressed debt investing. Since its inception in 1993, the fund has reportedly compounded at an average annual return of over 25% for much of its history.

By 2010, it was reported that Appaloosa had returned $12.4 billion to clients since inception, ranking it among the top hedge funds for total client returns. This figure reflects returns up to 17 years after its founding.

Appaloosa Management is renowned for its strong performance, particularly in distressed debt investing. Since its inception in 1993, the fund has reportedly compounded at an average annual return of over 25% for much of its history.

By 2010, it was reported that Appaloosa had returned $12.4 billion to clients since inception, ranking it among the top hedge funds for total client returns. This figure reflects returns up to 17 years after its founding.

His Strategy

Buy when others are fearful: “There comes a point where prices are so cheap that you just have to buy.”

Focus on Distressed Assets

Concentration over diversification

Buy when others are fearful: “There comes a point where prices are so cheap that you just have to buy.”

Focus on Distressed Assets

Concentration over diversification

Notable stock-buying moments:

Early 1990s: Argentina’s Economic Collapse

1998: Russia’s Financial Meltdown

2001: After the dot-com bubble burst, many tech and telecom companies were in distress.

Move: Tepper invested heavily in distressed bonds of companies like MCI and Conseco, then pivoted to equities as they rebounded.

Result: Appaloosa posted a 61% return in 2001, a year when most funds struggled

2009: Post-Financial Crisis

Move: U.S. banking sector on its knees after the 2008 crash, Tepper invested billions in distressed stocks and bonds of major banks like Bank of America and Citigroup

Result: Appaloosa scored a staggering $7 billion profit in 2009, achieving a 120% return net of fees

2022: China....He added Alibaba and became one of the largest shareholders the stock has a massive bull run from $70 to $145

2025: United Health…

Early 1990s: Argentina’s Economic Collapse

1998: Russia’s Financial Meltdown

2001: After the dot-com bubble burst, many tech and telecom companies were in distress.

Move: Tepper invested heavily in distressed bonds of companies like MCI and Conseco, then pivoted to equities as they rebounded.

Result: Appaloosa posted a 61% return in 2001, a year when most funds struggled

2009: Post-Financial Crisis

Move: U.S. banking sector on its knees after the 2008 crash, Tepper invested billions in distressed stocks and bonds of major banks like Bank of America and Citigroup

Result: Appaloosa scored a staggering $7 billion profit in 2009, achieving a 120% return net of fees

2022: China....He added Alibaba and became one of the largest shareholders the stock has a massive bull run from $70 to $145

