🚨 The Fed just shattered the “rate cut soon” narrative.

The Fed just admitted inflation is a bigger threat than jobs.

Cuts aren’t coming unless unemployment collapses.

(a thread)

The Fed just admitted inflation is a bigger threat than jobs.

Cuts aren’t coming unless unemployment collapses.

(a thread)

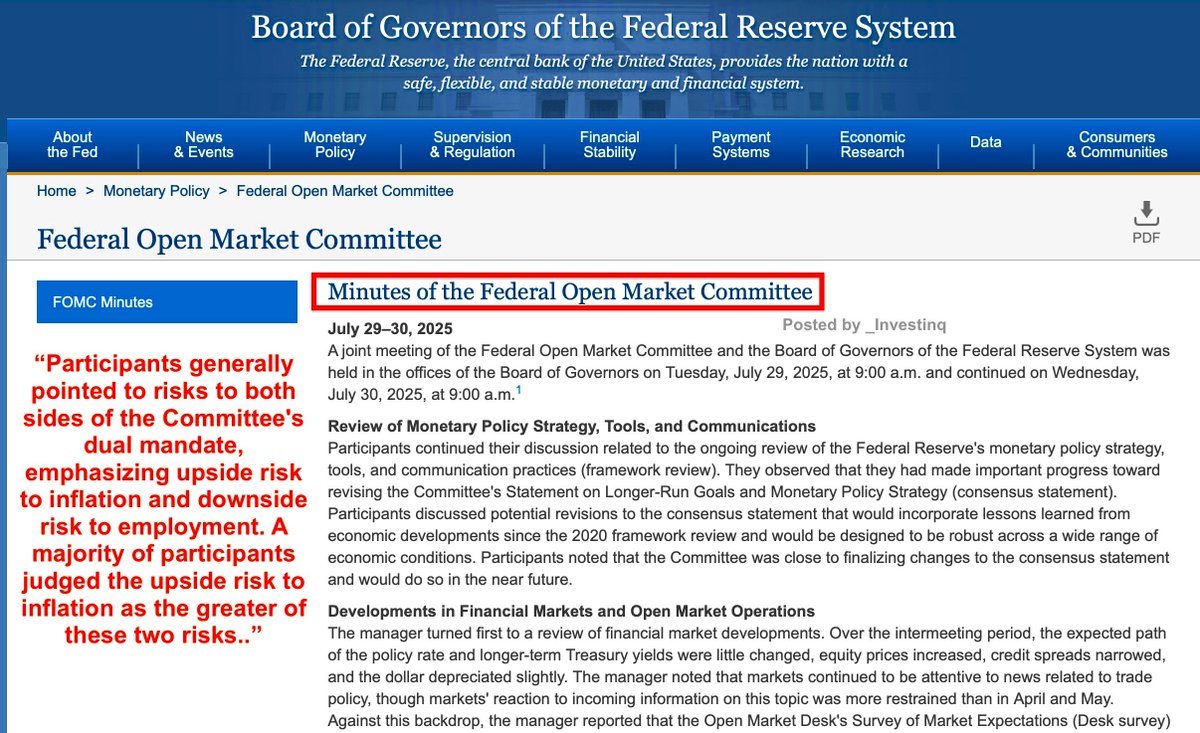

First, what are the FOMC minutes? They’re the detailed notes released three weeks after each Fed meeting.

While the statement and Powell’s press conference are polished and carefully worded, the minutes show what officials actually debated, their worries, and where they disagreed.

While the statement and Powell’s press conference are polished and carefully worded, the minutes show what officials actually debated, their worries, and where they disagreed.

The Fed’s “dual mandate” means it has two main jobs: keep inflation stable around 2% and maximize employment.

Every decision to raise, cut, or hold interest rates balances those two goals.

When both are risks, the Fed must choose which one is more dangerous at the moment.

Every decision to raise, cut, or hold interest rates balances those two goals.

When both are risks, the Fed must choose which one is more dangerous at the moment.

