1/ Founder-Led, Aligned, Accelerating

Incentives > everything

There’s signal in skin in the game. Across decades, founder/family influenced companies have outperformed by 300–400 bps annually, and founder CEOs tend to invest more in innovation and long term bets, advantages that compound.

So I screened for: Founder/insider ownership >10% (or clear voting control) + accelerating (or reaccelerating) revenue.

Here are 7 I like now, I’ll drop 3 more if this hits 500 likes. Let’s go👇🧵

Incentives > everything

There’s signal in skin in the game. Across decades, founder/family influenced companies have outperformed by 300–400 bps annually, and founder CEOs tend to invest more in innovation and long term bets, advantages that compound.

So I screened for: Founder/insider ownership >10% (or clear voting control) + accelerating (or reaccelerating) revenue.

Here are 7 I like now, I’ll drop 3 more if this hits 500 likes. Let’s go👇🧵

2/ $APP - AppLovin (adtech engines running hot)

Rev growth re-accelerated: +71% YoY in Q1’25 => +77% YoY in Q2’25 as AXON flywheel and ML bidding drove pricing & win rates. That’s step function momentum at scale.

Alignment: Co-founder/CEO Adam Foroughi is a reported 10% owner and (with a director) holds all Class B (20 votes/share).

Concentrated control = tight execution.

With model driven ad yield compounding and a founder who can move fast without a proxy fight, this is what durable operating leverage looks like.

Rev growth re-accelerated: +71% YoY in Q1’25 => +77% YoY in Q2’25 as AXON flywheel and ML bidding drove pricing & win rates. That’s step function momentum at scale.

Alignment: Co-founder/CEO Adam Foroughi is a reported 10% owner and (with a director) holds all Class B (20 votes/share).

Concentrated control = tight execution.

With model driven ad yield compounding and a founder who can move fast without a proxy fight, this is what durable operating leverage looks like.

