Growth Investments - Long Term | Insider News: @BourbonInsider

Find below the link to my Patreon and all my sources

2 subscribers

How to get URL link on X (Twitter) App

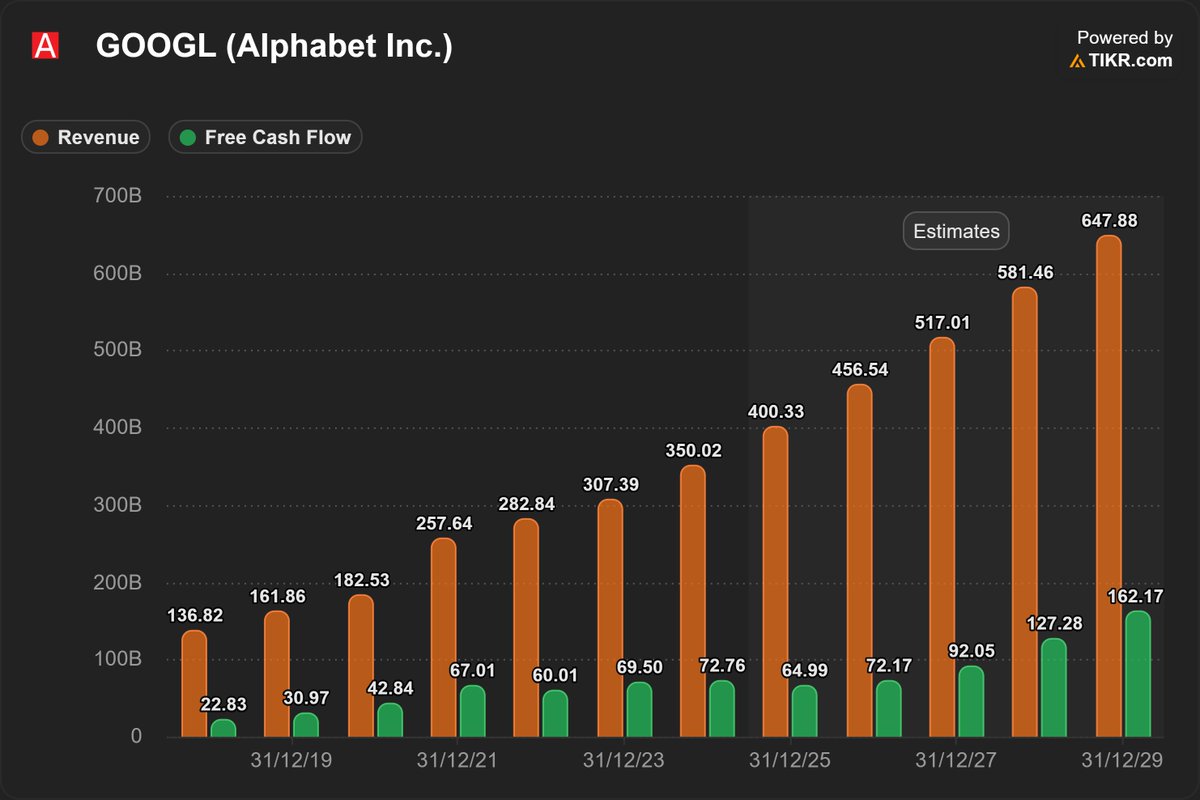