Directly from the July minutes: “A majority of participants judged the upside risk to inflation as the greater of these two risks.”

Translation: most officials think stubborn inflation is a bigger threat than job losses.

Until jobs break, they won’t cut rates just to please markets.

Translation: most officials think stubborn inflation is a bigger threat than job losses.

Until jobs break, they won’t cut rates just to please markets.

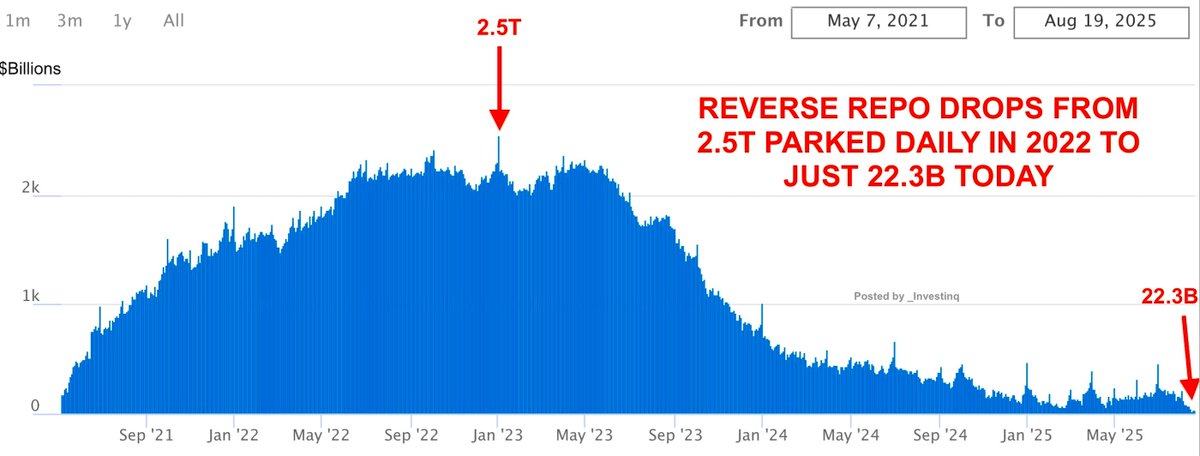

So why the fear of inflation? Because it’s still too high.

Core CPI, which excludes food and energy to show underlying price trends, was 3.1% year-over-year in July.

And remember, this FOMC meeting happened before the most recent CPI & PPI reports, which came in even hotter.

Core CPI, which excludes food and energy to show underlying price trends, was 3.1% year-over-year in July.

And remember, this FOMC meeting happened before the most recent CPI & PPI reports, which came in even hotter.

Producer prices (PPI), which measure wholesale costs, surged 0.9% in a single month, the sharpest jump in 3 years.

That report also came after the Fed met.

Translation: even before seeing that spike, the Fed already feared inflation risk > jobs risk. The new data only reinforces it.

That report also came after the Fed met.

Translation: even before seeing that spike, the Fed already feared inflation risk > jobs risk. The new data only reinforces it.

Think of CPI as what you pay at the store.

Think of PPI as what companies pay behind the scenes before goods hit shelves.

If producers’ costs climb, they usually pass them on to consumers. That’s why a hot PPI print now can mean higher CPI later and why the Fed stays cautious.

Think of PPI as what companies pay behind the scenes before goods hit shelves.

If producers’ costs climb, they usually pass them on to consumers. That’s why a hot PPI print now can mean higher CPI later and why the Fed stays cautious.

Tariffs add fuel to the fire. A tariff is a tax on imports that makes foreign goods more expensive.

Some Fed members argued tariffs are just a one-time bump, while others warned they could linger.

The reality: nobody knows yet. That uncertainty tilts the Fed toward caution.

Some Fed members argued tariffs are just a one-time bump, while others warned they could linger.

The reality: nobody knows yet. That uncertainty tilts the Fed toward caution.

The minutes even said: “It would not be feasible or appropriate to wait for complete clarity on the tariffs’ effects.”

