Husband & Father of 2 | From getting burned $100k from B.S. automation programs to now making over $20k/mo in passive income. 🙏🏽 | 150+ Case Studies📘 ⭐️

How to get URL link on X (Twitter) App

1) Your salary will never make you wealthy

1) Your salary will never make you wealthy

Most people think networking is about quantity.

Most people think networking is about quantity.

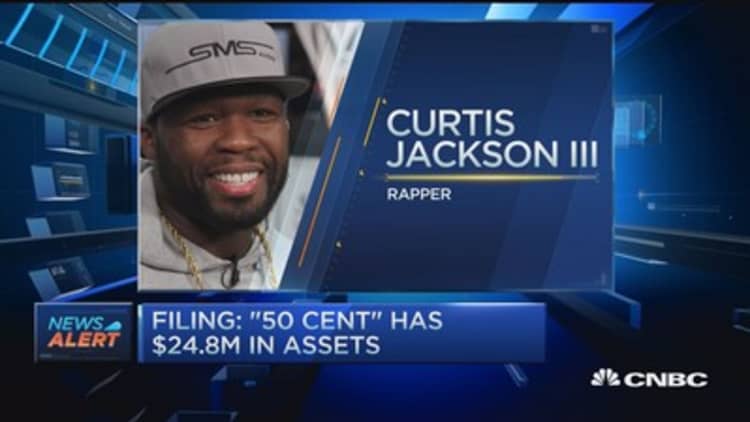

The lawsuits were brutal:

The lawsuits were brutal:

1.

1.

1.

1.

1.

1.

