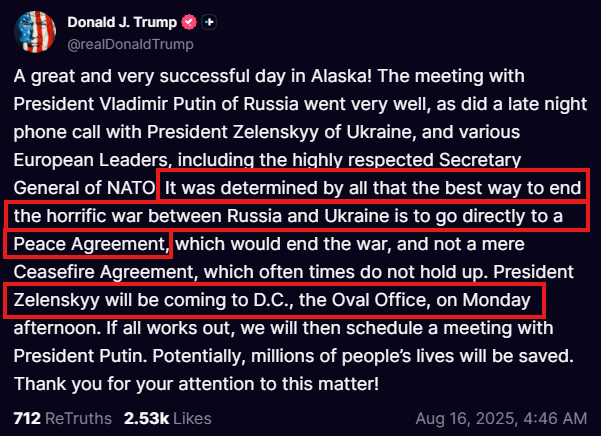

The Trump-Putin meeting has ended:

At 4:46 AM ET, Trump published a statement saying ALL parties want to "go directly to a Peace Agreement."

The implications of a direct peace agreement would be MASSIVE.

Is Trump about to end Europe's deadliest war since WW2?

(a thread)

At 4:46 AM ET, Trump published a statement saying ALL parties want to "go directly to a Peace Agreement."

The implications of a direct peace agreement would be MASSIVE.

Is Trump about to end Europe's deadliest war since WW2?

(a thread)

The Alaska meeting was expected to be ONLY between Putin and Trump.

However, Trump says Zelensky was also spoken with in a "late night call" along with EU leaders, including the NATO Secretary General.

This has led to a meeting on Monday and Zelensky is coming to the US.

However, Trump says Zelensky was also spoken with in a "late night call" along with EU leaders, including the NATO Secretary General.

This has led to a meeting on Monday and Zelensky is coming to the US.

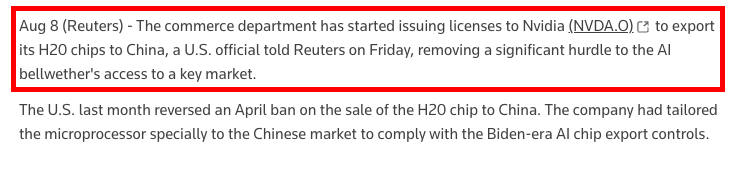

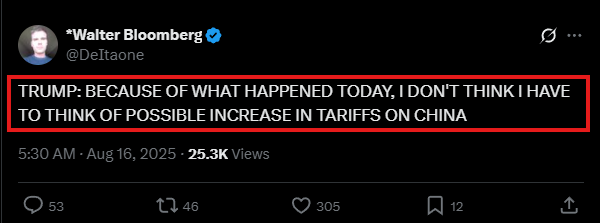

Prior to the meeting, Trump said failure to reach a peace deal would have economic implications.

He said he would likely penalize buyers of Russian oil, including China, if talks failed.

Now, Trump said "I don't think I have to think of possible increase in tariffs on China."

He said he would likely penalize buyers of Russian oil, including China, if talks failed.

Now, Trump said "I don't think I have to think of possible increase in tariffs on China."

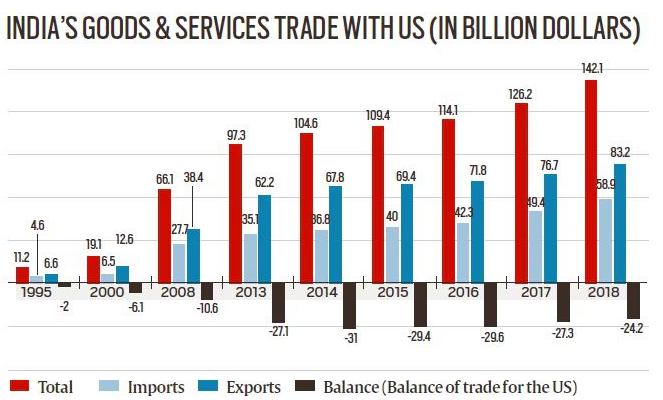

This is exactly what happened on August 6th, when President Trump raised tariffs on India by 25%.

India now pays a 50% tariff to the US, half for buying Russian oil.

If a peace agreement is reached, we believe these tariffs will also be rolled back.

This would be massive.

India now pays a 50% tariff to the US, half for buying Russian oil.

If a peace agreement is reached, we believe these tariffs will also be rolled back.

This would be massive.

