Bitcoin hit $124,500 last week.

This morning it plunged to $112,300 — a 9.7% pullback.

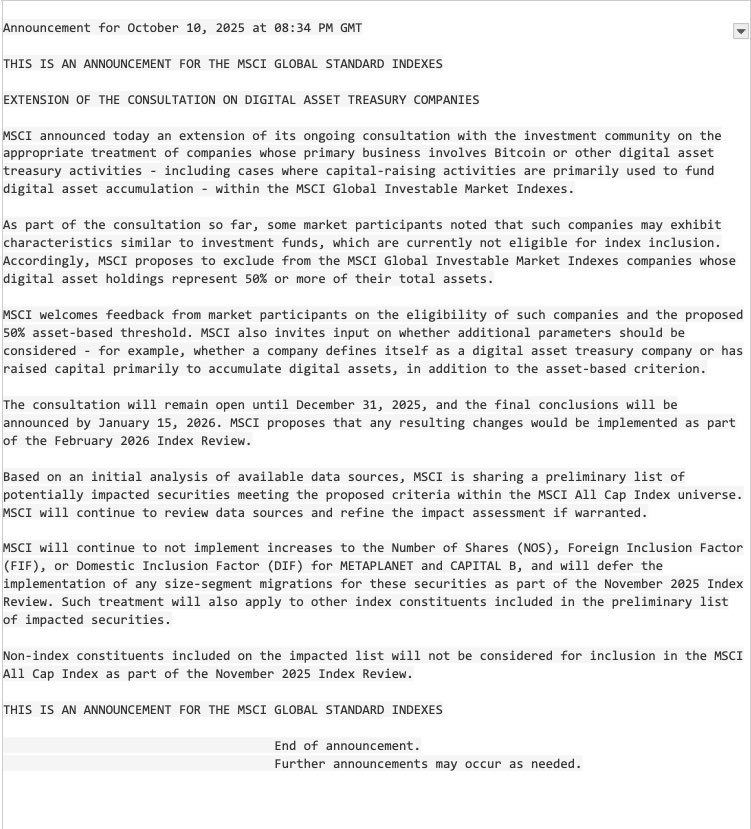

One spark? Strategy’s equity guidance update: a catalyst for MSTR’s sharp drop and the broader treasury shakeout.

But is this a crack in the model, or the setup for S&P 500 rocket fuel? 🧵👇

This morning it plunged to $112,300 — a 9.7% pullback.

One spark? Strategy’s equity guidance update: a catalyst for MSTR’s sharp drop and the broader treasury shakeout.

