The Next Gulf War is Loading.

India has to be on alert mode.

It is not Iraq or Kuwait. It is going to be Pakistan.

It is not for Oil but for Rare Earth Minerals.

Read this thread till the end.

India has to be on alert mode.

It is not Iraq or Kuwait. It is going to be Pakistan.

It is not for Oil but for Rare Earth Minerals.

Read this thread till the end.

In 1990, the world went to war not just because Iraq invaded Kuwait, but because the lifeline of global power—oil—was at stake.

Superpowers clashed, alliances shifted, and a regional dispute turned into a global confrontation.

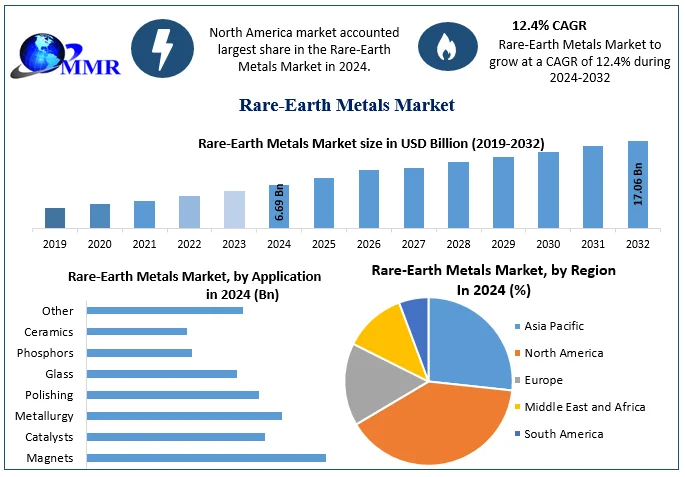

Today, the stage is being set again. But this time the battlefield isn’t the Persian Gulf—it’s Pakistan. And the prize isn’t oil—it’s rare earth elements (REEs), the hidden backbone of EVs, wind turbines, chips, and modern defense systems. What oil was in the 20th century, REEs will be in the 21st—and Pakistan sits right at the fault line.

Superpowers clashed, alliances shifted, and a regional dispute turned into a global confrontation.

Today, the stage is being set again. But this time the battlefield isn’t the Persian Gulf—it’s Pakistan. And the prize isn’t oil—it’s rare earth elements (REEs), the hidden backbone of EVs, wind turbines, chips, and modern defense systems. What oil was in the 20th century, REEs will be in the 21st—and Pakistan sits right at the fault line.

