Something is seriously wrong here:

For the first time in history, a NEW home in the US costs $33,500 LESS than an EXISTING home, per Reventure.

Not even June 2005 saw such a large gap, right before the 2008 Financial Crisis.

What is happening? Let us explain.

(a thread)

For the first time in history, a NEW home in the US costs $33,500 LESS than an EXISTING home, per Reventure.

Not even June 2005 saw such a large gap, right before the 2008 Financial Crisis.

What is happening? Let us explain.

(a thread)

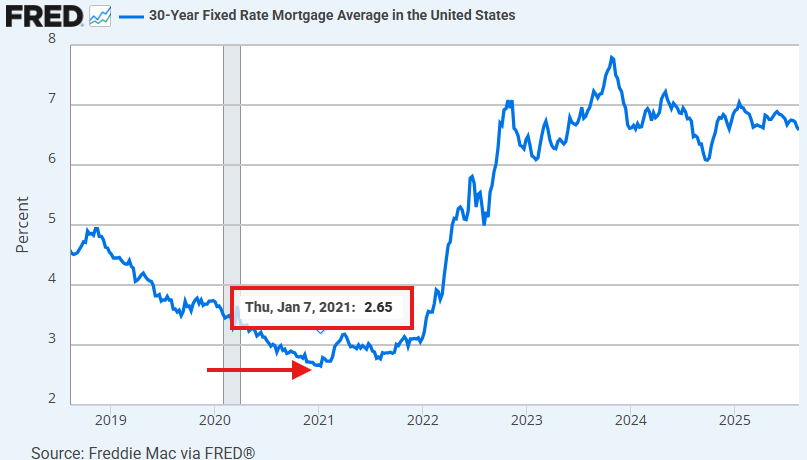

It all stems back to March 2020, when the Fed implemented their largest rate cut in history.

This led to the average rate on a 30Y Mortgage felling to a record low of 2.65%.

There was never a cheaper time in history to take a loan or refinance your mortgage than in 2021.

This led to the average rate on a 30Y Mortgage felling to a record low of 2.65%.

There was never a cheaper time in history to take a loan or refinance your mortgage than in 2021.

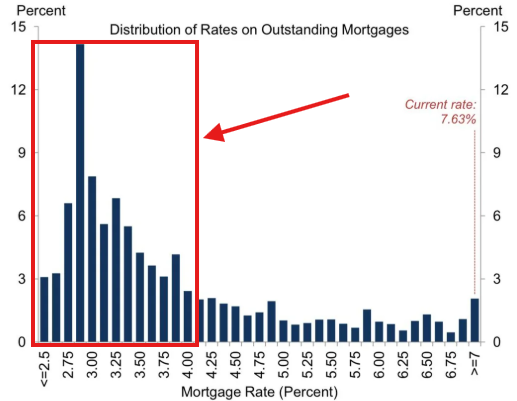

As a result, most Americans saw their mortgage rates drop well below 4%.

In fact, 55% of homeowners now have rates below 4% and 21% have rates below 3%.

This has created the ultimate "golden handcuffs" moment.

You can't sell your home because you will lose your mortgage rate.

In fact, 55% of homeowners now have rates below 4% and 21% have rates below 3%.

This has created the ultimate "golden handcuffs" moment.

You can't sell your home because you will lose your mortgage rate.

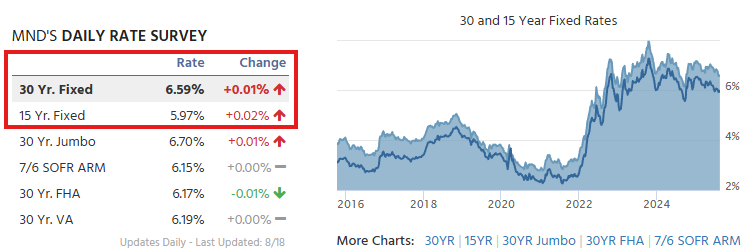

Currently, the average 30Y Mortgage rate for a home purchase is up to ~6.59%.

If you currently own a home with a 3% mortgage and want to move to a new home, your rate will more than DOUBLE.

The result?

A heavily skewed housing inventory situation in the US.

If you currently own a home with a 3% mortgage and want to move to a new home, your rate will more than DOUBLE.

The result?

A heavily skewed housing inventory situation in the US.

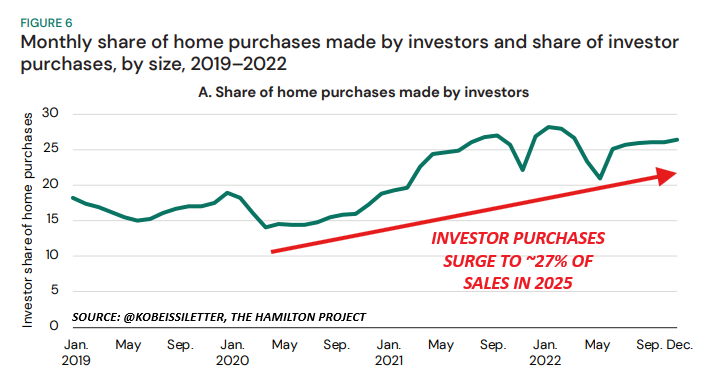

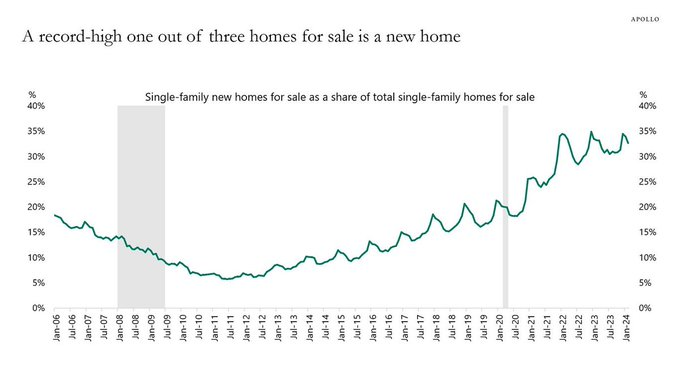

In fact, a record 1 out of 3 homes for sale is now a new home.

By comparison, after the 2008 Financial Crisis, 1 out of 20 homes for sale was a new home.

Just 4 years ago, only ~16% of homes for sale were new construction.

For many buyers, new homes are their ONLY option.

By comparison, after the 2008 Financial Crisis, 1 out of 20 homes for sale was a new home.

Just 4 years ago, only ~16% of homes for sale were new construction.

For many buyers, new homes are their ONLY option.

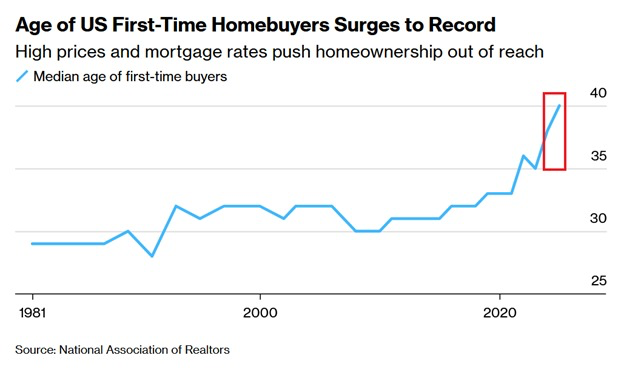

On top of this, housing affordability has hit a record low.

In 2023, mortgage rates neared 8% for the first time since 2000.

The Housing Affordability Index hit a record low of ~90 points.

This means that housing affordability has fallen over 50% since 2021.

In 2023, mortgage rates neared 8% for the first time since 2000.

The Housing Affordability Index hit a record low of ~90 points.

This means that housing affordability has fallen over 50% since 2021.

Now, affordability is at record lows, existing homeowners won't sell, and new inventory is surging.

What are homebuilders doing?

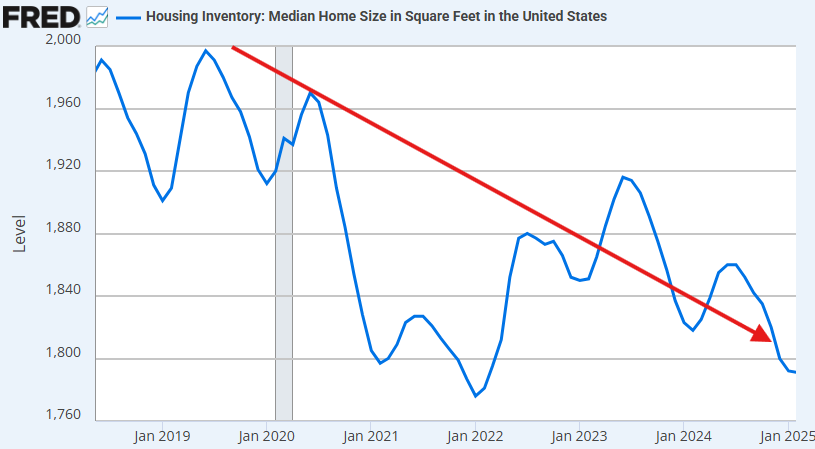

First, homes are getting smaller in the US.

The median home size in the US fell to 1,792 sq feet in January 2025.

In 2019, it hit 1,991 sq feet.

What are homebuilders doing?

First, homes are getting smaller in the US.

The median home size in the US fell to 1,792 sq feet in January 2025.

In 2019, it hit 1,991 sq feet.

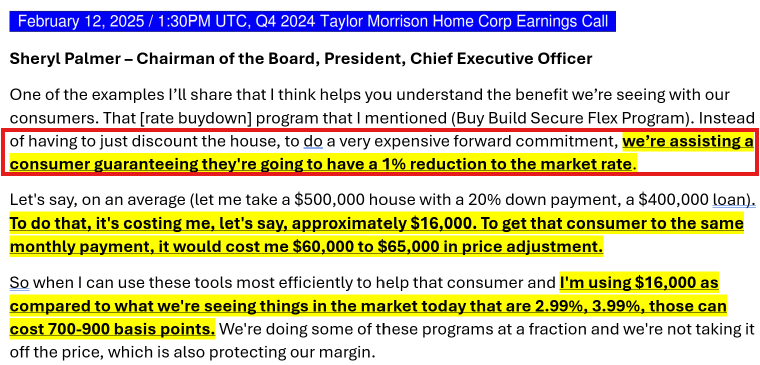

On top of this, homebuilders are BUYING DOWN mortgage rates for consumers.

Take a look at the screenshot below.

Taylor Morrison, $TMHC, is buying down rates by 100+ basis points for homebuyers.

New homebuilders are desperate to get rid of this inventory glut.

Take a look at the screenshot below.

Taylor Morrison, $TMHC, is buying down rates by 100+ basis points for homebuyers.

New homebuilders are desperate to get rid of this inventory glut.

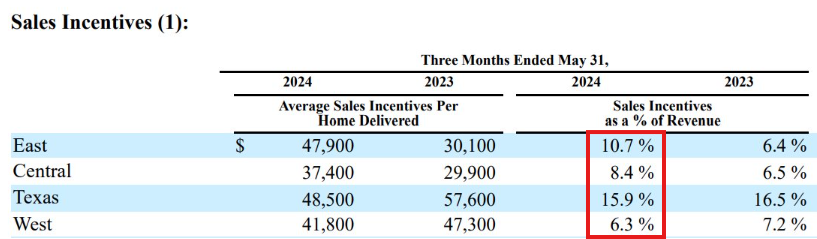

Take a look at this:

Lennar's, $LEN, sales incentives in 2024 hit as much as 15.9% of revenue in parts of the US, particularly in Texas.

In the Eastern US, Lennar provided sales incentives equaling 10.7% of sales.

This is not a "normal" market for homebuilders.

Lennar's, $LEN, sales incentives in 2024 hit as much as 15.9% of revenue in parts of the US, particularly in Texas.

In the Eastern US, Lennar provided sales incentives equaling 10.7% of sales.

This is not a "normal" market for homebuilders.

In 2024, the price of a new home fell below the price of an existing home for the first time since 2005.

That gap only widened, which is setting up for an interesting next few months.

As the Fed begins cutting rates, will we see this correct?

Are existing homes too expensive?

That gap only widened, which is setting up for an interesting next few months.

As the Fed begins cutting rates, will we see this correct?

Are existing homes too expensive?

Or, will the price of new homes simply come back up to the price of existing homes?

Regardless, history has shown that such a large shortfall between new and existing home prices cannot last.

Something will happen in the market that will ultimately narrow this gap.

Regardless, history has shown that such a large shortfall between new and existing home prices cannot last.

Something will happen in the market that will ultimately narrow this gap.

The first rate cut of 2025 is coming in September.

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and housing are tradable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

The macroeconomy is shifting and its implications on stocks, commodities, bonds, and housing are tradable.

Want to see how we are doing it?

Subscribe to access our premium analysis below:

thekobeissiletter.com/subscribe

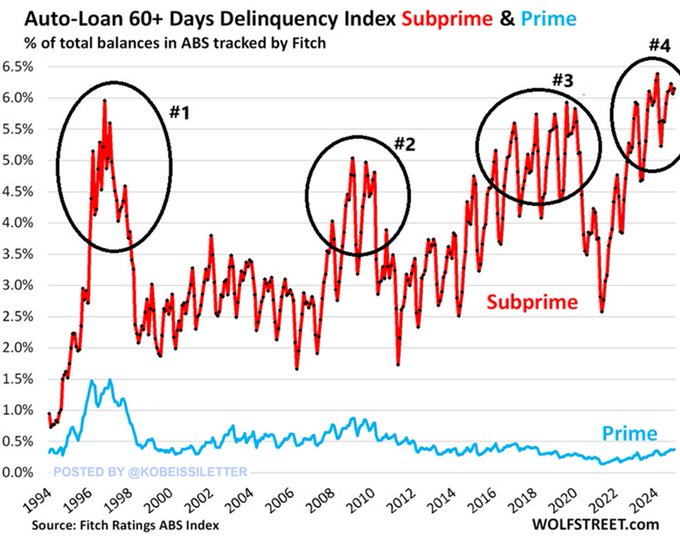

Lastly, delinquency rates outside of housing debt are skyrocketing.

US subprime auto loan 60+ day delinquency rates jumped to 6.2% in December 2024.

If this spreads to housing, the implications will be huge.

Follow us @KobeissiLetter for real time analysis as this develops.

US subprime auto loan 60+ day delinquency rates jumped to 6.2% in December 2024.

If this spreads to housing, the implications will be huge.

Follow us @KobeissiLetter for real time analysis as this develops.

• • •

Missing some Tweet in this thread? You can try to

force a refresh