$NU is one of my highest conviction stocks for the next decade.

It is still growing very fast despite dominating its market.

Yet, the stock is still cheap.

Here is everything you need to know about $NU, business, investment thesis, financials, everything.

(Thread 🧵)

It is still growing very fast despite dominating its market.

Yet, the stock is still cheap.

Here is everything you need to know about $NU, business, investment thesis, financials, everything.

(Thread 🧵)

1/ What does $NU really do?

David Velez, a Colombian, first came to Brazil for work and saw that opening a bank account was very hard.

He had previously worked at Sequoia Capital, so he knew when he saw an opportunity.

He decided to create a digital bank.

Hear the story:

David Velez, a Colombian, first came to Brazil for work and saw that opening a bank account was very hard.

He had previously worked at Sequoia Capital, so he knew when he saw an opportunity.

He decided to create a digital bank.

Hear the story:

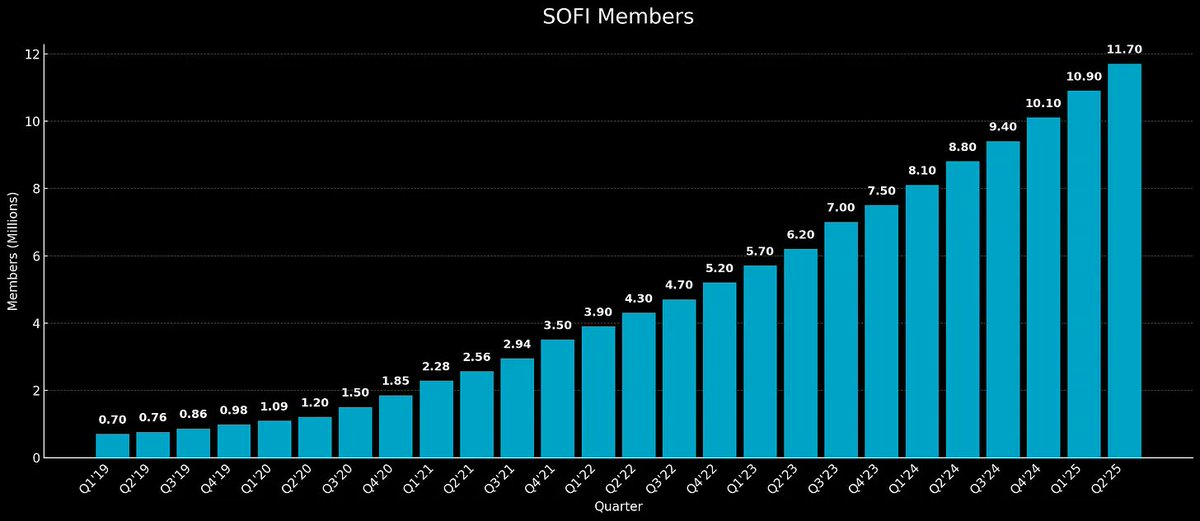

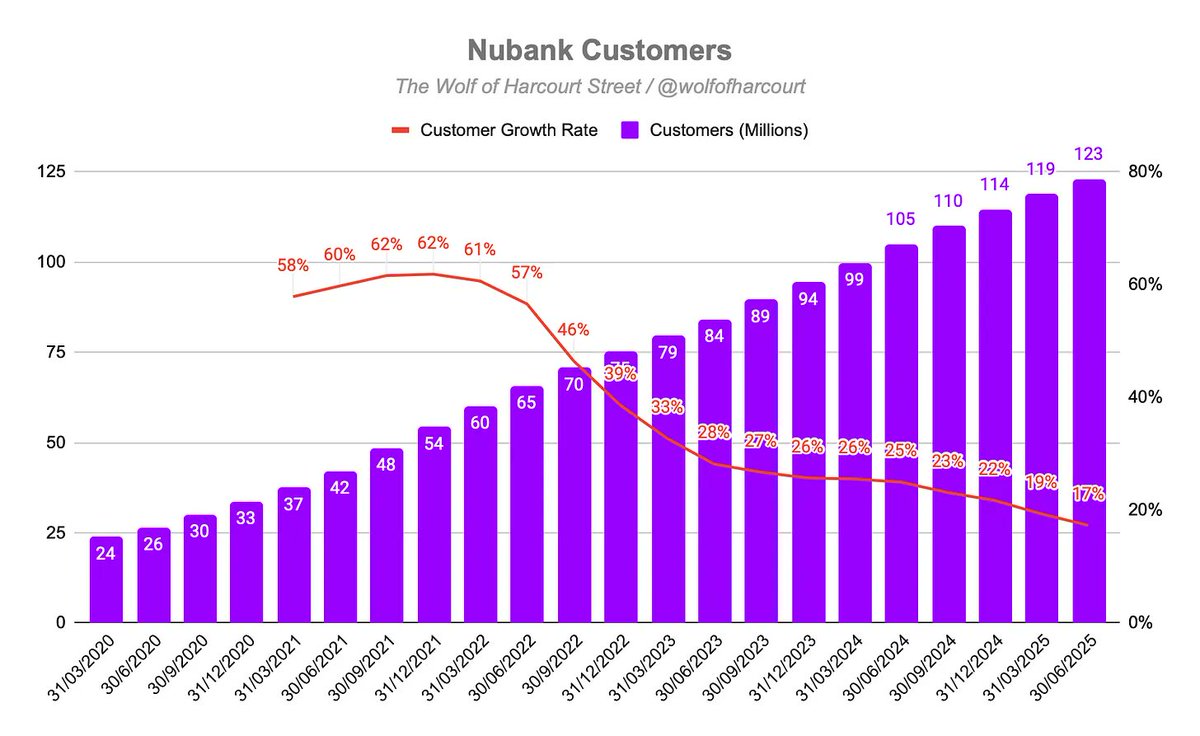

2/ They started with a simple credit card in Brazil back in 2014.

At the time, 40% of the Brazilian population was considered underbanked.

The demand exploded.

Since then, they have expanded to Mexico and Colombia and have just reached over 120 million customers.

At the time, 40% of the Brazilian population was considered underbanked.

The demand exploded.

Since then, they have expanded to Mexico and Colombia and have just reached over 120 million customers.

