🚨What to do with your LIC policies?

Most households have traditional Life insurance policies with an "Assured Sum of money" from LIC and other insurers

Most do not know what to do with these policies now

A thread🧵 on what you should do with ur LIC Policies?👇

Most households have traditional Life insurance policies with an "Assured Sum of money" from LIC and other insurers

Most do not know what to do with these policies now

A thread🧵 on what you should do with ur LIC Policies?👇

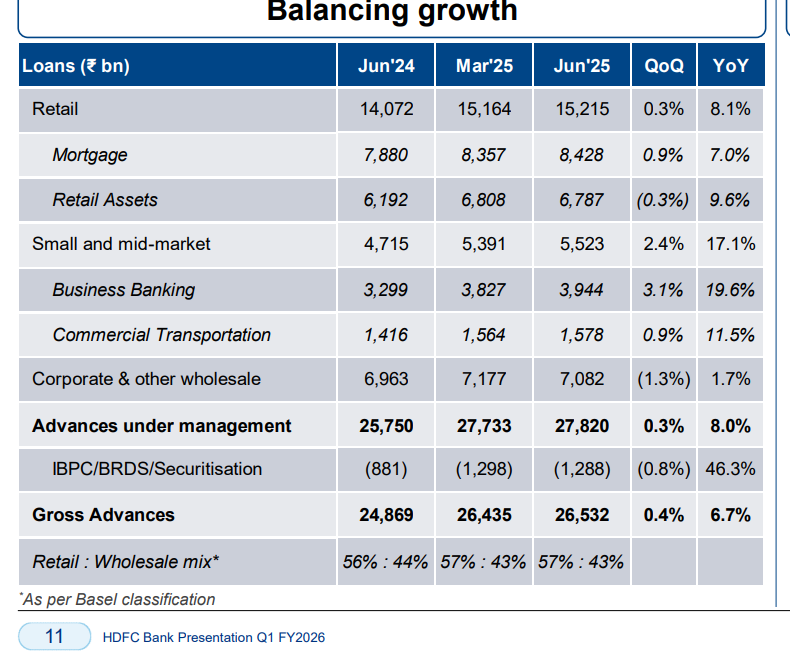

What is life insurance?

A Life Insurance policy provides financial security to the family of the insured, in case of their death during the policy period, and in some cases a maturity benefit to the insured person, after a set period of time.

A Life Insurance policy provides financial security to the family of the insured, in case of their death during the policy period, and in some cases a maturity benefit to the insured person, after a set period of time.

What is life insurance?

A Life Insurance policy provides financial security to the family of the insured, in case of their death during the policy period, and in some cases a maturity benefit to the insured person, after a set period of time.

A Life Insurance policy provides financial security to the family of the insured, in case of their death during the policy period, and in some cases a maturity benefit to the insured person, after a set period of time.

Combining insurance+Investments:-

These policies are known as:-

🏦Unit Linked Insurance policies

🏦Non-Linked, Participating Plans

🏦Non-Linked, Non-Participating Plans

These policies are known as:-

🏦Unit Linked Insurance policies

🏦Non-Linked, Participating Plans

🏦Non-Linked, Non-Participating Plans

Most people buy these policies because

🏦They want a return on the premium they paid

🏦They are lured by the fact that they will get some assured money at a future date

🏦Insurance agents mis-sell these products as they get a higher commission

🏦They want a return on the premium they paid

🏦They are lured by the fact that they will get some assured money at a future date

🏦Insurance agents mis-sell these products as they get a higher commission

So what is the problem with these traditional policies?

Traditional policies offer sum assured that is nearly 10x of the premium paid.

"Assured Sum" is a major attraction of these policies

Traditional policies offer sum assured that is nearly 10x of the premium paid.

"Assured Sum" is a major attraction of these policies

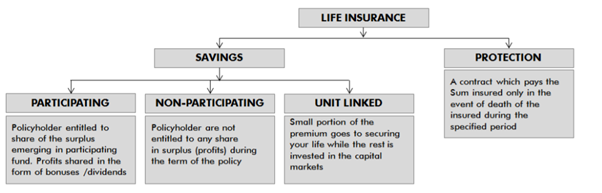

Poor returns:-

As the graph clearly shows....very subpar returns of 5-6% on these policies.

