A company called "Nexus Network" wrote to my personal email wanting long-term advice on "UK Regulatory Dynamics".

I've never heard of "UK Regulatory Dynamics". It's certainly not my field; I'm not sure it's anyone's field.

And Nexus Network looks rather "off".

I've never heard of "UK Regulatory Dynamics". It's certainly not my field; I'm not sure it's anyone's field.

And Nexus Network looks rather "off".

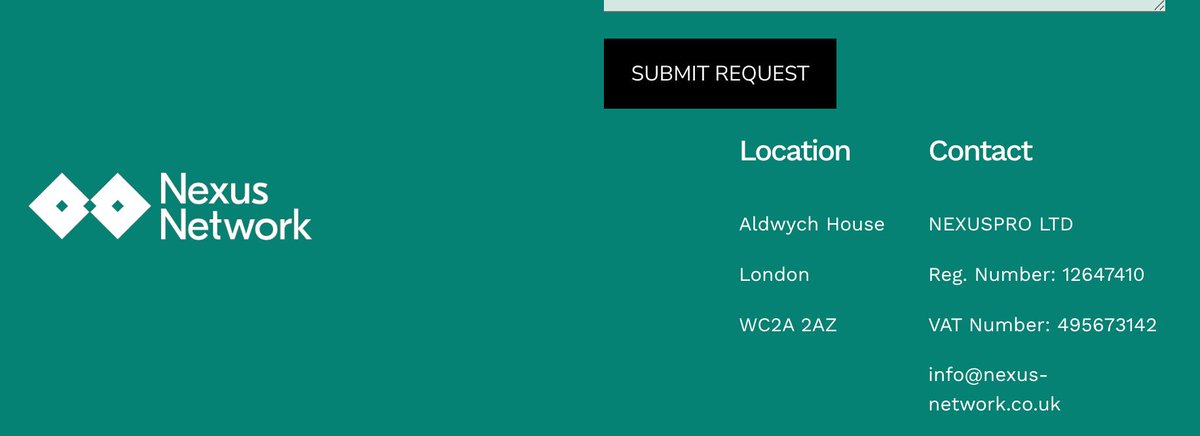

The email gives Nexus's address as 20-22 Wenlock Road, London, N1 7GU, UK, but the Nexus website says it’s Aldwych House, London WC2A 2AZ. Neither email nor website gave the name of the company, which is (1) weird and (2) an offence.