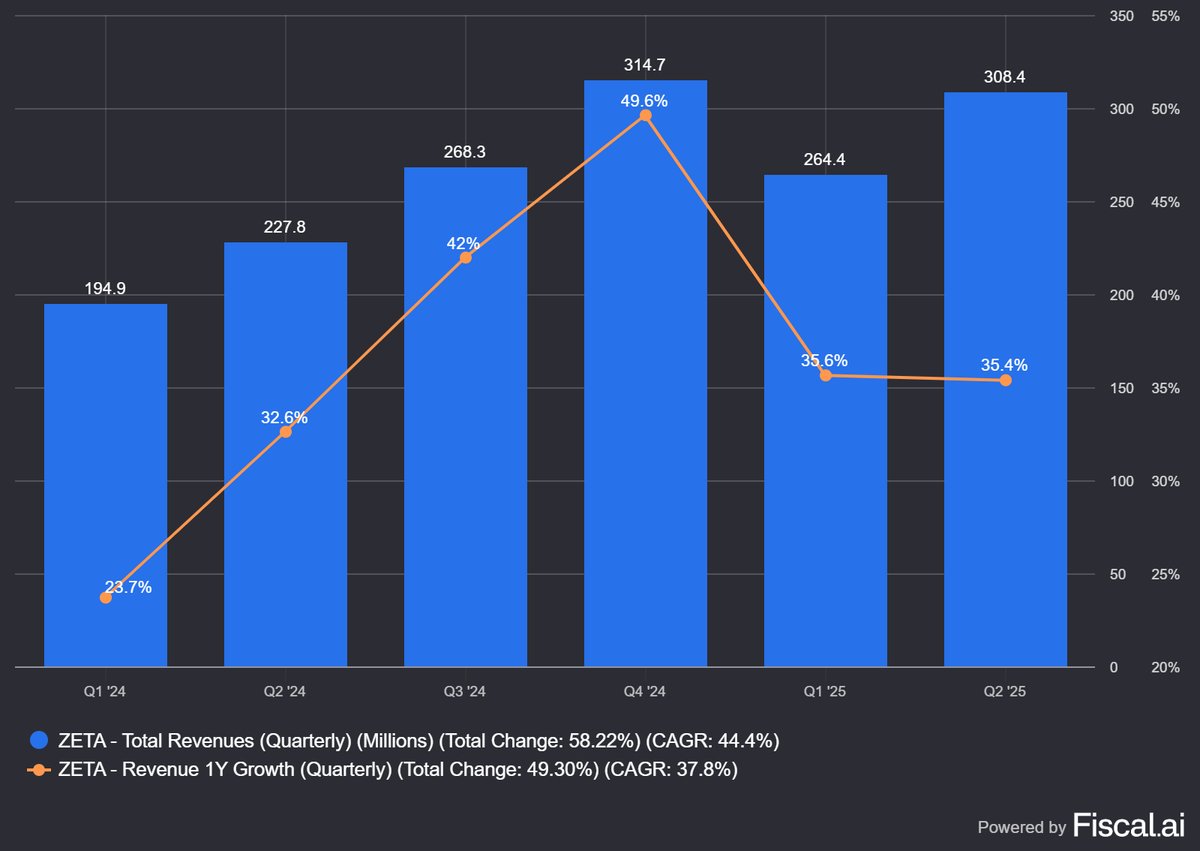

3/ $ZETA - Zeta Global

Co-founder/CEO David Steinberg & affiliates control 54% of voting power. Founder truly in the driver’s seat.

Q1 set the table, mgmt guided Q2 to +30–31%…then delivered Q2’25 rev $308M (+35% YoY) and raised FY’25 (rev, EBITDA, FCF). “Beat and raise” streak intact.

This is the “replacement cycle” trade in marketing clouds: identity + AI + owned data taking share from legacy suites. Founder control matters as $ZETA leans into buybacks and opex discipline while pushing platform wins (OneZeta). If macro wobbles, the guidance raise is your tell on pipeline visibility.

Co-founder/CEO David Steinberg & affiliates control 54% of voting power. Founder truly in the driver’s seat.

Q1 set the table, mgmt guided Q2 to +30–31%…then delivered Q2’25 rev $308M (+35% YoY) and raised FY’25 (rev, EBITDA, FCF). “Beat and raise” streak intact.

This is the “replacement cycle” trade in marketing clouds: identity + AI + owned data taking share from legacy suites. Founder control matters as $ZETA leans into buybacks and opex discipline while pushing platform wins (OneZeta). If macro wobbles, the guidance raise is your tell on pipeline visibility.