2. $ISRG - Intuitive Surgical

2. $ISRG - Intuitive Surgical

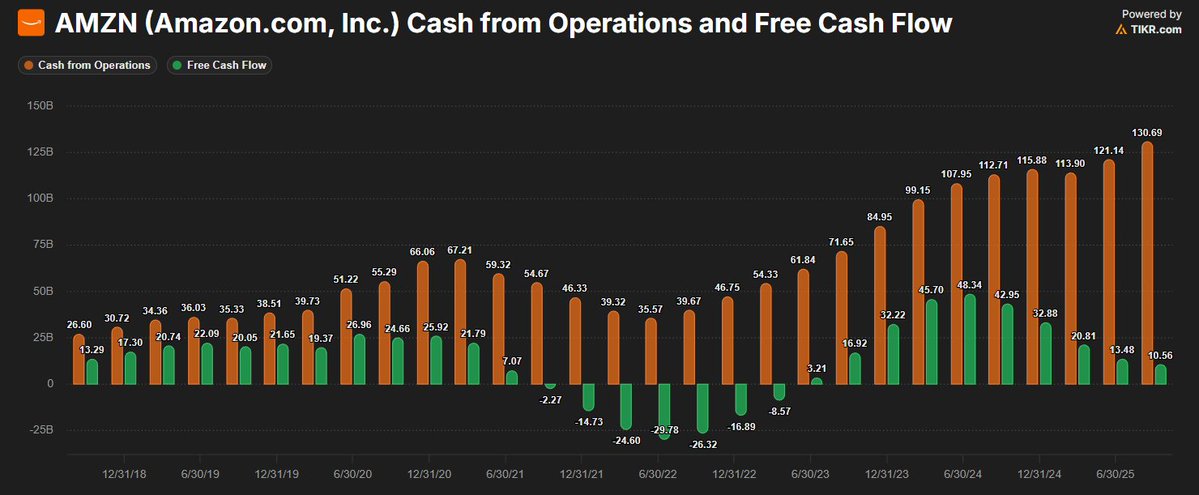

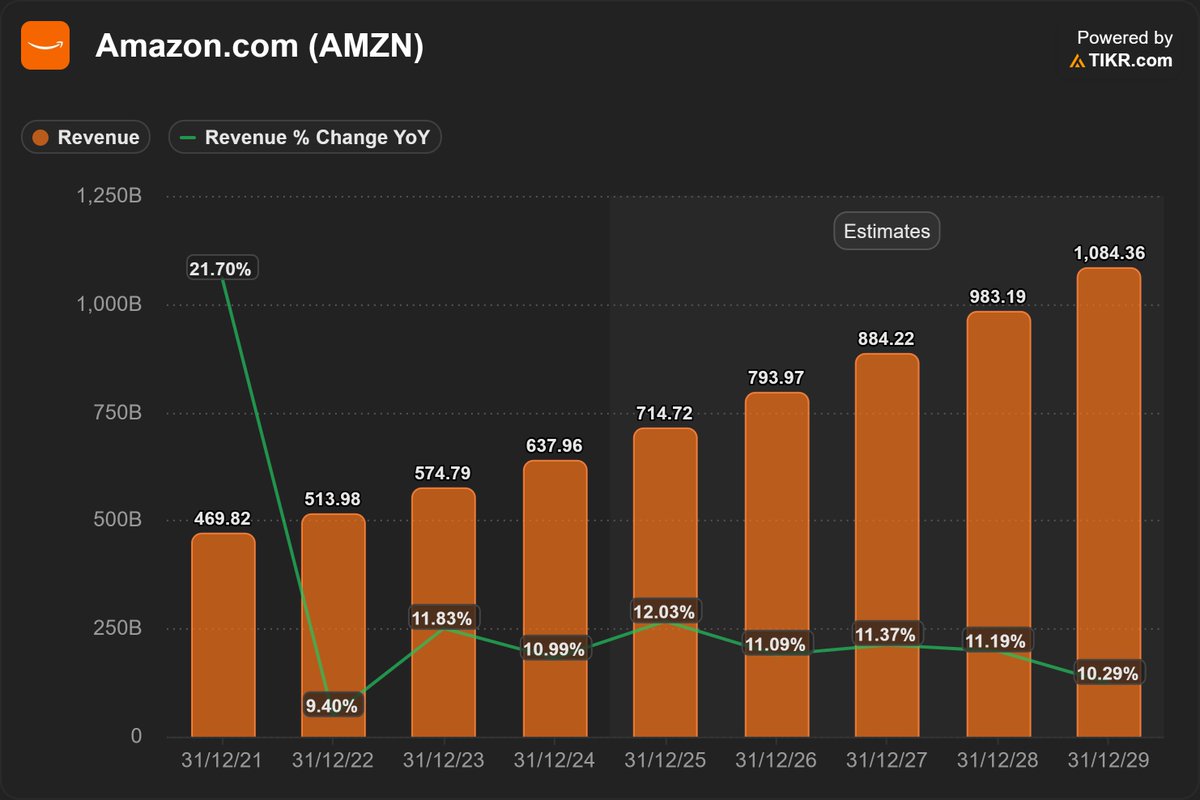

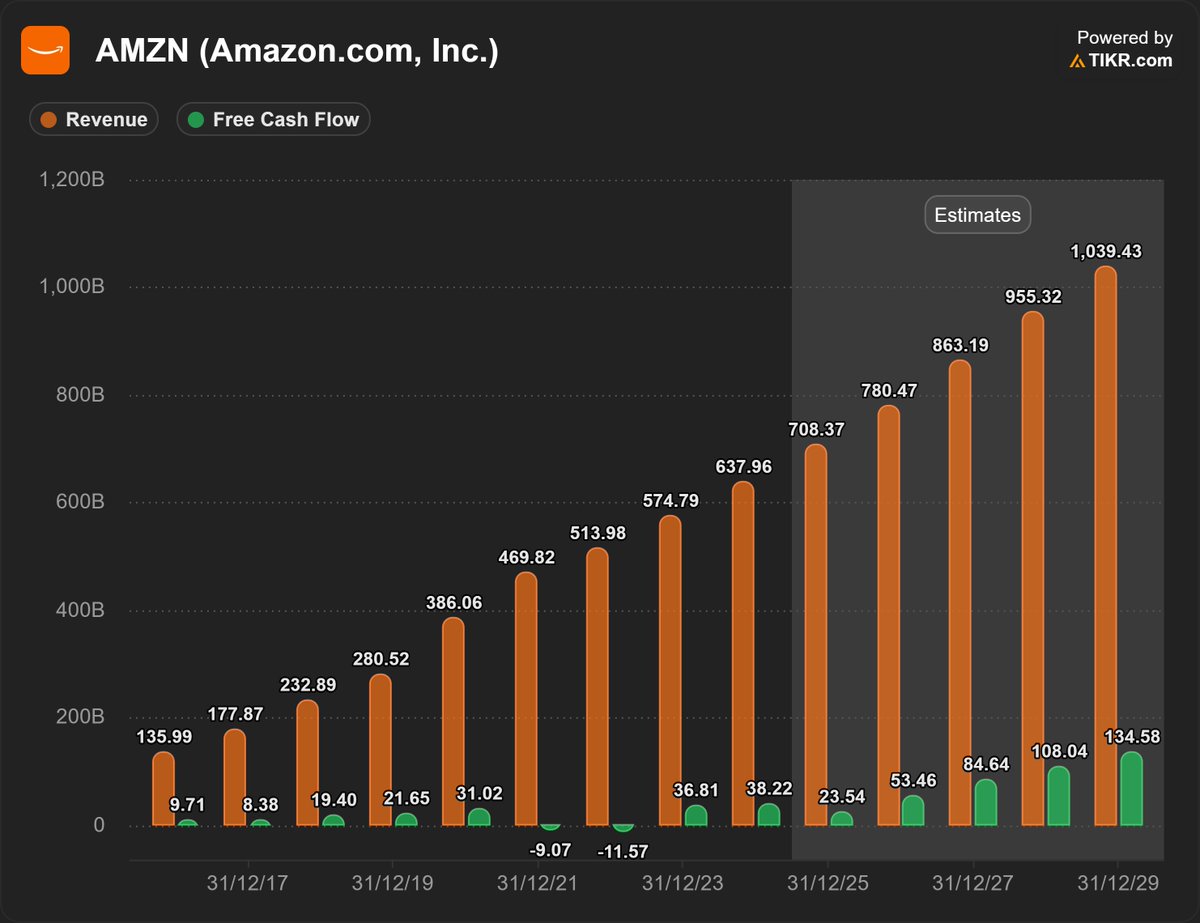

2. $AMZN - Amazon