In plain English: the Fed won’t wait around for perfect data.

If inflation looks sticky, they’ll keep policy tight now rather than risk cutting too early.

In plain English: the Fed won’t wait around for perfect data.

If inflation looks sticky, they’ll keep policy tight now rather than risk cutting too early.

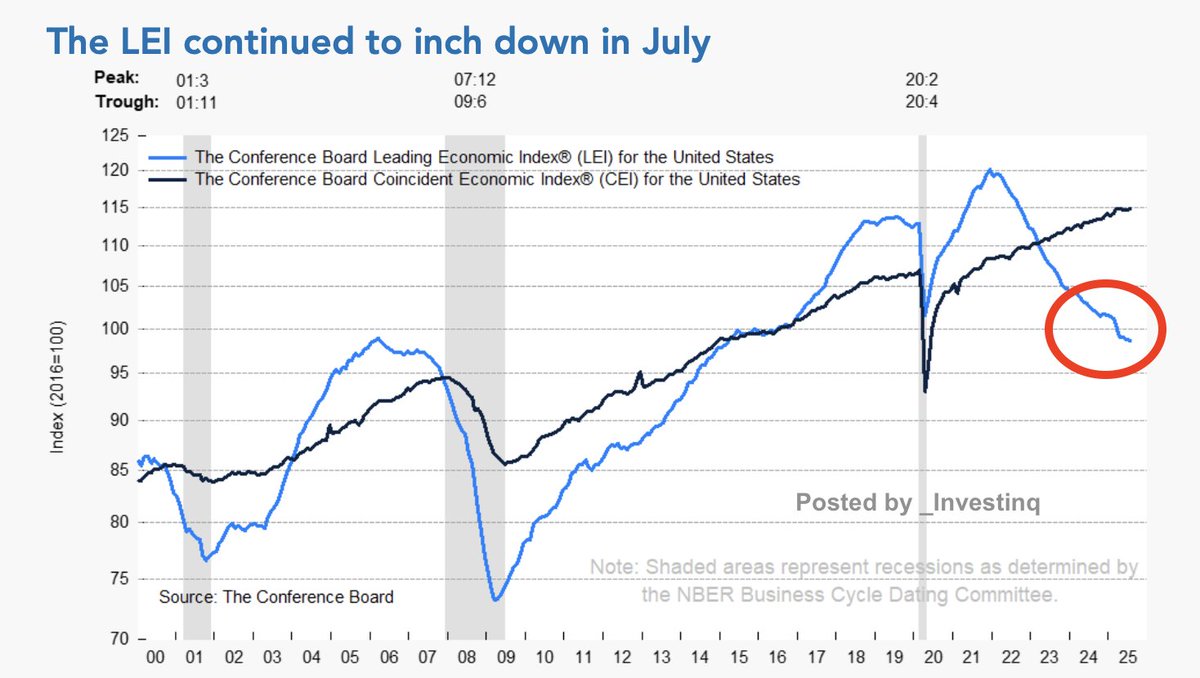

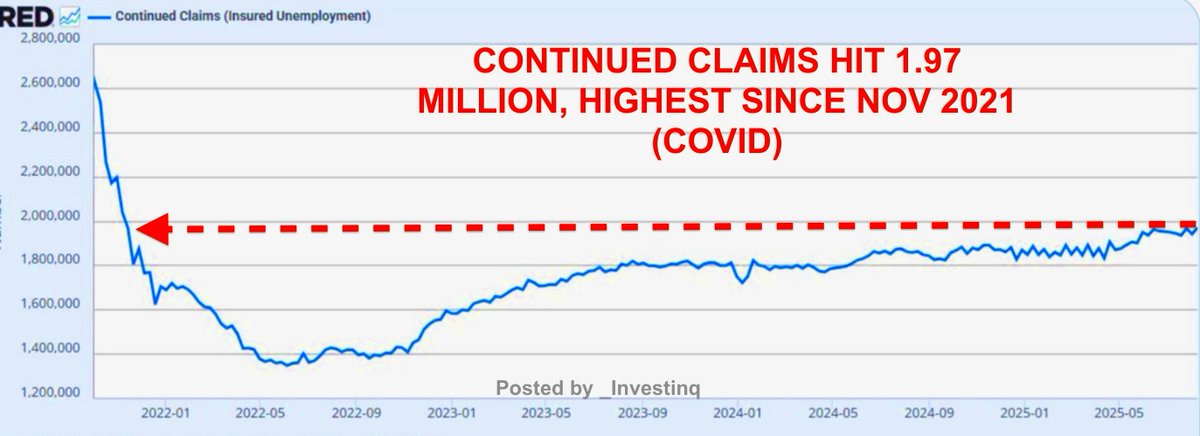

So why not cut anyway? Because the job market isn’t collapsing yet.

July payrolls rose by 73k, unemployment ticked up to 4.2%, and earlier reports were revised down by 258k.

That’s weaker, but not enough for panic. The Fed only cuts when the labor market cracks.

July payrolls rose by 73k, unemployment ticked up to 4.2%, and earlier reports were revised down by 258k.

That’s weaker, but not enough for panic. The Fed only cuts when the labor market cracks.

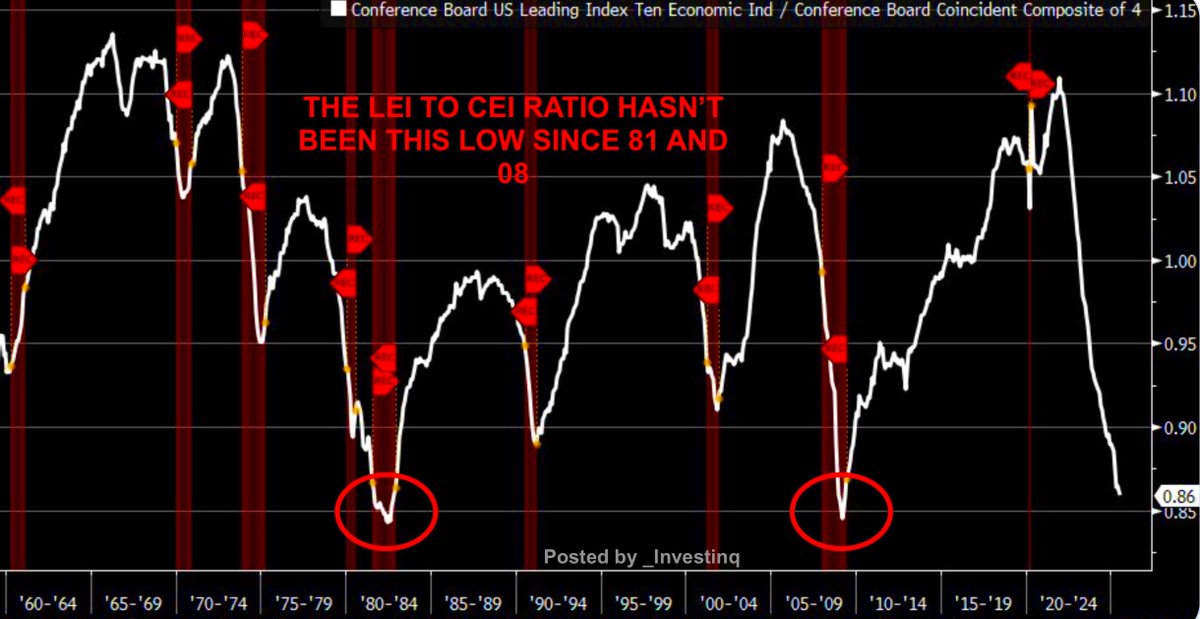

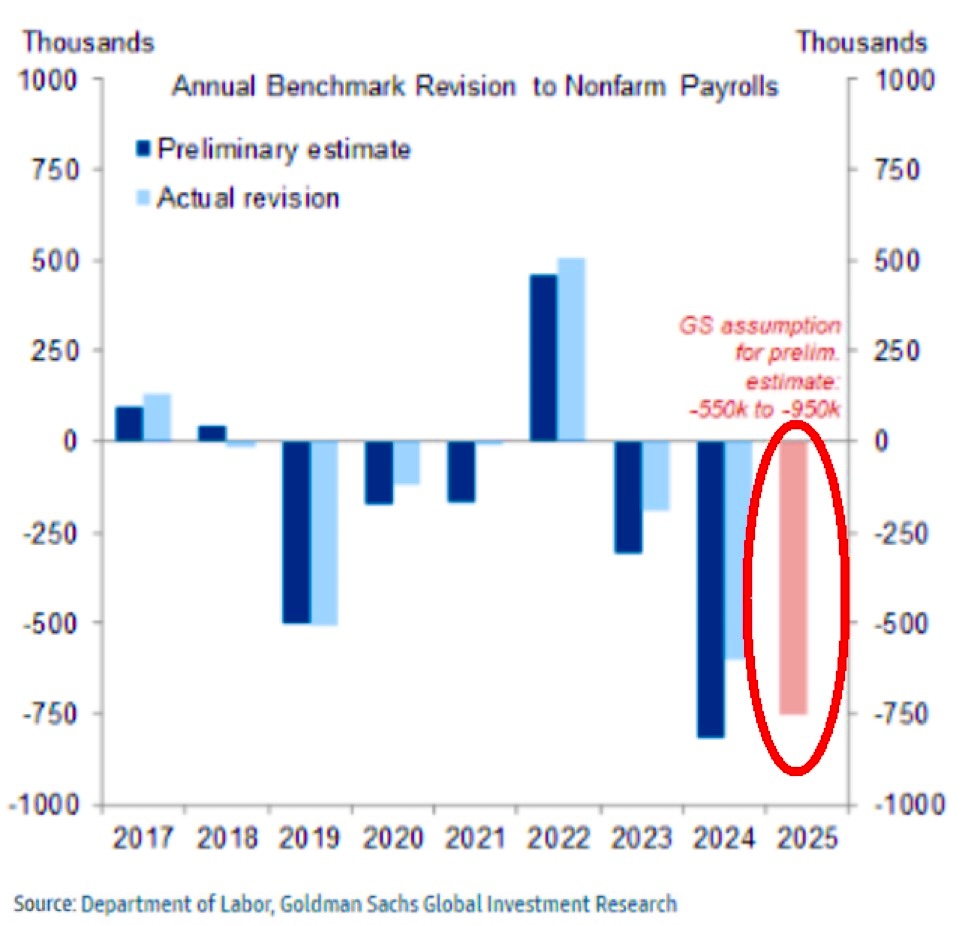

🚨 But here’s the kicker: the labor market may already be overstated.

Every September, the Bureau of Labor Statistics (BLS) issues an annual “benchmark revision” correcting payroll data.

Goldman Sachs expects a downward revision of 550k–950k jobs this year.

Every September, the Bureau of Labor Statistics (BLS) issues an annual “benchmark revision” correcting payroll data.

Goldman Sachs expects a downward revision of 550k–950k jobs this year.

If true, it would be the largest annual cut in 15 years since the 2009 financial crisis.

That’s big enough to rewrite the entire story of U.S. job growth for the past year.

It would mean the Fed has been looking at a stronger labor market than reality.

That’s big enough to rewrite the entire story of U.S. job growth for the past year.

It would mean the Fed has been looking at a stronger labor market than reality.

And this matters because jobs are the only datapoint left to justify cuts.

In September 2024, the Fed slashed rates by 50bps and immediately pointed to labor weakness as the reason.

Inflation wasn’t the excuse. Markets weren’t the excuse. The jobs market was the excuse.

In September 2024, the Fed slashed rates by 50bps and immediately pointed to labor weakness as the reason.

