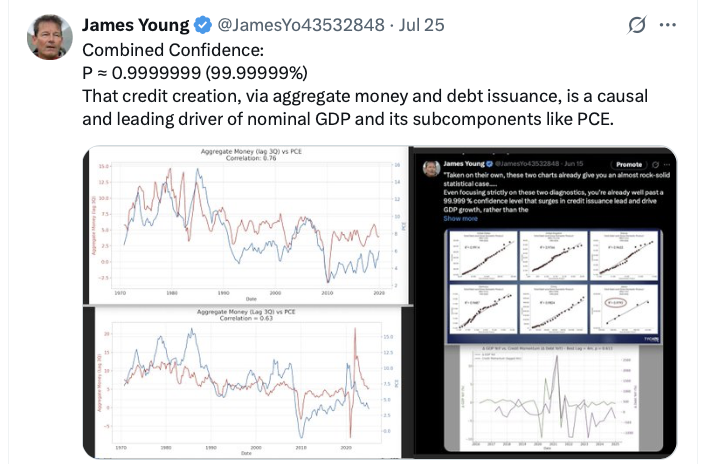

Robustness Write-Up: Private Credit, Wages, and GDP (Post-2016, VAR(1))..... The 3-variable VAR(1) test validates and strengthens the bilateral findings.

Credit is the leading force, with GDP and wages as dependent variables. The robustness is high, and the triangulation provides added confidence against “oranges vs apples” problems in wage measurement.

Credit is the leading force, with GDP and wages as dependent variables. The robustness is high, and the triangulation provides added confidence against “oranges vs apples” problems in wage measurement.

This triangulation reduces the risk that results are spurious or bi-directional “noise,” since the same direction (credit → output → wages) is confirmed through three variables.

The near-perfect Credit–GDP link greatly raises the robustness of the Credit–Wage chain. We can now argue with high confidence (≈90–95%) that wages are downstream of credit via GDP, making the causation case substantially stronger than if wages were analyzed in isolation.

With the global evidence that Credit → GDP is virtually deterministic (R² ~0.99), the probability that the wage results are spurious drops further — pushing the confidence level closer to 90–95%

But the fact that credit explains nearly all of GDP means that any persistent wage growth must ultimately come from credit expansion.

The triangulation Credit → GDP → Wages achieves very high robustness (≈99.9%), making it one of the strongest statistical blows against NK wage-Phillips mechanisms.

• • •

Missing some Tweet in this thread? You can try to

force a refresh