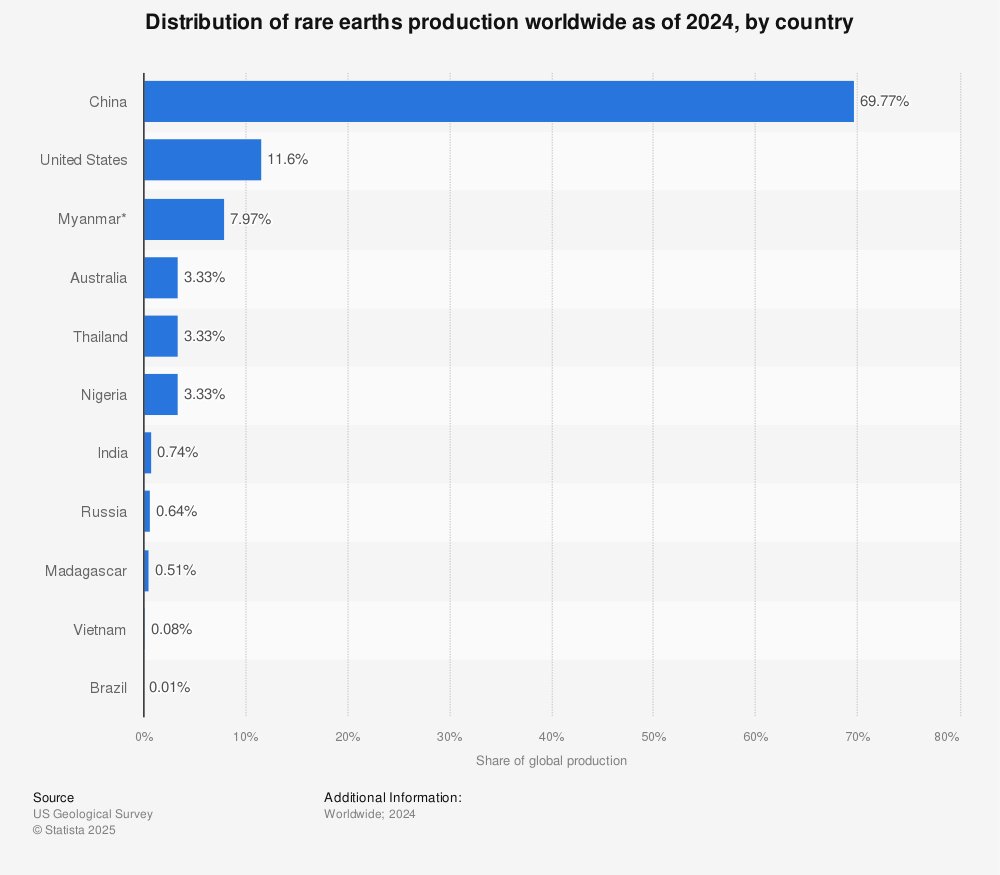

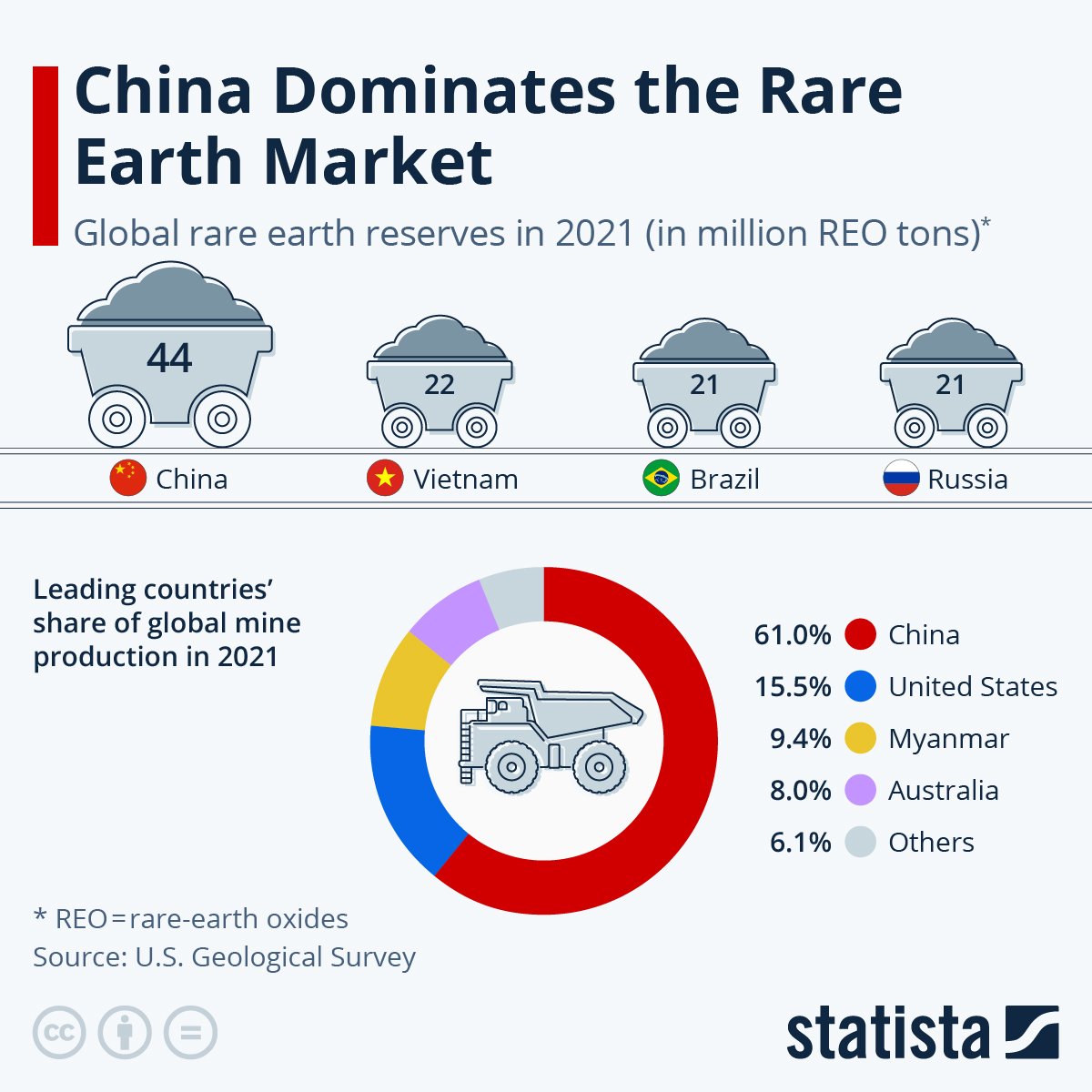

Oil defined power in the 20th century; rare earths will define power in the 21st. China controls ~60% of mining and ~90% of refining, giving Beijing unrivaled leverage over the “magnets” that drive EV motors, fighter jets, and wind farms.