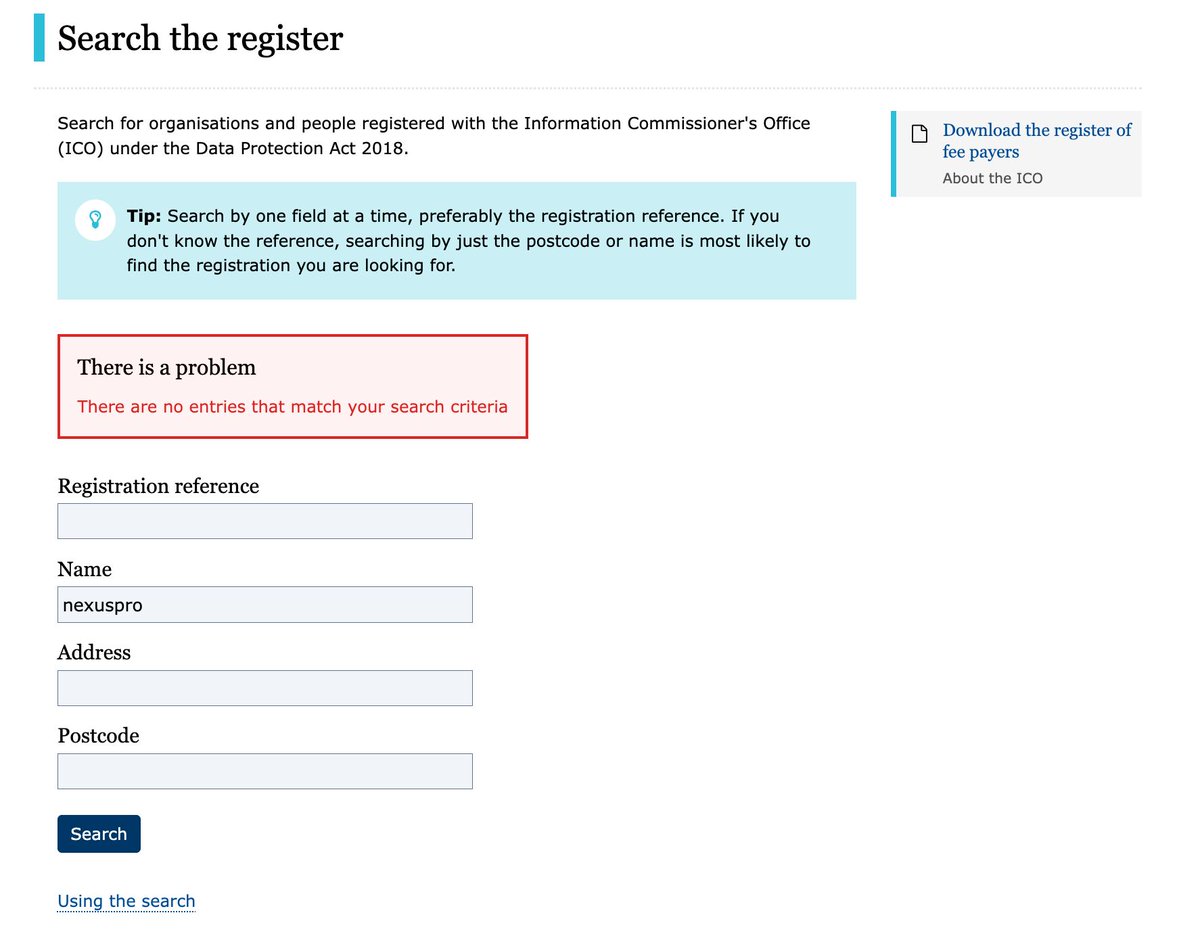

The company is actually NexusPro Limited, which has the Aldwych House address.