Here are the initial takeaways from the Alaska meeting:

1. Trump says meeting with Putin "was a 10" out of 10

2. Trump says “one or two significant items” remain unresolved

3. Trump says Zelensky will visit US on Monday

4. Zelensky says he had a 90-minute call with Trump

1. Trump says meeting with Putin "was a 10" out of 10

2. Trump says “one or two significant items” remain unresolved

3. Trump says Zelensky will visit US on Monday

4. Zelensky says he had a 90-minute call with Trump

Initial takeaways continued:

5. Zelensky says Ukraine is ready for “constructive cooperation”

6. Zelensky notes “positive signals” from US on security guarantees

7. No comment from Putin or Kremlin so far

This appears to be the most promising peace talk meeting yet.

5. Zelensky says Ukraine is ready for “constructive cooperation”

6. Zelensky notes “positive signals” from US on security guarantees

7. No comment from Putin or Kremlin so far

This appears to be the most promising peace talk meeting yet.

There would be many implications of ending this 3+ year war.

First, thousands of deaths per week would be eliminated.

Some estimates show that Russian losses ALONE are running at over 1,000+ people per DAY.

Including Ukrainian losses, this number could be over 2,000+ per day.

First, thousands of deaths per week would be eliminated.

Some estimates show that Russian losses ALONE are running at over 1,000+ people per DAY.

Including Ukrainian losses, this number could be over 2,000+ per day.

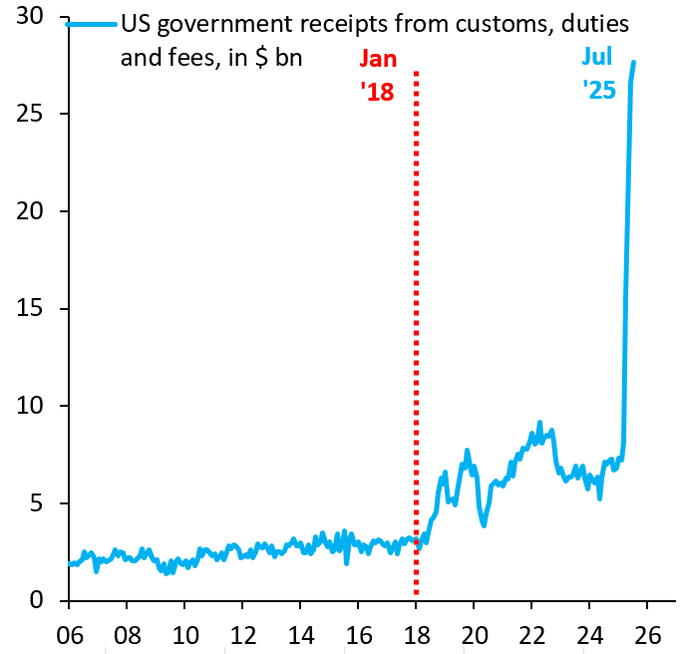

The economic implications of this war ending would also be huge:

In the early days of the war, natural gas prices spiked 10x higher than pre-war levels.

Since then, sanctions have been levied on Russian energy, including oil.

These sanctions would likely drop off.

In the early days of the war, natural gas prices spiked 10x higher than pre-war levels.

Since then, sanctions have been levied on Russian energy, including oil.

These sanctions would likely drop off.

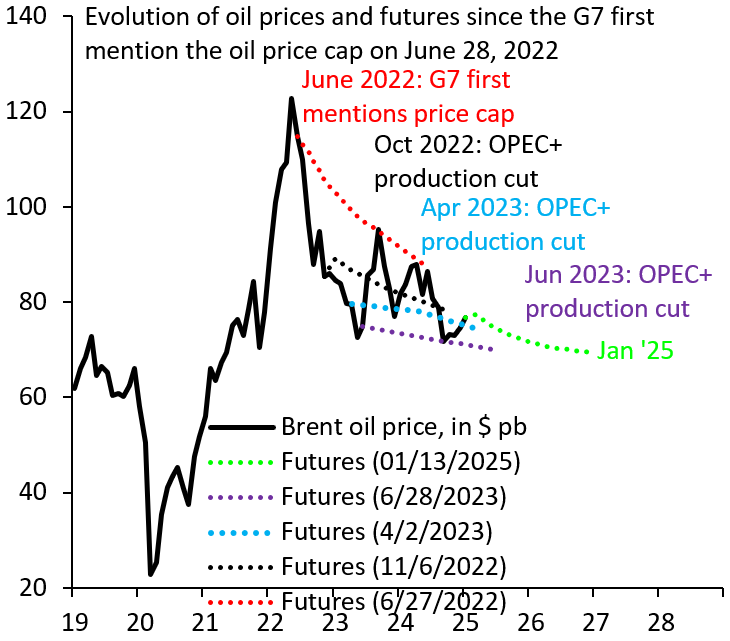

Oil prices have traded at a premium since the war began in Ukraine.