The West, shaken by its oil dependence in the 1970s and watching China’s stranglehold today, is desperate to diversify.

That’s where Pakistan comes in—home to copper-gold giants like Reko Diq and geological whispers of rare earths in the Peshawar Alkaline Province and coastal sands. It may not be Saudi Arabia of REEs yet—but the scramble has begun.

The West, shaken by its oil dependence in the 1970s and watching China’s stranglehold today, is desperate to diversify.

That’s where Pakistan comes in—home to copper-gold giants like Reko Diq and geological whispers of rare earths in the Peshawar Alkaline Province and coastal sands. It may not be Saudi Arabia of REEs yet—but the scramble has begun.

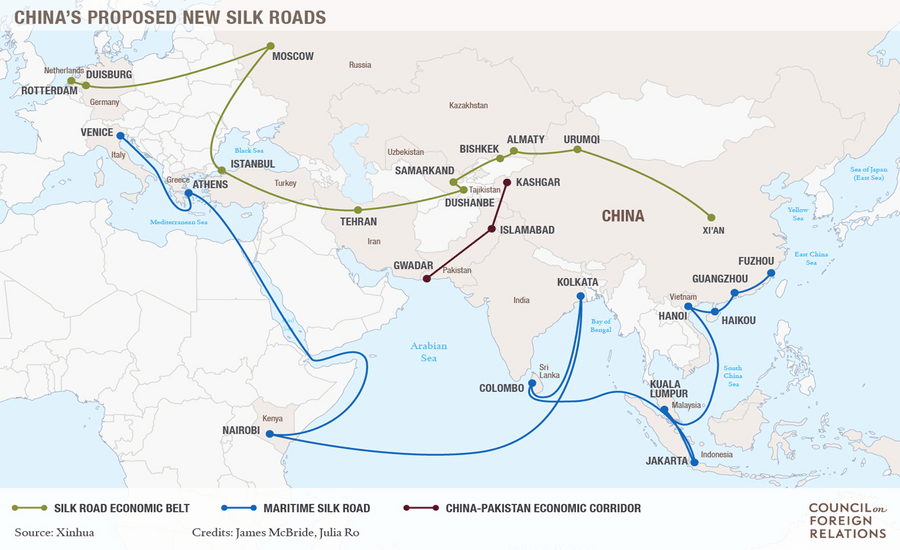

China saw this coming.

Through CPEC and Gwadar Port, Beijing locked itself deep into Pakistan’s arteries—highways, energy plants, and a logistics hub that connects western China to the Arabian Sea.

Gwadar is not just about trade—it’s China’s answer to the Malacca Strait, a way to bypass QUAD dominated chokepoints.

Now, imagine coupling Gwadar with REE extraction, refining, and export—China would not just own Pakistan’s roads, it would own the minerals of the future.

For Trump and US , this was like a untapped opportunity.

The U.S. cannot afford another strategic resource flowing smoothly through a Chinese-built corridor.

Through CPEC and Gwadar Port, Beijing locked itself deep into Pakistan’s arteries—highways, energy plants, and a logistics hub that connects western China to the Arabian Sea.

Gwadar is not just about trade—it’s China’s answer to the Malacca Strait, a way to bypass QUAD dominated chokepoints.

Now, imagine coupling Gwadar with REE extraction, refining, and export—China would not just own Pakistan’s roads, it would own the minerals of the future.

For Trump and US , this was like a untapped opportunity.

The U.S. cannot afford another strategic resource flowing smoothly through a Chinese-built corridor.

And so, the U.S. enters.

Not openly with mining drills or ships, but subtly—through financial levers, IMF pressure, crypto-linked deals like the WLF arrangement, and security pacts.

By supporting Pakistan’s designation of the Balochistan Liberation Army (BLA) as a terrorist group, Trump presents itself as a “stability partner.”

Trump assured Pakistani Army a face saving opportunity by put his name on line to claim credit for Op Sindoor ceasefire.

His aim was always the REE in Balochistan and Khyber Pakhtunwa region.

It’s Gulf War logic all over again—pretend to save the weak, but move in to secure the resource corridors.

For Pakistan, it’s déjà vu with new actors.

Not openly with mining drills or ships, but subtly—through financial levers, IMF pressure, crypto-linked deals like the WLF arrangement, and security pacts.

By supporting Pakistan’s designation of the Balochistan Liberation Army (BLA) as a terrorist group, Trump presents itself as a “stability partner.”