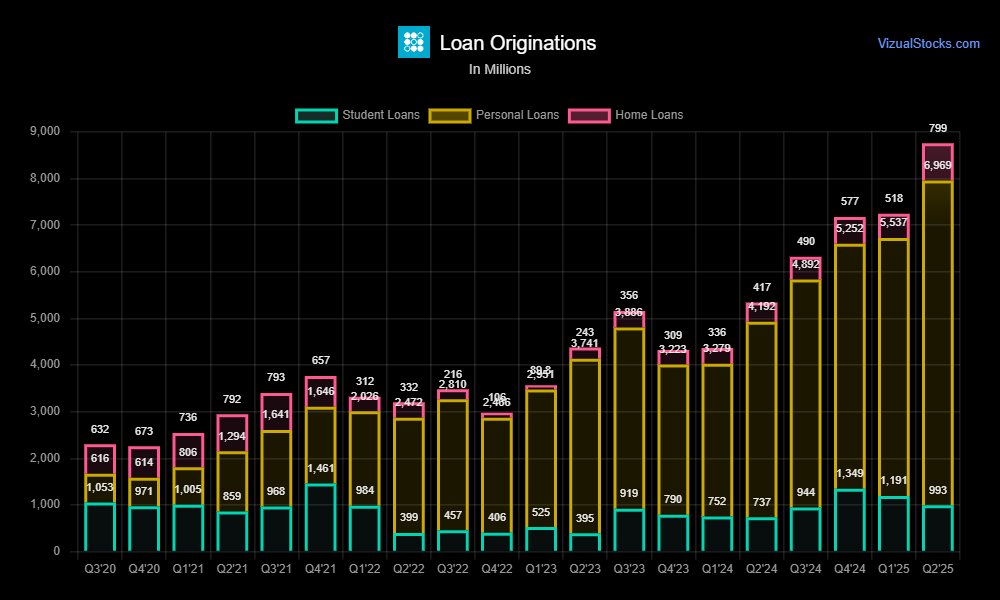

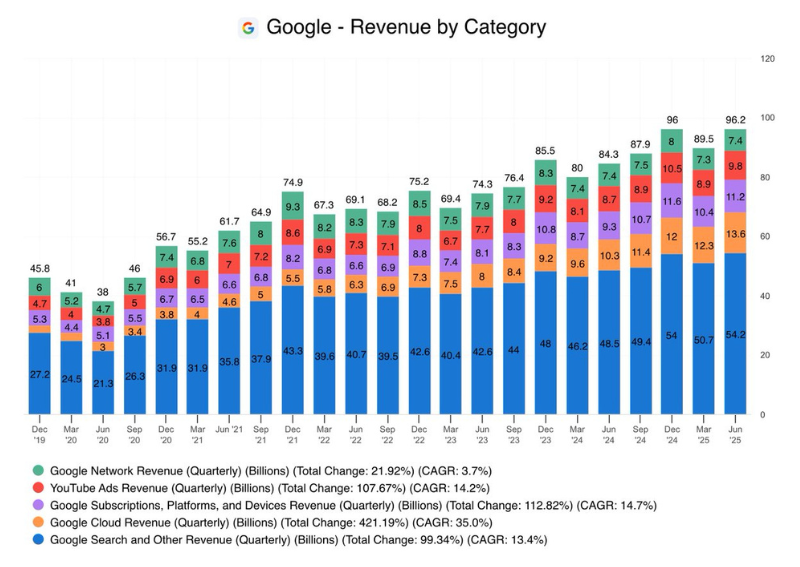

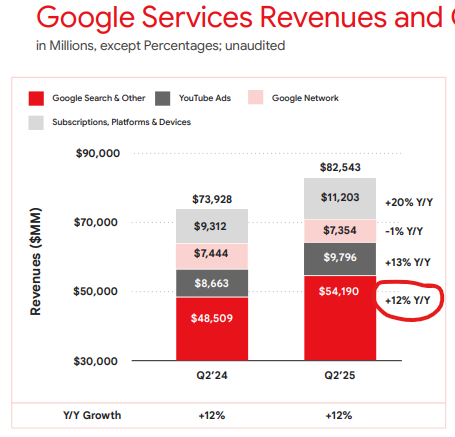

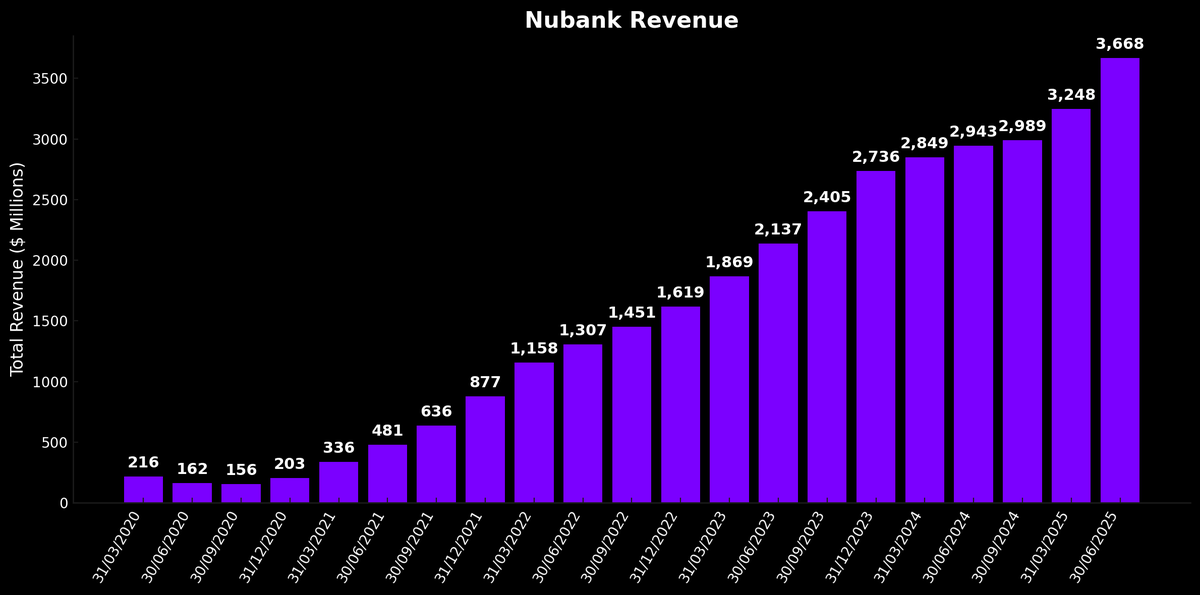

3/ As they scaled, revenues exploded.

They grew revenue by 108% annually since then, while net income reached over $2.3 billion.

Yet, this is just the beginning.

They still have immense opportunities ahead for further growth.