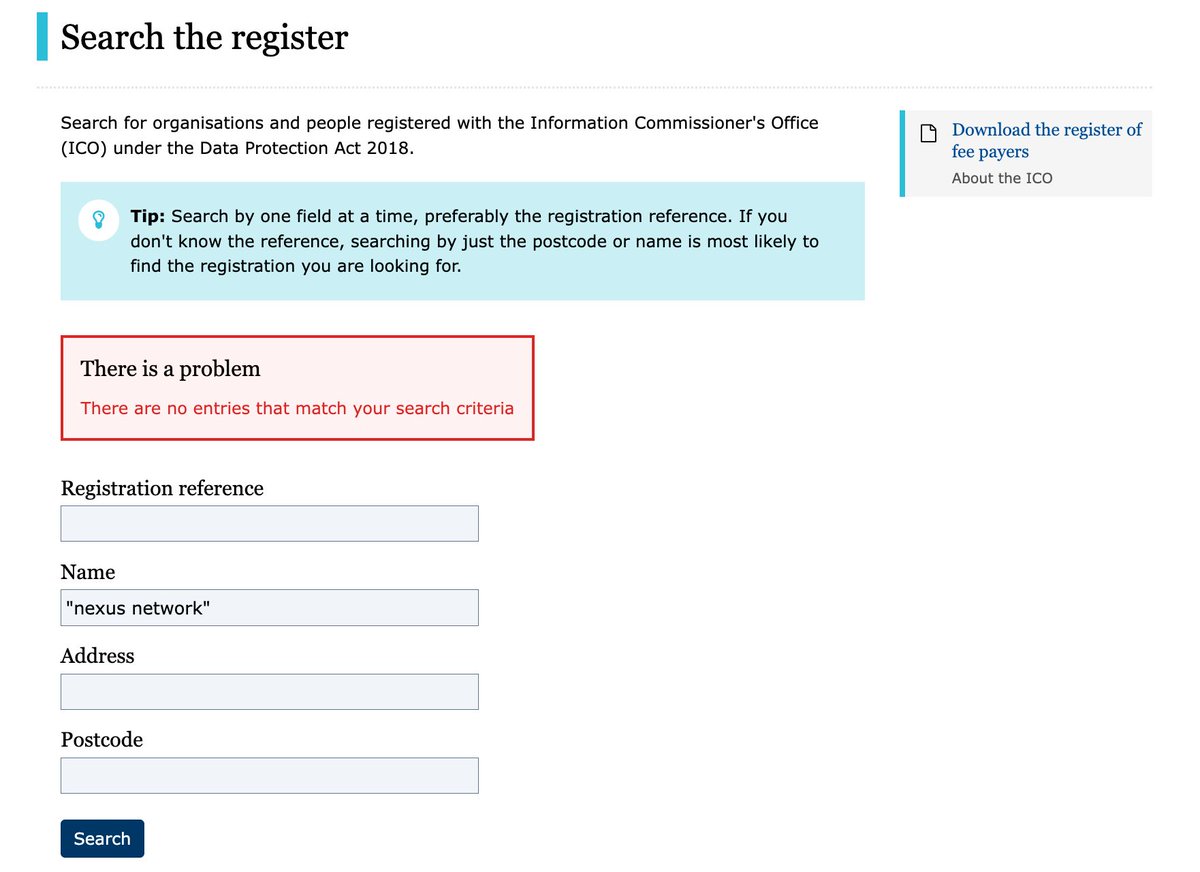

It hasn’t registered under GDPR with Information Commissioner’s Office - again an offence. I don’t know what they're doing with my personal email address - another offence.

It hasn’t registered under GDPR with Information Commissioner’s Office - again an offence. I don’t know what they're doing with my personal email address - another offence.