1. Your debt is someone else's passive income

1. Your debt is someone else's passive income

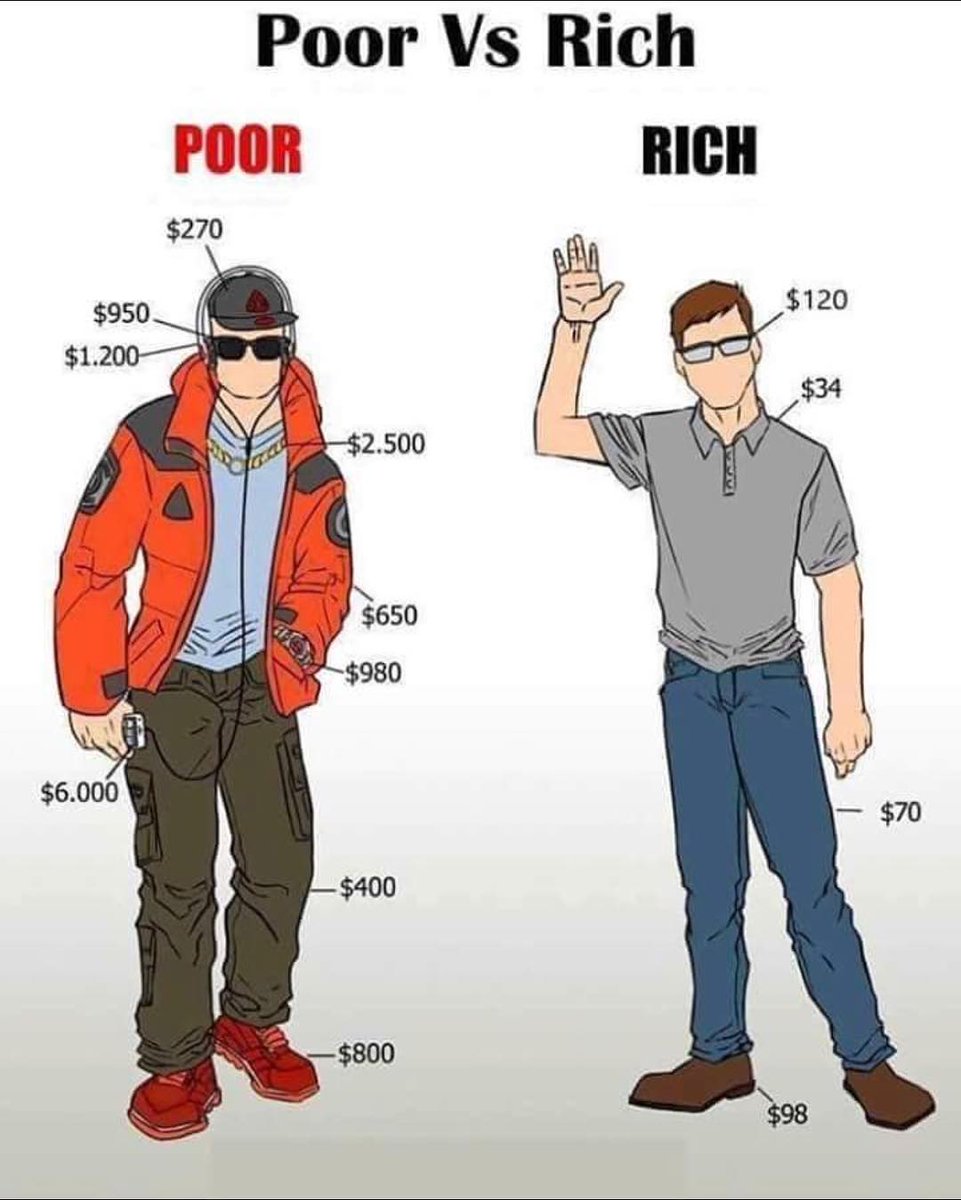

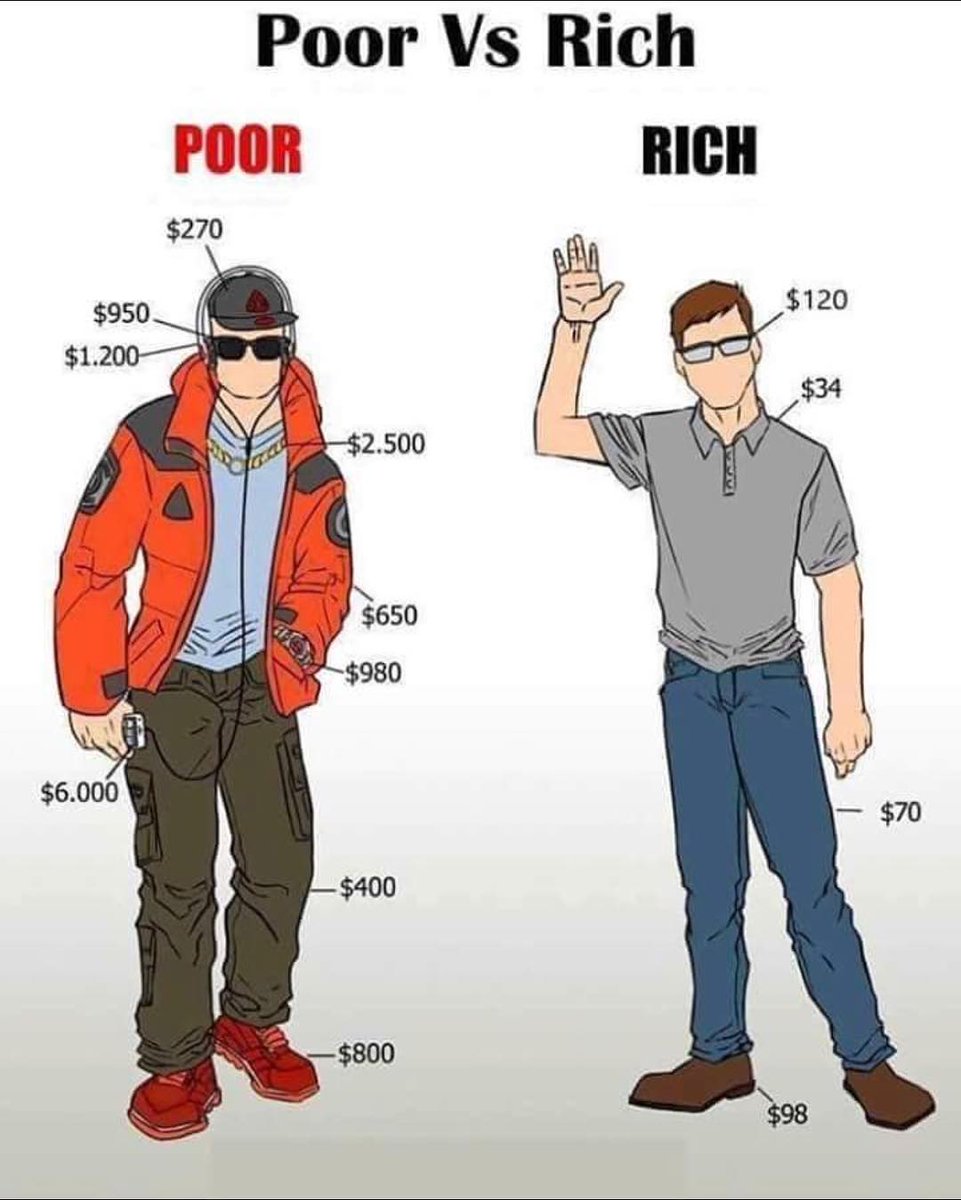

1. Purchase depreciating assets over appreciating ones.

1. Purchase depreciating assets over appreciating ones.

1. They don't worship the 9-to-5

1. They don't worship the 9-to-5

1) Your salary will never make you wealthy

1) Your salary will never make you wealthy

1.

1.

1.

1.

1. Real Estate

1. Real Estate

1.

1.

"It has the potential to be the biggest economic story of our lives."

"It has the potential to be the biggest economic story of our lives."

1) Mr. Market is irrational

1) Mr. Market is irrational

1) "A part of all you earn is yours to keep"

1) "A part of all you earn is yours to keep"