They grew revenue by 108% annually since then, while net income reached over $2.3 billion.

Yet, this is just the beginning.

They still have immense opportunities ahead for further growth.

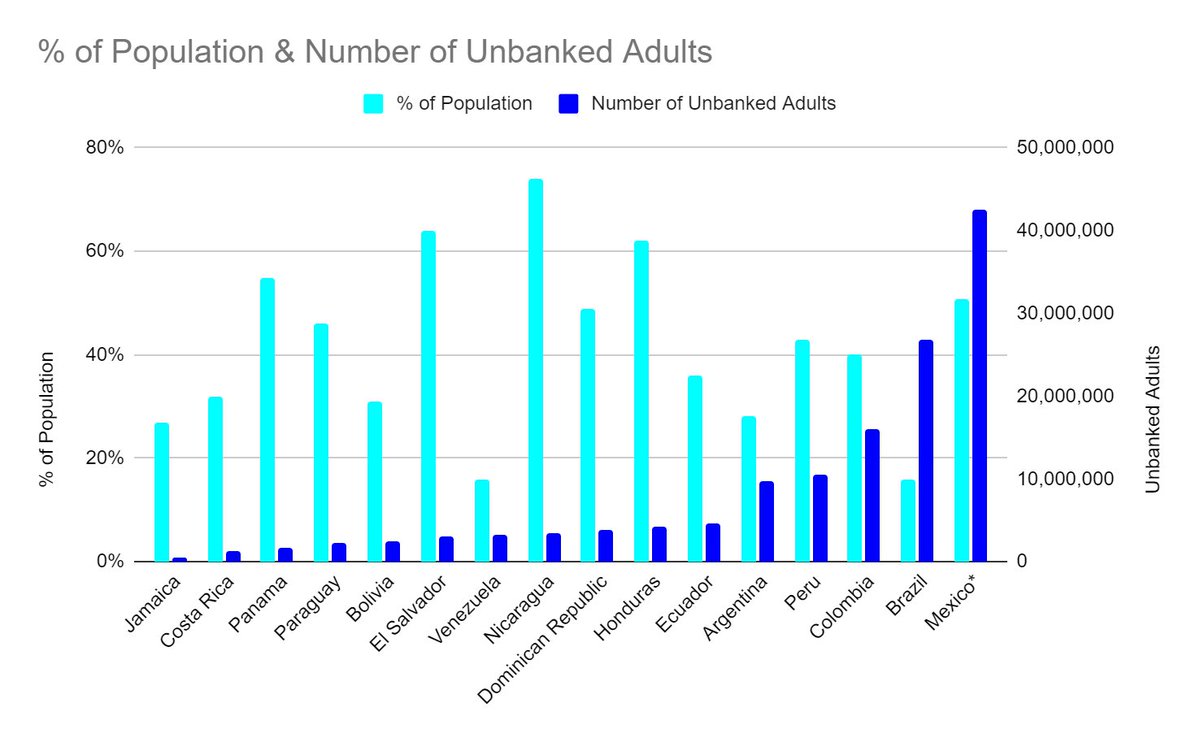

4/ Latin America still has one of the largest underbanked populations in the world.

In Mexico, over 50% of the population is still underbanked. This is around 25% in Argentina and 40% in Colombia.