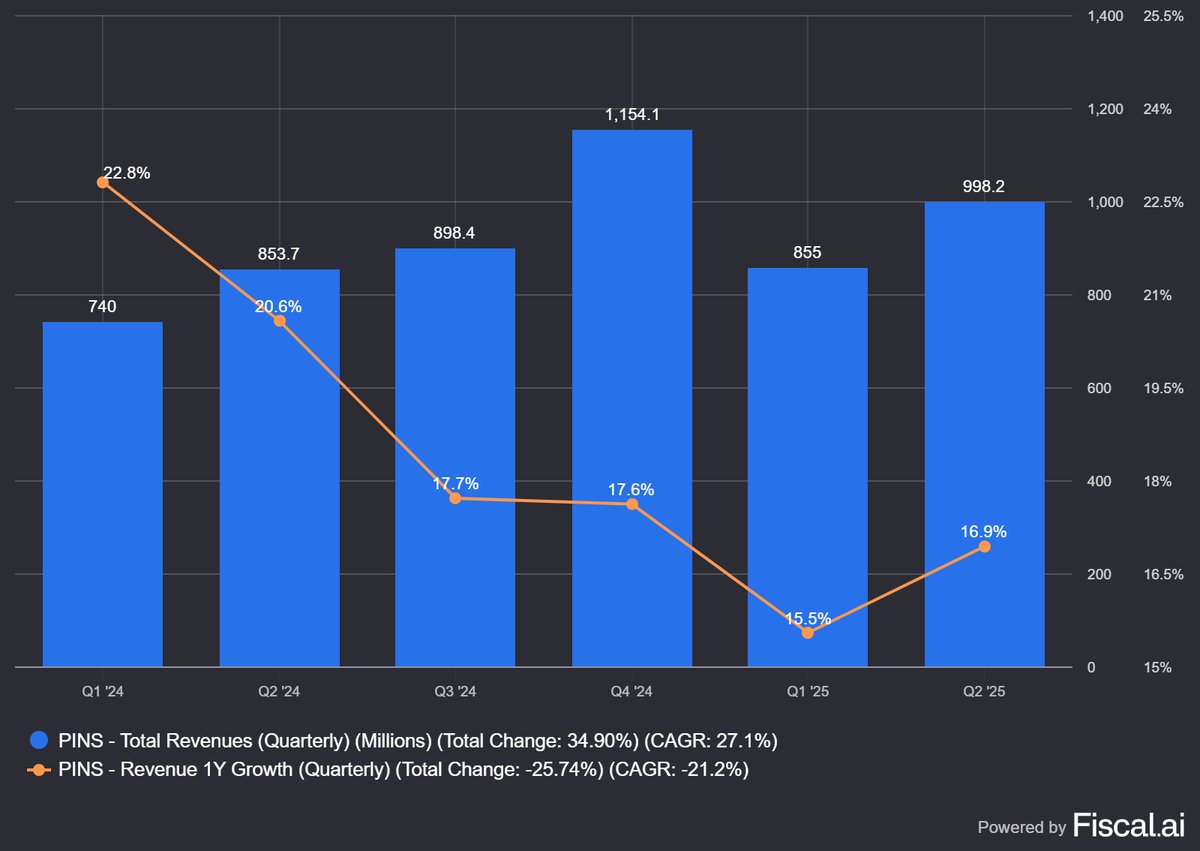

4/ $PINS - Pinterest (ads flywheel + better intent data)

Rev growth inched up: +16% YoY (Q1’25, $855M) => +17% (Q2’25, $998M) with MAUs at 578M.

Scale + intent = better ROAS

Co-founder Ben Silbermann holds mid single digit equity (5.5%), but dual class structure preserves high voting influence relative to his economic stake. Insider block remains under 11%, yet control dynamics still favor founders.

$PINS is morphing into shoppable search. If conversion ads keep compounding, margins follow.

Rev growth inched up: +16% YoY (Q1’25, $855M) => +17% (Q2’25, $998M) with MAUs at 578M.

Scale + intent = better ROAS

Co-founder Ben Silbermann holds mid single digit equity (5.5%), but dual class structure preserves high voting influence relative to his economic stake. Insider block remains under 11%, yet control dynamics still favor founders.

$PINS is morphing into shoppable search. If conversion ads keep compounding, margins follow.

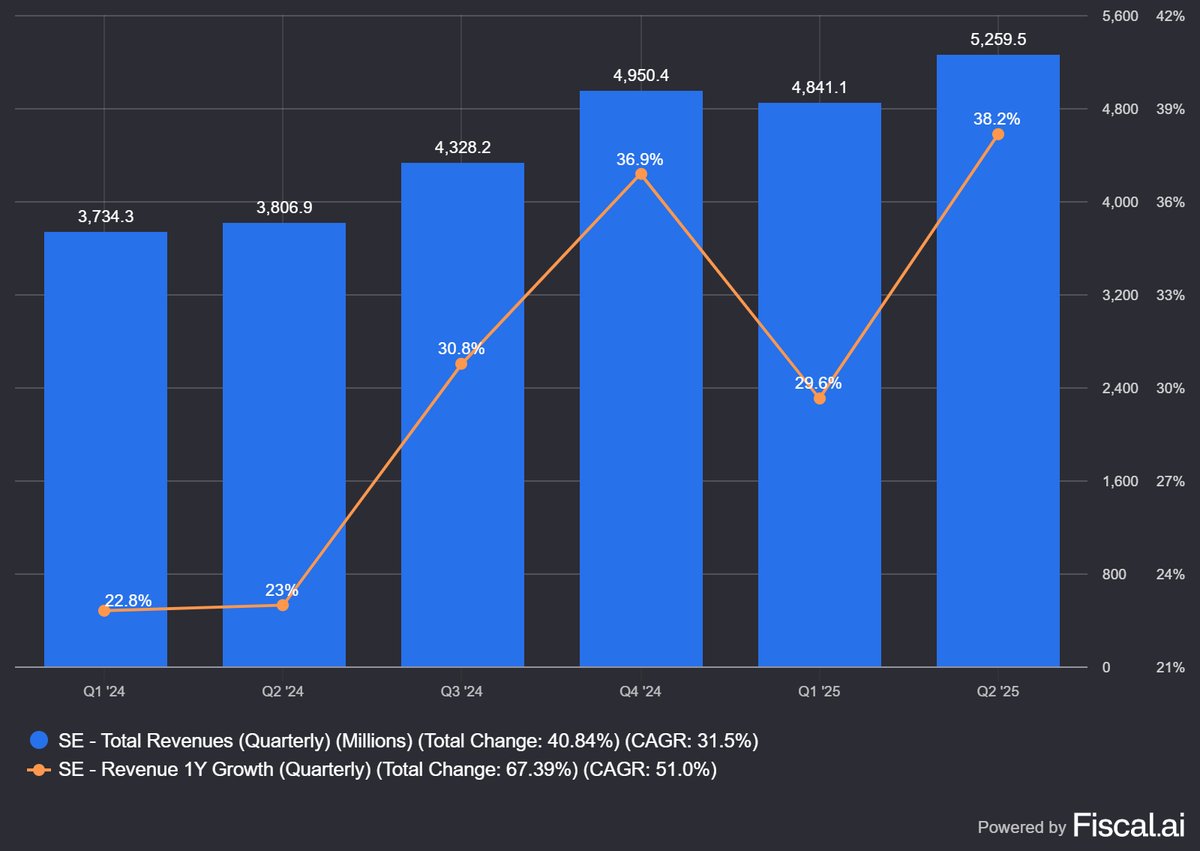

5/ $SE - Sea Limited (Garena stabilized; commerce + fintech driving)

Rev growth re-accelerated: +29.6% YoY (Q1’25) => +38.2% YoY (Q2’25), with Shopee + SeaMoney both inflecting.

Founder/CEO Forrest Li retains 60%+ voting power via super-voting stock.

When a founder can throttle profitability vs. growth without second guessing, the company can hunt share when rivals blink.

Rev growth re-accelerated: +29.6% YoY (Q1’25) => +38.2% YoY (Q2’25), with Shopee + SeaMoney both inflecting.

Founder/CEO Forrest Li retains 60%+ voting power via super-voting stock.

When a founder can throttle profitability vs. growth without second guessing, the company can hunt share when rivals blink.

