Scaling is the only way to take trading from “side income” to life-changing wealth

But most traders are stuck recycling the same few thousand dollars & never take off

Here’s the foolproof way to scale until your account goes parabolic:

🧵

But most traders are stuck recycling the same few thousand dollars & never take off

Here’s the foolproof way to scale until your account goes parabolic:

🧵

Two traders start trading on the same day.

Same account size, same skill level.

5 years later:

Trader A: multiple 5-figures every month

Trader B: same results as day 1

Why the massive gap?

Same account size, same skill level.

5 years later:

Trader A: multiple 5-figures every month

Trader B: same results as day 1

Why the massive gap?

The difference boils down to this:

Trader A simply put himself in a position to scale his account… and he did.

Trader B never did, so he never grew.

Trader A simply put himself in a position to scale his account… and he did.

Trader B never did, so he never grew.

So how do you put yourself in a position to scale?

First, find an edge you can scale easily (this is where most fail)

Trade it consistently & increase size the right way

Let’s break it down:

First, find an edge you can scale easily (this is where most fail)

Trade it consistently & increase size the right way

Let’s break it down:

1) Find a scalable edge

Not all edges are created equal. Your edge needs to survive under pressure.

If it relies on instinct, it’ll collapse when you’re stressed.

But mechanical rules will scale forever.

Want to scale? Go mechanical.

Not all edges are created equal. Your edge needs to survive under pressure.

If it relies on instinct, it’ll collapse when you’re stressed.

But mechanical rules will scale forever.

Want to scale? Go mechanical.