2. $AMZN - Amazon

2. $ODD - Oddity Tech

2. $ODD - Oddity Tech

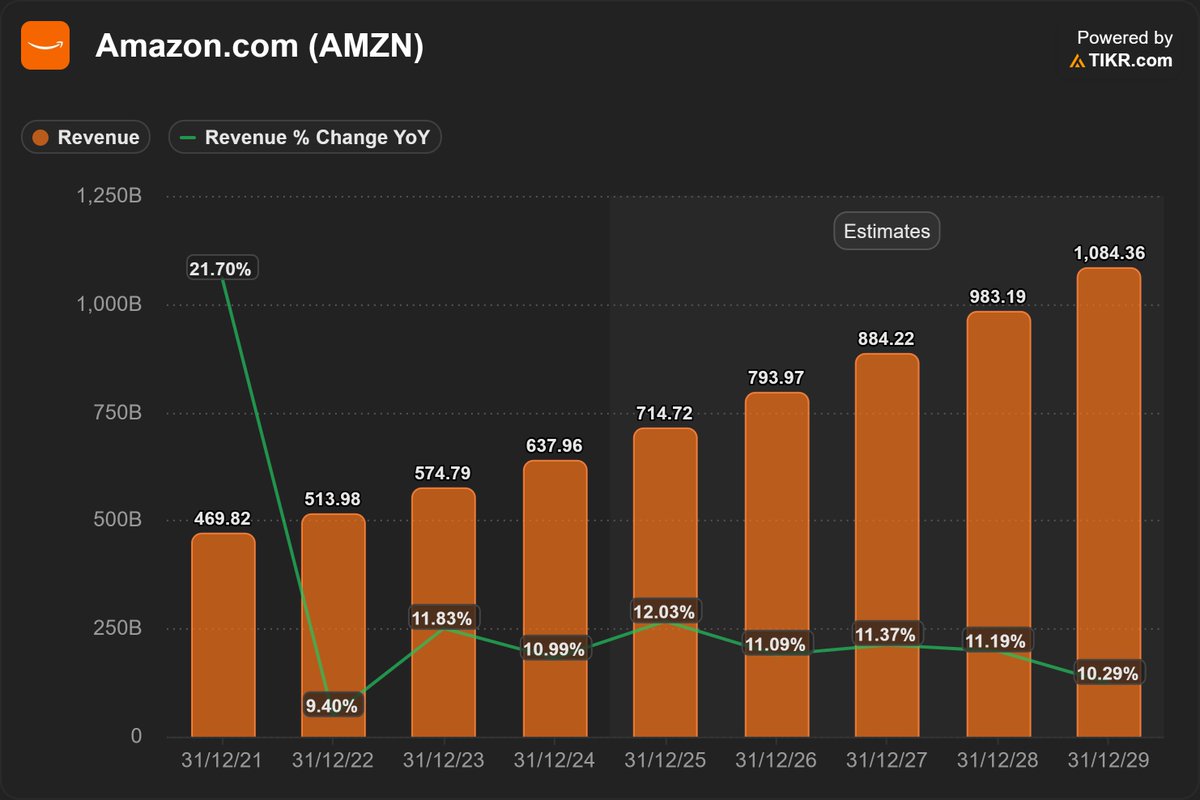

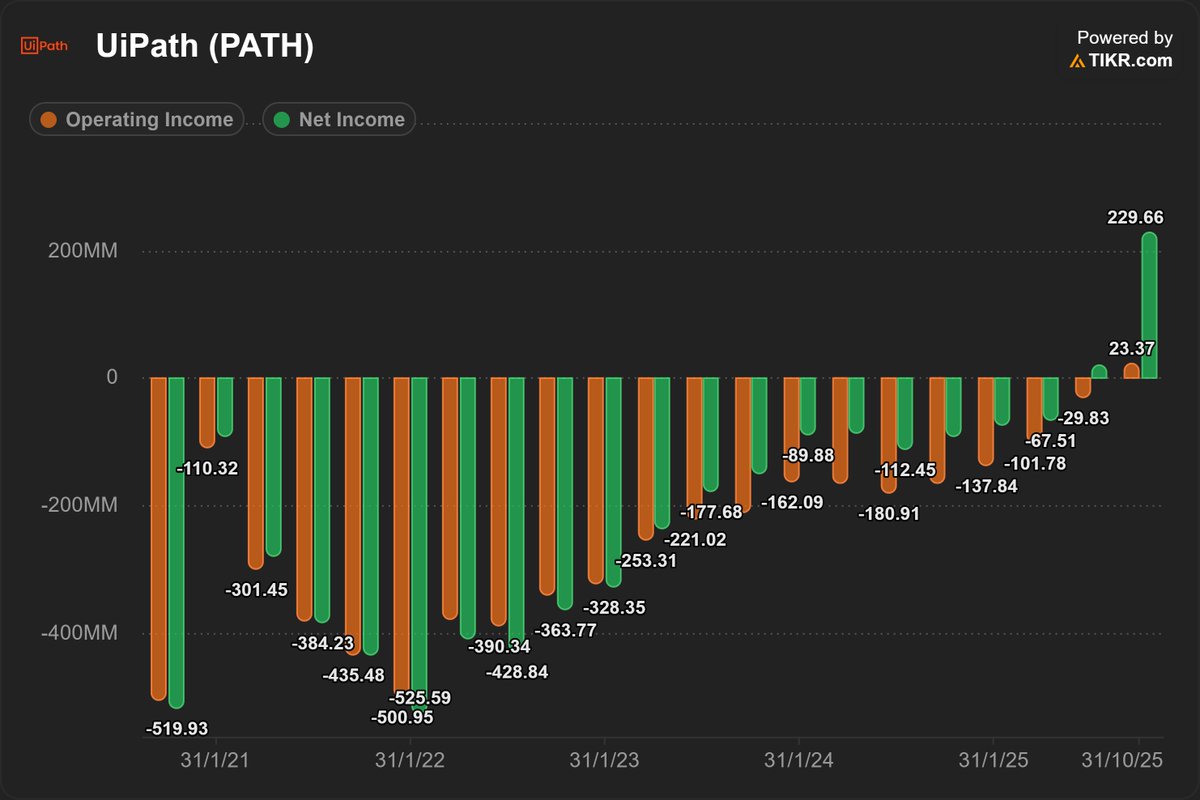

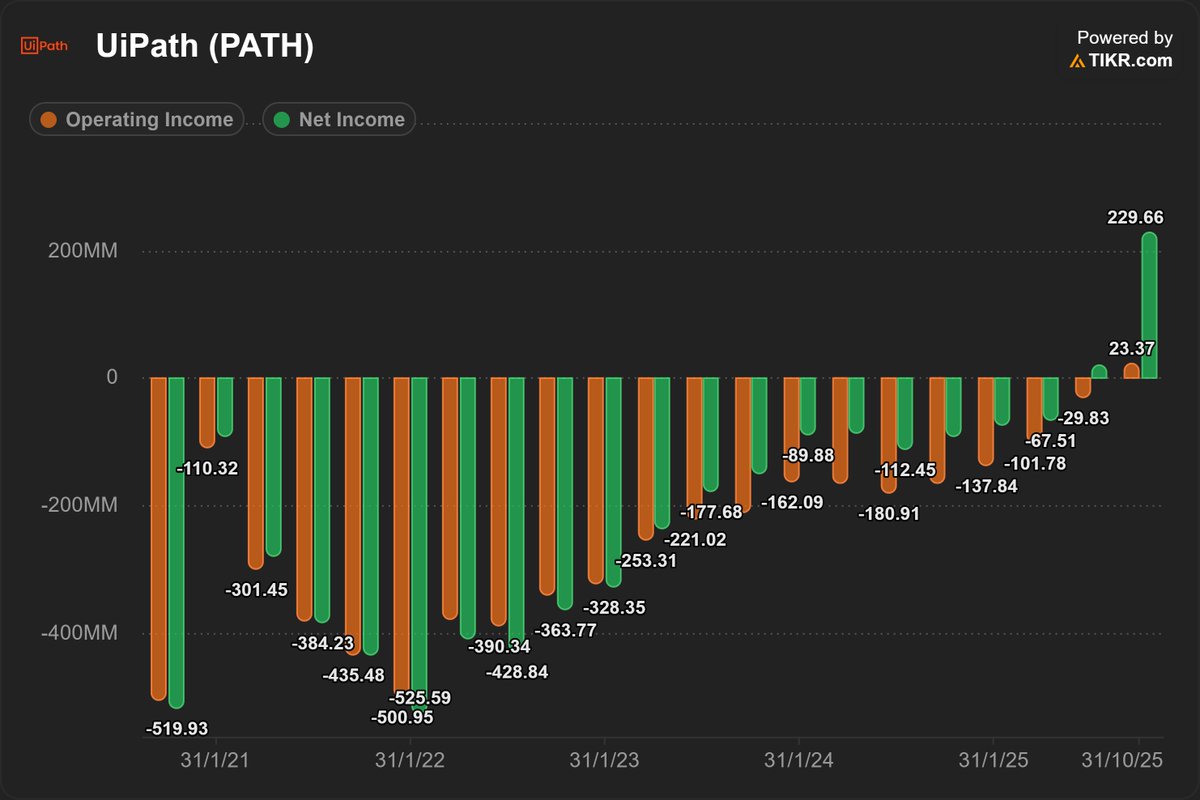