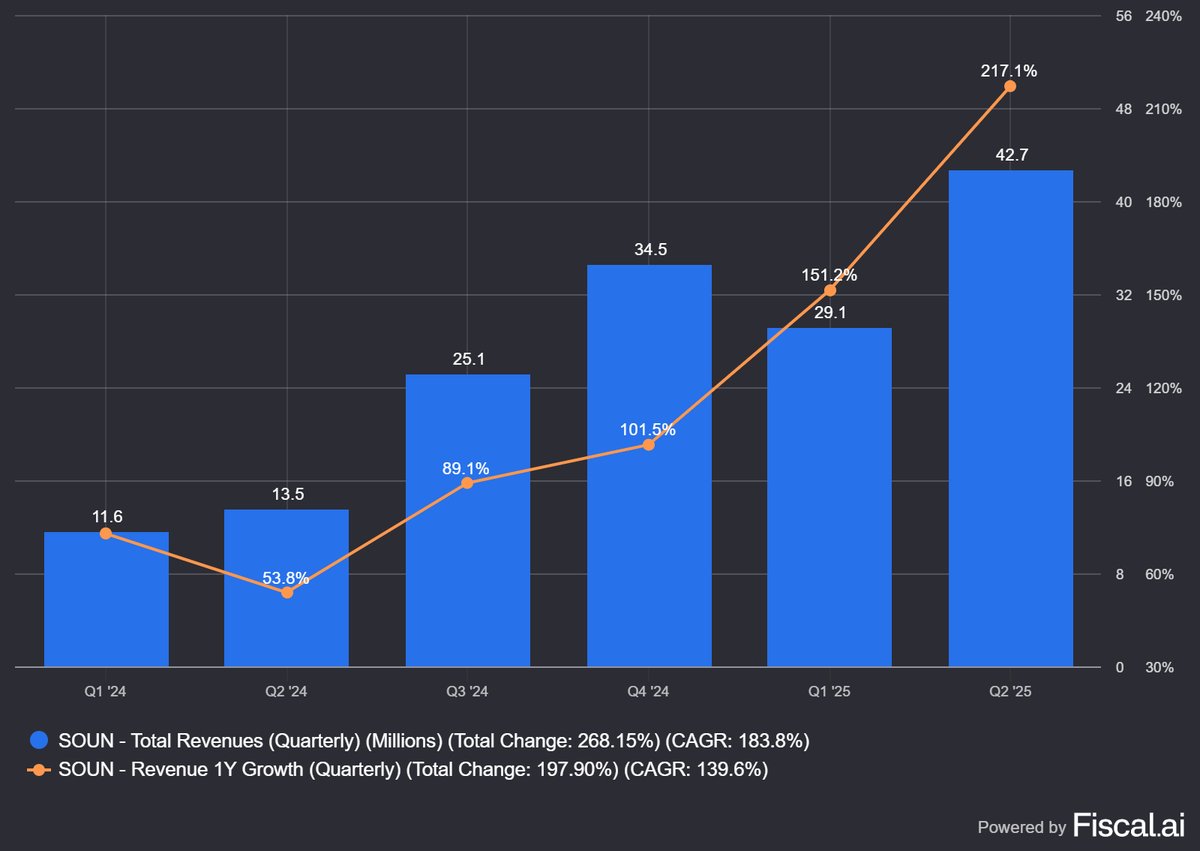

6/ $SOUN - SoundHound AI (voice AI monetization finally shows up)

Rev growth exploded: Q2’25 +197% YoY to $42.7M, with FY’25 guide raised ($160–178M). That’s commercialization, not vibes.

Founders hold super-voting Class B (10 votes/share) and collectively 48% of voting power, real control.

Automotive + enterprise voice is a grind until scale hits, then margins inflect as models/partnerships amortize.

Rev growth exploded: Q2’25 +197% YoY to $42.7M, with FY’25 guide raised ($160–178M). That’s commercialization, not vibes.

Founders hold super-voting Class B (10 votes/share) and collectively 48% of voting power, real control.

Automotive + enterprise voice is a grind until scale hits, then margins inflect as models/partnerships amortize.

7/ $SHOP - Shopify (taking more of the GMV wallet)

Rev growth tick up: +26% YoY in Q1’25 to +31% YoY in Q2’25; mix shift (payments, capital, logistics-lite, ads) is widening take-rate.

Founder Tobi Lütke holds 40% voting power via the 2022 “founder share”, long runway, long leash.

Pricing power and attach rate beats volume in software Commerce; founder control lets $SHOP keep shipping where public company committees hesitate.

Rev growth tick up: +26% YoY in Q1’25 to +31% YoY in Q2’25; mix shift (payments, capital, logistics-lite, ads) is widening take-rate.

Founder Tobi Lütke holds 40% voting power via the 2022 “founder share”, long runway, long leash.

Pricing power and attach rate beats volume in software Commerce; founder control lets $SHOP keep shipping where public company committees hesitate.

