India's biggest trading partner just slapped us with a 50% tariff practically out of nowhere. That's a 25% base tariff, plus another 25% because we buy Russian oil, a punishment whose logic we don't quite get. The first 25% is already in force, another 25% kicks in August 27.🧵👇

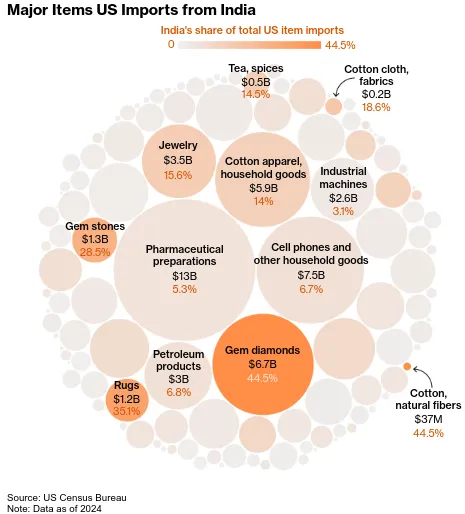

These tariffs could practically close the world's biggest consumer market to our exports. From shrimp exporters to carpet weavers, some pockets of our economy will see extreme pain. But this situation is terribly confusing, too extreme and sudden for anyone to accurately predict.

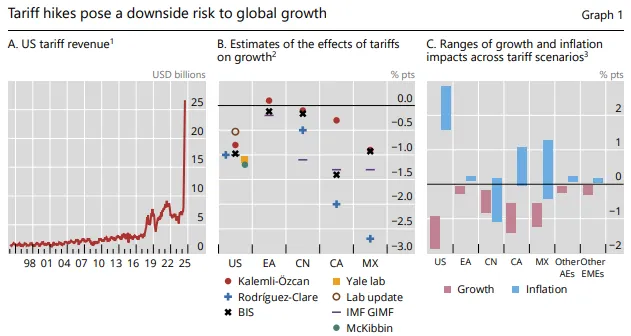

We're starting to see rigorous research around what these tariffs are doing. A comprehensive bulletin by the Bank for International Settlements and a paper by Ignatenko, Lashkaripour and others paint a picture more complex than most people realize.

Tariffs are like casting the first stone into a calm pond, the waves ripple outward. They create a "direct trade impact" first, choking supply and making imports more expensive. People see prices of imported goods shoot up, almost as if there was a sudden shortage.

This guts their "real wages", although paychecks stay the same, they buy fewer things. How this plays out varies depending on business margins and how much more people are willing to pay. But timing matters because inflation is often about what people believe.

If people believe prices will go up further, they hoard supplies, sending prices up. Businesses find people more tolerant of higher rates. As people lose sight of what prices "should" be, as expectations become "unanchored," this vicious cycle becomes increasingly hard to fight.

Many Americans never recovered from post-pandemic inflation surge, their expectations weren't anchored to begin with. Adding staggering tariffs like 54% on Chinese goods could derail those expectations severely, making the cycle increasingly hard to fight.

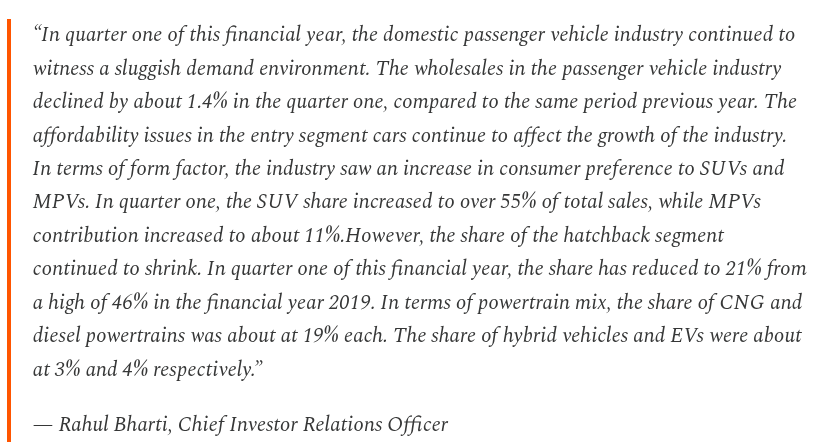

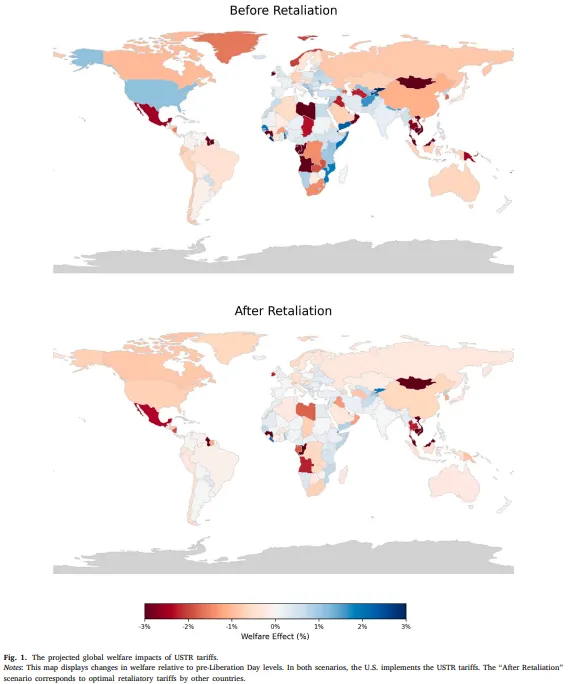

In the aggregate, research points to one thing, the US, despite imposing the tariffs, suffers the most. Although America's tariff revenues quadrupled in July, that came at a cost, the country is modeled to take a growth hit of around 1% of GDP growth.