Overall, more than 122 million people are still underbanked in the region.

In Mexico, over 50% of the population is still underbanked. This is around 25% in Argentina and 40% in Colombia.

Overall, more than 122 million people are still underbanked in the region.

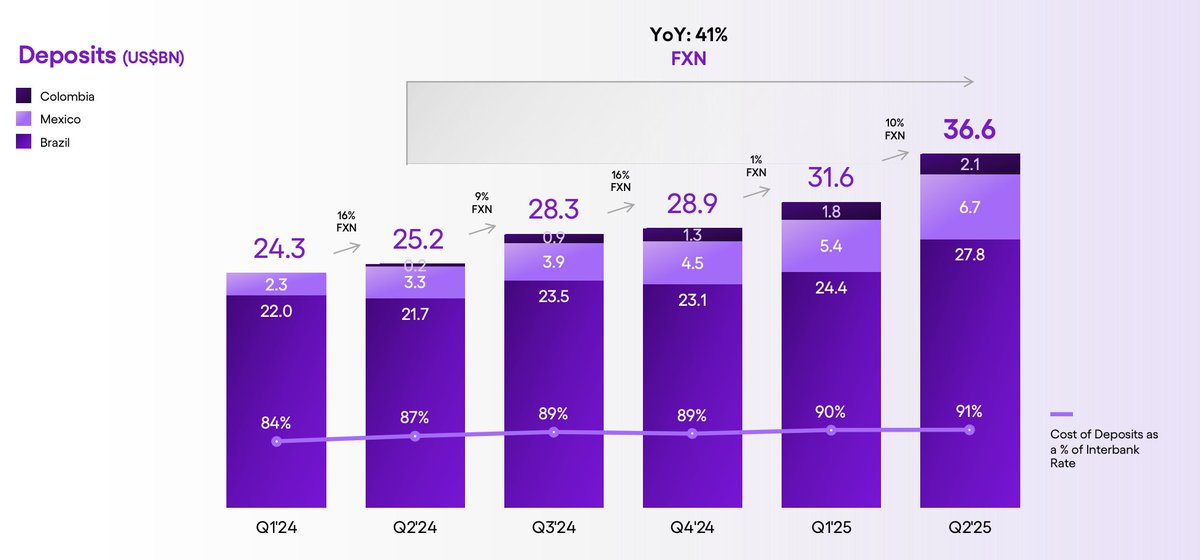

5/ $NU is taking advantage of it by expanding internationally.

They are currently active in Mexico and Colombia, too.

Both of these geographies are growing exponentially.

In Mexico, deposits tripled since the first quarter last year, while Colombian deposits nearly tripled in the last three quarters.

They are currently active in Mexico and Colombia, too.

Both of these geographies are growing exponentially.

In Mexico, deposits tripled since the first quarter last year, while Colombian deposits nearly tripled in the last three quarters.

