Everyone has become a Fed watcher, but no one understands HOW the flows of capital are happening

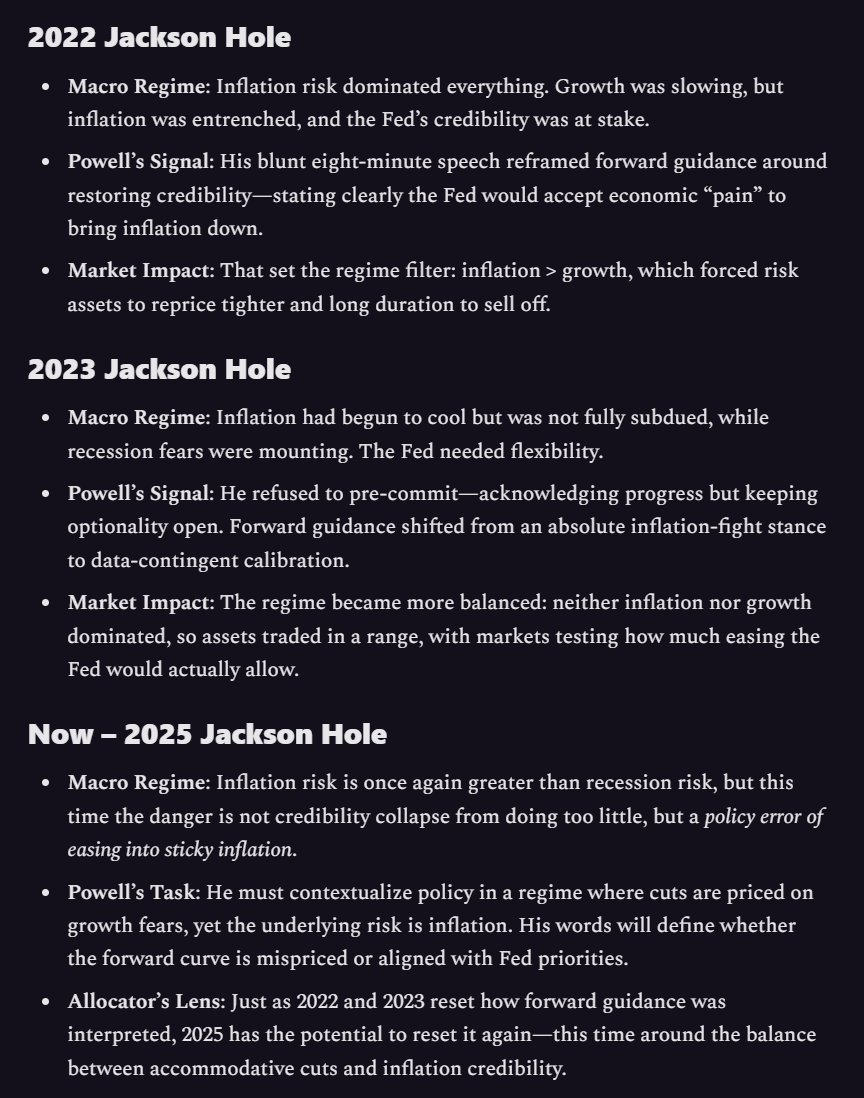

As we move into Jackson Hole this week, we are very likely to see a shift in monetary policy, but the key will be understanding HOW this is transmitted into markets

🧵👇

As we move into Jackson Hole this week, we are very likely to see a shift in monetary policy, but the key will be understanding HOW this is transmitted into markets

🧵👇

If you understand the macro context for flows and how positioning is set up, then you will understand how Jackson Hole will be transmitted into markets.

This will frame all of the changes we see in interest rates, equities, and crypto.

This will frame all of the changes we see in interest rates, equities, and crypto.

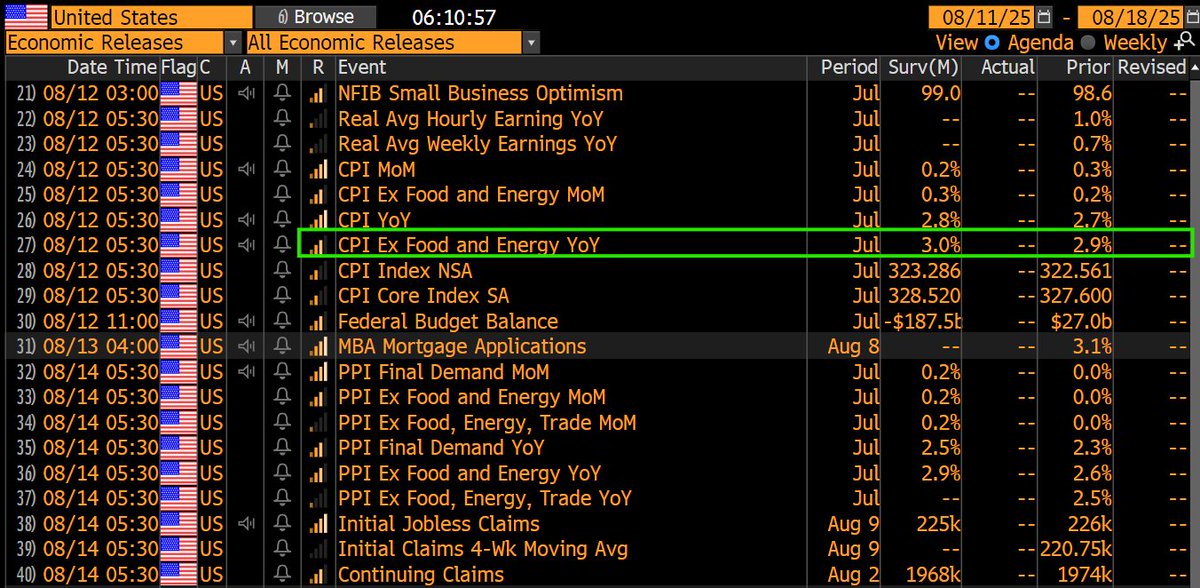

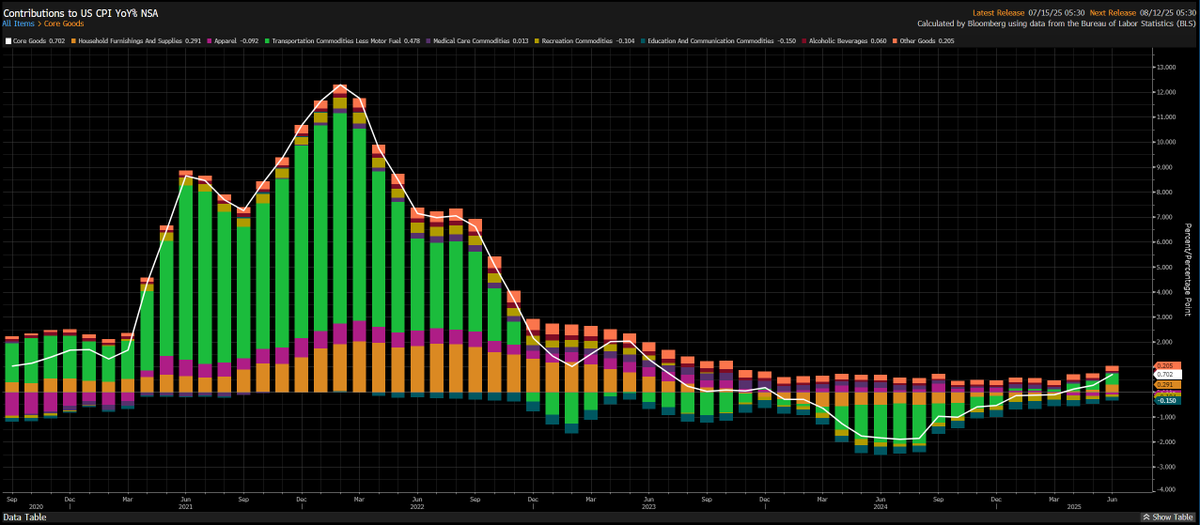

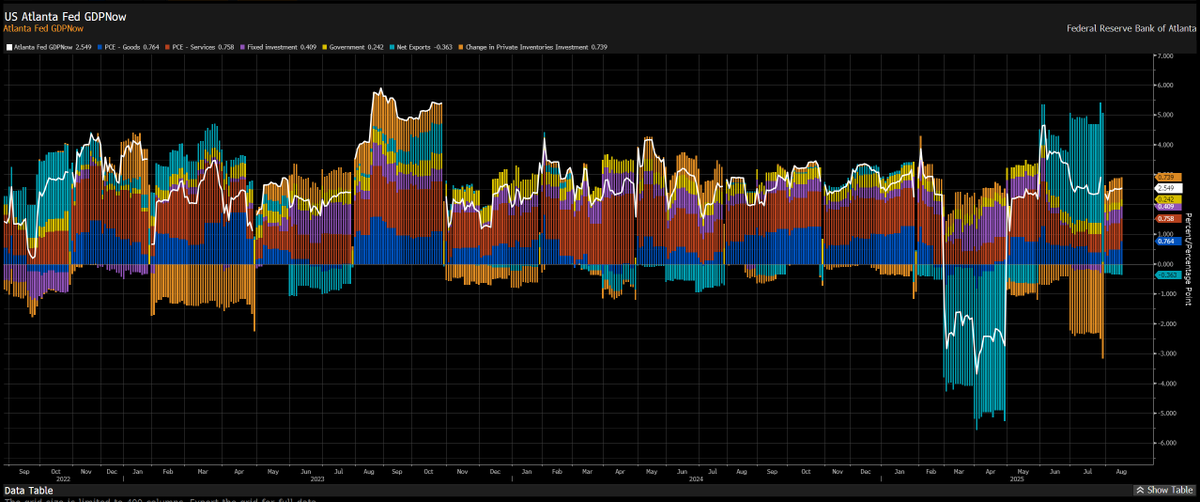

First, we are in a period of time where growth AND inflation are accelerating.

The Atlanta Fed nowcast is running at 2.5% and long end rates have retraced the entire move they made from the NFP print.

The Atlanta Fed nowcast is running at 2.5% and long end rates have retraced the entire move they made from the NFP print.

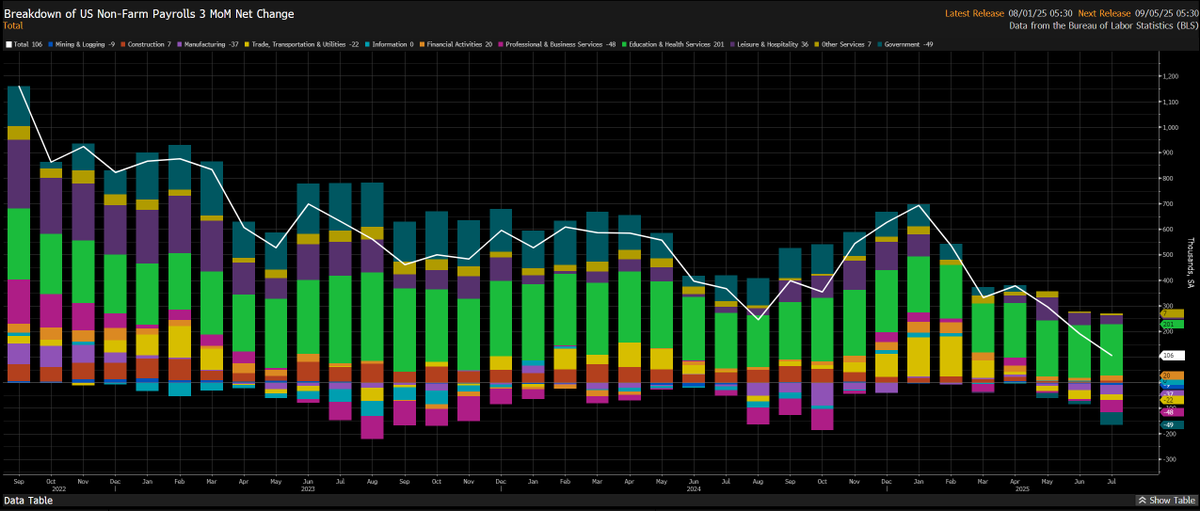

The 3 month trend of NFP remains positive and we are adding jobs to the economy every single month. More jobs = more money being added to the underlying system.

Notice that UB has already retraced the entire rally from the NFP print. What does this mean? If we were truly at risk of a recession right now, UB would have made a new high or been flat, not retraced the entire move on such a violent NFP print.

The underlying data and market expectations are both confirming the views I have been laying out for a while: Inflation risk is greater than recession risk. You can see the full report here:

https://x.com/Globalflows/status/1956404293948633522

And notice that inflation swaps are sitting well above 3% with credit spreads at cycle lows. This means that inflation risk is clearly higher than recession risk right now. On top of this, the last PCE, CPI, and PPI inflation prints all came in above expectations.

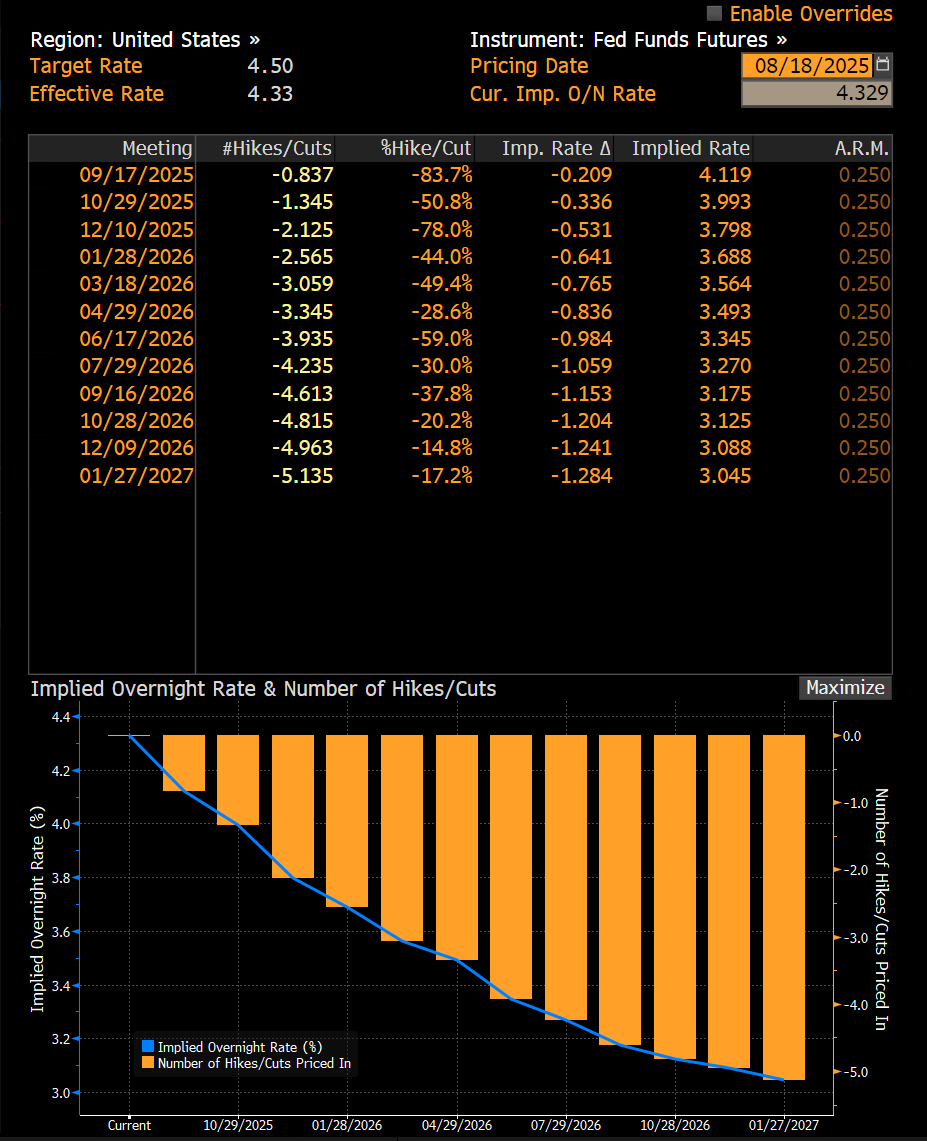

But what is the Fed doing? They are still allowing 50bps of cuts get priced on the forward curve. This is why there is a positive liquidity impulse pushing asset prices higher

https://x.com/Globalflows/status/1955320999068700677