2025: United Health…

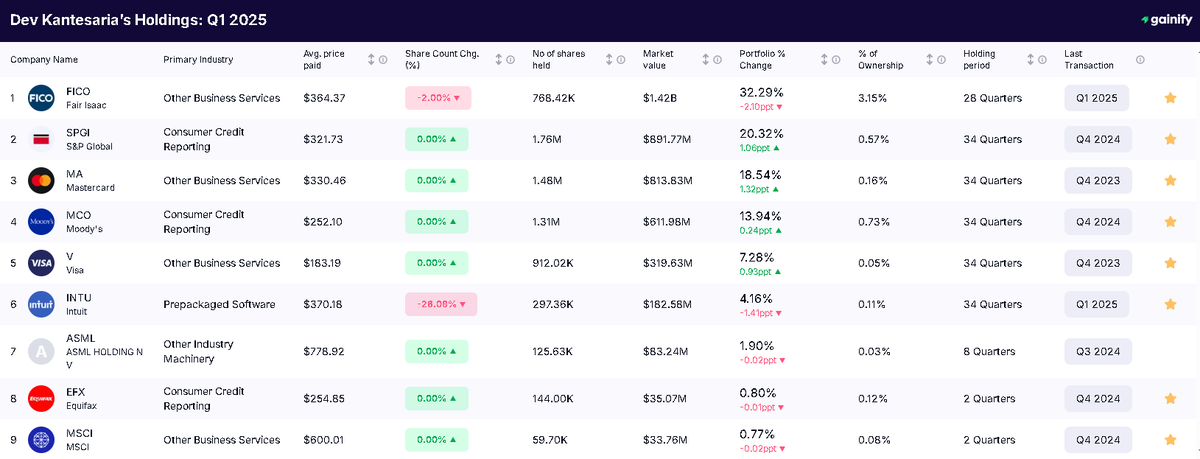

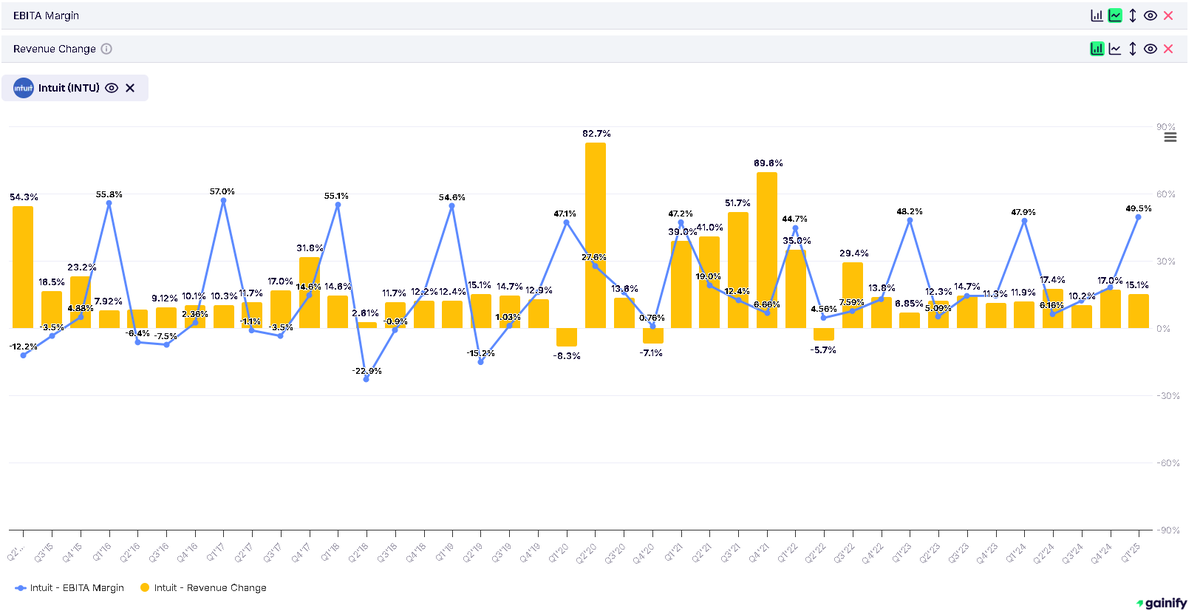

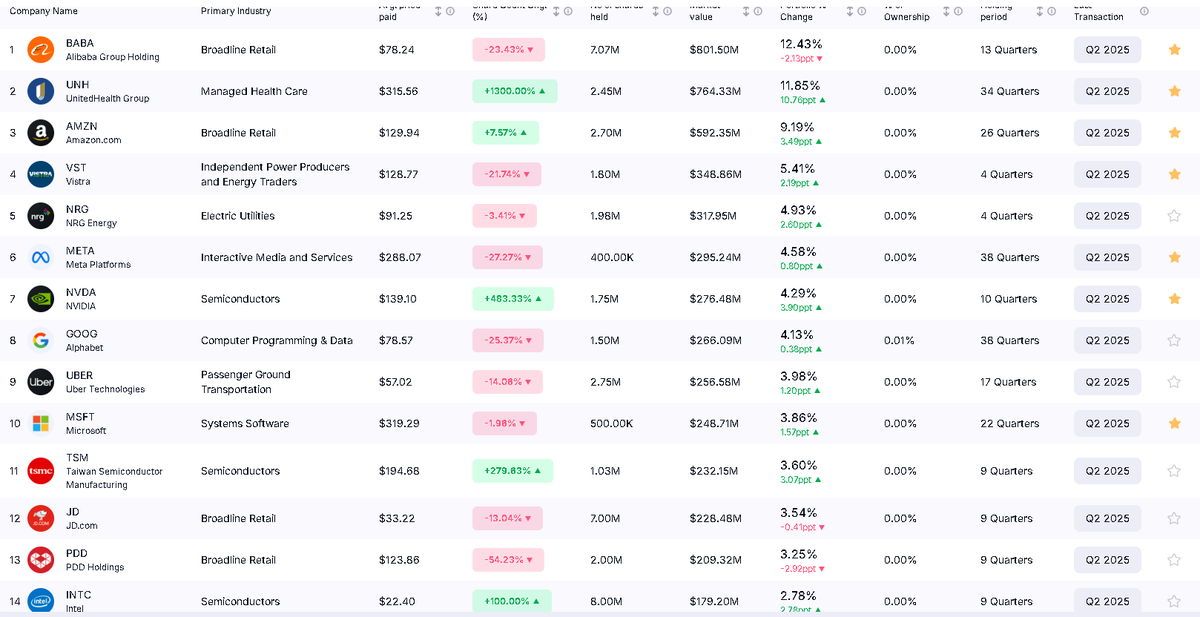

David has increased his $UNH position by 1,300%; it is now his second-largest holding and is close to Alibaba, which has been his largest bet recently.

