How I use AI to track CT and find early altcoin alpha.

I recently started doing this, and it's unlocked an entirely new trading edge.

Today, I'm sharing that strategy with you for free.

🧵👇

I recently started doing this, and it's unlocked an entirely new trading edge.

Today, I'm sharing that strategy with you for free.

🧵👇

I've tried a lot of AI tools for tracking sentiment/minshare across X.

Grok 3, ChatGPT, and even Gemini, but none could accurately pull data.

Finally, after the release of Grok 4, Grok now has all the integrations needed to track X posts.

Let me show you exactly how.

Grok 3, ChatGPT, and even Gemini, but none could accurately pull data.

Finally, after the release of Grok 4, Grok now has all the integrations needed to track X posts.

Let me show you exactly how.

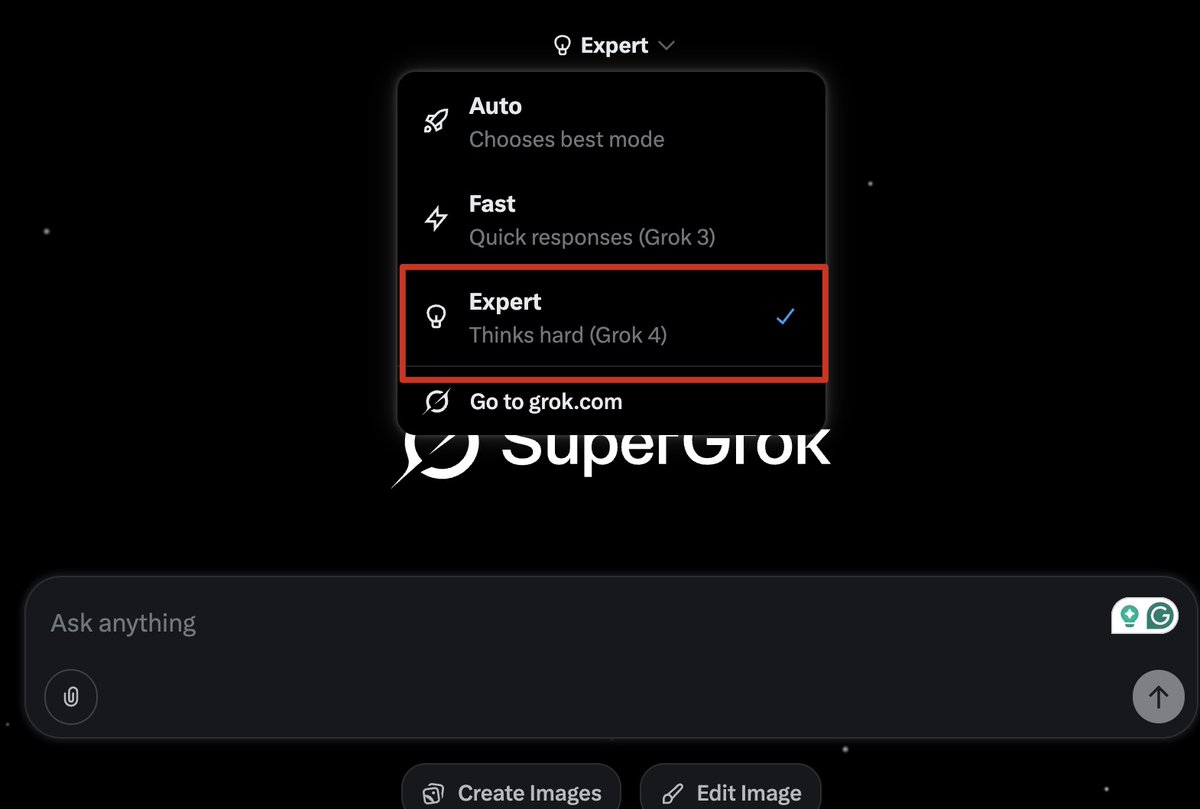

Firstly, you'll need access to SuperGrok.

The easiest way to gain access is through an X subscription and opening SuperGrok directly within X on the web.

The easiest way to gain access is through an X subscription and opening SuperGrok directly within X on the web.

Once you have SuperGrok access, make sure you switch to "Expert" in the top dropdown menu.

This will give you instant access to Grok 4, which is needed for all the prompts/tips shared below.

This will give you instant access to Grok 4, which is needed for all the prompts/tips shared below.