Since the G7 imposed a $60 cap on Russian oil, supply has been lower.

The EU also now has a $47.60 cap on Russian oil prices.

Removing this cap would likely send oil below $50 and inflation toward 2%.

Since the G7 imposed a $60 cap on Russian oil, supply has been lower.

The EU also now has a $47.60 cap on Russian oil prices.

Removing this cap would likely send oil below $50 and inflation toward 2%.

In anticipation of a peace deal, wheat prices have fallen to a 5-year low.

Ukraine exports grains to nearly 400 MILLION people world-wide.

Food inflation has been elevated as a result of sharply declining Ukrainian grain exports during the war.

Prices would fall further.

Ukraine exports grains to nearly 400 MILLION people world-wide.

Food inflation has been elevated as a result of sharply declining Ukrainian grain exports during the war.

Prices would fall further.

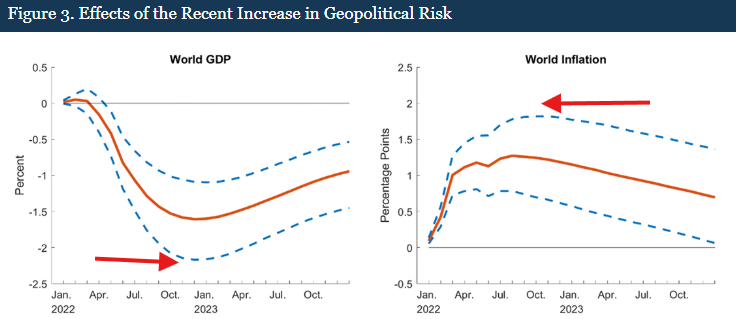

According to the US Fed, the war added up to 2% to global inflation.

The reversal of sanctions on Russia, now one of the most sanctioned countries in the world, would be huge.

It would also allow Ukraine to ramp up exports.

Global inflation would likely fall by 100+ bps.

The reversal of sanctions on Russia, now one of the most sanctioned countries in the world, would be huge.

It would also allow Ukraine to ramp up exports.

Global inflation would likely fall by 100+ bps.

Monday's meeting with Zelensky will be crucial and ending this war would be historic.

Even Hillary Clinton has said she would nominate Trump for the Nobel Peace Prize if he strikes a no-land-loss peace deal.

We expect a positive market reaction on Monday to these developments.

Even Hillary Clinton has said she would nominate Trump for the Nobel Peace Prize if he strikes a no-land-loss peace deal.

We expect a positive market reaction on Monday to these developments.

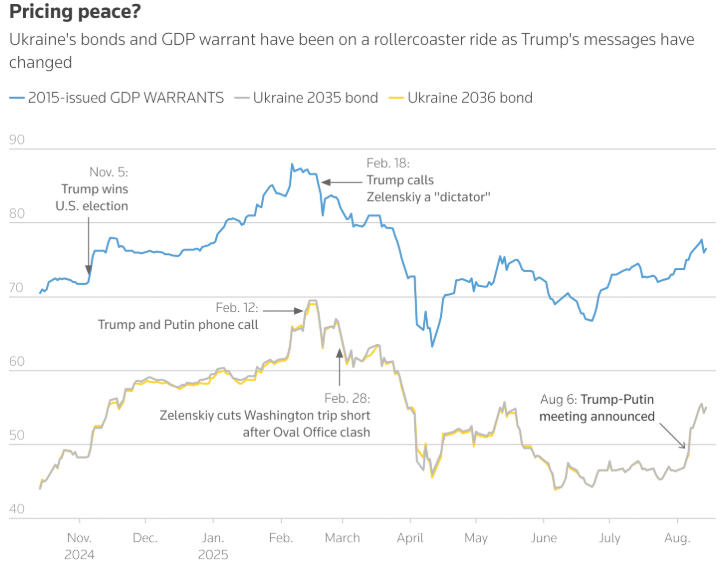

Lastly, the market is pricing-in a potential peace agreement.

Ukrainian bonds have jumped sharply since the Alaska meeting was announced.

Keep watching markets as a leading indicator as talks progress.

Follow us @KobeissiLetter for real time analysis as this develops.

Ukrainian bonds have jumped sharply since the Alaska meeting was announced.

Keep watching markets as a leading indicator as talks progress.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh