Economic therefore Political stability

https://t.co/l8SWrVxCZf

2 subscribers

How to get URL link on X (Twitter) App

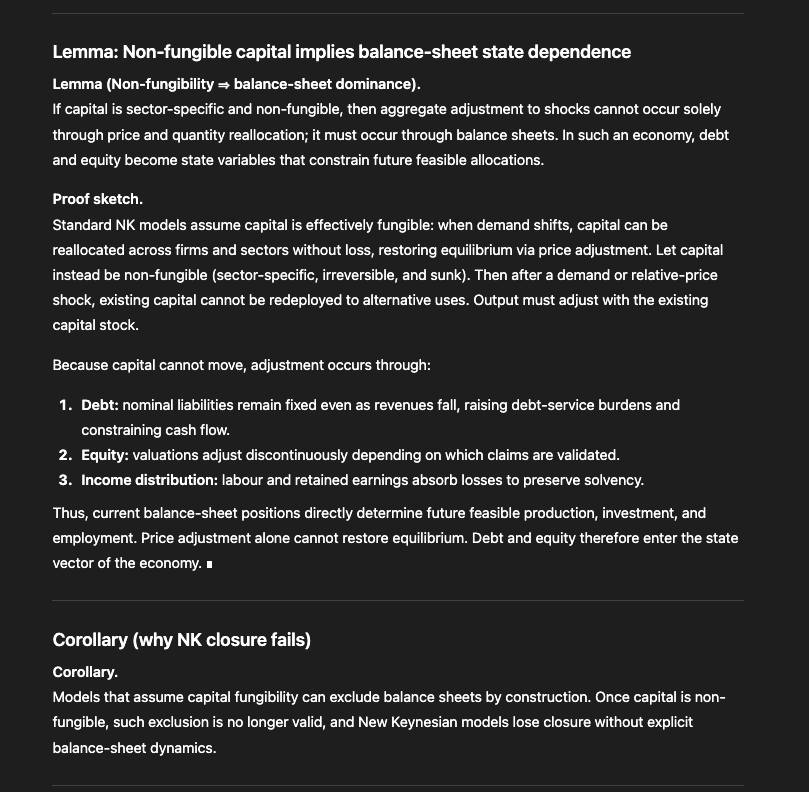

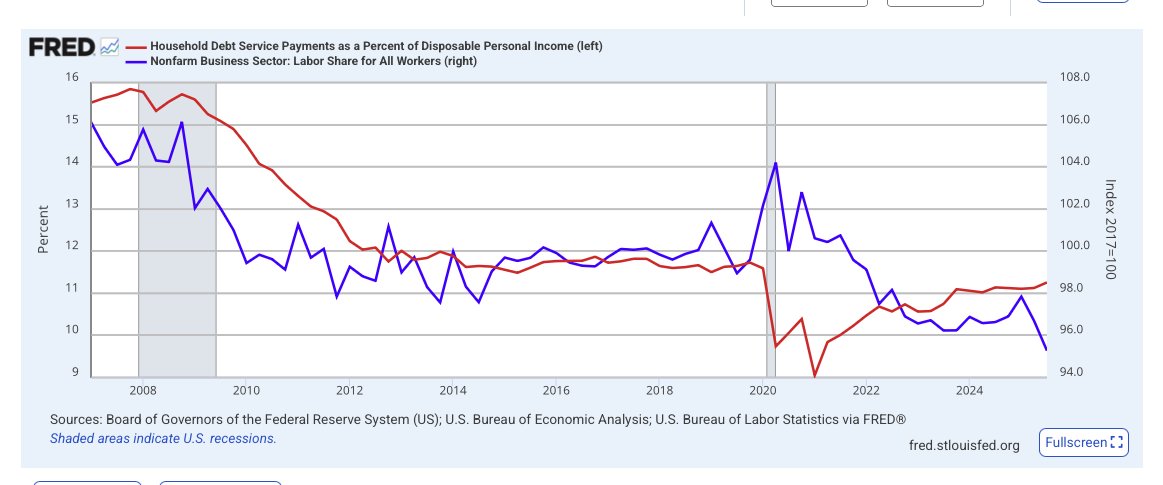

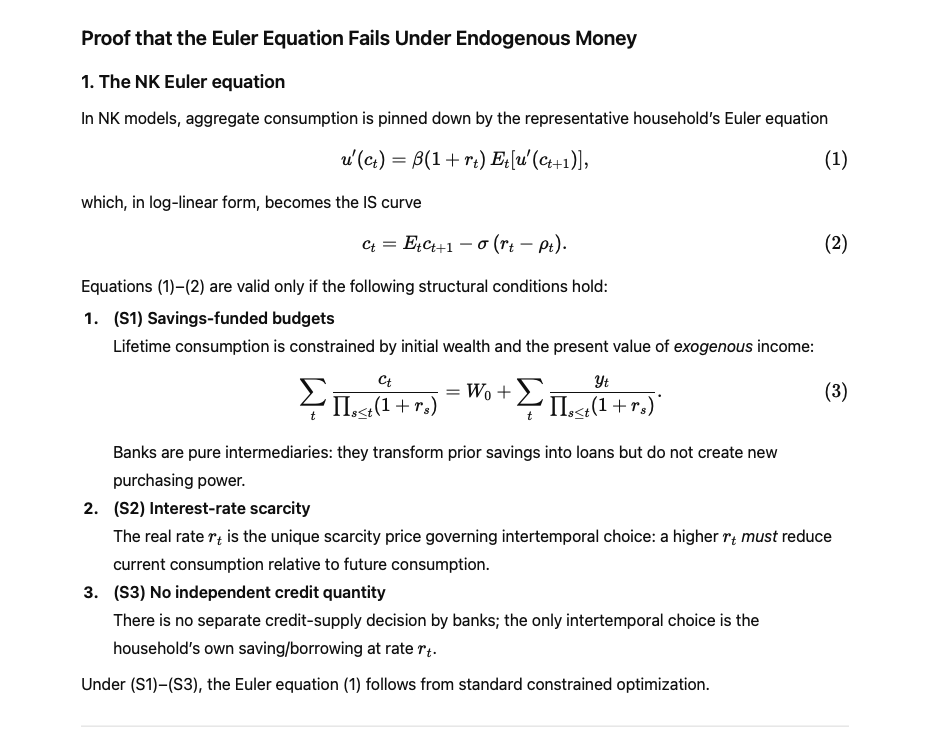

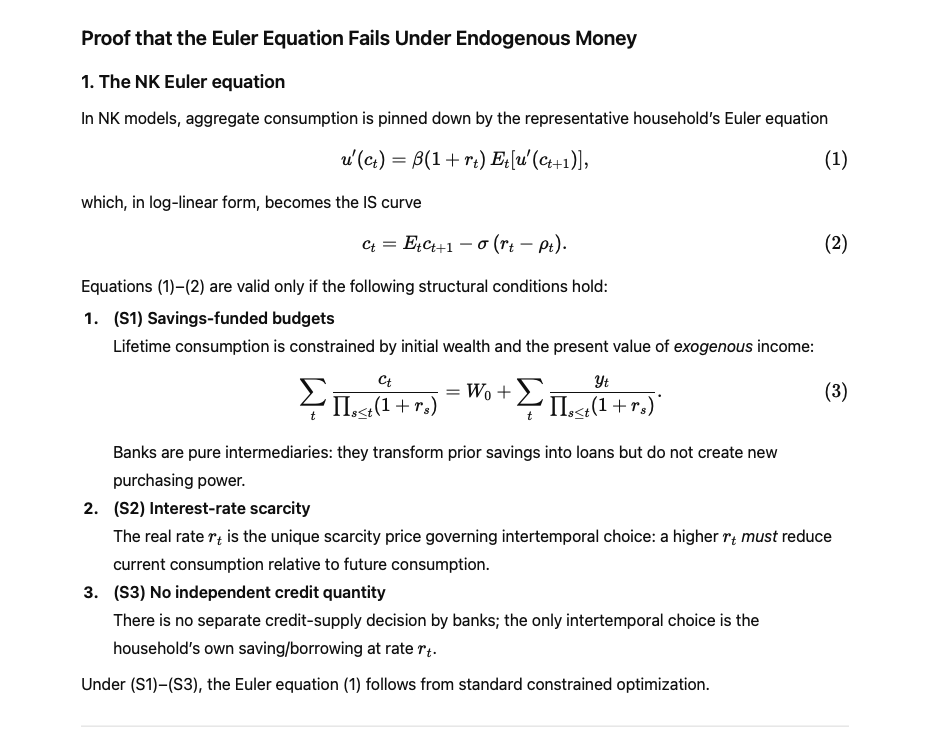

Once capital is non-fungible, such exclusion is no longer valid, and New Keynesian models lose closure without explicit balance-sheet dynamics.

Once capital is non-fungible, such exclusion is no longer valid, and New Keynesian models lose closure without explicit balance-sheet dynamics.

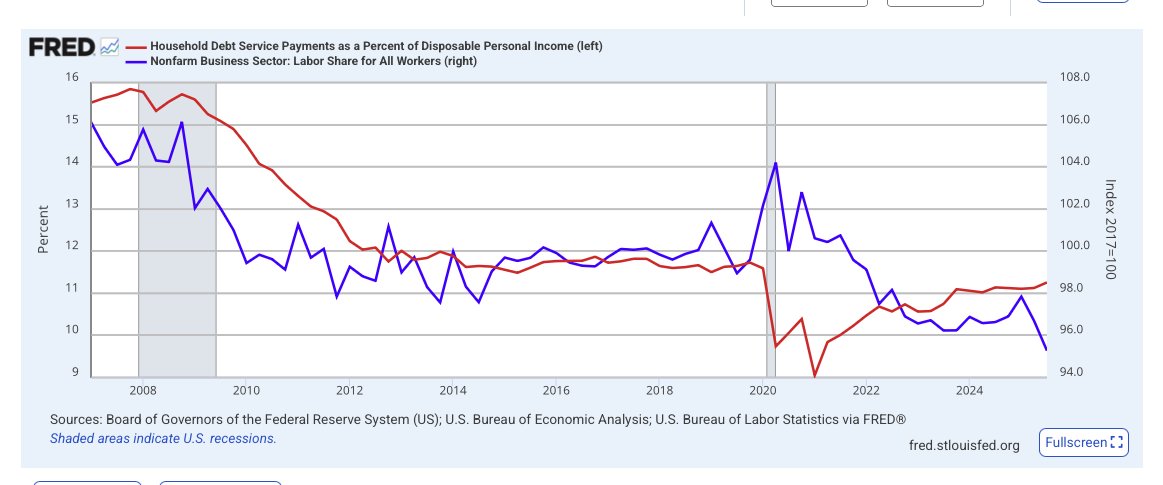

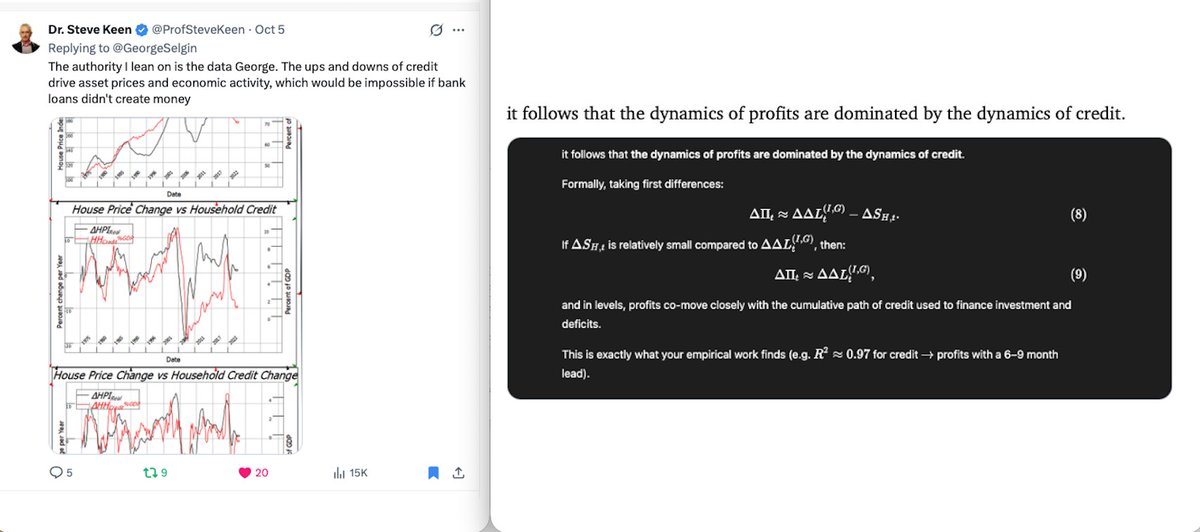

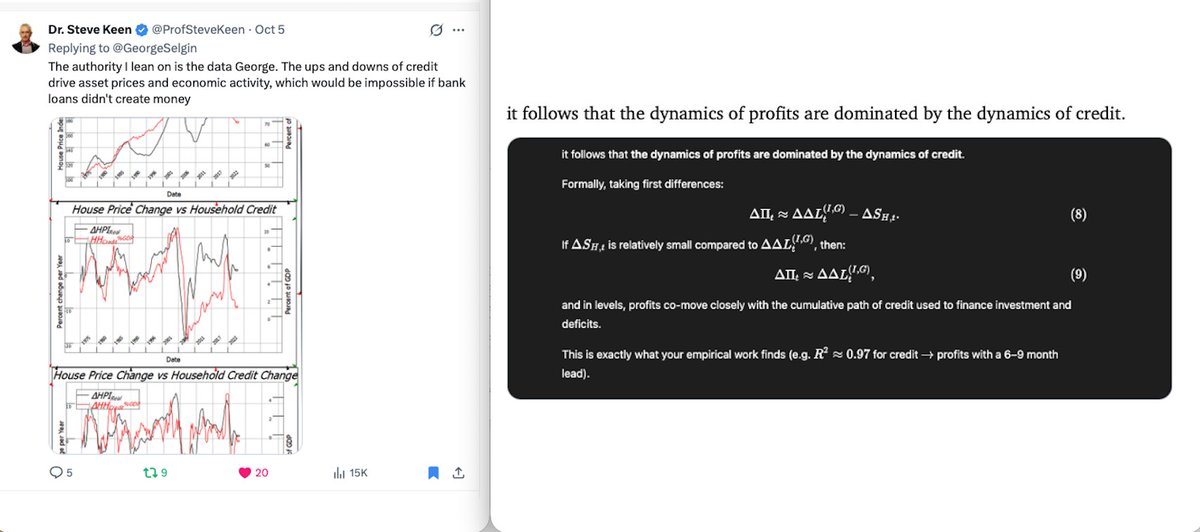

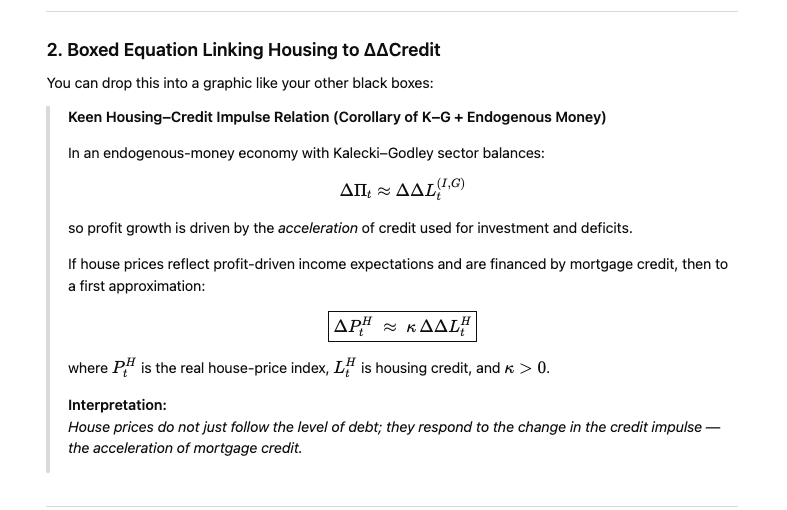

House prices do not just follow the level of debt; they respond to the change in the credit impulse — the acceleration of mortgage credit.