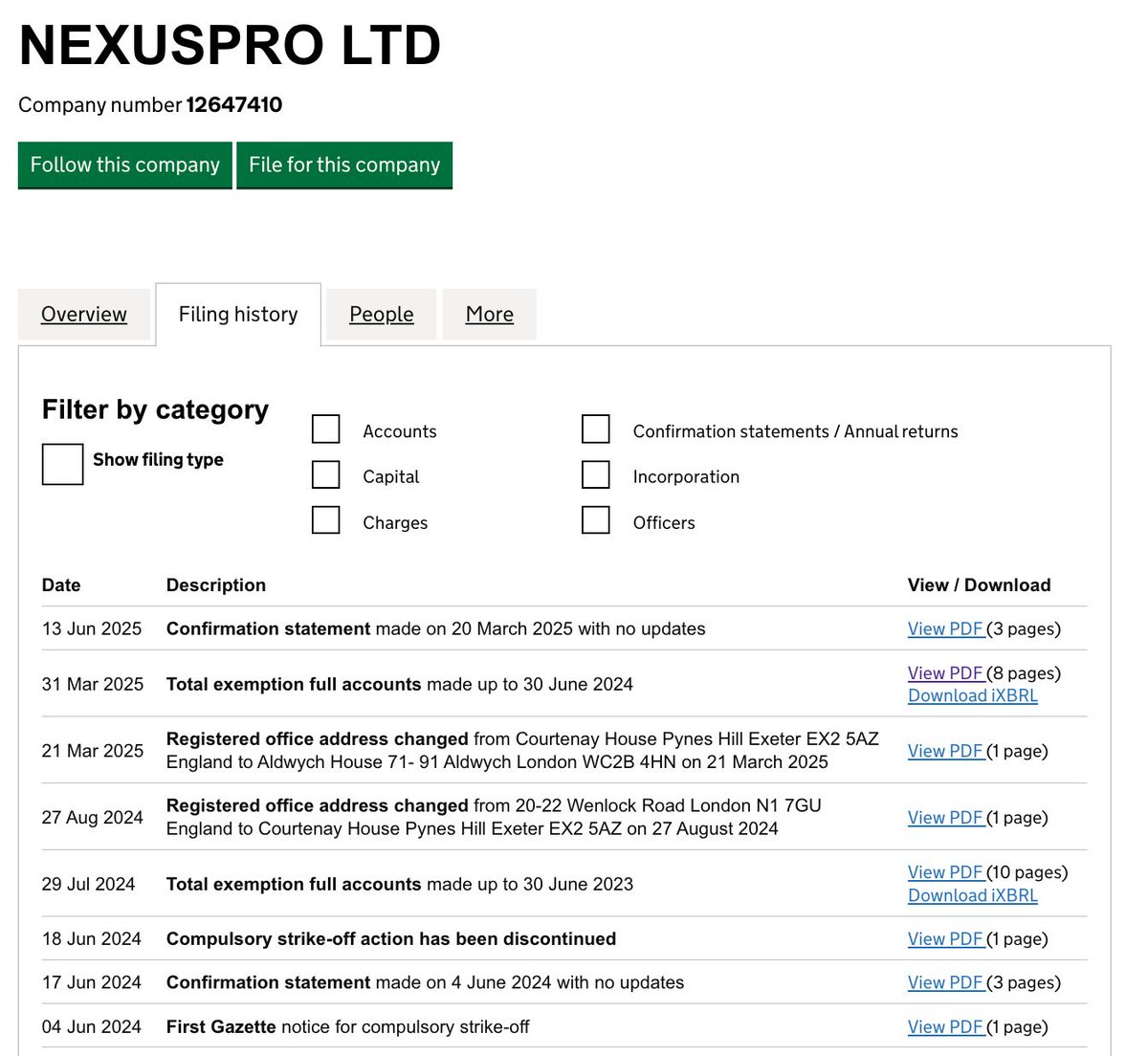

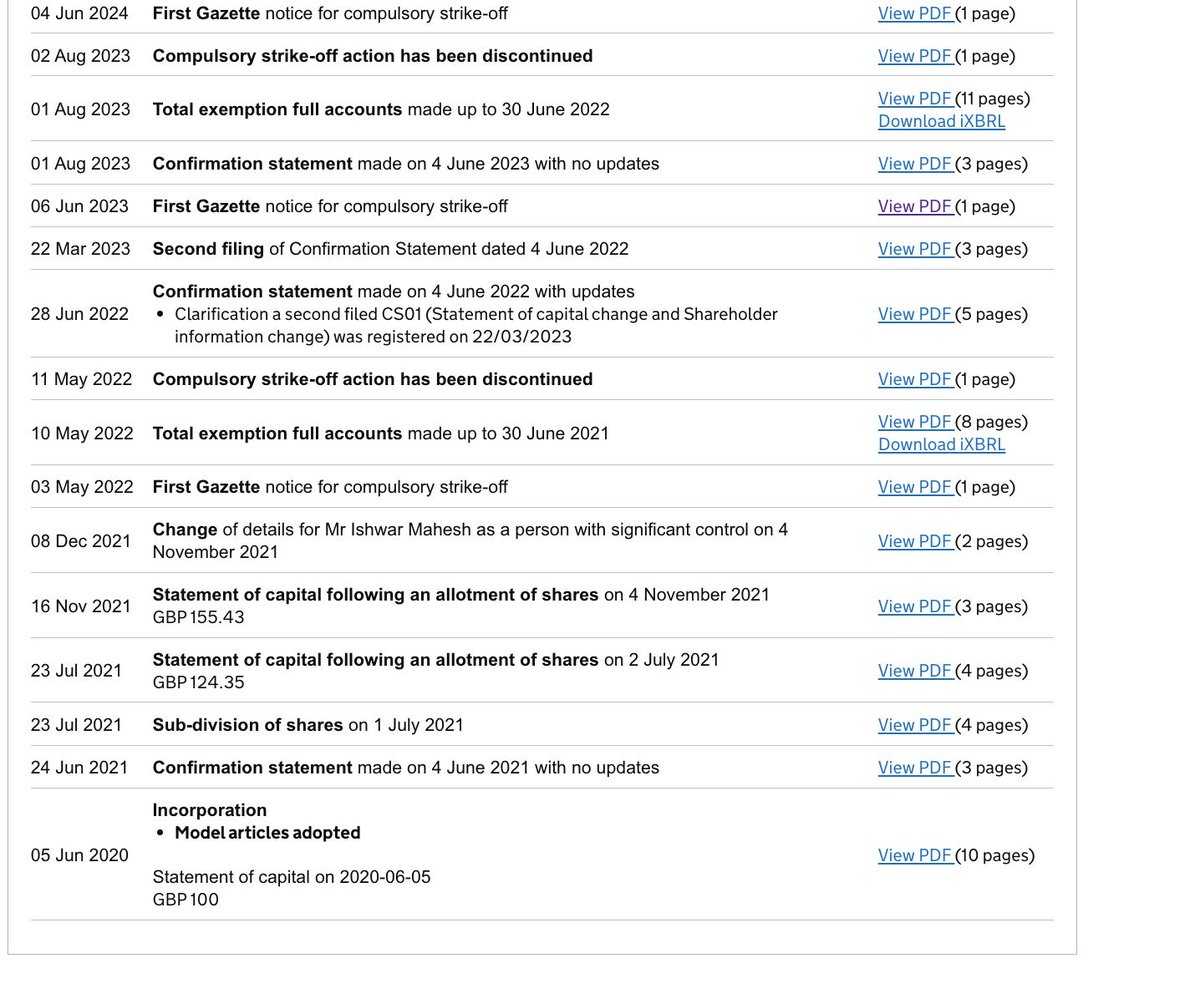

For three successive years, NexusPro Limited failed to file its accounts on time with Companies House, and only filed them after Companies House started the striking-off process.