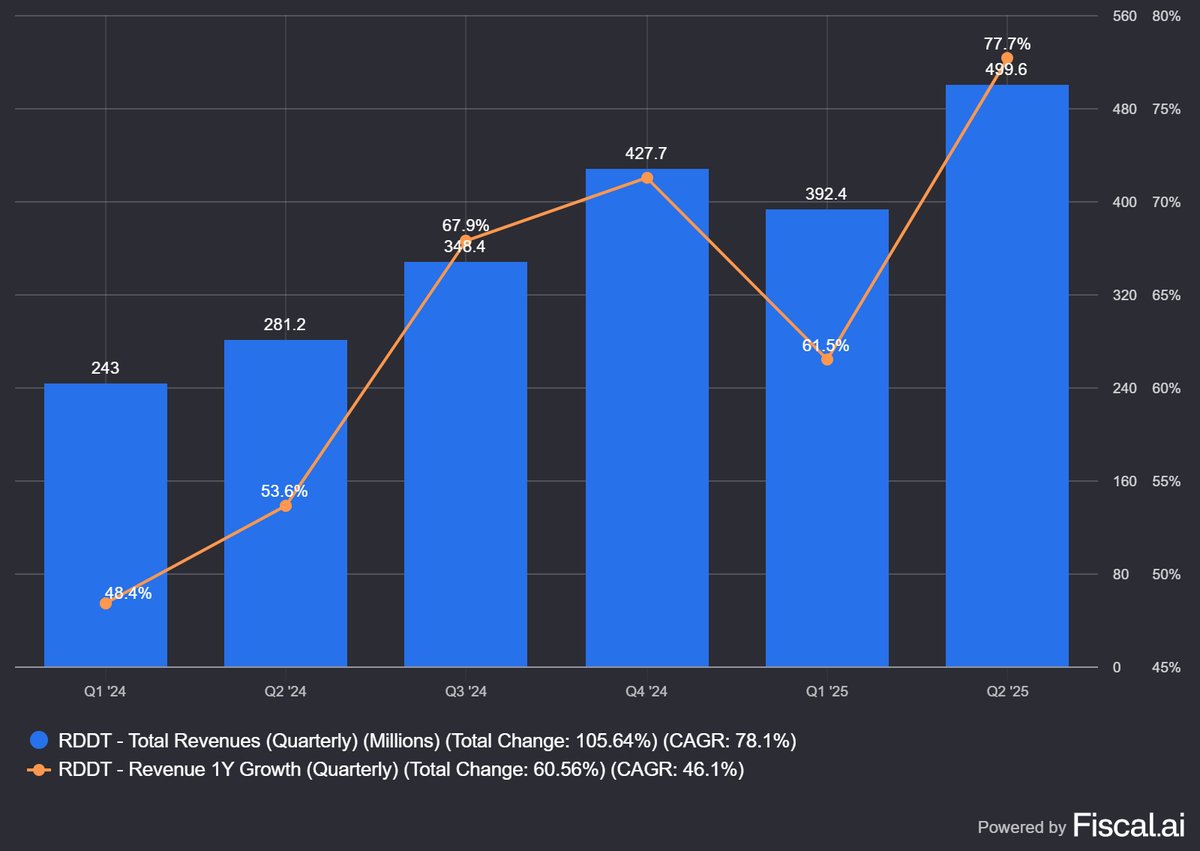

8/ $RDDT — Reddit

Revenue is actually accelerating.

- Q1’25: $392.4M, +61% YoY

- Q2’25: $500.0M, +78% YoY; GAAP net income $89M; Adj. EBITDA $167M; gross margin 90.8%. Q3 guide: $535–$545M revenue.

That’s clean acceleration with operating leverage. Retail interest isn’t hypothetical. They run an open IR subreddit (r/RDDT) and take questions directly from the community around earnings, rare access that keeps retail engaged and sticky around the story.

Founder control is real, not vibes. CEO/co-founder Steve Huffman holds majority voting power via Class B (10 votes/share) plus voting agreements with key early holders. The company confirms he can vote 74% of outstanding voting power; dual class explicitly preserves founder control.

Revenue is actually accelerating.

- Q1’25: $392.4M, +61% YoY

- Q2’25: $500.0M, +78% YoY; GAAP net income $89M; Adj. EBITDA $167M; gross margin 90.8%. Q3 guide: $535–$545M revenue.

That’s clean acceleration with operating leverage. Retail interest isn’t hypothetical. They run an open IR subreddit (r/RDDT) and take questions directly from the community around earnings, rare access that keeps retail engaged and sticky around the story.

Founder control is real, not vibes. CEO/co-founder Steve Huffman holds majority voting power via Class B (10 votes/share) plus voting agreements with key early holders. The company confirms he can vote 74% of outstanding voting power; dual class explicitly preserves founder control.

Why this basket?

Alignment means fewer strategy U turns and faster product cadence.

Acceleration is the market’s favorite language, multiple expansion rides alongside revenue growth (and reverses just as violently when it stalls).

Founder control (via ownership or votes) lets management optimize for NPV, not next quarter.

If this thread clears 500 likes, I’ll drop 3 more with numbers + diligence notes.

Incentives first. Everything else later.

Alignment means fewer strategy U turns and faster product cadence.

Acceleration is the market’s favorite language, multiple expansion rides alongside revenue growth (and reverses just as violently when it stalls).

Founder control (via ownership or votes) lets management optimize for NPV, not next quarter.

If this thread clears 500 likes, I’ll drop 3 more with numbers + diligence notes.

Incentives first. Everything else later.

• • •

Missing some Tweet in this thread? You can try to

force a refresh