Advanced Liquidity - How to find precise liquidity points to using SnR Levels.

Educational Thread 🧵

Like and RT for more 💚

Educational Thread 🧵

Like and RT for more 💚

First where the liquidity rests?

Liquidity mainly rests at retail stop loss areas.

The most common are swing highs and swing lows.

Retail sees these points as safe to hide their stops, but they are actually magnets for price.

Liquidity mainly rests at retail stop loss areas.

The most common are swing highs and swing lows.

Retail sees these points as safe to hide their stops, but they are actually magnets for price.

Swing rules are simple.

A Swing Low is a low with a higher low before and after it.

A Swing High is a high with a lower high before and after it.

Anything that does not meet these conditions is not a swing point.

Retail automatically clusters stops at these obvious levels.

A Swing Low is a low with a higher low before and after it.

A Swing High is a high with a lower high before and after it.

Anything that does not meet these conditions is not a swing point.

Retail automatically clusters stops at these obvious levels.

Once we know where retail places stops, we must ask the next question.

Where are they buying and selling.

To answer that we use market structure together with support and resistance.

Where are they buying and selling.

To answer that we use market structure together with support and resistance.

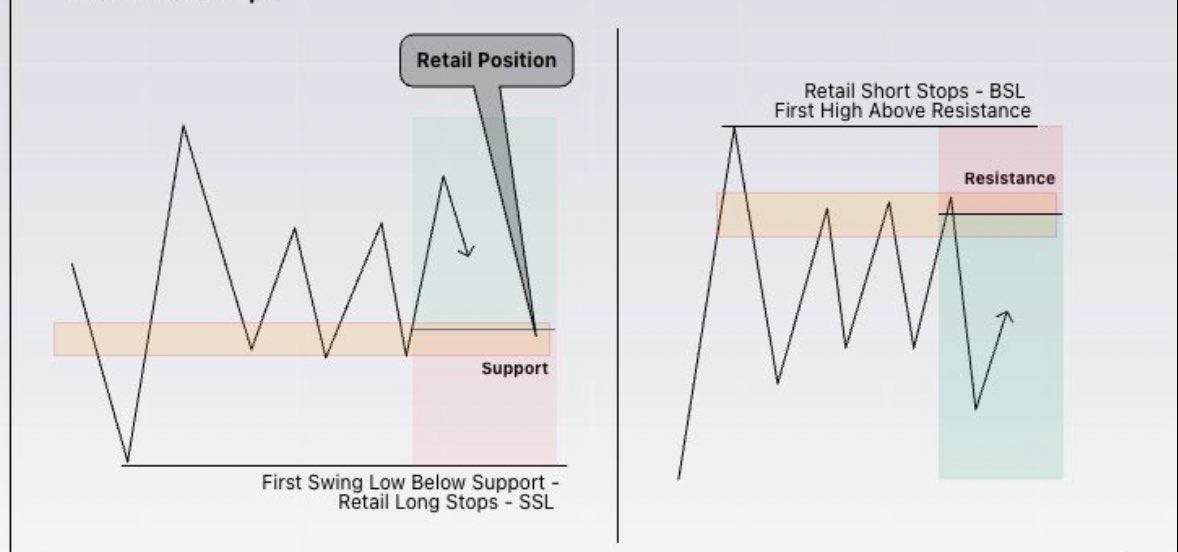

Retail behavior repeats.

They always place stops at the closest swing point near support or resistance.

That is why liquidity pools form exactly at those areas.

When liquidity builds at support, price will naturally be drawn there before making a move.

They always place stops at the closest swing point near support or resistance.

That is why liquidity pools form exactly at those areas.

When liquidity builds at support, price will naturally be drawn there before making a move.

Using support and resistance to find liquidity is straightforward.

Begin with the first swing low or swing high.

Follow how retail builds positions and where stops collect.

Notice how price eventually manipulates those levels to grab liquidity.

Begin with the first swing low or swing high.

Follow how retail builds positions and where stops collect.

Notice how price eventually manipulates those levels to grab liquidity.

A clear example.

The first swing low forms, retail buys.

Stops build under that point, retail keeps adding.

A second stop forms, even more buyers step in.

Price is not respecting support, it is targeting the liquidity that has accumulated below it.

The first swing low forms, retail buys.

Stops build under that point, retail keeps adding.

A second stop forms, even more buyers step in.

Price is not respecting support, it is targeting the liquidity that has accumulated below it.

This is the key lesson.

What retail calls support and safety is where smart money sees a liquidity pool.

Once you understand this flip, you stop trading like the herd and start reading the market as it truly moves.

What retail calls support and safety is where smart money sees a liquidity pool.

Once you understand this flip, you stop trading like the herd and start reading the market as it truly moves.

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh