🚨Premium rise in Health insurance

You didn't claim, but

Ur health insurance premium rose suddenly from Rs 50,000 to Rs 70000!🤯🤯

Why did this happen?🧐

Does the premium rise after every claim?🧐🧐

A thread🧵on why health insurance premiums rise & do premiums rise after claims?👇

You didn't claim, but

Ur health insurance premium rose suddenly from Rs 50,000 to Rs 70000!🤯🤯

Why did this happen?🧐

Does the premium rise after every claim?🧐🧐

A thread🧵on why health insurance premiums rise & do premiums rise after claims?👇

Do premiums rise with age?

Yes, health insurance premiums rise with age.

As the risk of hospitalisation increases as time goes on,

The insurer increases as time goes on

Yes, health insurance premiums rise with age.

As the risk of hospitalisation increases as time goes on,

The insurer increases as time goes on

So what are the sources of premium increase?

1. Insurer takes company-wide premium increase due to massive increase in claims

2. Your age band changes

3. Rise in medical costs

1. Insurer takes company-wide premium increase due to massive increase in claims

2. Your age band changes

3. Rise in medical costs

Company-wide:-

When claims surge and the insurer starts to make a loss

The insurer takes a premium increase.

Suring COVID when claims surged, the industry witnessed a loss.

TO cover these losses industry-wide premiums were increases

When claims surge and the insurer starts to make a loss

The insurer takes a premium increase.

Suring COVID when claims surged, the industry witnessed a loss.

TO cover these losses industry-wide premiums were increases

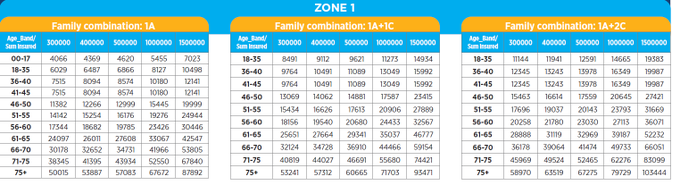

Rise in age band:-

Insurers generally increase the premium in age band of 5 years

Here is the premium increase chart of one such comprehensive policies

Insurers generally increase the premium in age band of 5 years

Here is the premium increase chart of one such comprehensive policies

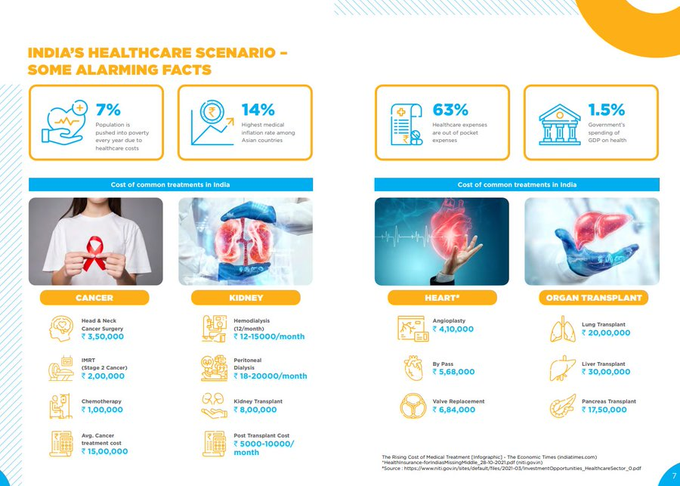

Rise in Medical costs

🚨India's Healthcare Scenario:-

🩺India's medical inflation=14%

🩺Cost of treatment nearly doubles every 5 years

🩺A 10L cover today will be reduced to a 5L cover in 5 years time

🩺63% of the hospitalization bill is paid from the pocket

🚨India's Healthcare Scenario:-

🩺India's medical inflation=14%

🩺Cost of treatment nearly doubles every 5 years

🩺A 10L cover today will be reduced to a 5L cover in 5 years time

🩺63% of the hospitalization bill is paid from the pocket

So does the premium increase after claims?

There is a common misconception that claims will lead to an increase in premium

According to IRDAI rules the insurer cannot increase the premium if u claim multiple times

However,the insurer can investigate the cause of multiple claim

There is a common misconception that claims will lead to an increase in premium

According to IRDAI rules the insurer cannot increase the premium if u claim multiple times

However,the insurer can investigate the cause of multiple claim

So what then is the conclusion?

For Health insurance premiums will increase with age.

There is not way around it.

Premium get really expensive with older age and that is the reality of it.

For Health insurance premiums will increase with age.

There is not way around it.

Premium get really expensive with older age and that is the reality of it.

Follow me @NIKHILLJHA as I write deep insights into health insurance

Go to my profile and hit the bell icon🔔to always stay updated

Go to my profile and hit the bell icon🔔to always stay updated

• • •

Missing some Tweet in this thread? You can try to

force a refresh