Inflation wasn’t the excuse. Markets weren’t the excuse. The jobs market was the excuse.

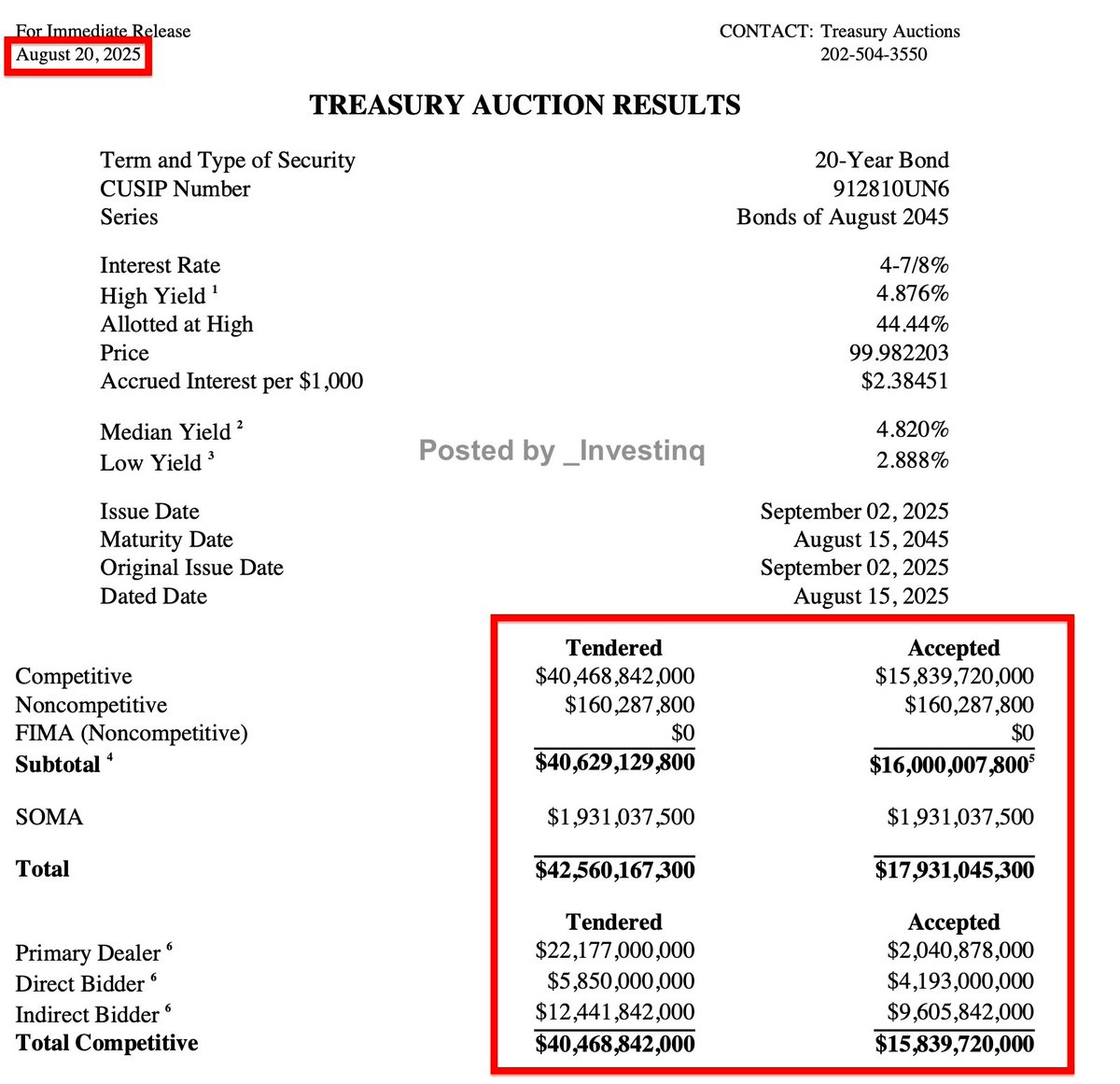

Meanwhile, the Fed is monitoring financial stability. Officials flagged “elevated asset valuation pressures.”

That’s central bank code for: stocks are expensive, valuations are stretched, credit spreads are tight.

Cutting too soon risks fueling bubbles while inflation is high.

That’s central bank code for: stocks are expensive, valuations are stretched, credit spreads are tight.

Cutting too soon risks fueling bubbles while inflation is high.

Not everyone agreed. Two Fed governors, Bowman and Waller wanted a 25bp cut in July.

They argued tariffs are temporary, jobs are weakening, and better to start easing now.

But they were outvoted. The majority held rates steady at 4.25%–4.50%.

They argued tariffs are temporary, jobs are weakening, and better to start easing now.

But they were outvoted. The majority held rates steady at 4.25%–4.50%.

So where are we?

• Inflation = sticky

• Tariffs = uncertain

• Jobs = softer than headlines suggest, with big revisions looming

• Stocks = frothy

That mix gives Powell zero urgency to pivot. Until labor data truly cracks, the Fed holds steady.

• Inflation = sticky

• Tariffs = uncertain

• Jobs = softer than headlines suggest, with big revisions looming

• Stocks = frothy

That mix gives Powell zero urgency to pivot. Until labor data truly cracks, the Fed holds steady.

Circle these dates:

• Sept 5 → August Jobs Report

• September 6 → possible 550k–950k jobs

• Sept 16–17 → Next Fed Meeting

If labor weakens, Powell has cover to pivot. If not, no cut. That’s why the July minutes crushed “pivot now” hopes.

• Sept 5 → August Jobs Report

• September 6 → possible 550k–950k jobs

• Sept 16–17 → Next Fed Meeting

If labor weakens, Powell has cover to pivot. If not, no cut. That’s why the July minutes crushed “pivot now” hopes.