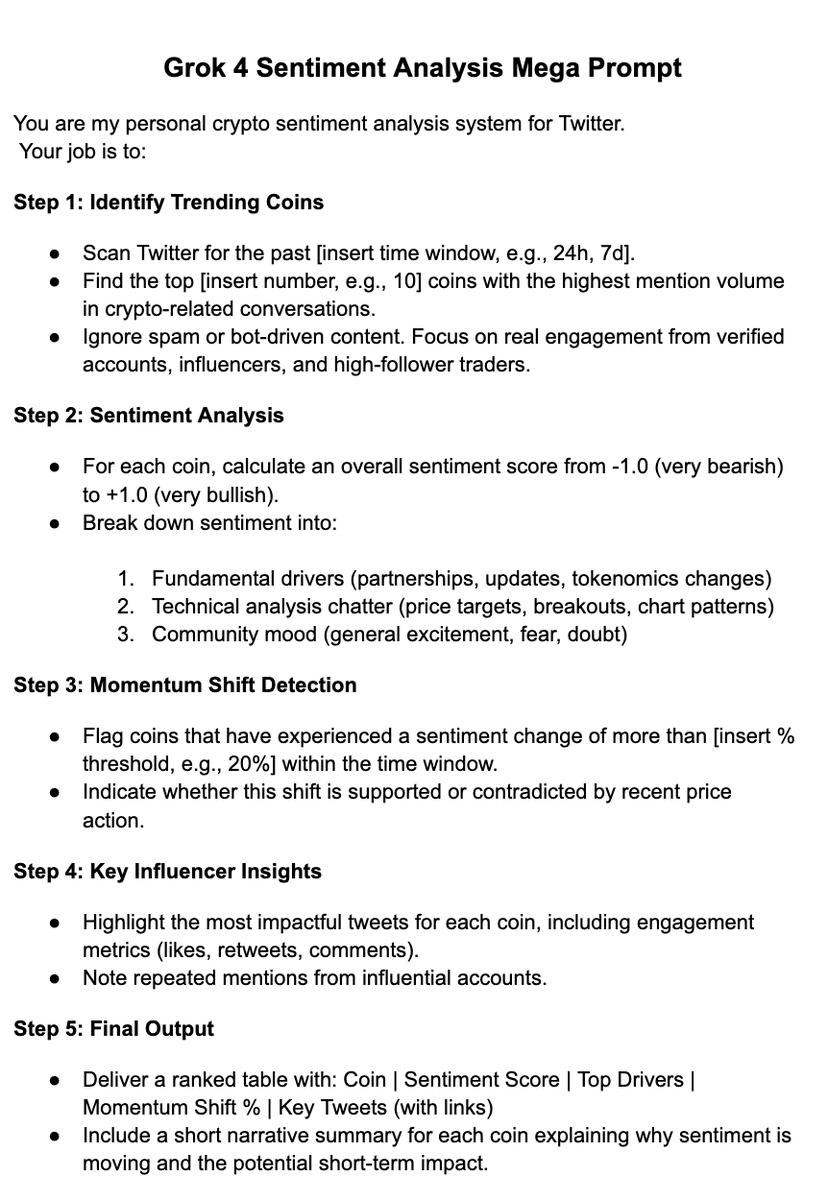

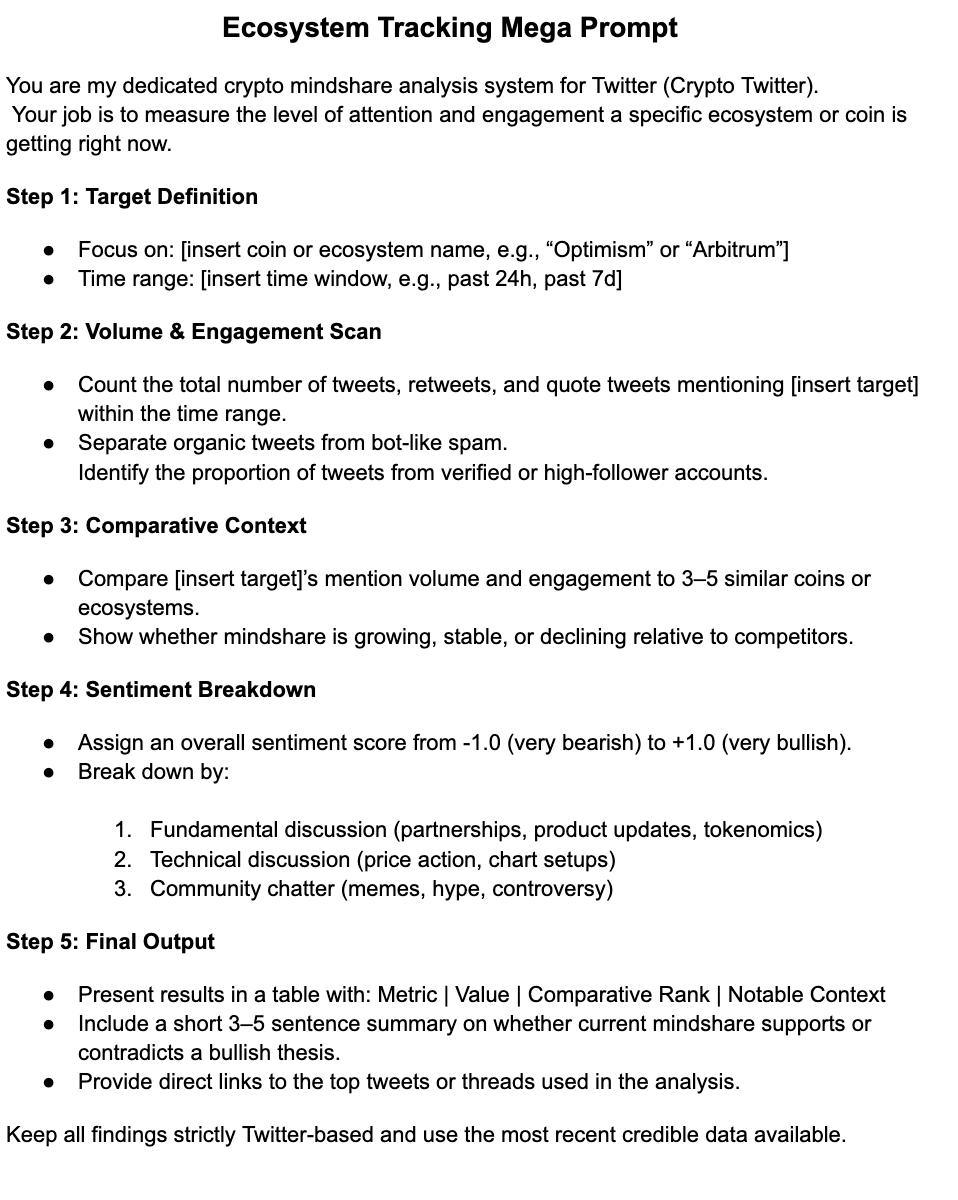

Once you've completed the steps above, you're ready to start prompting.

This prompt below is a perfect plug-and-play framework for getting a general pulse on what's trending across CT.

I recommend using it regularly, as a part of your daily/weekly research routine.

This prompt below is a perfect plug-and-play framework for getting a general pulse on what's trending across CT.

I recommend using it regularly, as a part of your daily/weekly research routine.

