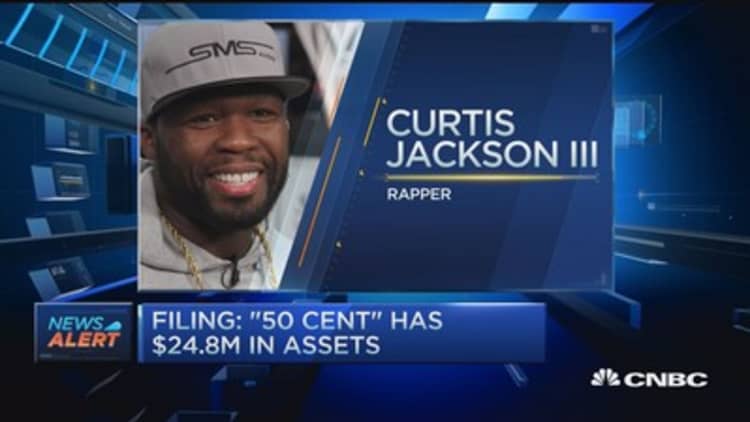

In 2015, 50 Cent owed $32 million in lawsuits.

So, he filed for bankruptcy.

The media laughed and called him broke...

But he was playing chess while they were playing checkers.

Here's how he turned a $32 million crisis into a masterclass in asset protection:

So, he filed for bankruptcy.

The media laughed and called him broke...

But he was playing chess while they were playing checkers.

Here's how he turned a $32 million crisis into a masterclass in asset protection:

The lawsuits were brutal:

• $17 million+ to Sleek Audio

• $7 million to Lastonia Leviston

• Multiple other creditors circling

His liquid cash couldn't cover it all at once.

Most people would panic. 50 Cent saw an opportunity.

• $17 million+ to Sleek Audio

• $7 million to Lastonia Leviston

• Multiple other creditors circling

His liquid cash couldn't cover it all at once.

Most people would panic. 50 Cent saw an opportunity.

Chapter 11 bankruptcy isn't surrender.

It's a strategic weapon.

The moment he filed, all collection efforts stopped immediately.

No more creditors seizing assets. No fire sales of his properties.

He bought himself time and leverage.

It's a strategic weapon.

The moment he filed, all collection efforts stopped immediately.

No more creditors seizing assets. No fire sales of his properties.

He bought himself time and leverage.

While the media mocked him, posting "prop money" on Instagram...

He was systematically protecting his most valuable assets:

• Music catalog and royalties

• "Power" TV show rights

• Business partnerships

• Real estate holdings

None of it could be touched during bankruptcy protection.

He was systematically protecting his most valuable assets:

• Music catalog and royalties

• "Power" TV show rights

• Business partnerships

• Real estate holdings

None of it could be touched during bankruptcy protection.

Here's the genius part:

The court allowed him to keep working and earning.

He continued:

• Acting in movies and TV

• Running his businesses

• Touring & performing

• Collecting royalties

His income never stopped. But his debts were frozen.

The court allowed him to keep working and earning.

He continued:

• Acting in movies and TV

• Running his businesses

• Touring & performing

• Collecting royalties

His income never stopped. But his debts were frozen.

Most people think bankruptcy ruins your negotiating power.

But 50 Cent proved the opposite.

Instead of paying $32 million immediately...

He controlled the timeline and terms of repayment.

Creditors had to work with him, not against him.

But 50 Cent proved the opposite.

Instead of paying $32 million immediately...

He controlled the timeline and terms of repayment.

Creditors had to work with him, not against him.

The results speak for themselves:

• Paid off $23 million+ in just 2 years

• Got discharged from bankruptcy early

• Even won a $14.5 million malpractice lawsuit against his former law firm

• Used that settlement to pay off more creditors

• Paid off $23 million+ in just 2 years

• Got discharged from bankruptcy early

• Even won a $14.5 million malpractice lawsuit against his former law firm

• Used that settlement to pay off more creditors

By 2017, he was officially out of bankruptcy.

His major assets? Completely protected.

His earning power? Intact.

His net worth today? Back to around $60 million.

The "broke" rapper had just pulled off financial jiu-jitsu at the highest level.

His major assets? Completely protected.

His earning power? Intact.

His net worth today? Back to around $60 million.

The "broke" rapper had just pulled off financial jiu-jitsu at the highest level.

The lesson here isn't to go bankrupt.

It's to understand that the wealthy use every legal tool available.

While others panic, they strategize.

While others surrender, they negotiate.

50 Cent turned his biggest crisis into his smartest move.

It's to understand that the wealthy use every legal tool available.

While others panic, they strategize.

While others surrender, they negotiate.

50 Cent turned his biggest crisis into his smartest move.

If you want to learn more about building and protecting wealth like the pros do...

Follow me @AaronRofficial_

Follow me @AaronRofficial_

• • •

Missing some Tweet in this thread? You can try to

force a refresh