2. $PATH - UiPath

2. $PATH - UiPath

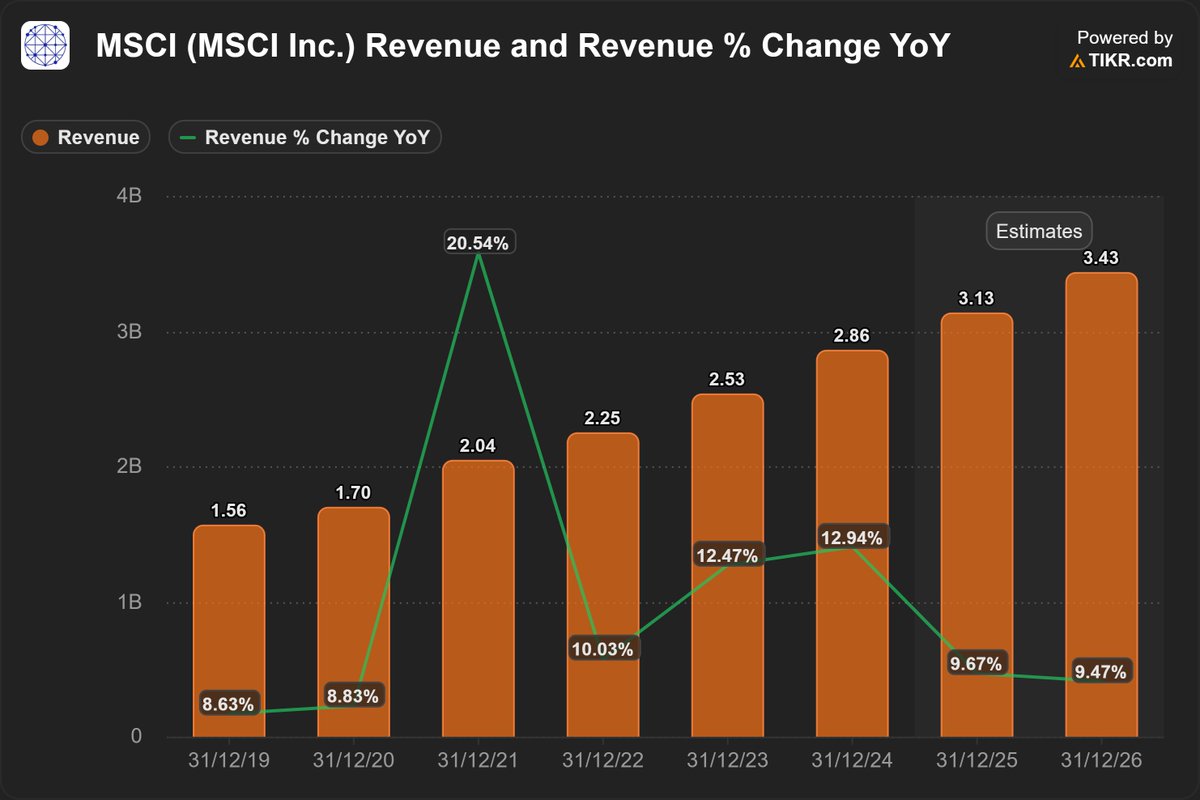

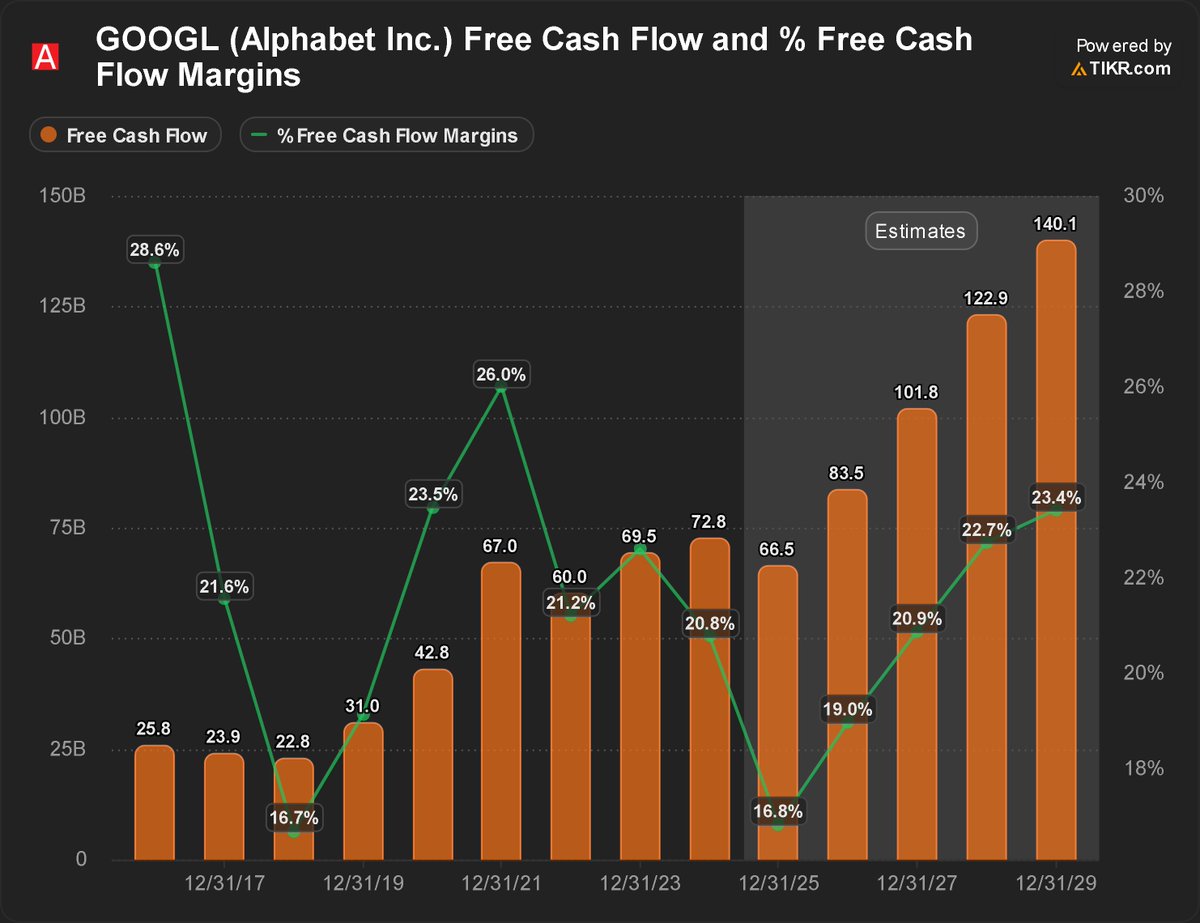

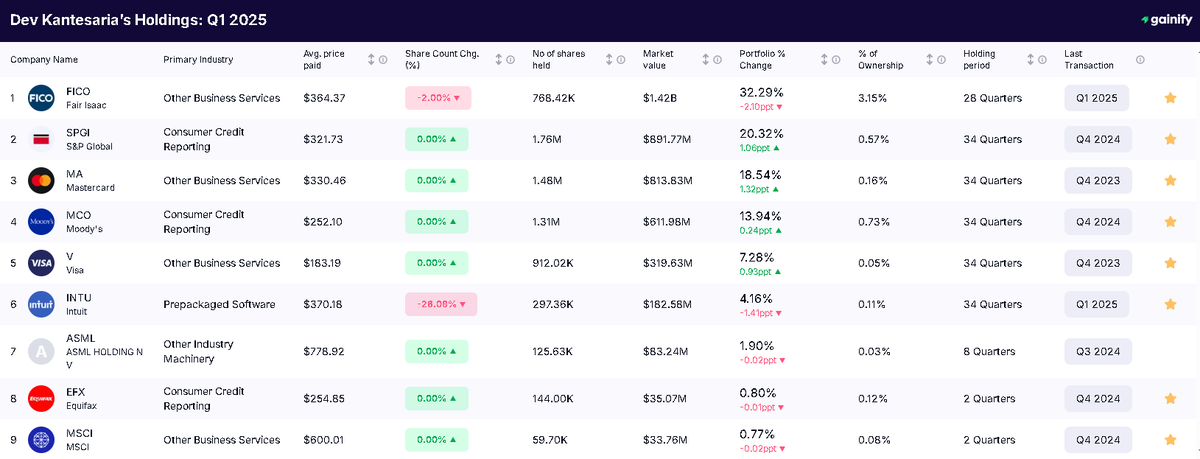

2. $MSCI - MSCI

2. $MSCI - MSCI

Tepper is betting big on commerce and AI, while expecting for stronger consumer sentiment in the coming years

Tepper is betting big on commerce and AI, while expecting for stronger consumer sentiment in the coming years