This is a blatant policy error by the Federal Reserve in being too accommodating as growth and inflation rise.

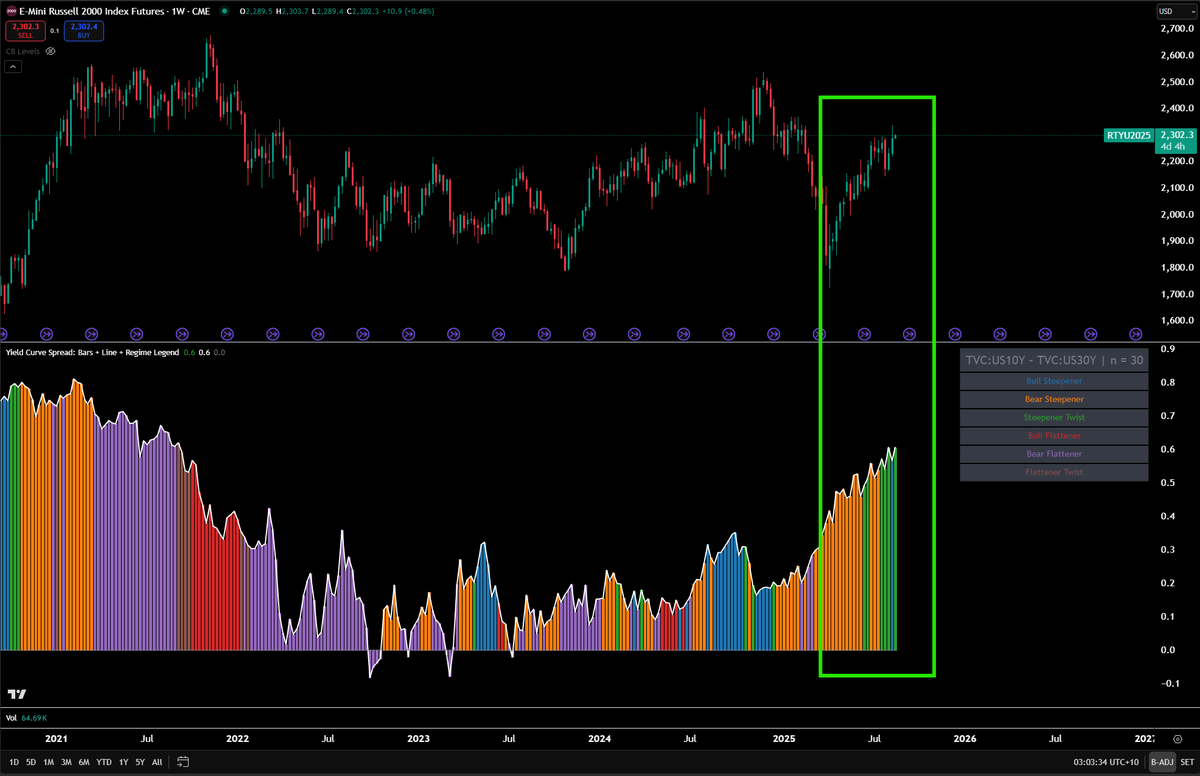

This is why the Russell has rallied as 10s30s curve has been steepening.

