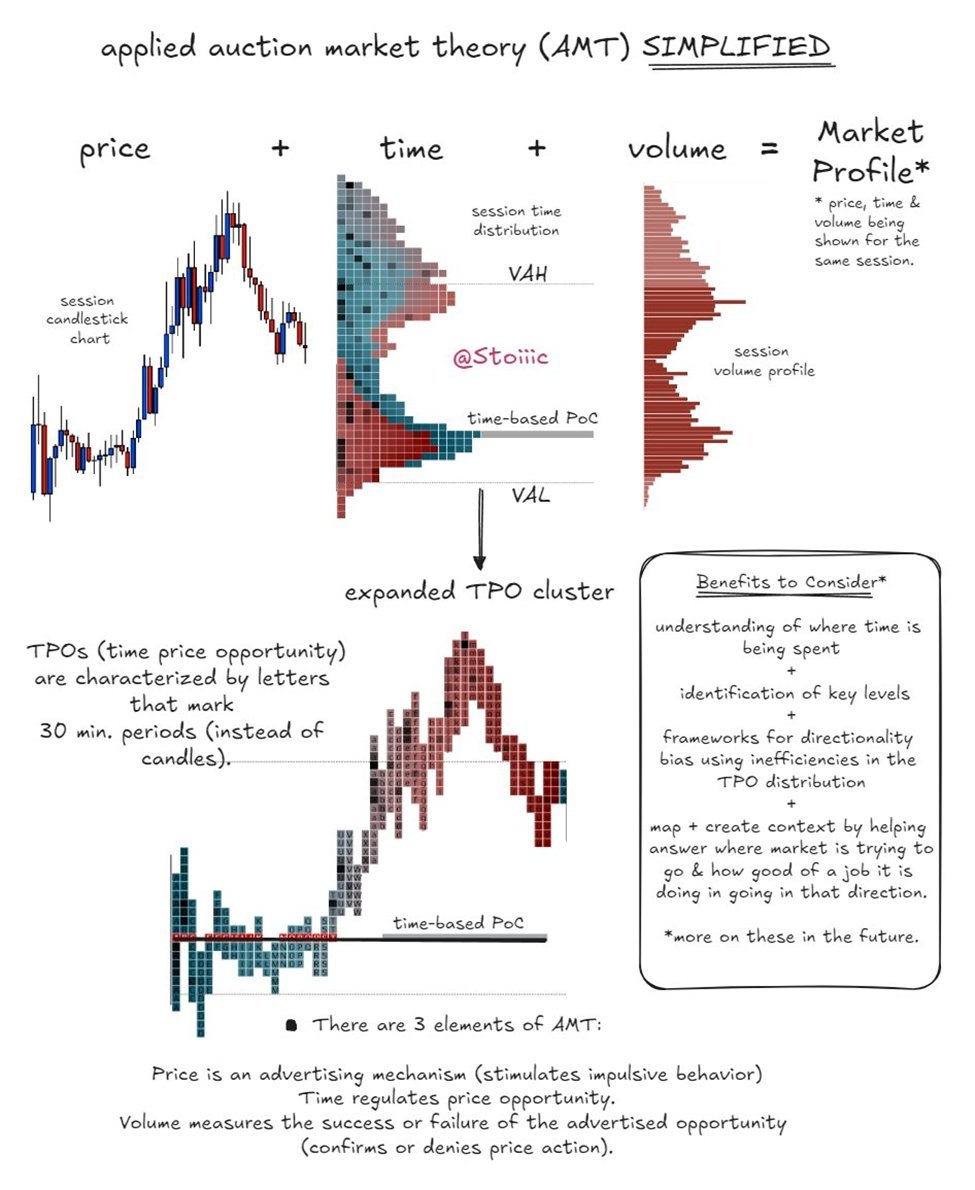

“… time regulates price opportunity…” – Dalton

TPO (time price opportunity) 101

a detailed thread-:

> what are the f*ck are the tetris looking charts?

> why consider using time-based distributions?