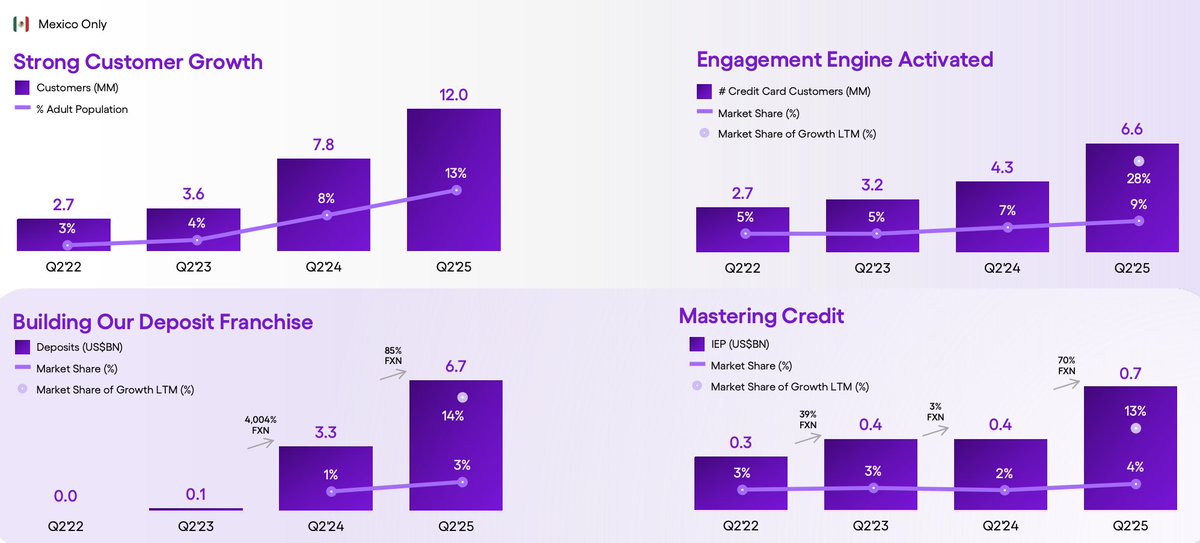

6/ Mexico is growing especially fast.

They have now reached 13% of the adult population and have 9% share in the credit card market.

As they keep executing, this market could become as big a market as Brazil for $NU, as it's the second-largest economy on the continent.

They have now reached 13% of the adult population and have 9% share in the credit card market.

As they keep executing, this market could become as big a market as Brazil for $NU, as it's the second-largest economy on the continent.

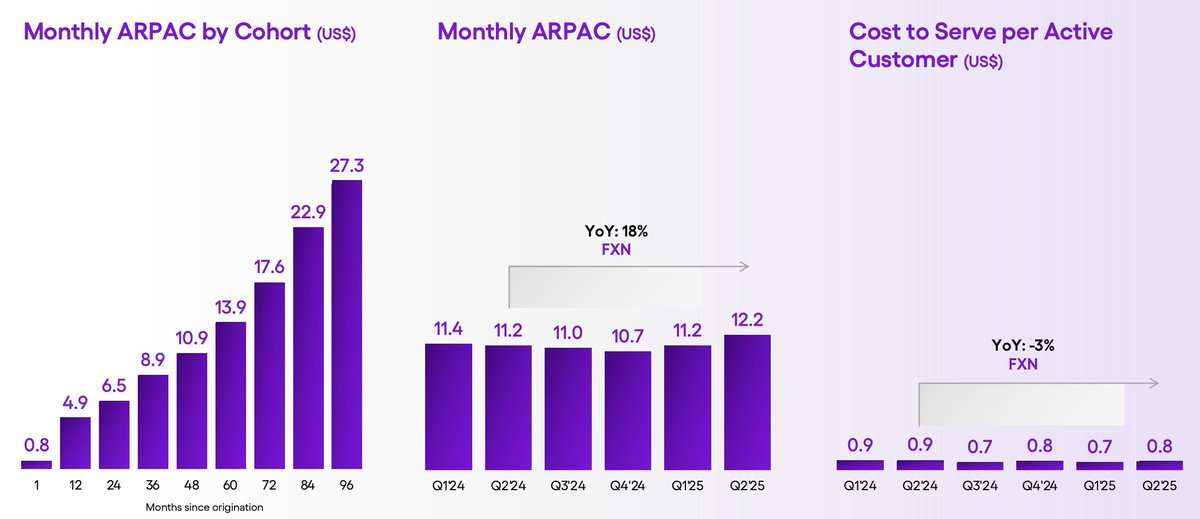

7/ They also have significant up-sell, cross-sell opportunities.

Their monthly ARPAC is currently around $12, while this goes up to $27 for mature cohorts.

Monthly ARPAC will converge to the mature cohort ARPAC in the long term, meaning they still have much room for growth even if the expansion stops.

Their monthly ARPAC is currently around $12, while this goes up to $27 for mature cohorts.

Monthly ARPAC will converge to the mature cohort ARPAC in the long term, meaning they still have much room for growth even if the expansion stops.