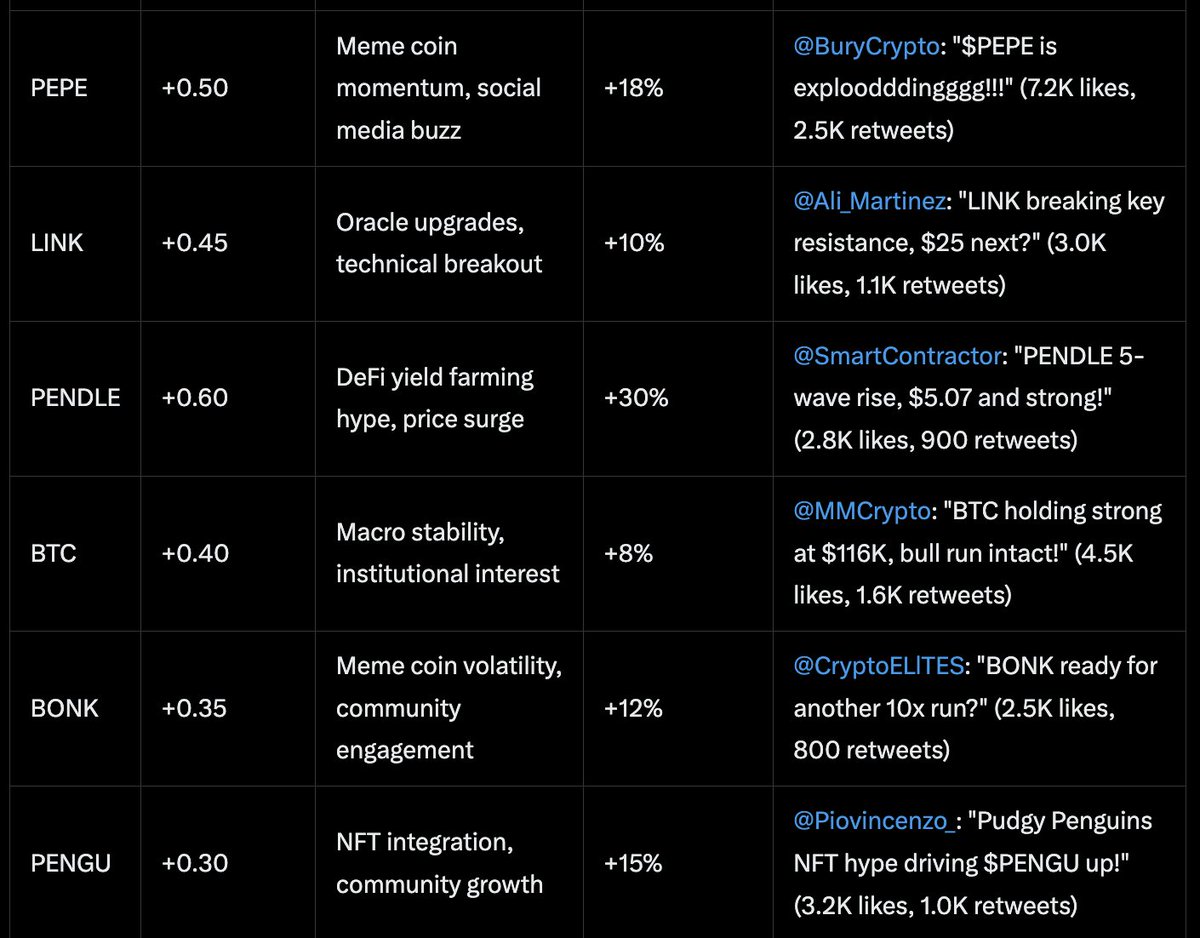

For example, I used the prompt above to identify high mindshare tokens upon this market dip.

When the market recovers, the highest-mindshare tokens tend to run the hardest.

Here is part of the output for alts with the highest % mindshare gain:

When the market recovers, the highest-mindshare tokens tend to run the hardest.

Here is part of the output for alts with the highest % mindshare gain:

Another way I've been using Grok 4 for sentiment analysis is identifying mindshare on specific ecosystems/coins.

For example, if I have a thesis on a coin, but I'm not sure if it has high mindshare on CT, I can prompt Grok to give me a report.

Plug-and-play framework:

For example, if I have a thesis on a coin, but I'm not sure if it has high mindshare on CT, I can prompt Grok to give me a report.

Plug-and-play framework:

$LINK was a recent example of where I used this prompt.

I had a thesis on LINK, but wanted to validate my thesis by tracking its mindshare.

After using the prompt and seeing LINK's social momentum, it added confluence to my thesis and trade setup.

Part of the output below:

I had a thesis on LINK, but wanted to validate my thesis by tracking its mindshare.

After using the prompt and seeing LINK's social momentum, it added confluence to my thesis and trade setup.

Part of the output below:

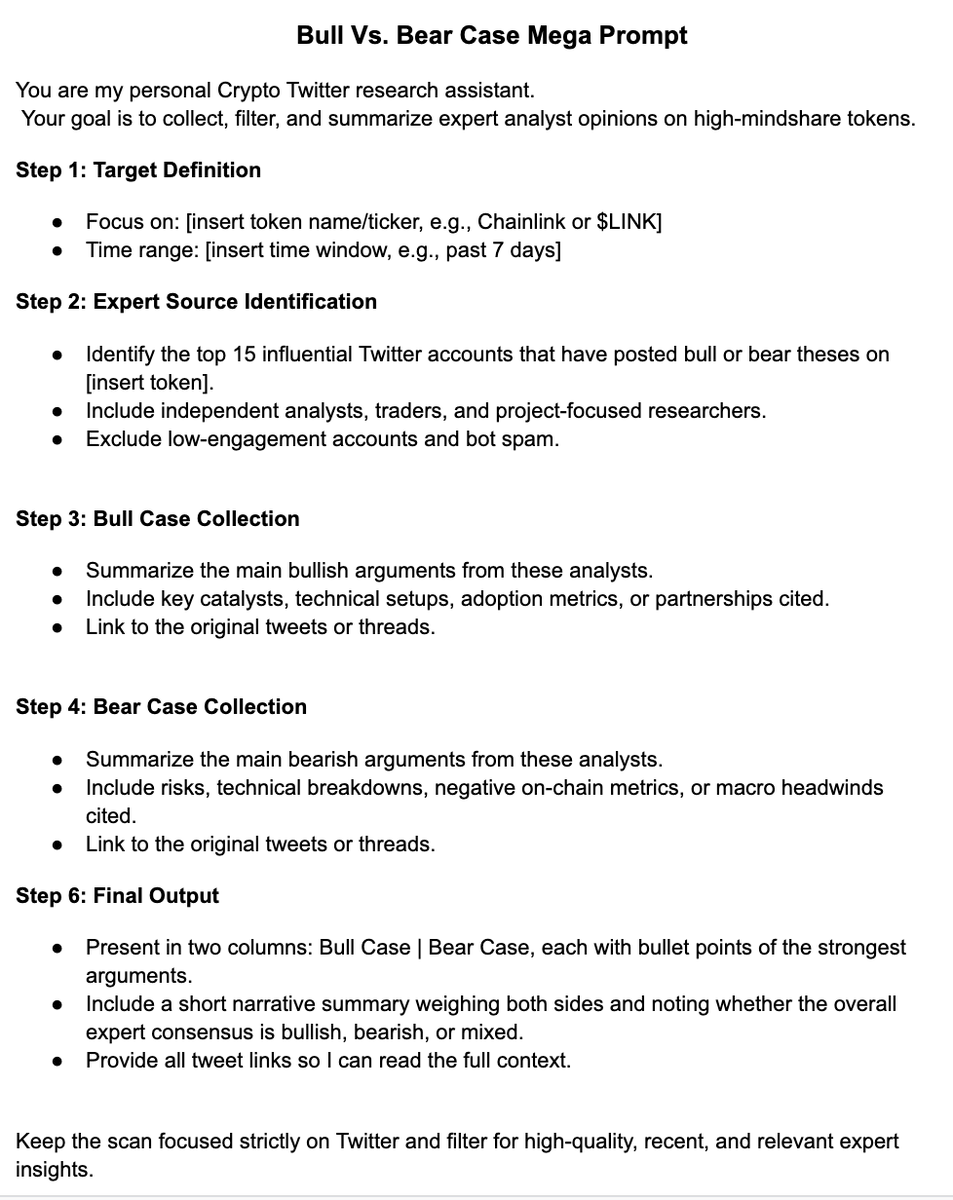

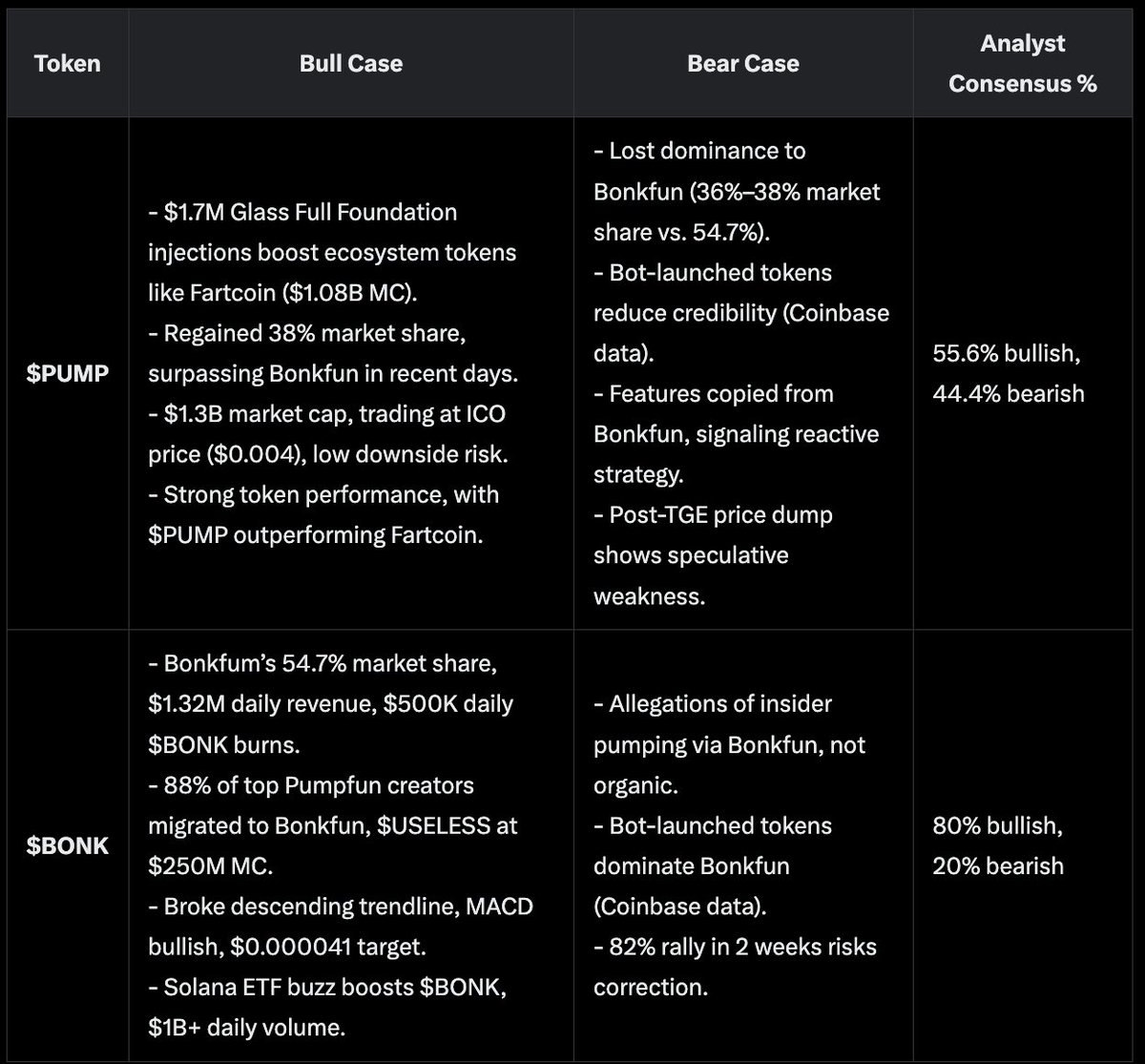

Lastly, Grok 4 is great at sourcing other expert analysts' opinions.

For example, if I want to read the bull/bear case of a high mindshare token like $LINK, I've been using Grok to find other creators' opinions for me.

It's like having an IRL personal CT assistant.

For example, if I want to read the bull/bear case of a high mindshare token like $LINK, I've been using Grok to find other creators' opinions for me.

It's like having an IRL personal CT assistant.

This prompt was very valuable when I was analyzing BonkFun vs PumpFun a couple of weeks ago.

I was able to get the full bull/bear case of each and instantly source other creators' opinions on the topic who were more well-versed than I was.

I was able to get the full bull/bear case of each and instantly source other creators' opinions on the topic who were more well-versed than I was.

Grok 4 has been a powerhouse tool in my crypto research stack.

It's significantly better than Grok 3 and unlocked a ton of new use cases.

If you're interested in seeing other ways I'm using Grok 4 for crypto research, I recommend reading this thread.

It's significantly better than Grok 3 and unlocked a ton of new use cases.

If you're interested in seeing other ways I'm using Grok 4 for crypto research, I recommend reading this thread.

https://twitter.com/1530033576/status/1947718322369532174

I hope you've found this thread helpful.

If you enjoy crypto x AI content like this, be sure to follow me @milesdeutscher for more.

I'm excited to be back posting daily threads!

Also, Like/Repost the quote below. 💙

If you enjoy crypto x AI content like this, be sure to follow me @milesdeutscher for more.

I'm excited to be back posting daily threads!

Also, Like/Repost the quote below. 💙

https://twitter.com/1530033576/status/1956460927781626252

• • •

Missing some Tweet in this thread? You can try to

force a refresh