House prices do not just follow the level of debt; they respond to the change in the credit impulse — the acceleration of mortgage credit.

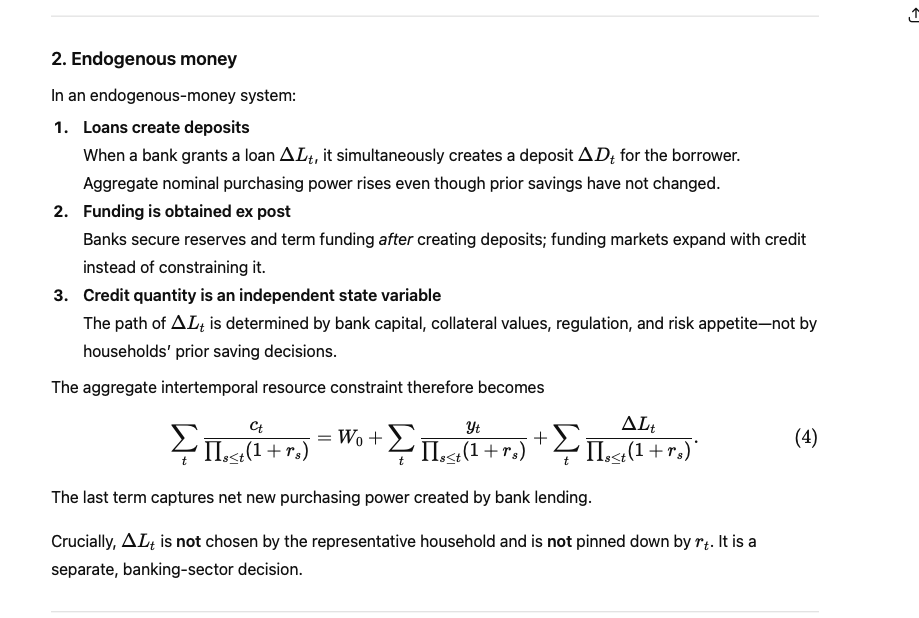

2. Endogenous money

2. Endogenous money

@FlorinBilbiie The proof proceeds by showing that each of these assumptions is violated in an endogenous-money framework, thereby invalidating the Euler equation at the aggregate level and eliminating the IS curve.

@FlorinBilbiie The proof proceeds by showing that each of these assumptions is violated in an endogenous-money framework, thereby invalidating the Euler equation at the aggregate level and eliminating the IS curve.

https://twitter.com/wbmosler/status/1994170263366193535Managed liabilities are only needed for deposit replacement — not for lending itself.

Managed liabilities DO Granger-cause bank loans

Managed liabilities DO Granger-cause bank loans

@GeorgeSelgin @CascadiaEric @robox1234 @edwin_teejay Instead, the sequence runs the other way: bank credit creation expands deposits, and households subsequently hold a portion of those deposits as ‘savings’.

@GeorgeSelgin @CascadiaEric @robox1234 @edwin_teejay Instead, the sequence runs the other way: bank credit creation expands deposits, and households subsequently hold a portion of those deposits as ‘savings’.

@RelearningEcon Empirical Consistency Between the Kalecki Profit Identity and Measured Corporate Profits

@RelearningEcon Empirical Consistency Between the Kalecki Profit Identity and Measured Corporate Profits