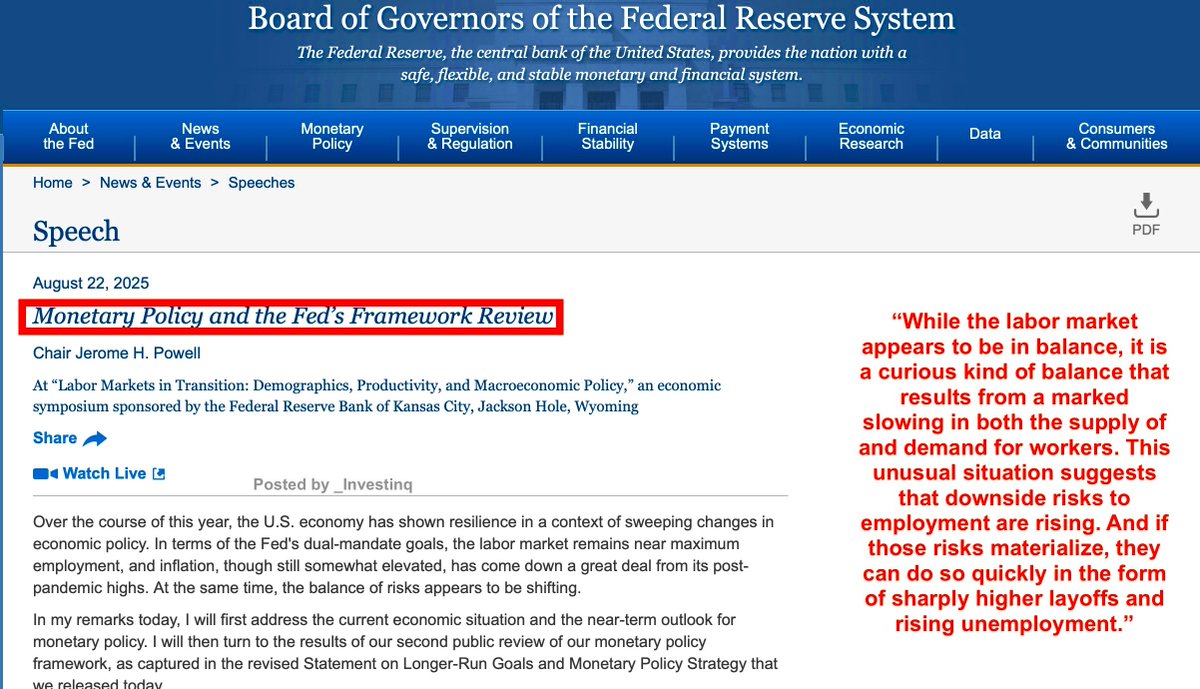

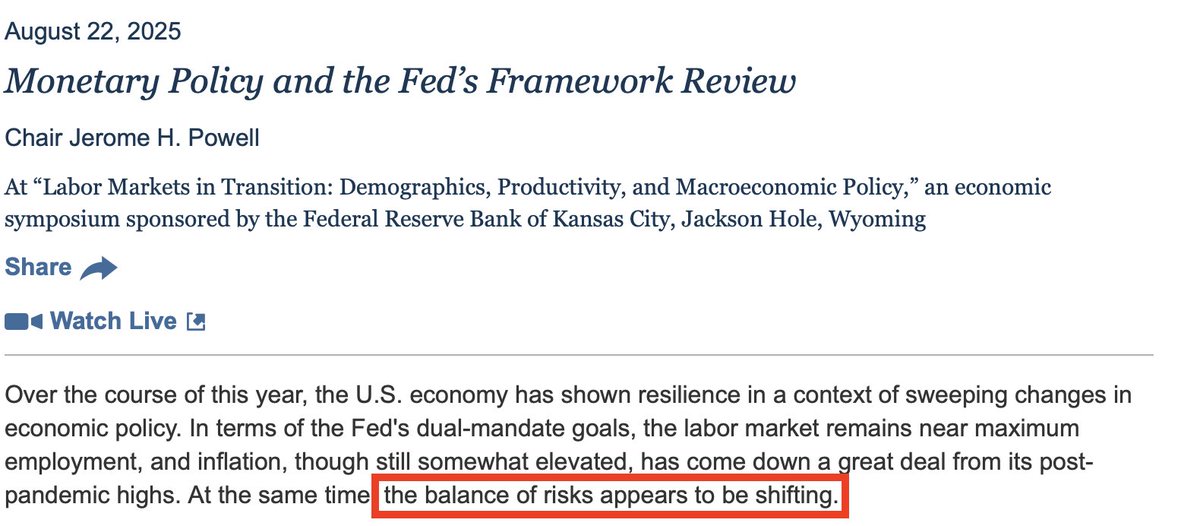

And now, all eyes shift to Jackson Hole.

Powell faces an economic crossroads, inflation still sticky, jobs softening, and tariffs clouding the outlook.

His speech this Friday matters even more with his tenure as Fed Chair set to end next May. Markets will hang on every word.

Powell faces an economic crossroads, inflation still sticky, jobs softening, and tariffs clouding the outlook.

His speech this Friday matters even more with his tenure as Fed Chair set to end next May. Markets will hang on every word.

Bottom line: The Fed just told us inflation risk > jobs risk.

With CPI above 3% and PPI surging, they have cover to hold.

The labor market is the only lever left. If the September revision slashes up to 950k jobs, it could flip the script. Until then, Powell stays put.

With CPI above 3% and PPI surging, they have cover to hold.

The labor market is the only lever left. If the September revision slashes up to 950k jobs, it could flip the script. Until then, Powell stays put.

If you found these insights valuable: Sign up for my FREE newsletter! thestockmarket.news

I hope you've found this thread helpful.

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

Follow me @_Investinq for more.

Like/Repost the quote below if you can:

https://x.com/_investinq/status/1958263664751878591?s=46

To make this extremely clear, I do believe the rate cuts will happen after the yearly job revision in September!

• • •

Missing some Tweet in this thread? You can try to

force a refresh