Trump assured Pakistani Army a face saving opportunity by put his name on line to claim credit for Op Sindoor ceasefire.

His aim was always the REE in Balochistan and Khyber Pakhtunwa region.

It’s Gulf War logic all over again—pretend to save the weak, but move in to secure the resource corridors.

For Pakistan, it’s déjà vu with new actors.

Pakistan’s tragedy or asset is its geography.

It has been darling of US and lately China because of its geography.

Pakistan gave US a perfect position to do their operation in USSR, Afghanistan, keep eye on China and India.

For China, Pakistan opened a route to Arabian sea via BRI and Gwadar.

But it is also tragedy for Pakistan once the superpowers eyed its reserve.

It has been darling of US and lately China because of its geography.

Pakistan gave US a perfect position to do their operation in USSR, Afghanistan, keep eye on China and India.

For China, Pakistan opened a route to Arabian sea via BRI and Gwadar.

But it is also tragedy for Pakistan once the superpowers eyed its reserve.

It sits at the crossroads of China’s Belt & Road, near the Strait of Hormuz, and at the edge of Afghanistan’s mineral basin.

Every corridor out of Pakistan matters to someone—China needs Gwadar, Iran eyes regional transit, Russia sees an Afghan entry, the West sees a counterweight to Beijing.

But Pakistan itself? It struggles with debt, insurgency, weak governance, and unemployment.

Like Kuwait in 1990, it risks becoming the battleground for others’ ambitions, not the beneficiary. Its resources may light up the world—but leave its own people in the dark.

Every corridor out of Pakistan matters to someone—China needs Gwadar, Iran eyes regional transit, Russia sees an Afghan entry, the West sees a counterweight to Beijing.

But Pakistan itself? It struggles with debt, insurgency, weak governance, and unemployment.

Like Kuwait in 1990, it risks becoming the battleground for others’ ambitions, not the beneficiary. Its resources may light up the world—but leave its own people in the dark.

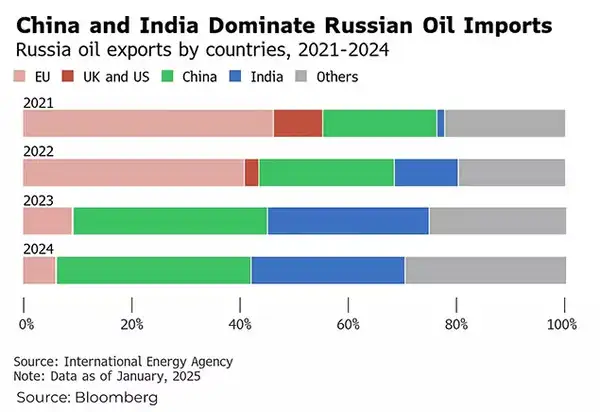

Then comes Russia.

With Afghanistan unstable yet open, Moscow sees a chance to repeat its African playbook—move in where the West fears to tread, secure access to lithium, copper, and rare earths, and trade minerals for weapons and cash.

Sanctioned at home, Russia’s survival depends on resource corridors abroad.

If it secures routes through Afghanistan and northern Pakistan, Moscow could place itself at the table of the REE game.

For Pakistan, this adds yet another heavyweight power demanding entry.

Surrounded by debt from the West, dependence on China, and insurgency within, it risks being pulled apart.

With Afghanistan unstable yet open, Moscow sees a chance to repeat its African playbook—move in where the West fears to tread, secure access to lithium, copper, and rare earths, and trade minerals for weapons and cash.

Sanctioned at home, Russia’s survival depends on resource corridors abroad.

If it secures routes through Afghanistan and northern Pakistan, Moscow could place itself at the table of the REE game.

For Pakistan, this adds yet another heavyweight power demanding entry.

Surrounded by debt from the West, dependence on China, and insurgency within, it risks being pulled apart.

The picture is grim:

China: long-term investor, holding infrastructure and port access.

U.S.: opportunistic entrant, using finance and counter-terror leverage to carve a stake.

Russia: probing via Afghanistan, seeking sanctions relief through minerals.

Iran: influencing transit corridors, tying Pakistan’s exports to its own leverage.

And Pakistan? Caught between loyalty to its old partner (China), the temptation of U.S. dollars, the pressure of insurgency, and the weight of geography.

This isn’t about rare earths alone.

It’s about a fragile nation becoming the chessboard for a new great game.

China: long-term investor, holding infrastructure and port access.

U.S.: opportunistic entrant, using finance and counter-terror leverage to carve a stake.

Russia: probing via Afghanistan, seeking sanctions relief through minerals.