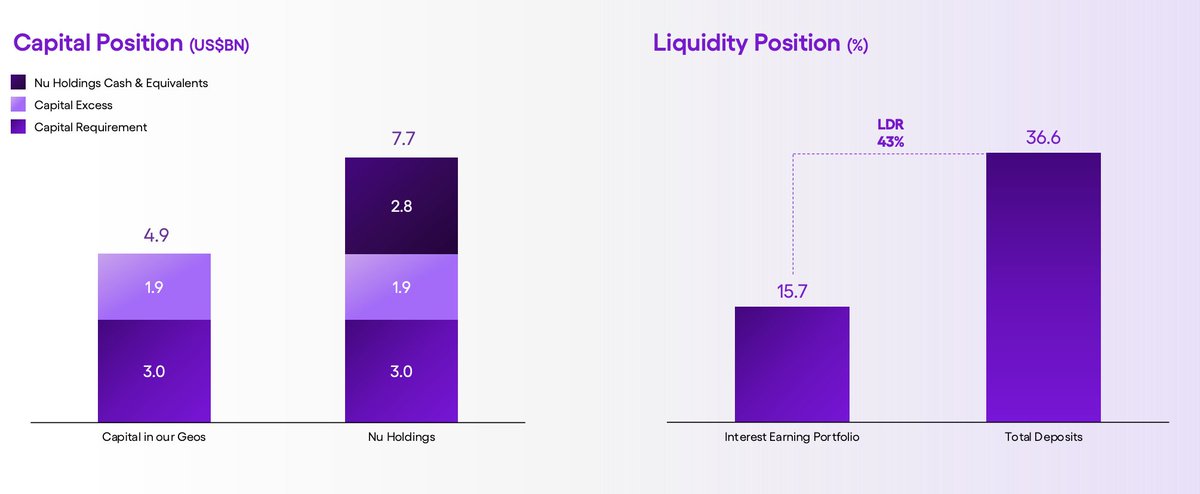

8/ Its financial condition is also rock solid.

It currently holds $7.7 billion in cash on its balance sheet against the current capital requirement of just $3 billion.

Its deposit pool is also more than twice as big as its loan portfolio.

Despite this comfortable position, it doesn't ease its underwriting standards much.

It currently holds $7.7 billion in cash on its balance sheet against the current capital requirement of just $3 billion.

Its deposit pool is also more than twice as big as its loan portfolio.

Despite this comfortable position, it doesn't ease its underwriting standards much.

9/ Its non-performing loan % is a bit above the industry standards, but it offsets this with a high coverage ratio.

Its coverage ratio for all 90+ non-performing consumer loans in Brazil is above 200%.

This is an extremely comfortable position despite a higher NPL ratio.

Its coverage ratio for all 90+ non-performing consumer loans in Brazil is above 200%.

This is an extremely comfortable position despite a higher NPL ratio.

10/ Valuation is also fair.

They are on track to bring $14 billion in revenue before loss provisions and $2.8 billion in net income.

This gives them a 20% net margin.

Assuming that it'll grow revenues by 25% annually in the next 5 years, we will get nearly $43 billion in revenue in 2030.

Assuming a stable net margin, we will $8.6 billion in net income.

At a conservative 15 times earnings, we get a $129 billion company.

It's currently valued at $63 billion, meaning it offers at least 2x in the next 5 years.

Given the quality of the company, I would buy this every day.

They are on track to bring $14 billion in revenue before loss provisions and $2.8 billion in net income.

This gives them a 20% net margin.

Assuming that it'll grow revenues by 25% annually in the next 5 years, we will get nearly $43 billion in revenue in 2030.

Assuming a stable net margin, we will $8.6 billion in net income.

At a conservative 15 times earnings, we get a $129 billion company.

It's currently valued at $63 billion, meaning it offers at least 2x in the next 5 years.

Given the quality of the company, I would buy this every day.

Do you want to become a better investor?

I share all my insights in my free weekly newsletter.

Join 18,000+ readers to become a better investor.

You will also get a free e-book when you join 👇

capitalist-letters.com

I share all my insights in my free weekly newsletter.

Join 18,000+ readers to become a better investor.

You will also get a free e-book when you join 👇

capitalist-letters.com

• • •

Missing some Tweet in this thread? You can try to

force a refresh