But is this a crack in the model, or the setup for S&P 500 rocket fuel? 🧵👇

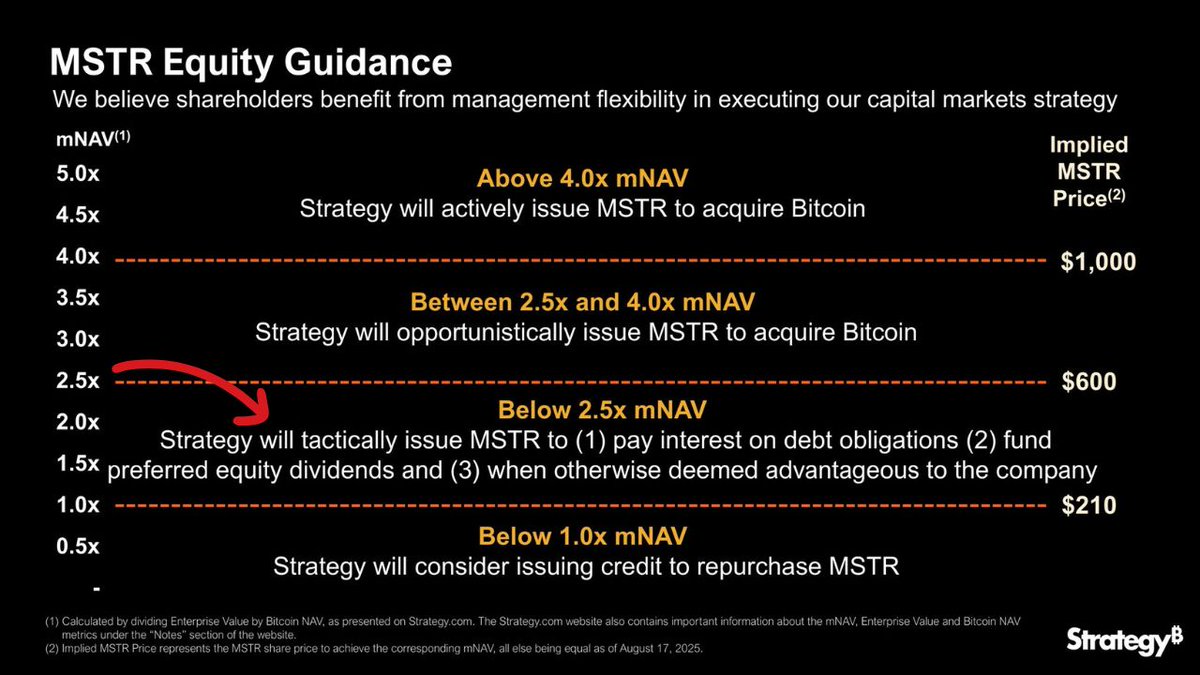

The update was announced publicly by Saylor.

Here’s the part that caused the outrage:

Strategy “may issue equity to pay debt interest, fund preferred dividends, or when otherwise deemed advantageous.”

That single line reopened optionality and rattled confidence.

Here’s the part that caused the outrage:

Strategy “may issue equity to pay debt interest, fund preferred dividends, or when otherwise deemed advantageous.”

That single line reopened optionality and rattled confidence.

Why? Because mNAVs across treasury companies are collapsing.

When stocks trade at or below the value of their underlying Bitcoin, the whole leverage model looks fragile.

And traders are quick to ask: “Has the strategy broken?”

When stocks trade at or below the value of their underlying Bitcoin, the whole leverage model looks fragile.

And traders are quick to ask: “Has the strategy broken?”

As valuations sank, some feared trading below 1x NAV was fatal.

Ben Werkman disagrees:

“I don’t believe trading below one times NAV is like the kiss of death in the Bitcoin treasury space… these valuations are gonna ebb and flow and sentiment’s gonna be a huge driver.”

Ben Werkman disagrees:

“I don’t believe trading below one times NAV is like the kiss of death in the Bitcoin treasury space… these valuations are gonna ebb and flow and sentiment’s gonna be a huge driver.”

Matt Cole says the short-term panic misses the point:

“We have a 10 to 15 year period of a digital gold rush. You want to accumulate as much Bitcoin as possible during that time… you don’t unwind a long-term thesis because you’ve seen one month traded at a discount.”

“We have a 10 to 15 year period of a digital gold rush. You want to accumulate as much Bitcoin as possible during that time… you don’t unwind a long-term thesis because you’ve seen one month traded at a discount.”

Enter Preston Pysh’s analogy:

Saylor hasn’t built a fragile structure.

He’s built a transmission.

Different gears for different environments — tightening or easing.

The goal: keep the machine moving forward and keep stacking Bitcoin in all conditions.

Saylor hasn’t built a fragile structure.

He’s built a transmission.

Different gears for different environments — tightening or easing.

The goal: keep the machine moving forward and keep stacking Bitcoin in all conditions.

So yes, some traders lost trust in the guidance change.

But zoom out: Strategy holds $73B in Bitcoin. Its balance sheet can cover preferred dividend obligations for decades, even if BTC fell over 50%.

Hardly the picture of imminent collapse.

But zoom out: Strategy holds $73B in Bitcoin. Its balance sheet can cover preferred dividend obligations for decades, even if BTC fell over 50%.

Hardly the picture of imminent collapse.

And here’s the bigger question:

Is this shakeout just the storm before Strategy’s potential inclusion in the S&P 500?

Ben Workman:

“Management needs optionality. If S&P 500 inclusion happens, you want the ability to take advantage of massive inflows.”