This is why the Russell has rallied as 10s30s curve has been steepening.

If some of these concepts are new for you, then there is an entire educational playbook on every single aspect of it laid out here. 100% free.

https://x.com/Globalflows/status/1955806585680486866

Here is the deal with the Fed right now, as long as inflation swaps are sitting above 3% and the Fed is allowing 50bps of cuts to be priced for this year, they are being to accommodative and actually increasing the probability of inflation and lowering the probability of a recession.

Everyone is so laser focused on the Sept cut happening or not that they are missing the fact that the larger context is one of the Fed being to accomadative.

This matters because if one of the major drivers of this rally has been driven by the Fed being to accommodative, what do you think happens when they shift their stance? All of the AI narratives and factor rotations will get smacked with macro volatility and cause a black hole in markets as people rush for the exit.

This matters because if one of the major drivers of this rally has been driven by the Fed being to accommodative, what do you think happens when they shift their stance? All of the AI narratives and factor rotations will get smacked with macro volatility and cause a black hole in markets as people rush for the exit.

This is WHY Jackson Hole is such a critical step this week in the progression of the Fed's cycle.

The main idea is that the Fed is already operating in a tension where they are trying to manage the policy error they are making.

The main idea is that the Fed is already operating in a tension where they are trying to manage the policy error they are making.

Like I said here, any error by the Fed will be priced by the long end of the curve and the currency. It doesn't matter who the Fed chair is; there are always constraints.

https://x.com/Globalflows/status/1957473364911735182

If the Fed continues on this path, we are almost certainly going to end with long end rates being higher. Read the entire report on this dynamic here:

https://x.com/Globalflows/status/1954751662662590820

The entire question is HOW FAST do we progress toward the inevitable end game of long-end rates dragging equities down.