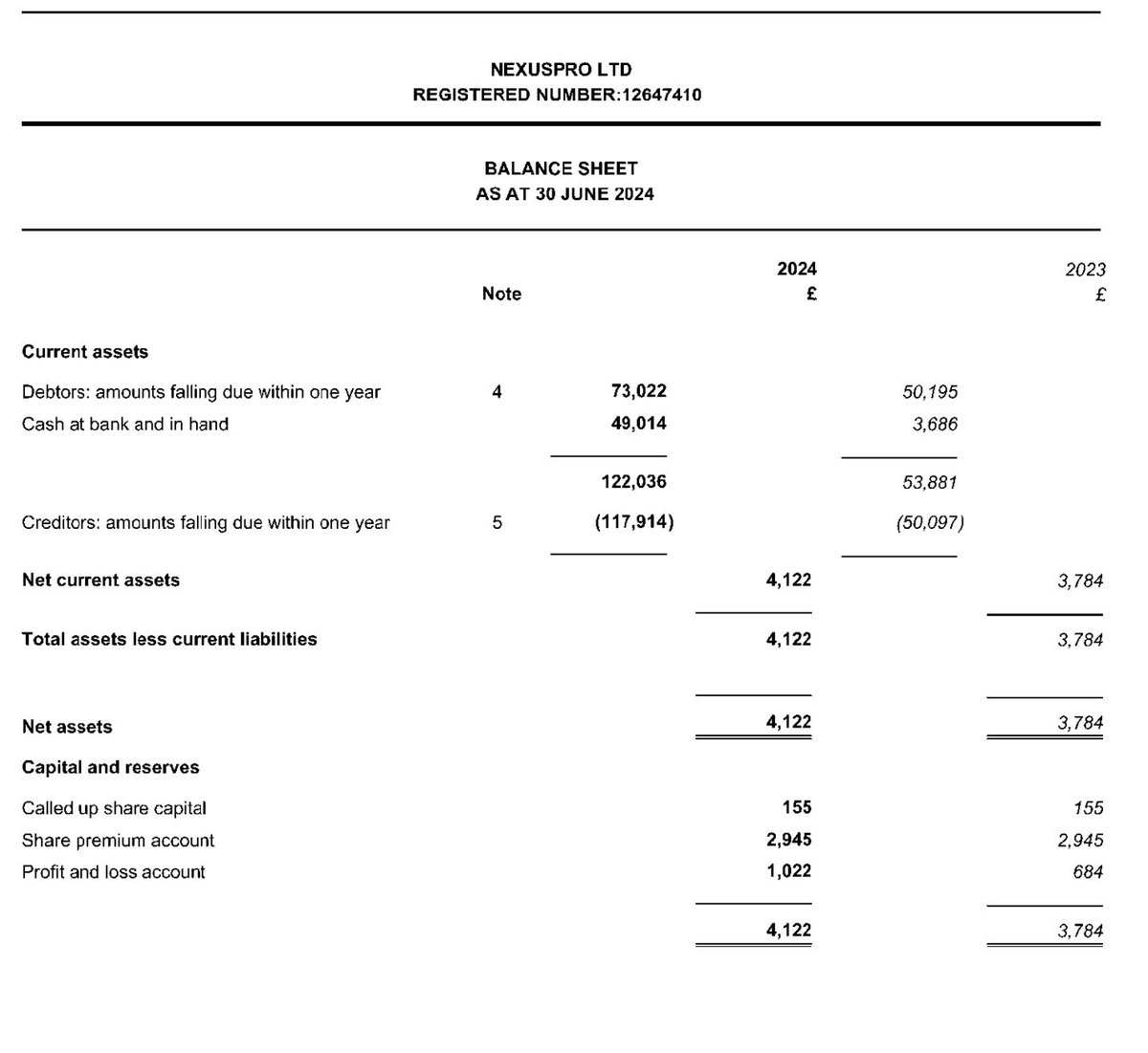

They should be able to afford the £52 data protection fee, because it looks like they made c£200k of profit in 2024.