Is this shakeout just the storm before Strategy’s potential inclusion in the S&P 500?

Ben Workman:

“Management needs optionality. If S&P 500 inclusion happens, you want the ability to take advantage of massive inflows.”

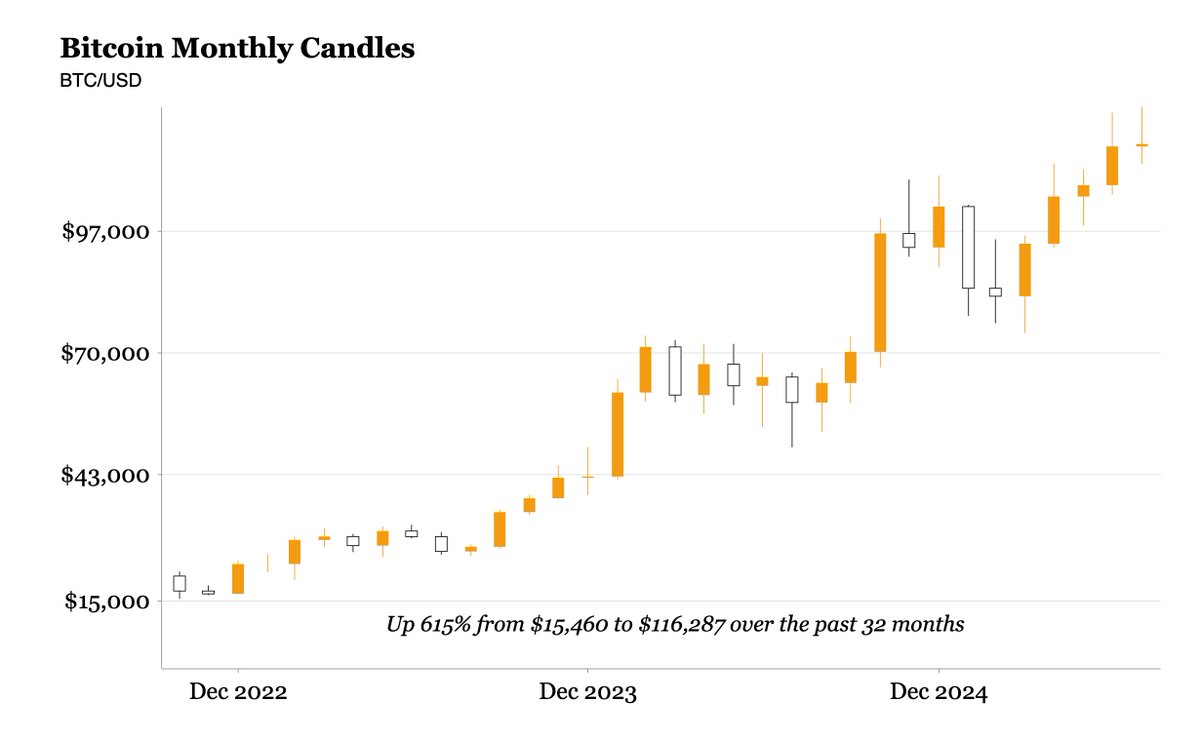

Remember to zoom out: Bitcoin is still up 615% in 32 months.

Sideways price action hardens support, resets leverage, and brings new capital.

As Pierre Rochard says:

“Sideways BTC is maintenance.”

Sideways price action hardens support, resets leverage, and brings new capital.

As Pierre Rochard says:

“Sideways BTC is maintenance.”

Optionality ≠ betrayal.

Volatility ≠ failure.

The name of the game is Bitcoin accumulation in all environments.

If you want to build your own long-term Bitcoin strategy, Swan Private helps HNW investors, family offices & corporations do exactly that.

swanbitcoin.com/private?utm_ca…

Volatility ≠ failure.

The name of the game is Bitcoin accumulation in all environments.

If you want to build your own long-term Bitcoin strategy, Swan Private helps HNW investors, family offices & corporations do exactly that.

swanbitcoin.com/private?utm_ca…

• • •

Missing some Tweet in this thread? You can try to

force a refresh