Then three "indirect channels" take over. First, supply chains break. Imagine you're a car parts manufacturer and steel suddenly costs 25% more. Switching suppliers takes time, meanwhile you reduce production, creating bottlenecks for everyone depending on you.

These problems cascade through entire industries, creating shortages and price spikes. Second, trade starts going elsewhere. Chinese exports to Europe and Southeast Asia have surged while exports to US collapsed. This flood of diverted goods can depress prices in new markets.

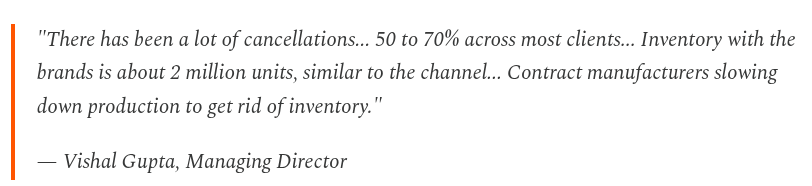

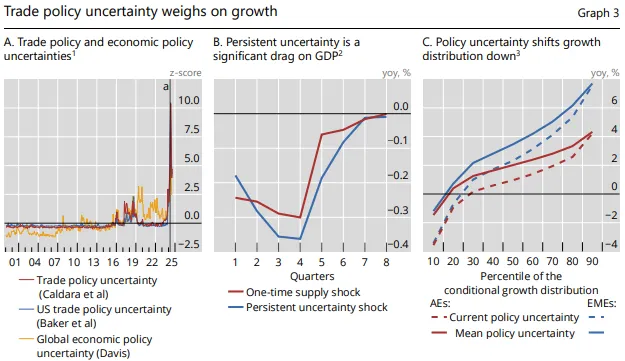

Some ASEAN countries are already seeing their manufacturing struggle in the face of Chinese goods. Third, there's uncertainty, which businesses hate more than high costs. When trade policies keep changing, companies freeze, unable to judge what risks are worth taking.

They stop investing, delay hiring, cancel expansion plans. This can damage growth as much as the tariffs themselves. The tariff story looks different depending on where you live. Advanced economies like Europe or Japan face more muted effects with diversified trading relationships.

Coincidentally, these are also markets that struck deals for lower tariffs. There's a twist, Trump's tariffs could actually be deflationary for these countries. Their economies accommodate produce from manufacturers with lower export demand, plus diverted goods seeking rich markets.

Emerging markets face a much more complex picture. Some will look for opportunities in the debris of 50%+ tariffs on countries like India and China. But they'll also run massive risks that could easily reverse their fortunes abruptly.

So far, trade tensions have actually been good for emerging markets in a weird way. They pushed down the dollar's value against other currencies. Excellent news for businesses who borrowed in dollars. As long as the dollar stayed in check, this debt load was comfortable.

But this isn't luck you can trust. With so much chaos, you could easily see an abrupt reversal, pushing up the dollar's value and putting massive pressure on those same borrowers. If tensions push an emerging market into crisis, they could be stranded.

Research shows emerging markets have less fiscal and monetary firepower to respond to shocks. They can't cut rates or boost spending like advanced economies when growth slows. Canada and Mexico deserve special mention, facing "stagflationary effects" second only to the US.

These countries were integrated deeply with the US economy for decades. Even as tariffs hit, diversifying away from American markets hasn't been easy. Unlike a conventional war which often has a victor, nobody wins a trade war.

Even with bilateral deals, average US tariffs will settle at unprecedented modern levels. America's average tariff was 2.4% end of 2024. The best deal offered to UK puts these at 10%. Everyone else faces higher rates. At these levels, expect meaningful global economic drag.

We're seeing early warning signs. Recent US data shows people spending less as costs rise, economy struggling to create jobs. Outside the US, consumer confidence has fallen worldwide. Corporate earnings feel the pinch in an already slowing global growth environment.

We haven't seen real damage yet. Global economy has been remarkably resilient. American companies frontloaded purchases, rushing to stock inventories before tariffs hit. This temporary trade boost masked weakness and may have distorted near-term GDP figures. But that exercise is over.

In its place will come a persistent "uncertainty tax" where businesses stop making long-term decisions. Research suggests this level of uncertainty shifted growth distributions downward by up to two percentage points. For many countries, that's the difference between growth and stagnation.

Financial markets played shock absorber, conditions remained accommodative throughout tensions. After the rout following April 2 "Liberation Day," markets rebounded. Companies secured credit lines in late 2024, creating liquidity war chests. But these buffers aren't infinite.

Research shows firms in tradable sectors could struggle beyond a quarter without new cash flows. India's 50% tariffs aren't isolated, they're part of a larger web of disruptions. Global employment could contract by 0.58%, roughly 21 million jobs. The resilience was on borrowed time.

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here:thedailybrief.zerodha.com/p/what-does-50…

All links here:thedailybrief.zerodha.com/p/what-does-50…

• • •

Missing some Tweet in this thread? You can try to

force a refresh