2. $JD - JD,com

2. $JD - JD,com

2. $ADBE

2. $ADBE

2. $ADBE - Adobe

2. $ADBE - Adobe

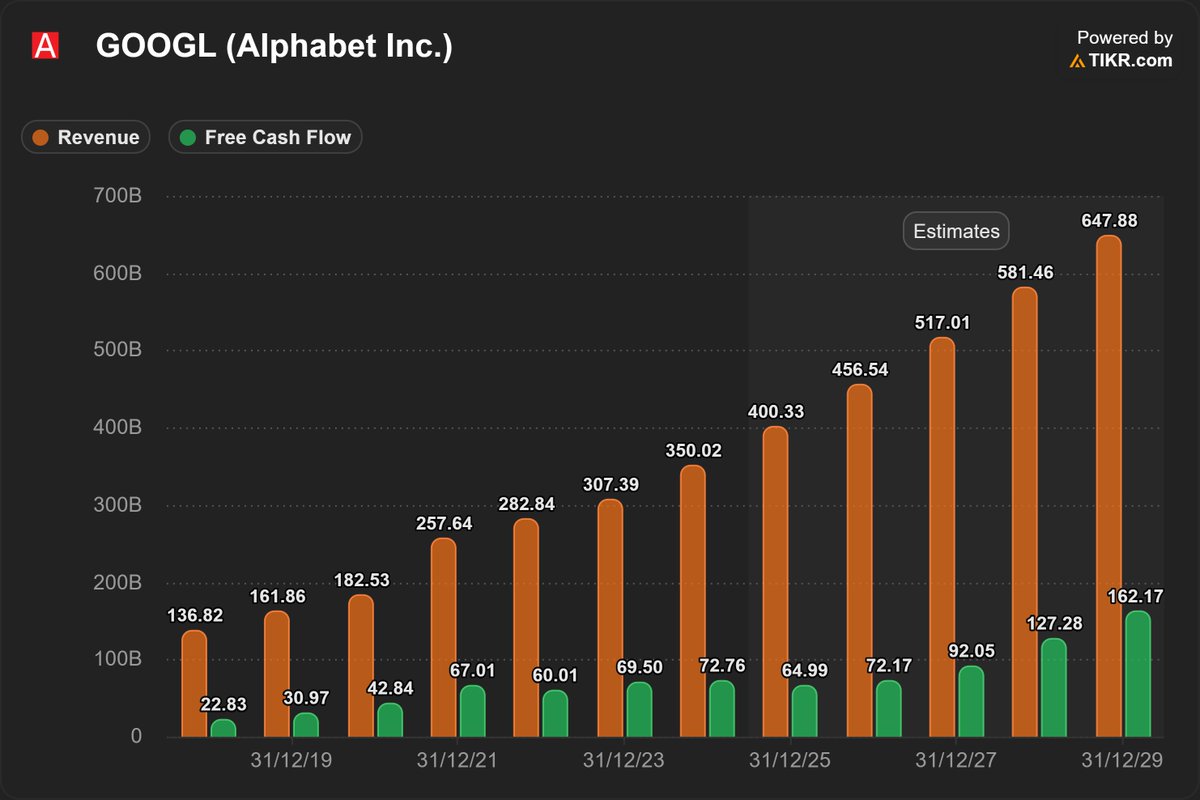

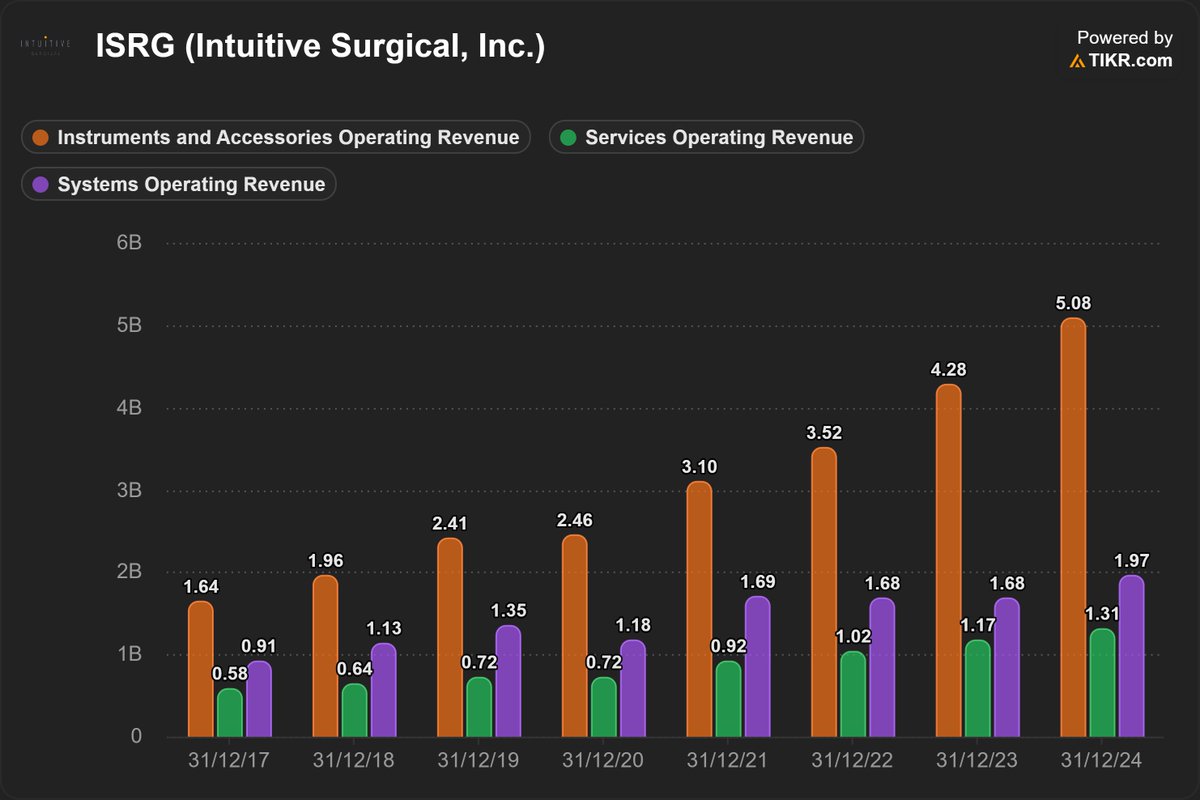

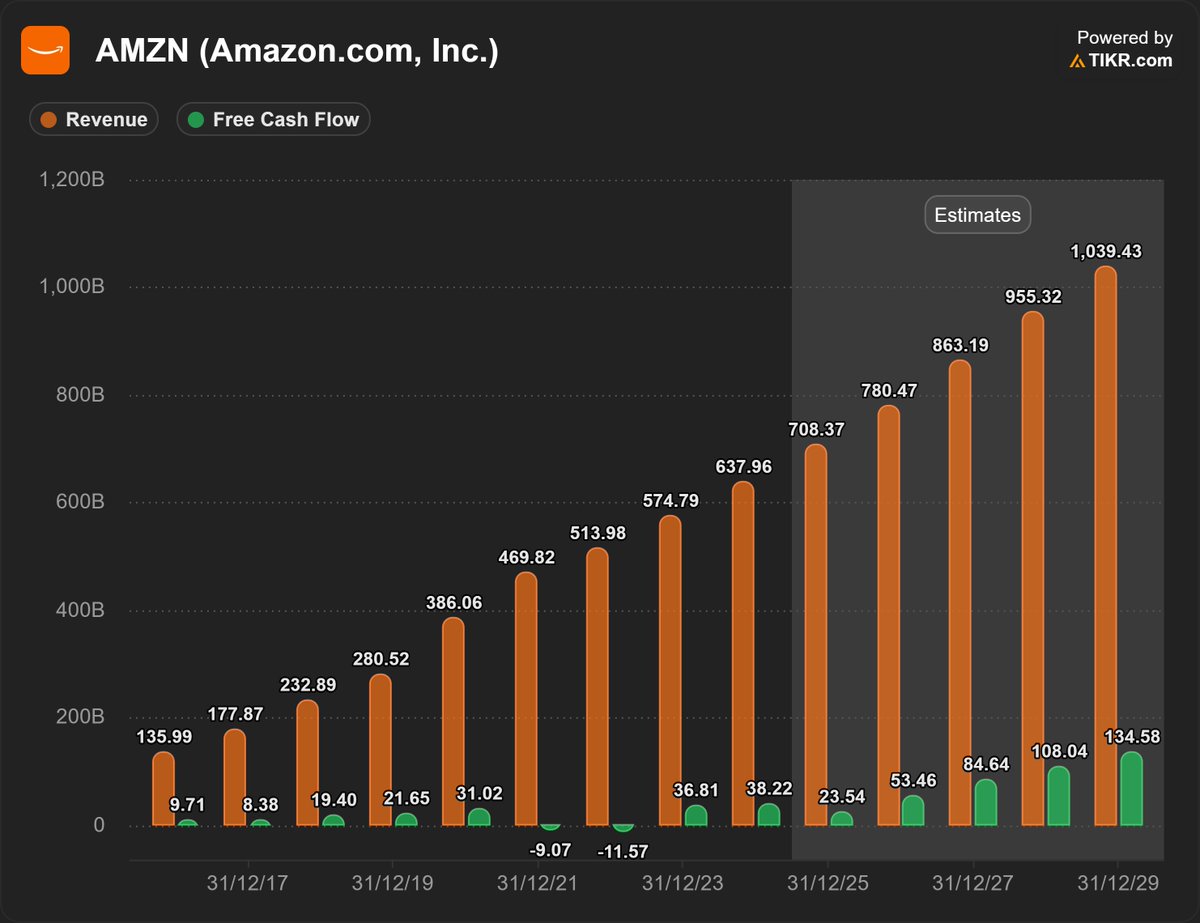

2. $GOOG - Alphabet

2. $GOOG - Alphabet

2. The Trade Desk $TTD

2. The Trade Desk $TTD

2. Alphabet $GOOG

2. Alphabet $GOOG

Copart, Inc. $CPRT

Copart, Inc. $CPRT

2. $OSCR - Oscar Health

2. $OSCR - Oscar Health

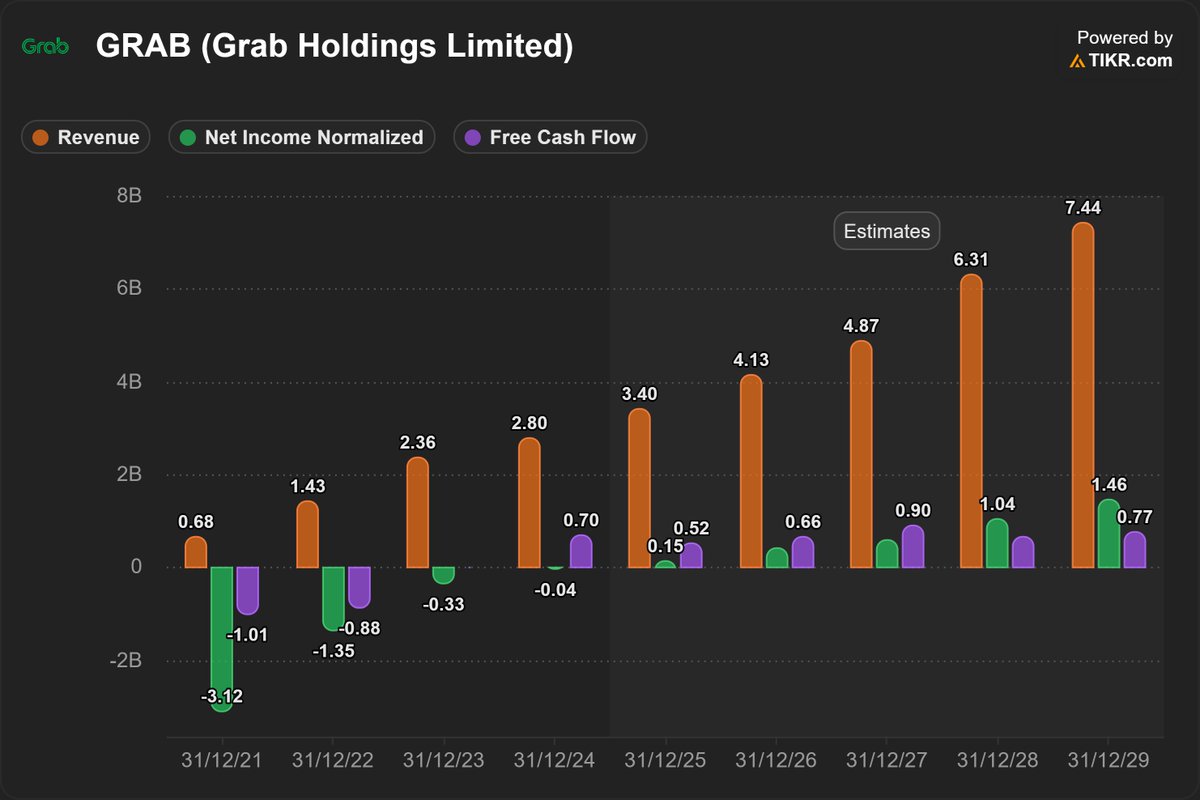

1. $DLO - DLocal Limited ($14)

1. $DLO - DLocal Limited ($14)