Iran: influencing transit corridors, tying Pakistan’s exports to its own leverage.

And Pakistan? Caught between loyalty to its old partner (China), the temptation of U.S. dollars, the pressure of insurgency, and the weight of geography.

This isn’t about rare earths alone.

It’s about a fragile nation becoming the chessboard for a new great game.

The Gulf War taught the world that when superpowers say “we are defending sovereignty,” what they mean is “we are defending access.”

Back then, it was barrels of oil.

Today, it may be grams of neodymium, dysprosium, and praseodymium.

For the U.S., keeping Pakistan out of China’s full control is the prize.

For China, locking Pakistan as a mineral and maritime hub means long time dominance of Rare Earth Mineral export.

What will Pakistan gain out of it?

Back then, it was barrels of oil.

Today, it may be grams of neodymium, dysprosium, and praseodymium.

For the U.S., keeping Pakistan out of China’s full control is the prize.

For China, locking Pakistan as a mineral and maritime hub means long time dominance of Rare Earth Mineral export.

What will Pakistan gain out of it?

Pakistan have lot of debt to China, US and other countries.

At best Pakistan will be able to offset some loans through this.

Asim Munir and few top level leadership would get some money out of it.

At the end, Pakistan is going to be broken into many pieces ie Balochistan, KPK and others.

Is it something India should be happy about?

At best Pakistan will be able to offset some loans through this.

Asim Munir and few top level leadership would get some money out of it.

At the end, Pakistan is going to be broken into many pieces ie Balochistan, KPK and others.

Is it something India should be happy about?

NO.

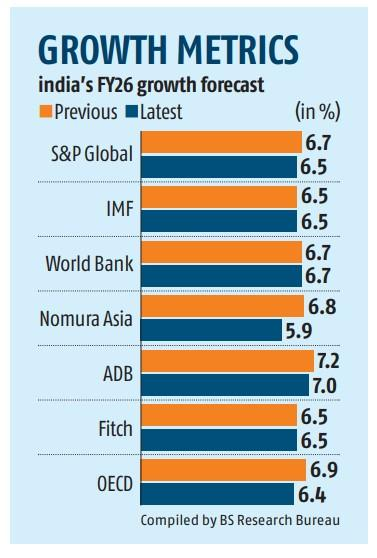

As Pakistan starts becoming silent battle ground between the powers. To hide its instability , they will try to create same sort of situation in India through terror attacks, cross border firing and so on.

Some of the hints are already in front of us to see.

Attack on Election commission through fake propaganda, caste divide politics and so on.

India needs to remain vigilant and act based on how things unfold.

India holds key...

As Pakistan starts becoming silent battle ground between the powers. To hide its instability , they will try to create same sort of situation in India through terror attacks, cross border firing and so on.

Some of the hints are already in front of us to see.

Attack on Election commission through fake propaganda, caste divide politics and so on.

India needs to remain vigilant and act based on how things unfold.

India holds key...

... exit point from Pakistan ie Arabian Sea.

It won't be easy for US to extract and move minerals from Pakistan

On one side its China, India. On the other side its Afghanistan and Iran.

Only exit point is Karachi port and Indian Navy's command over arabian sea is as good as anywhere.

Same applies for China as well.

If they can't take India in confidence, they wont be able to move anything out of Pakistan.

India holds all the cards despite no interest in Pakistan's reserve.

To summarize, Pakistan is happy being darling to both but it has one major problem which will be cause everything ....

It won't be easy for US to extract and move minerals from Pakistan

On one side its China, India. On the other side its Afghanistan and Iran.

Only exit point is Karachi port and Indian Navy's command over arabian sea is as good as anywhere.

Same applies for China as well.

If they can't take India in confidence, they wont be able to move anything out of Pakistan.

India holds all the cards despite no interest in Pakistan's reserve.

To summarize, Pakistan is happy being darling to both but it has one major problem which will be cause everything ....

... discussed above. It is division of resources between US and China.

India has some critical pressure points in control ie how would anyone take out their treasure from Pakistan without taking India in confidence.

This Gulf war 2.0 ie Pakistan REE war is going to be war of technical superiority, manipulation game and control of infrastructure.

China was ahead but US have gained good ground taking Asim Munir in confidence but India, Iran and Afghan hold key.

India has some critical pressure points in control ie how would anyone take out their treasure from Pakistan without taking India in confidence.

This Gulf war 2.0 ie Pakistan REE war is going to be war of technical superiority, manipulation game and control of infrastructure.

China was ahead but US have gained good ground taking Asim Munir in confidence but India, Iran and Afghan hold key.

• • •

Missing some Tweet in this thread? You can try to

force a refresh