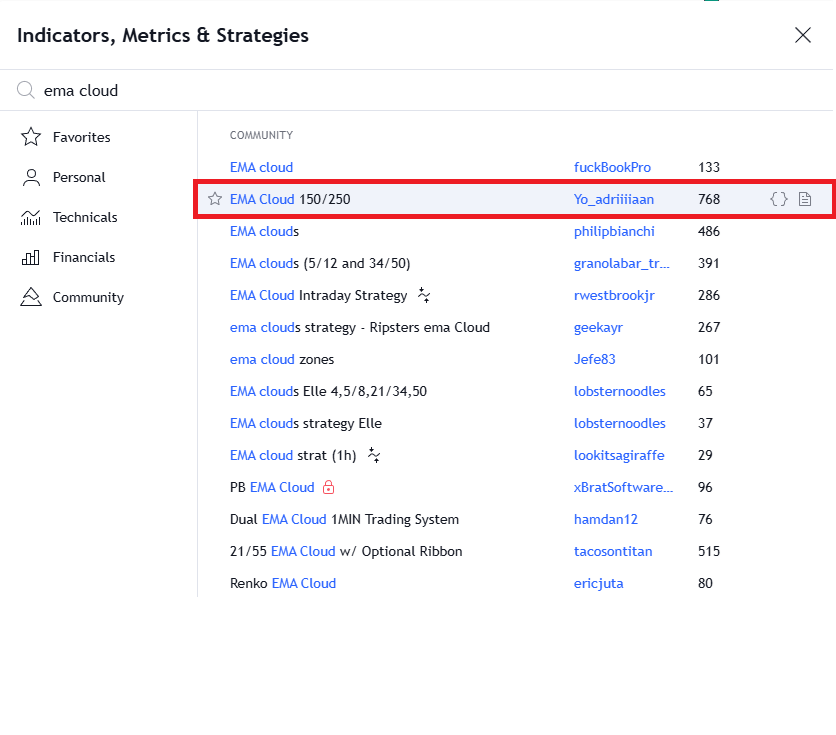

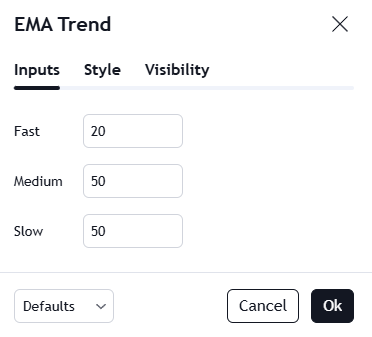

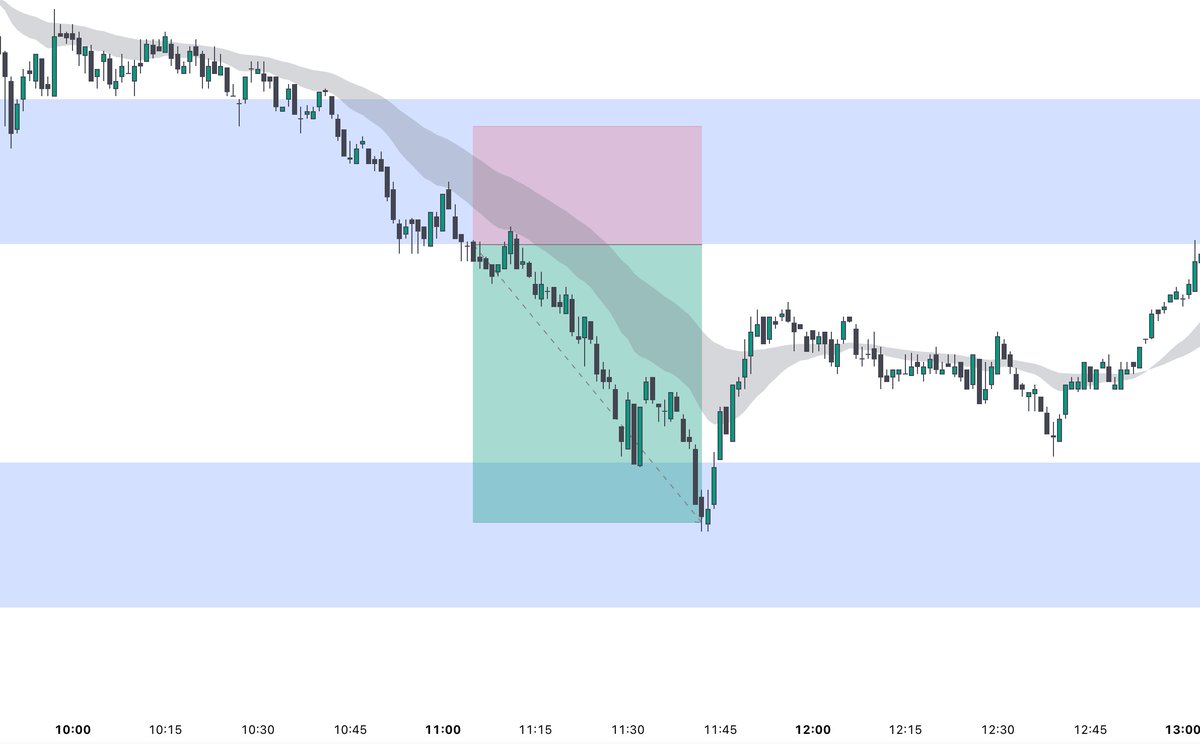

I trade the LCE model, a mechanical system so simple your dog could do it.

If you can pull $100/day consistently, scaling to $1k+/day is automatic.

I break it all down in this thread:

If you can pull $100/day consistently, scaling to $1k+/day is automatic.

I break it all down in this thread:

https://x.com/Tradewrite/status/1952547164183511543

2) Make failure impossible

Our #1 risk is blowing up & having to start from zero

Scaling isn’t about “going big”

It’s about staying alive long enough to let compounding do its work.

Your edge will produce consistent profit, but risk management decides if you keep it.

Our #1 risk is blowing up & having to start from zero

Scaling isn’t about “going big”

It’s about staying alive long enough to let compounding do its work.

Your edge will produce consistent profit, but risk management decides if you keep it.

Just follow these 4 rules:

- Only 1–2 trades a day

- Hard max daily loss (never break it)

- Same size every trade

- Accept the outcome, never force PnL

This will keep you consistent & protect your profit.

- Only 1–2 trades a day

- Hard max daily loss (never break it)

- Same size every trade

- Accept the outcome, never force PnL

This will keep you consistent & protect your profit.

3) Scale to your limits - but not past it

Now that you have an edge to generate profit & rules to protect them,

Your growth has no ceiling.

You can double your size every week & grow aggressively,

But here’s the smarter path:

Now that you have an edge to generate profit & rules to protect them,

Your growth has no ceiling.

You can double your size every week & grow aggressively,

But here’s the smarter path:

There’s nothing stopping you from trading enormous size.

The only resistance is in your head.

But that doesn’t mean it’s not real.

Trying to scale too fast is like trying to lift 400 lbs just because you learned how to lift 50.

The only resistance is in your head.

But that doesn’t mean it’s not real.

Trying to scale too fast is like trying to lift 400 lbs just because you learned how to lift 50.

If you rush it, you’ll choke.

Don’t trade 10 accounts at once after you got your first payout on one.

Build the stairs as you go.

Double your risk slowly and add accounts when you’re ready

Don’t trade 10 accounts at once after you got your first payout on one.

Build the stairs as you go.

Double your risk slowly and add accounts when you’re ready

As your account grows, so does your ability to handle size.

Don’t aim for home runs.

Aim for base hits, and keep scaling those base hits until your average base hit is the size of a home run.

Don’t aim for home runs.

Aim for base hits, and keep scaling those base hits until your average base hit is the size of a home run.

Most traders never leave the “few thousand in, few thousand out” cycle.

I help traders break that ceiling & scale into consistent 5-figure months.

See exactly how:

thetradewriter.com/lce-mentorship…

I help traders break that ceiling & scale into consistent 5-figure months.

See exactly how:

thetradewriter.com/lce-mentorship…

• • •

Missing some Tweet in this thread? You can try to

force a refresh