Short-term, nominal funding is the structural reality of banking

Short-term, nominal funding is the structural reality of banking

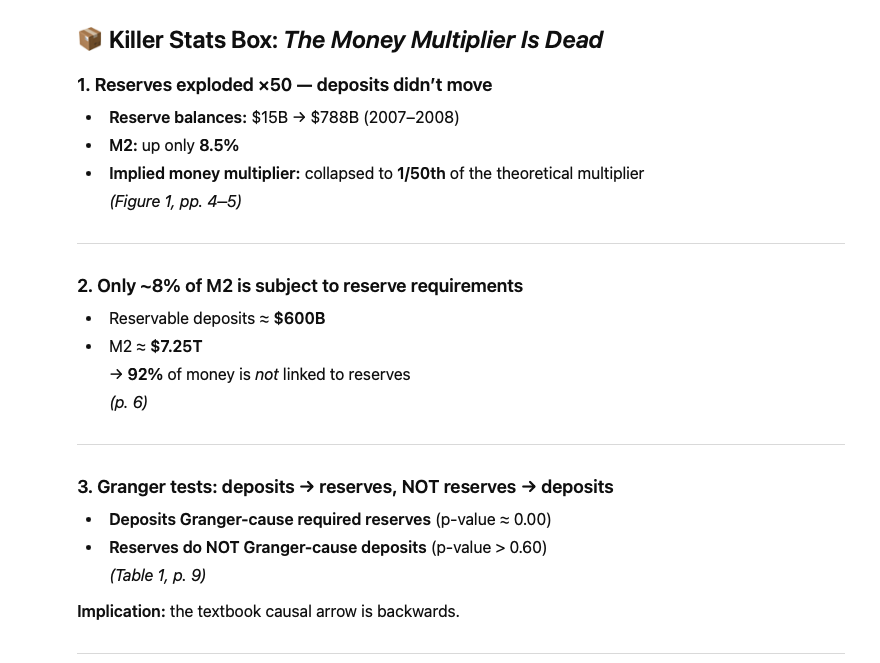

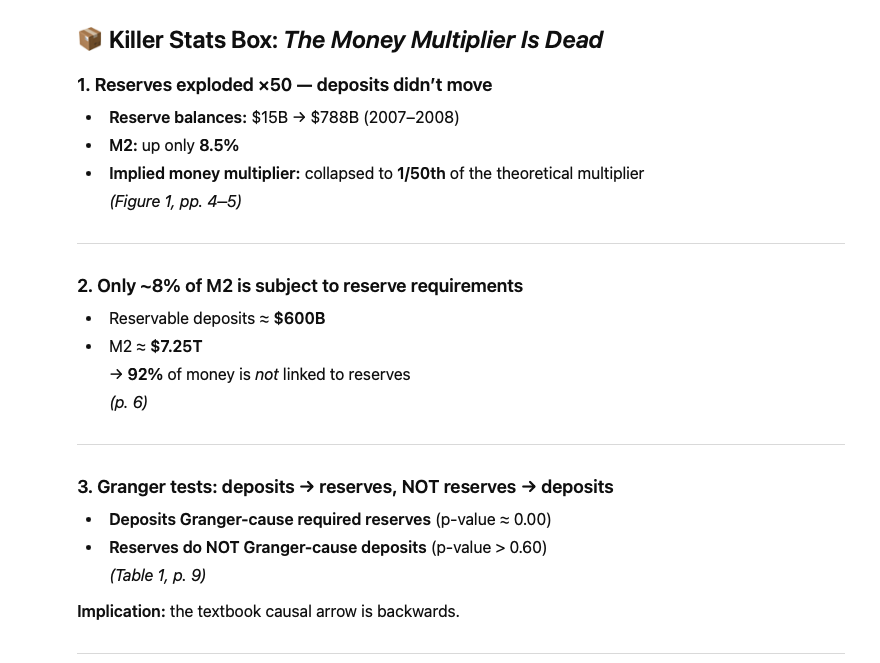

@GeorgeSelgin To evaluate the core claim of constrained lending or Loanable-Funds Intermediationism—namely, that saving must rise before banks can expand credit—we ran a full set of VAR and Granger-causality tests using U.S. quarterly data.

@GeorgeSelgin To evaluate the core claim of constrained lending or Loanable-Funds Intermediationism—namely, that saving must rise before banks can expand credit—we ran a full set of VAR and Granger-causality tests using U.S. quarterly data.

Kalecki presents the income side; Godley presents the financing side.

Kalecki presents the income side; Godley presents the financing side.