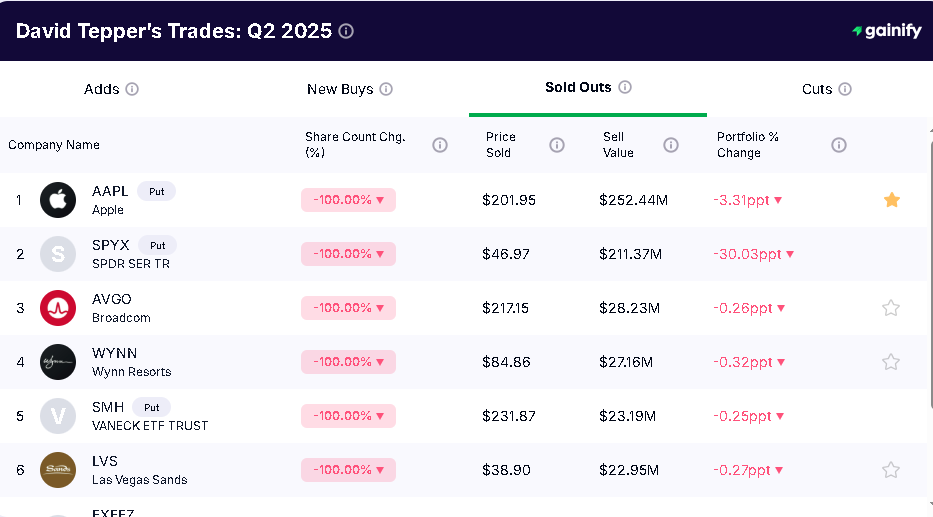

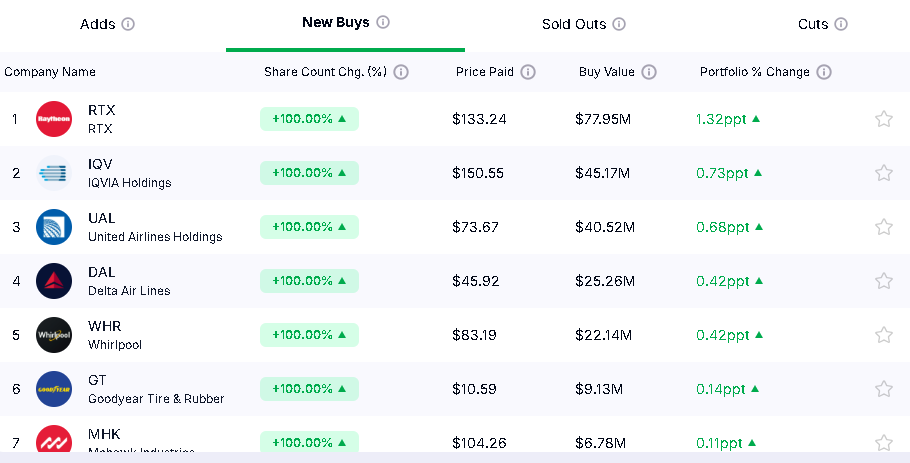

Data from @gainify_io

Data from @gainify_io

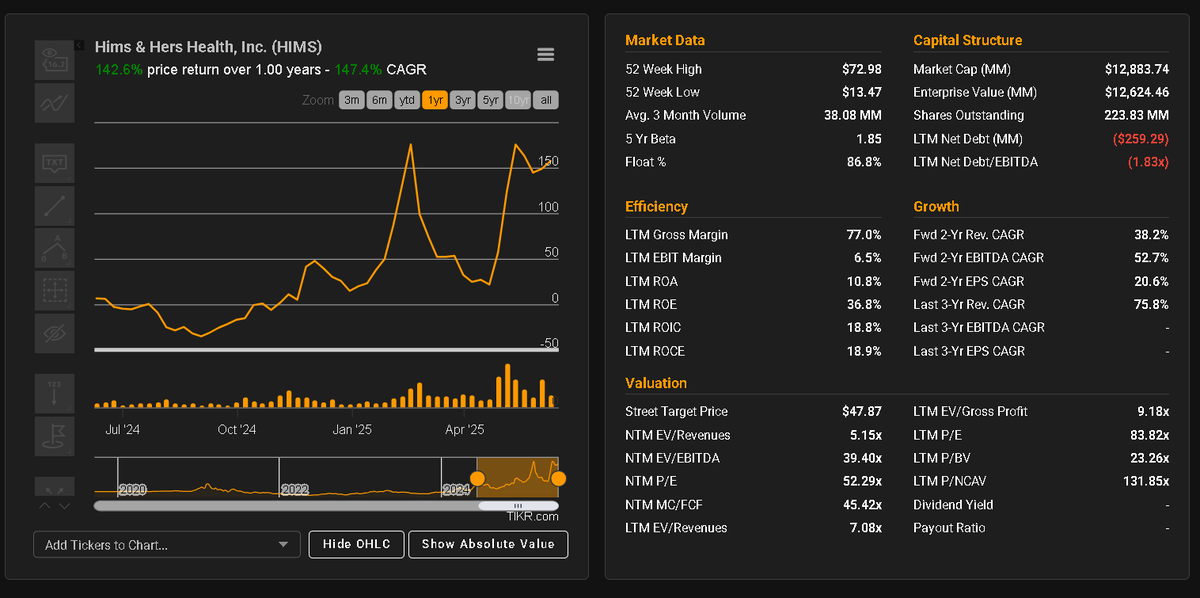

I'm a huge fan of David; he was 100% correct about Alibaba. The stock price generated modest wealth during 2022 and 2025, experienced significant volatility, remains undervalued, and is one of the most hated companies among investors.

At some point, the stock will become extremely hated and too cheap to ignore. Alibaba was trading close to its book value per share in 2023, then in 2024 and early 2025, and David seized the opportunity, creating significant wealth.

UnitedHealth is facing a similar experience, and it looks like he has spotted an opportunity there as well.

Thanks for reading

At some point, the stock will become extremely hated and too cheap to ignore. Alibaba was trading close to its book value per share in 2023, then in 2024 and early 2025, and David seized the opportunity, creating significant wealth.

UnitedHealth is facing a similar experience, and it looks like he has spotted an opportunity there as well.

Thanks for reading

• • •

Missing some Tweet in this thread? You can try to

force a refresh