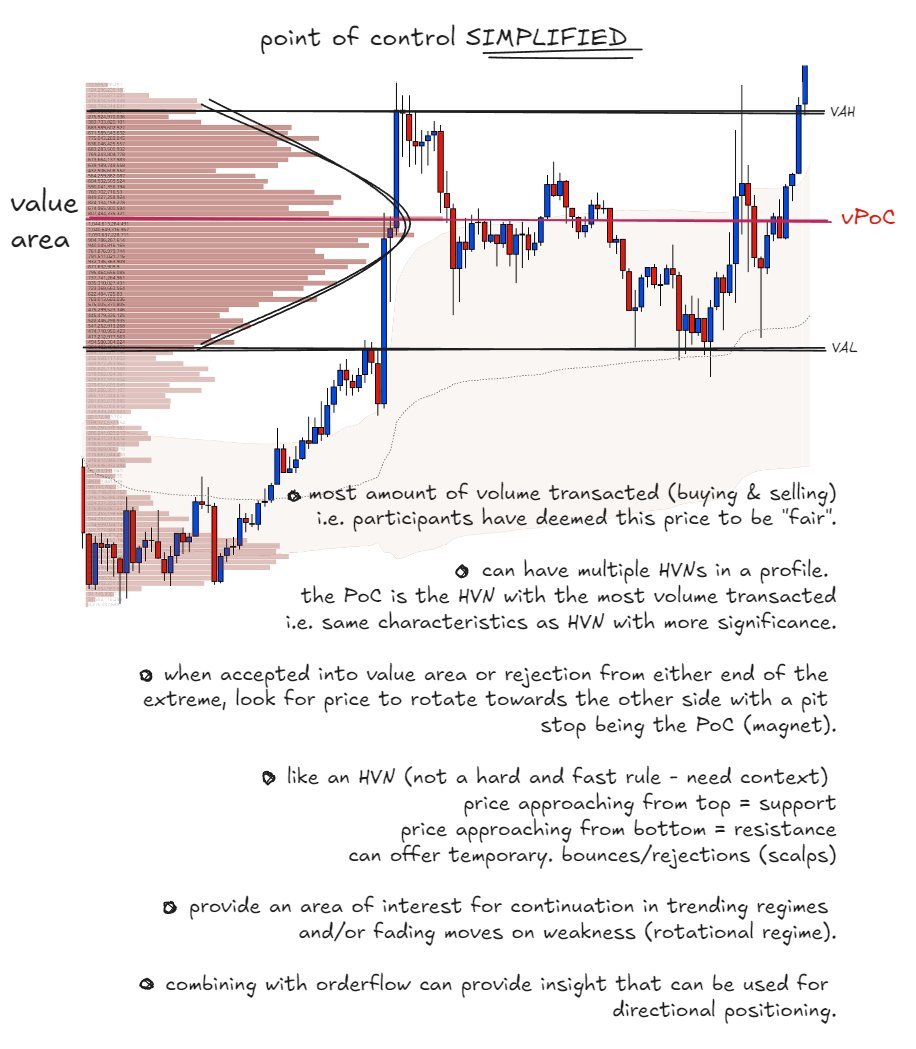

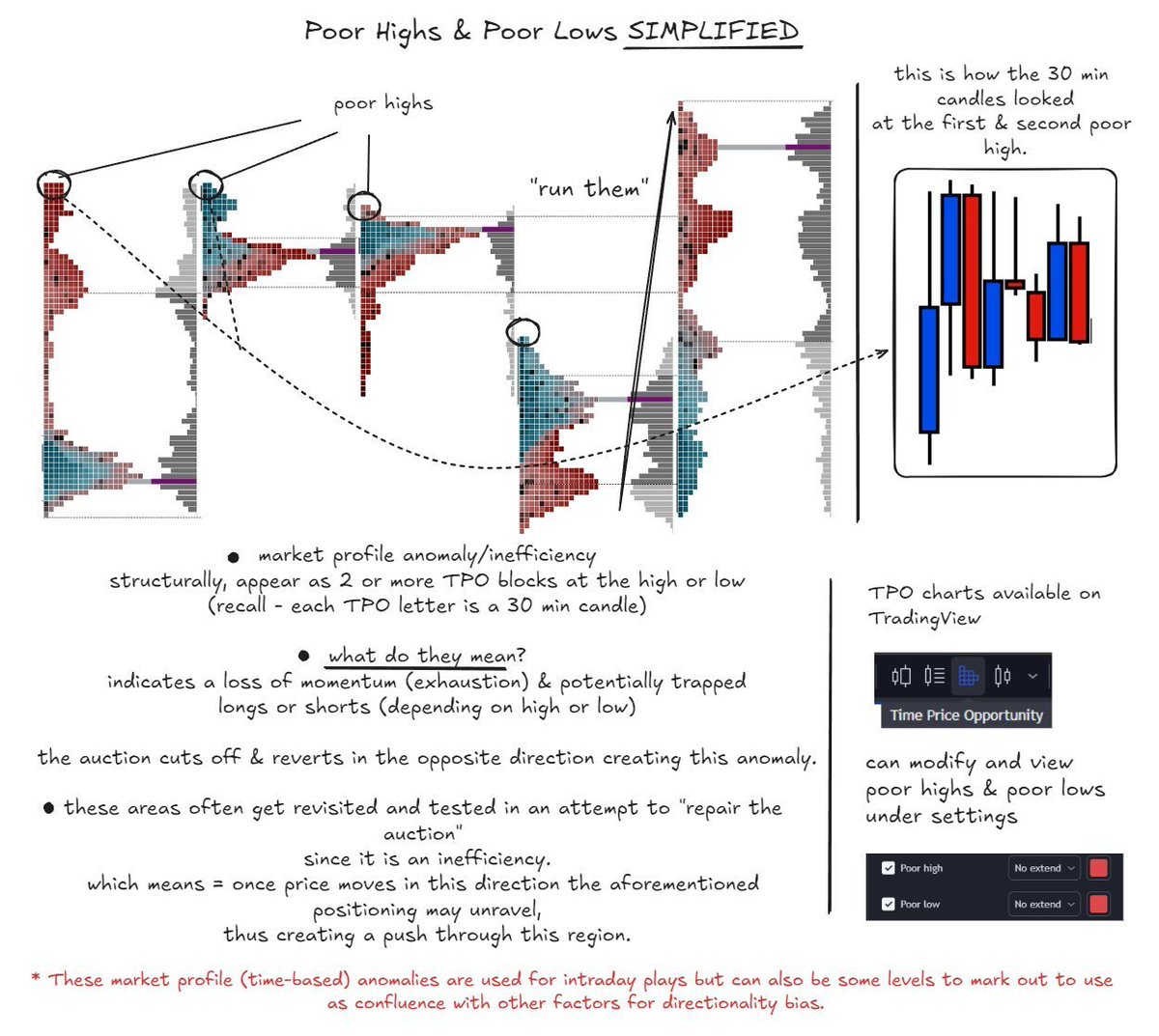

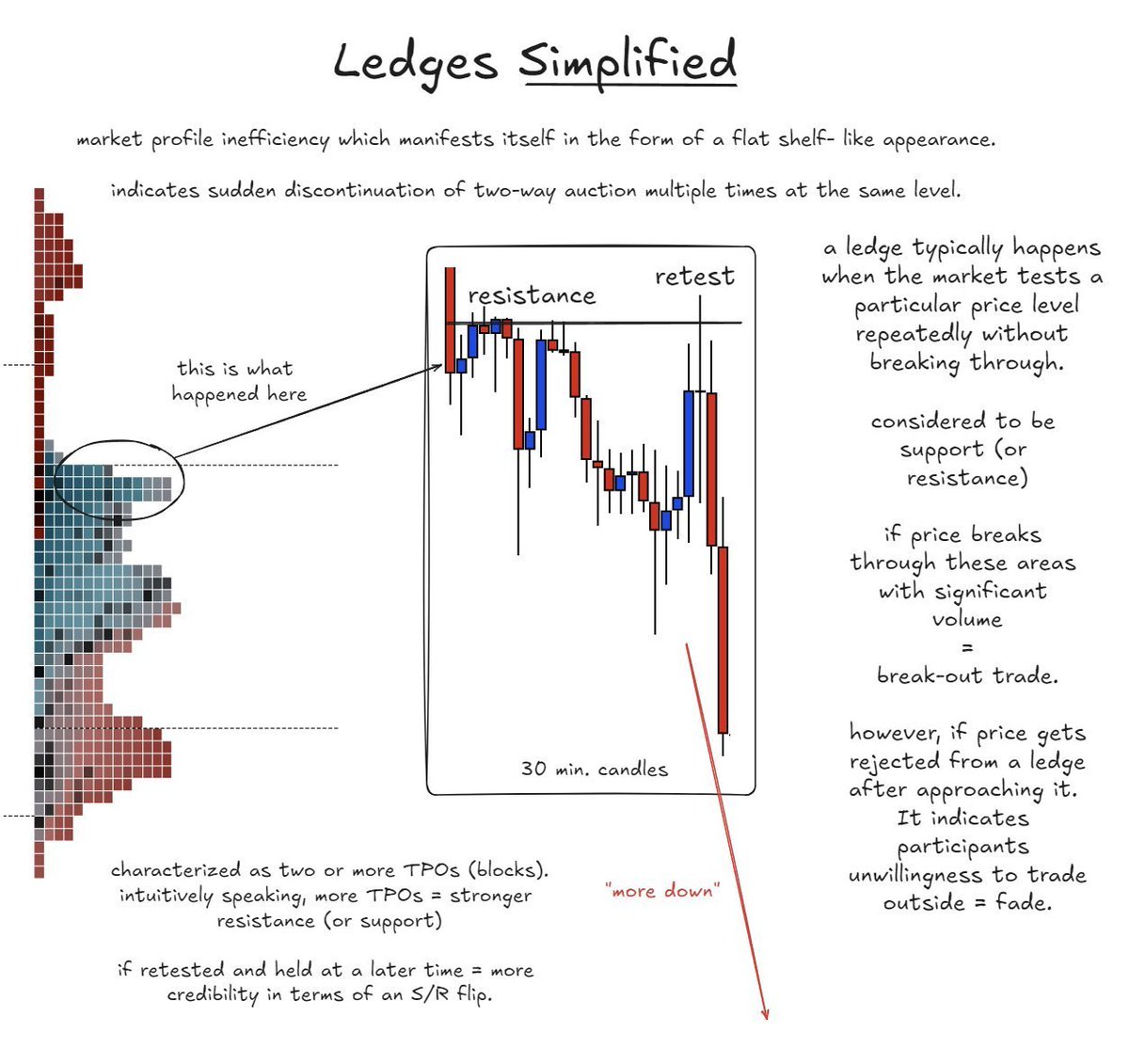

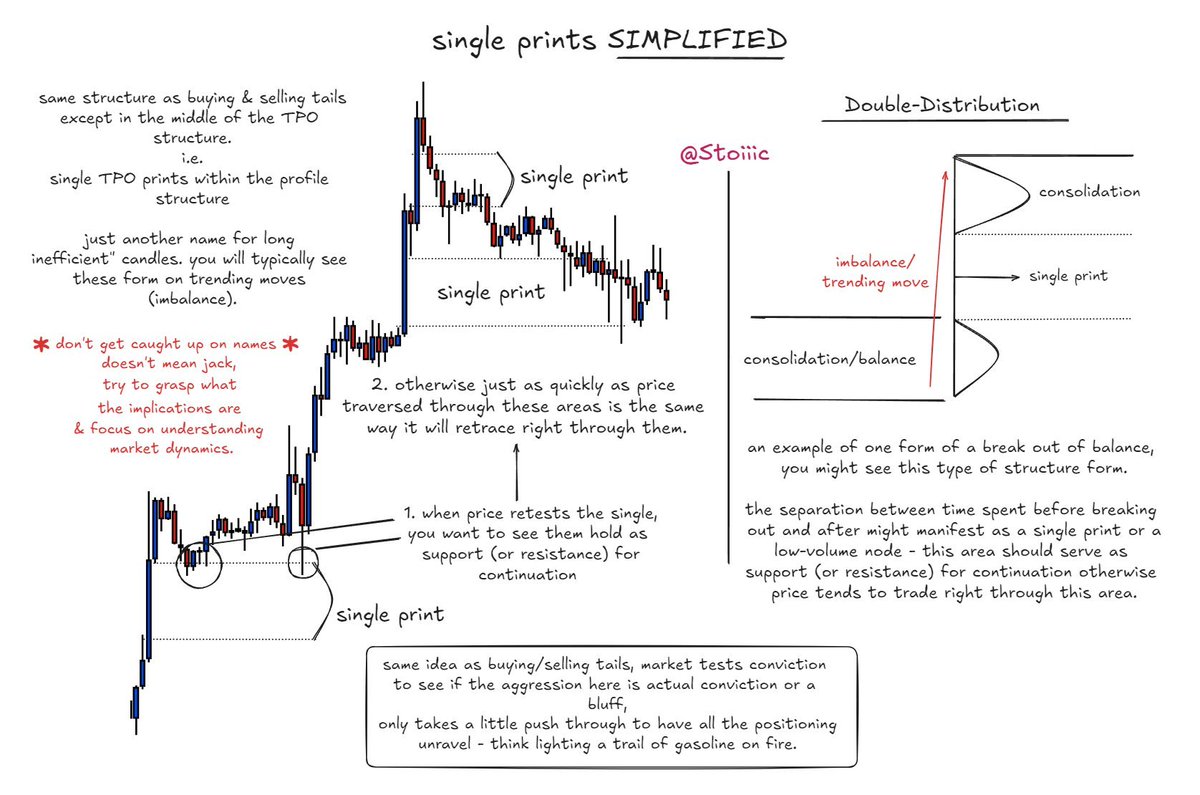

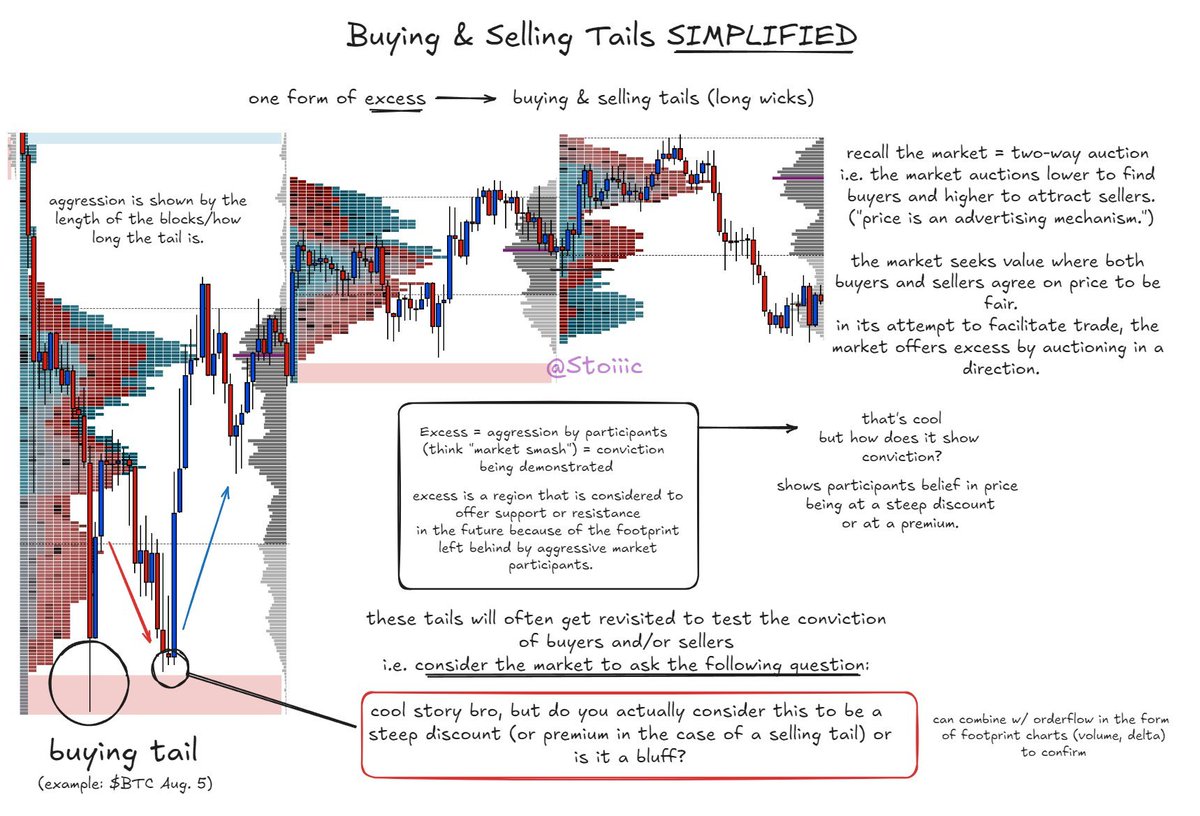

> anomalies - what they mean and potential use

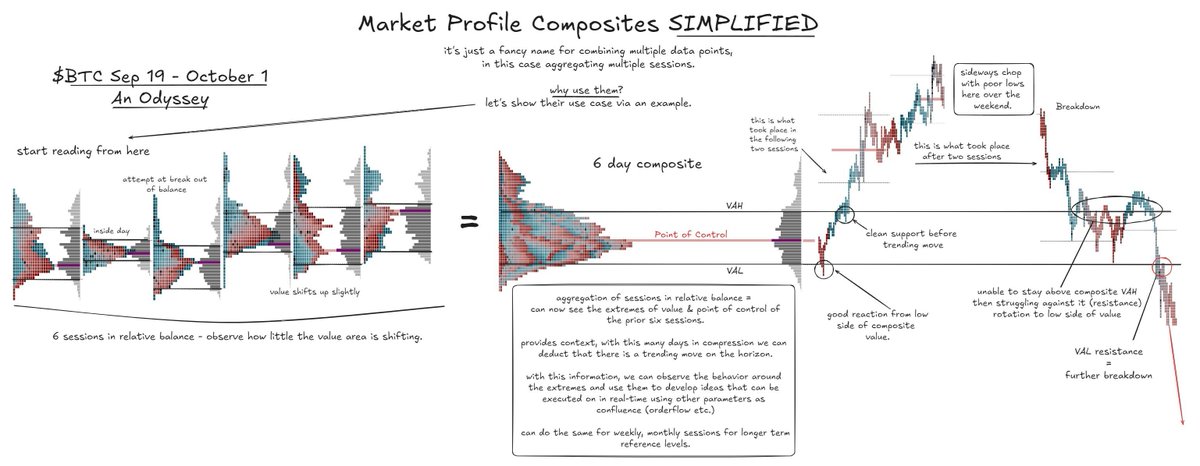