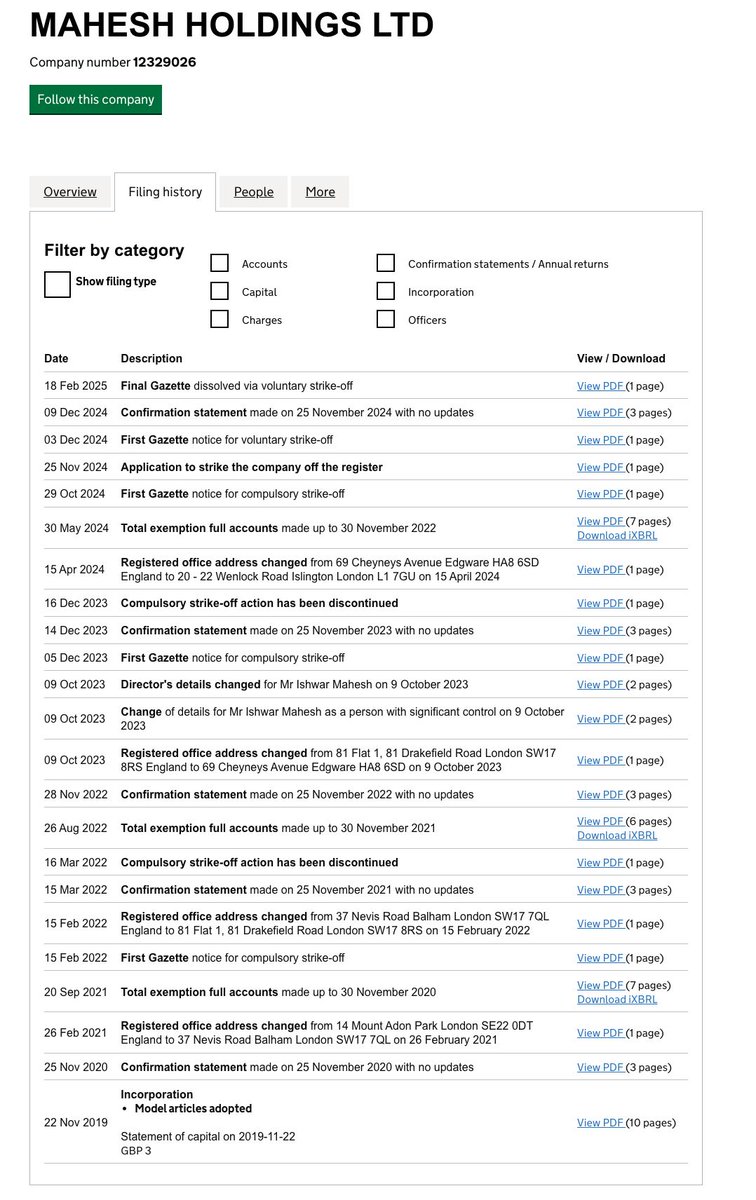

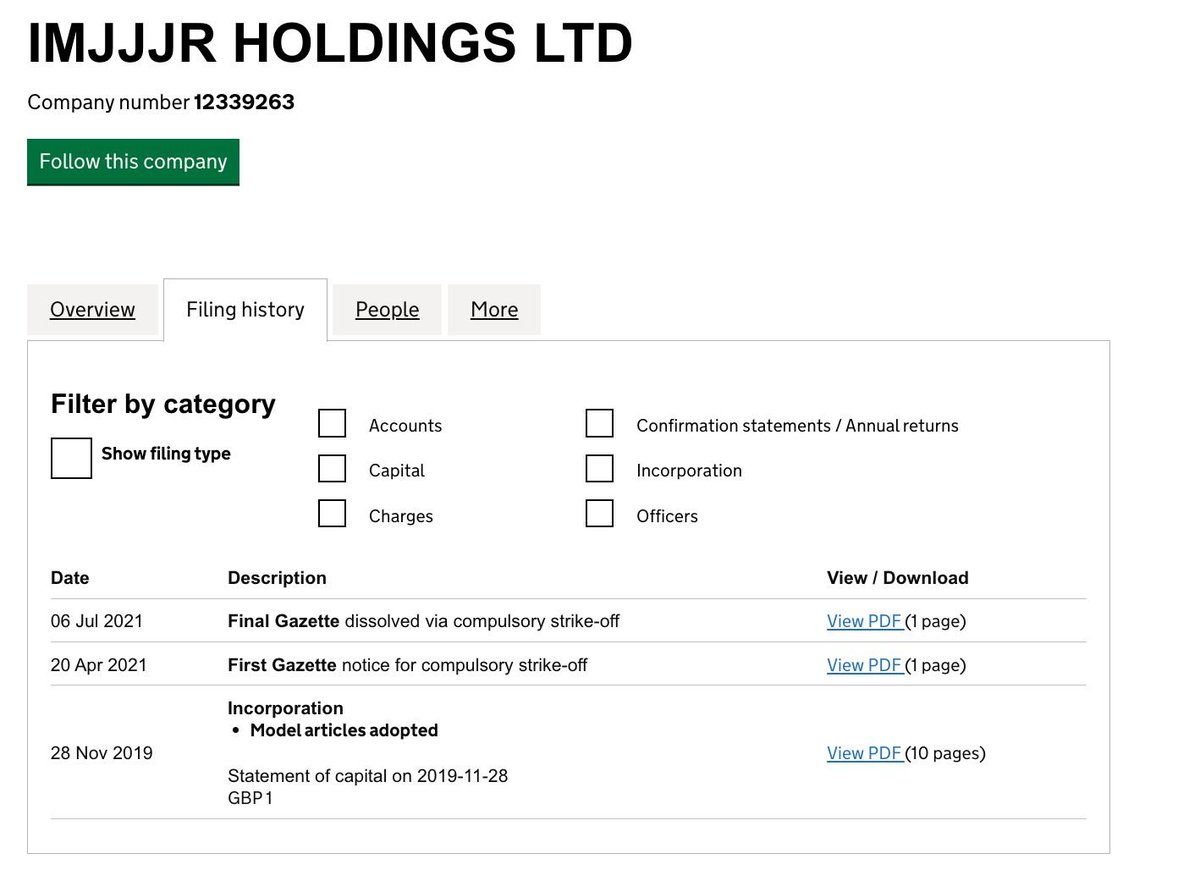

Its founder is an Ishwar Mahesh. His other two companies failed to file documents with Companies House and were struck off.

I asked Nexus Networks if they could respond to these concerns; I didn't receive a reply. But they did add their company name to the website.

I don't know if this is a complete scam, or merely a shady business, but either way: best avoided.

• • •

Missing some Tweet in this thread? You can try to

force a refresh