Treasury bills are more tax efficient than savings accounts or CDs.

Yet 99% don't know much about them.

Here’s why they are the best place for your cash:

Yet 99% don't know much about them.

Here’s why they are the best place for your cash:

Treasury Bills (T-Bills) are short term debt securities backed by the U.S. government.

They come in maturities of 4, 8, 13, 17, 26 and 52 weeks.

T-Bills are sold at a discount and pay you their full face value at maturity. The difference is your interest.

They come in maturities of 4, 8, 13, 17, 26 and 52 weeks.

T-Bills are sold at a discount and pay you their full face value at maturity. The difference is your interest.

Example:

A $10,000 4-week T-Bill sells at auction for a discount rate of 4.23%.

Price = 10,000 * (1 – (0.0423 * 28) / 360) = $9,967.

After 4 weeks, you'll receive $10,000 and earned $37 in "interest"

A $10,000 4-week T-Bill sells at auction for a discount rate of 4.23%.

Price = 10,000 * (1 – (0.0423 * 28) / 360) = $9,967.

After 4 weeks, you'll receive $10,000 and earned $37 in "interest"

These T-bills can be purchased directly from banks, brokers (i.e. Fidelity or Vanguard) or from the U.S. Treasury directly through TreasuryDirect.

The big benefit of T-bills over your savings account or CDs is taxes.

Here's why...

The big benefit of T-bills over your savings account or CDs is taxes.

Here's why...

Interest income from T-bills is exempt from state and local taxes.

If a HYSA and a Treasury bill both give you $1,000 of interest, you'd pay $50 in state tax on the HYSA earnings (assuming a 5% rate).

But with T-bills, you'd keep the full $1,000.

This adds up over time.

If a HYSA and a Treasury bill both give you $1,000 of interest, you'd pay $50 in state tax on the HYSA earnings (assuming a 5% rate).

But with T-bills, you'd keep the full $1,000.

This adds up over time.

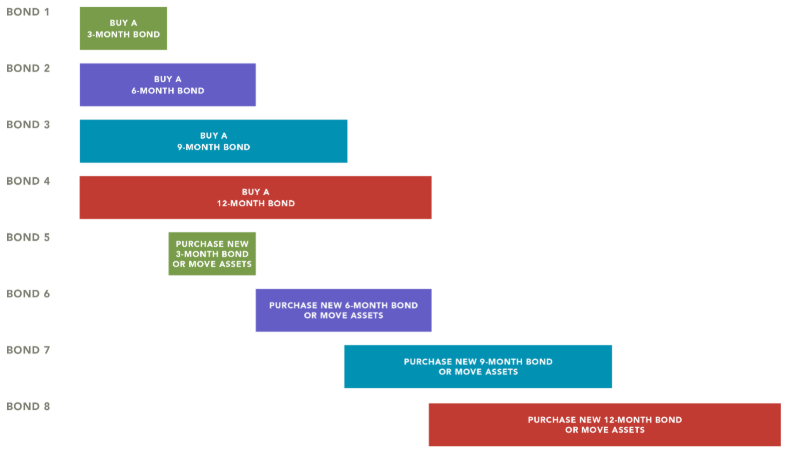

Some people use the Ladder strategy, where you buy T-bills of varying maturities to maximize liquidity.

For example, you can buy a 4-week T-bill in Week 1, another in Week 2, and so on.

After 4 weeks, a T-bill will mature every week, similarly to this:

For example, you can buy a 4-week T-bill in Week 1, another in Week 2, and so on.

After 4 weeks, a T-bill will mature every week, similarly to this:

What this accomplishes is that after the initial 4 week period, you'll have a T-bill paying you interest every single week (assuming you get the 4, 4 week ladder)

This way, you don't have to sell your T-bills before maturity if you need to access your funds.

This way, you don't have to sell your T-bills before maturity if you need to access your funds.

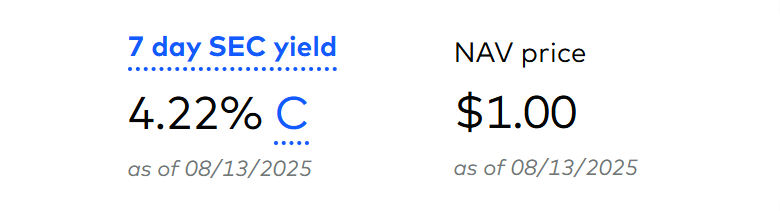

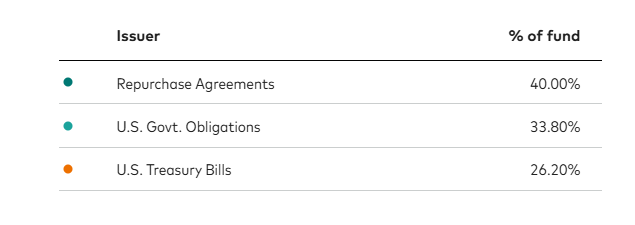

If you don’t want to buy T-bills directly, you could buy a Money Market Fund that invests only in Treasury Bills.

Of course, with convenience comes a small expense, as these funds charge management fees of 0.07%-0.15%.

Some examples...

Of course, with convenience comes a small expense, as these funds charge management fees of 0.07%-0.15%.

Some examples...

1. $VUSXX - Vanguard Treasury Money Market Fund (4.24%, 0.07% expense ratio)

2. $FDLXX - Fidelity Treasury Money Market Fund (3.94%, 0.42% expense ratio)

3. $SNSXX - Schwab Treasury Money Market Fund (3.97%, 0.34%)

There are also ETF versions like $VBIL, $SGOV, $BIL.

2. $FDLXX - Fidelity Treasury Money Market Fund (3.94%, 0.42% expense ratio)

3. $SNSXX - Schwab Treasury Money Market Fund (3.97%, 0.34%)

There are also ETF versions like $VBIL, $SGOV, $BIL.

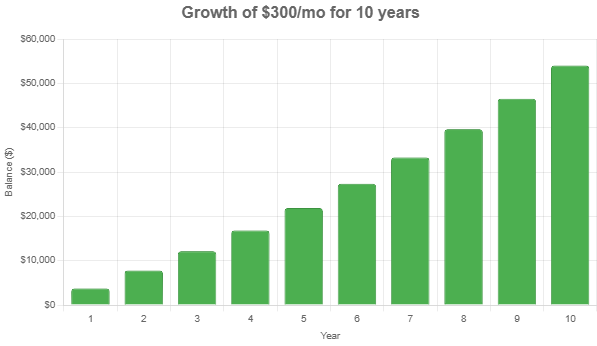

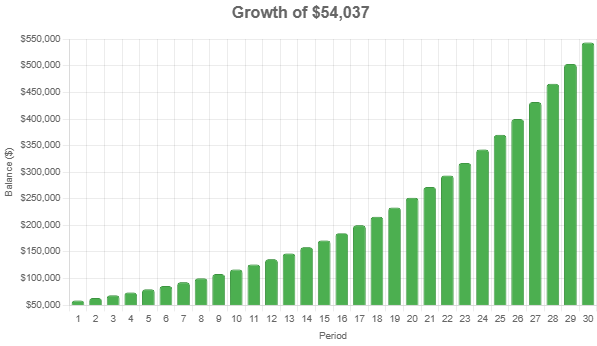

Keep in mind once the Fed lowers interest rates, this will impact the yield of T-bills, similar to your HYSA.

I hope you know that holding T-bills is not a good long term strategy and should ONLY be used for your emergency savings or future cash needs (i.e. down payment)

I hope you know that holding T-bills is not a good long term strategy and should ONLY be used for your emergency savings or future cash needs (i.e. down payment)

So many people keep their cash in savings accounts and overpay on taxes.

Please help spread this message by:

1. reposting the first post

2. sending this post to a friend or family

3. following me @money_cruncher for more tips!

Please help spread this message by:

1. reposting the first post

2. sending this post to a friend or family

3. following me @money_cruncher for more tips!

P.S. If you liked this thread, you'll enjoy my newsletter.

Every week, I share tips on how to save money on taxes, build wealth and invest.

Join 18,000+ subscribers: TheCrunch.co

Every week, I share tips on how to save money on taxes, build wealth and invest.

Join 18,000+ subscribers: TheCrunch.co

• • •

Missing some Tweet in this thread? You can try to

force a refresh