🚨WEF Just Gave the Keys to BlackRock and XRP Is at the Center of It

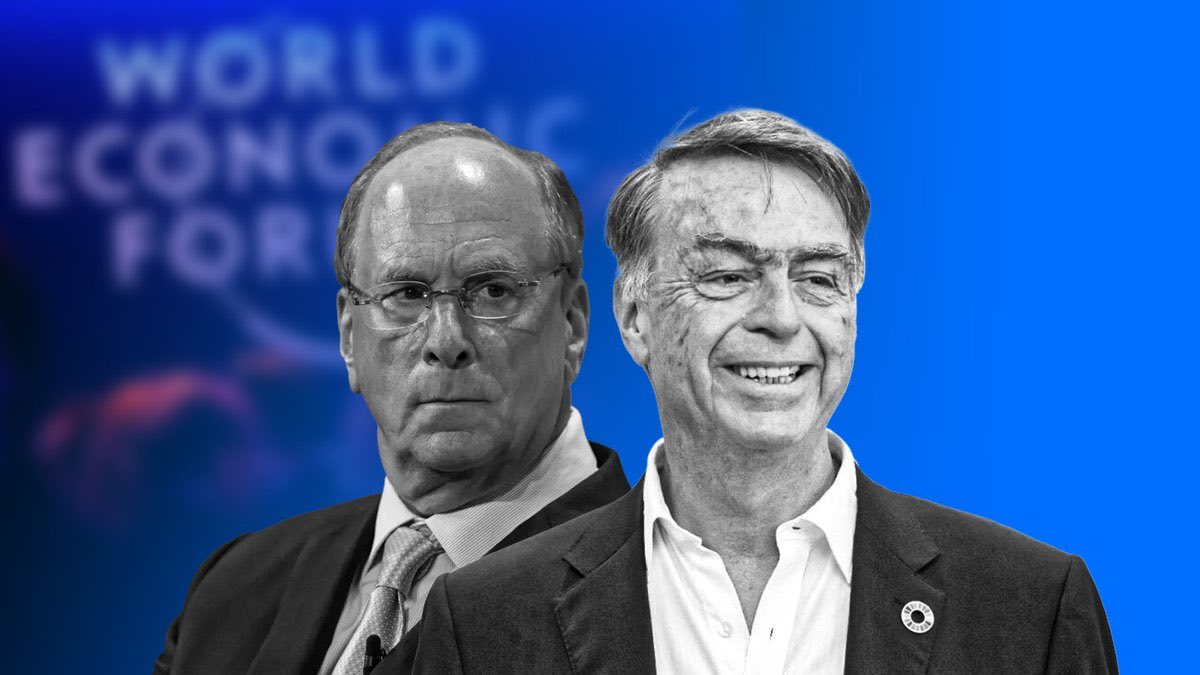

Larry Fink & André Hoffmann have been appointed interim co-chairs of the World Economic Forum.

This is the consolidation of global finance under a cartel that has already set its eyes on the XRP Ledger. 🧵👇

Larry Fink & André Hoffmann have been appointed interim co-chairs of the World Economic Forum.

This is the consolidation of global finance under a cartel that has already set its eyes on the XRP Ledger. 🧵👇

2/7

BlackRock manages $10 trillion. The WEF is the mouthpiece for global governance.

When the two merge, you don’t get “policy discussions.” You get execution of a new architecture: tokenized markets, auditable rails, programmable money.

BlackRock manages $10 trillion. The WEF is the mouthpiece for global governance.

When the two merge, you don’t get “policy discussions.” You get execution of a new architecture: tokenized markets, auditable rails, programmable money.

3/7

Why XRP Ledger?

Because unlike BTC or ETH, XRPL already runs with central bank–level compliance, speed, and neutrality. Ripple has the institutional deals. BlackRock has the capital. WEF has the political cover. The rails are already live.

Why XRP Ledger?

Because unlike BTC or ETH, XRPL already runs with central bank–level compliance, speed, and neutrality. Ripple has the institutional deals. BlackRock has the capital. WEF has the political cover. The rails are already live.

4/7

Now here’s the buried clue: BlackRock’s ETF named $XDNA. At the same time, DNA Protocol on XRPL emerges: @DNAOnChain with its own native $XDNA. Coincidence? Or signaling?

Both are aimed at tokenizing the genome, the ultimate Real World Asset.

Now here’s the buried clue: BlackRock’s ETF named $XDNA. At the same time, DNA Protocol on XRPL emerges: @DNAOnChain with its own native $XDNA. Coincidence? Or signaling?

Both are aimed at tokenizing the genome, the ultimate Real World Asset.

5/7

DNA Protocol is onboarding labs globally, anchoring human identity to XRPL. Imagine what happens when WEF + BlackRock get to position themselves as gatekeepers of genomic finance, your biological “ID” tied to a ledger they already control.

DNA Protocol is onboarding labs globally, anchoring human identity to XRPL. Imagine what happens when WEF + BlackRock get to position themselves as gatekeepers of genomic finance, your biological “ID” tied to a ledger they already control.

6/7

This is why the elites are quiet on XRP price action. The ledger isn’t a “speculative coin”, it’s the backbone for their new operating system. The missing Pentagon trillions, the secret ETFs, the sudden WEF appointments… all are converging here.

This is why the elites are quiet on XRP price action. The ledger isn’t a “speculative coin”, it’s the backbone for their new operating system. The missing Pentagon trillions, the secret ETFs, the sudden WEF appointments… all are converging here.

7/7

The BlackRock-WEF partnership isn’t about Davos panels. It’s about enshrining XRP Ledger as the final clearing layer.

And with DNA Protocol (@DNAOnChain ), they’re not just after money. They’re after the code of life.

The BlackRock-WEF partnership isn’t about Davos panels. It’s about enshrining XRP Ledger as the final clearing layer.

And with DNA Protocol (@DNAOnChain ), they’re not just after money. They’re after the code of life.

/END

I’m building an intel team to track this convergence.

Exclusive documents, hidden links, and deeper analysis will only drop inside my Telegram.

👉 Join now: t.me/alexanderthewh…

I’m building an intel team to track this convergence.

Exclusive documents, hidden links, and deeper analysis will only drop inside my Telegram.

👉 Join now: t.me/alexanderthewh…

• • •

Missing some Tweet in this thread? You can try to

force a refresh