Remember that late-night Domino's order when nothing else was open? These brands are so embedded in our daily lives that we barely think about the companies running them. But their Q1 results reveal fascinating economics behind fulfilling millions of Indians' cravings daily.🧵👇

We'll examine three Indian QSR giants, Jubilant FoodWorks (Domino's), Westlife Foodworld (McDonald's), and Restaurant Brands Asia (Burger King, Tim Hortons). Their businesses run extremely tight operations to ensure every next meal feels as delightful as the last.

QSRs operate as master franchisees, paying brands like Domino's and McDonald's an initial fee plus 5-6% of everything they make. In exchange, they get exclusive rights to operate these brands in India, along with recipes and global marketing power that comes with them.

These QSRs have nearly full authority to grow brand names in India however they choose, changing menus to suit Indian tastes or opening new outlets anywhere. But this great power doesn't come without risks. If you win, the upside is yours. If you lose, you bear the losses.

One of the biggest risks is location. When expanding to untested tier-2 towns, you don't know whether your outlet will succeed. If it runs into losses, you want to exit quickly and open elsewhere. Property rent becomes a major cost item that can determine success or failure.

Pick the right location and you're printing money, but pick wrong and you're stuck paying rent on a dud for months. RBA emphasizes how important rent optimization is for them, as it can be the difference between profitability and sustained losses in competitive markets.

The promise of Indian QSRs lies in satisfying customers as quickly as possible, and robust supply chains are key. Every Maharaja Mac must taste the same whether you're in Delhi or Chennai, requiring serious logistics including suitable vendors and adequate cold storage facilities.

When tomato prices double during monsoons, these companies can't just switch to something cheaper or pass higher prices to customers. They have to absorb the cost or risk disappointing customers. This creates constant tension between maintaining quality and controlling costs.

QSRs resolve this by using commissary kitchens, central hubs where raw materials like cheese and tomato are converted into complex ingredients. Outlets mostly assemble and finish cooking, making the process standardized across India and more efficient than individual preparation.

Technology has streamlined supply chains significantly. McDonald's has self-serving kiosks, Domino's has its own app and delivery tracking. Behind the scenes, QSRs use analytics to track where, what, when and how often customers order, and which customers need discounts.

They also use data extensively to ensure inventories never have shortages or excess supply. However, restaurants require significant manpower spending and face low barriers to entry competition. Even profitable restaurants don't generate huge profits.

Jubilant's net margin was just 5.2% this quarter, while Westlife barely managed 0.2%. So QSR businesses focus on what they can control, their day-to-day operations, usually represented by gross margins and EBITDA. But even those metrics faced challenges this quarter.

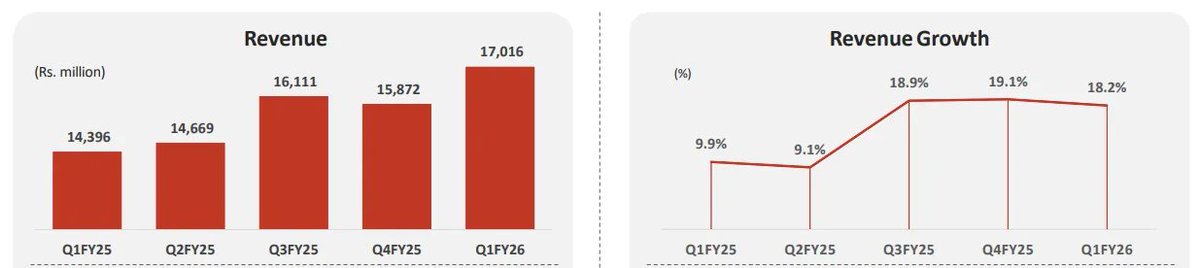

Jubilant FoodWorks, the largest of three, saw revenue grow 18% to ₹1,701.6 crores. Volumes jumped over 17% from last year. Average daily sales across all outlets reached ₹85,396. They opened 71 net new stores during the quarter, with 73% of sales coming from delivery.