You would be better of with a Term plan and investing in index funds

Source:@livemint

As the graph clearly shows....very subpar returns of 5-6% on these policies.

You would be better of with a Term plan and investing in index funds

Source:@livemint

Very low Life cover:-

The life cover – that is, claim amount the policyholder’s family will receive in case of her death – tends to be small.

For an amount far lesser you can get a higher cover in a pure play protection plan. i.e. Term plan

The life cover – that is, claim amount the policyholder’s family will receive in case of her death – tends to be small.

For an amount far lesser you can get a higher cover in a pure play protection plan. i.e. Term plan

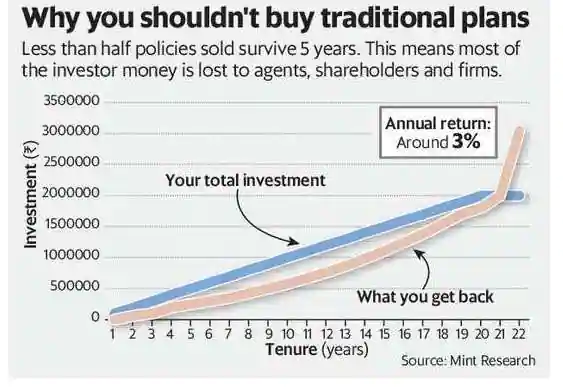

So what can u do with these policies?

There are 2 options available for these policies

1. Surrender the policy

2. Make the policy paid up

There are 2 options available for these policies

1. Surrender the policy

2. Make the policy paid up

Surrendering the policy:-

Under this option, you close the policy completely and take back your money.

The money you get will be some percentage of your premiums paid minus the first-year premium.

And this percentage increases depending on how many years the policy premium has been paid.

Under this option, you close the policy completely and take back your money.

The money you get will be some percentage of your premiums paid minus the first-year premium.

And this percentage increases depending on how many years the policy premium has been paid.

The money you get back depends on the premium u have paid.

The earlier you close the policies,lesser is the money u get back.

Different insurers have different methods to calculate the surrender value

The earlier you close the policies,lesser is the money u get back.

Different insurers have different methods to calculate the surrender value

Paid up policies:-

Under this option, if a policy holder does not close the policy, but stops paying any further premium.

However, note that this option is generally applicable only after one has paid for at least 3 yrs. (however, check your policy wordings for exact years)

Under this option, if a policy holder does not close the policy, but stops paying any further premium.

However, note that this option is generally applicable only after one has paid for at least 3 yrs. (however, check your policy wordings for exact years)

The amount which you will receive at maturity will be reduced, in proportion to the premiums paid.

This sum assured is called the paid up value.

It is calculated using the following formula:

Paid up value = Original sum assured x (No. of premiums paid / No. of premiums payable)

This sum assured is called the paid up value.

It is calculated using the following formula:

Paid up value = Original sum assured x (No. of premiums paid / No. of premiums payable)

When to choose “Surrender” and “Paid up” option?

Surrendering a policy is suggested when

You are not able to pay the premiums

You need money for some reason

When the remaining number of years in policy is more than 8-10 yrs

This option is suggested because you still have many years left and you can pay the same premium amount in a better product which will do wealth creation for you.

Surrendering a policy is suggested when

You are not able to pay the premiums

You need money for some reason

When the remaining number of years in policy is more than 8-10 yrs

This option is suggested because you still have many years left and you can pay the same premium amount in a better product which will do wealth creation for you.

Making a policy paid up is suggested when:-

You don’t need money but don’t want to pay further premiums

When you don’t want to pay premiums, but still want the policy to run

When your policy maturity is very near (2-4 yrs)

You don’t need money but don’t want to pay further premiums

When you don’t want to pay premiums, but still want the policy to run

When your policy maturity is very near (2-4 yrs)

Keep following me -@AdityaD_Shah as I write daily to make you aware around:

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

📈Personal Finance

📈Investing

📈Stock Analysis

Go to my profile and hit the bell icon🔔to always stay updated

• • •

Missing some Tweet in this thread? You can try to

force a refresh