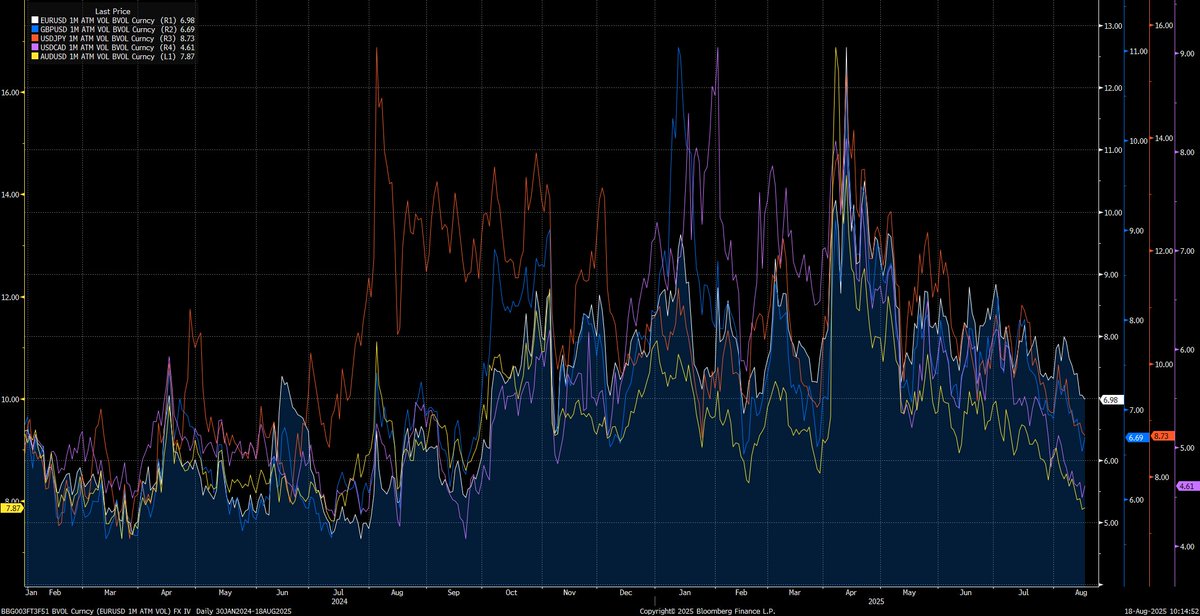

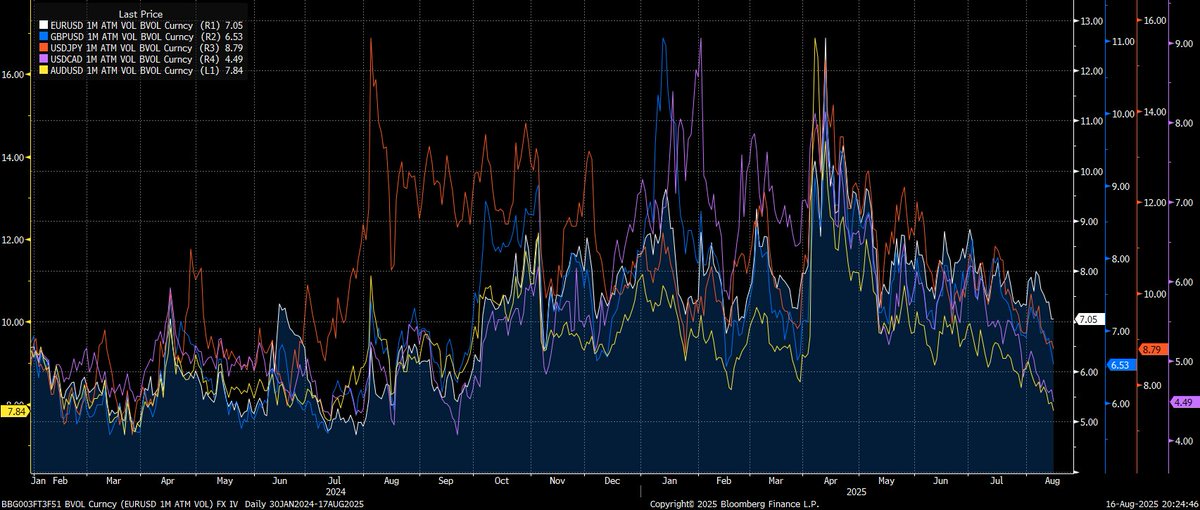

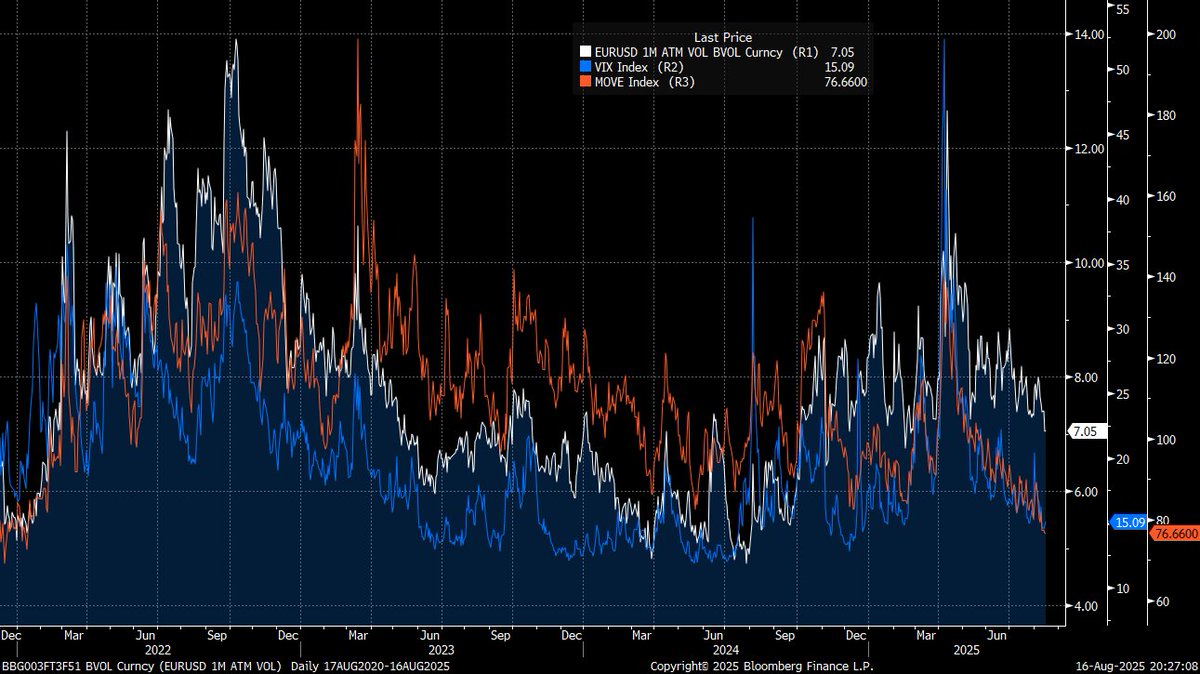

Volatility is still compressing in a range which is why Im still long risk assets.

Volatility is still compressing in a range which is why Im still long risk assets.

So we aren't seeing macro volatility and long end rates cause this credit cycle to collapse. HOWEVER, if Powell comes out to dovish or to hawkish in this meeting, it would be easy for either extreme to cause volatility to spike.

Think about it like this, if they try to recontextualize the monetary policy framework for more dovish decisions, this could actually cause long end rates to rise because it is to accomadative relative to the inflation risk we are seeing.

Inversely, a stance that is to hawkish could begin to reprice how the 2026 pricing of the forward curve. This has been one of the primary drivers in the weaker dollar. See the Z5Z6 sofr contract below overlaid with the DXY.

In simple terms, for the credit cycle to continue and not undergo a shock, they CANNOT have a dramatic change to their monetary policy framework. The thing is, Jackson Hole has consistently been a place where they reframe things. The wild card is the fact that Powell is going to get booted next year and so in one sense no one really cares what he has to say.

This goes back to understanding the actual constraints of the Fed and Powell. The Fed is NOT exerting its force in markets which is why the curve has been steepening as they fall behind.

So while everyone focuses on Powell, the more important thing will be watching for how theyre just keeping things constant and the larger macro constraints function.

x.com/Globalflows/st…

So while everyone focuses on Powell, the more important thing will be watching for how theyre just keeping things constant and the larger macro constraints function.

x.com/Globalflows/st…

Positioning in the forward curve is already pricing a relatively dovish outcome. All we need is the absence of change. If you have not read them yet, I wrote full reports on the forward curve and Jackson Hole here:

https://x.com/Globalflows/status/1957297835906658310

Everything is setting up for a larger macro move but for now, I remain bullish risk assets and bearish bonds until macro volatility spikes and begins to drag on risk assets. There will be a moment to exit the train but we are not there yet. Jackson Hole will be a critical signal in this progression.

You can find all of the free educational playbooks on interest rates, the credit cycle, and macro here:

x.com/Globalflows/st…

You can find all of the free educational playbooks on interest rates, the credit cycle, and macro here:

x.com/Globalflows/st…

• • •

Missing some Tweet in this thread? You can try to

force a refresh