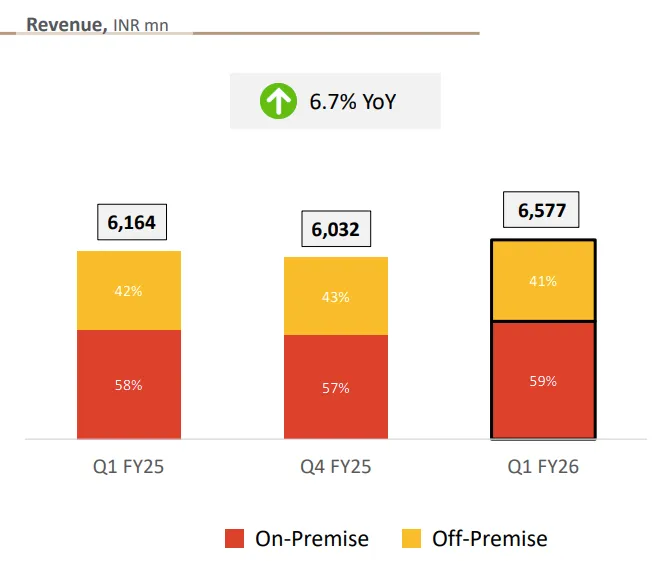

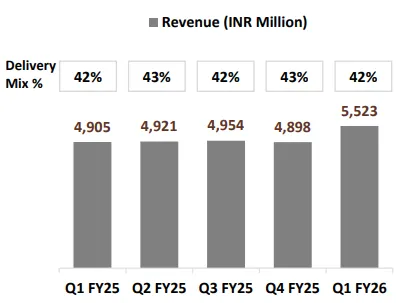

Westlife grew revenue 7% to ₹657 crores through measured expansion. They added 9 new McDonald's restaurants but closed 3 underperforming ones. Their dine-in and takeaway business grew 8%, making up 60% of sales, with remaining 40% from food delivery.

RBA's Indian operations grew healthily with revenue up 13% to ₹552.3 crores. Each Burger King store generates ₹120,000 per day, higher than most QSR chains. They added 6 net new Burger King stores but recorded ₹42 crores in losses this quarter.

RBA's expansion proves costly due to stiff competition. To gain market share, Burger King India sells low-ticket, value-conscious meals more than premium items. This shows up as higher sales but far tighter, even negative margins in the crowded market.

Same-store sales reveal the real health. Jubilant recorded best growth at 11.6%, with delivery business growing over 20%. Westlife barely grew at 0.5% but showed third straight quarter of improvement. RBA's same-store performance grew merely 3%, mostly from dine-in.

Westlife launched Korean-themed menu in March, expecting meaningful impact next quarter. McDonald's affordable McSaver line drives major chunk of dine-in. However, each McDonald's location generates 3% less money per year, down to ₹6.2 crores, with southern states underperforming.

Cost inflation hit hard. Jubilant's raw material costs exploded 28% year-over-year, everything from cheese to flour to chicken got significantly more expensive. Instead of passing costs to customers, they absorbed impact, compressing EBITDA margin to 19.0% from 19.3%.

Westlife didn't hurt from cost inflation as much, actually making more money while everything got expensive. They cut food costs from 30% to 28% of sales through more efficient supply chain procurement, plus small March price raise that didn't deter repeat orders.

RBA's Indian arm saw EBITDA margin rise to 4.1% from 3.6%, already measly compared to peers. They added ₹10 crores in employee expenses to train staff for self-ordering systems, absorbed ₹7 crores in one-time costs from closing 5 underperforming stores.

Success in the restaurant business isn't just about making good food anymore. It's about making tough choices, where to open, when to shut loss-making stores, expand aggressively or play safe. In an industry where one bad location drags results for years, strategic choices determine winners.

We cover this and one more interesting story in today's edition of The Daily Brief. Watch on YouTube, read on Substack, or listen on Spotify, Apple Podcasts, or wherever you get your podcasts.

All links here:thedailybrief.zerodha.com/p/what-does-50…

All links here:thedailybrief.zerodha.com/p/what-does-50…

• • •

Missing some Tweet in this thread? You can try to

force a refresh