Before the 1960s, there was no easy way to know a person’s credit card history, so loan decisions were largely based on trust.

Before the 1960s, there was no easy way to know a person’s credit card history, so loan decisions were largely based on trust.

His Stock-Buying Criteria:

His Stock-Buying Criteria:

Tepper left Goldman Sachs in 1992 and founded Appaloosa Management in 1993 with $57 million in capital

Tepper left Goldman Sachs in 1992 and founded Appaloosa Management in 1993 with $57 million in capital

1) It's a boring business than operating in multiple industries like hospitality, gaming, casinos, hotels, and e-commerce, yet it's still growing, expanding, and adding new features.

1) It's a boring business than operating in multiple industries like hospitality, gaming, casinos, hotels, and e-commerce, yet it's still growing, expanding, and adding new features.

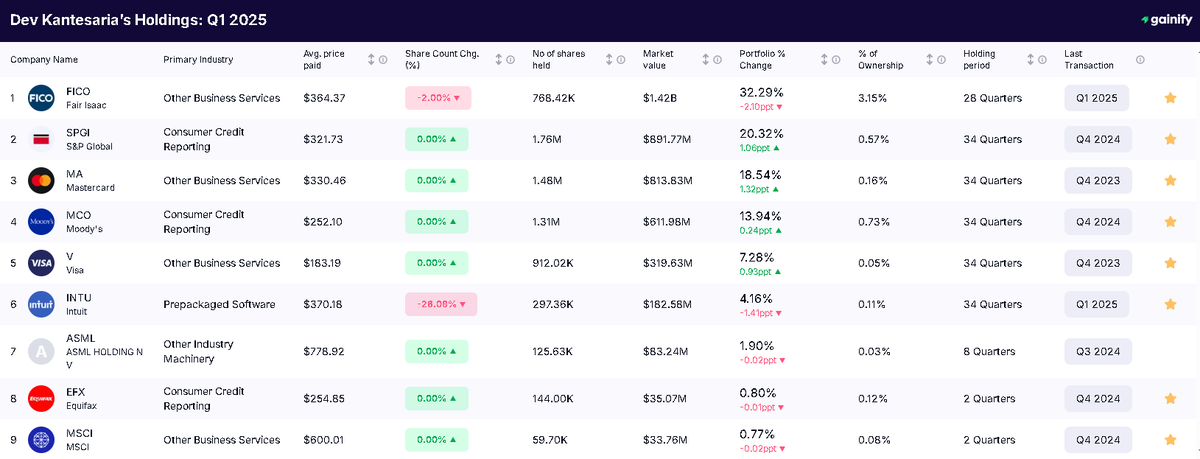

$MSCI is a company he recently added, and he will probably DCA in the coming months or years.

$MSCI is a company he recently added, and he will probably DCA in the coming months or years.