> composites

TPO (time price opportunity) 101

a detailed thread-:

> what are the f*ck are the tetris looking charts?

> why consider using time-based distributions?

> anomalies - what they mean and potential use

> composites

> how does time fit into applied auction market theory?

> what is tpo? (click on thread)

> what are potential benefits of incorporating tpo?

> what is tpo? (click on thread)

> what are potential benefits of incorporating tpo?

https://x.com/Stoiiic/status/1875452048491032974

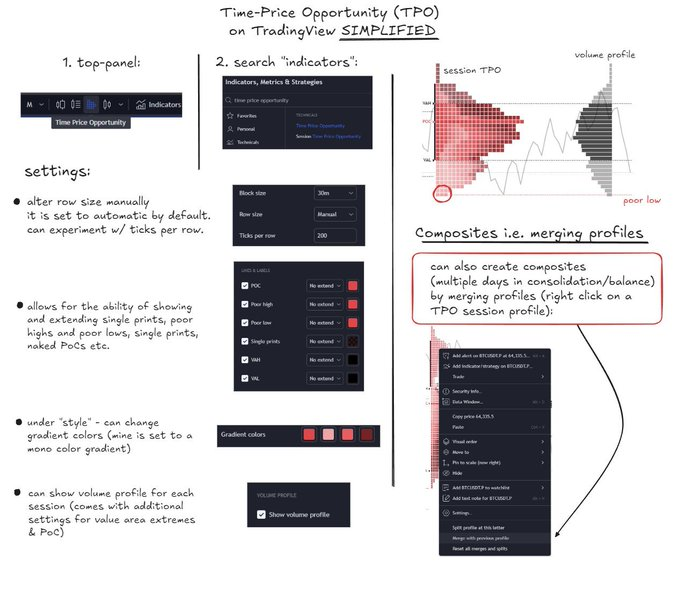

This is a complete aggregation of the TPO series. The platform I use the most is Exocharts but TradingView also offers a TPO option as well that can be used to start off.

Hope this was helpful. If you want more long form edu threads, like the first tweet in the thread.

Also considering doing a full series on youtube (will gauge interest through this thread) - link for youtube in bio.

Hope this was helpful. If you want more long form edu threads, like the first tweet in the thread.

Also considering doing a full series on youtube (will gauge interest through this thread) - link for youtube in bio.

• • •

Missing some Tweet in this thread? You can try to

force a refresh